The Future of Workplace Productivity Insurance – A 2025

In the rapidly evolving work landscape of 2025, a new trend is making waves: Workplace Productivity Insurance. As organizations become increasingly digital and remote, the need to safeguard productivity against unexpected disruptions has never been greater. What is Workplace Productivity Insurance? This innovative concept provides a safety net for businesses, offering protection against productivity losses caused by factors like system outages, employee burnout, cyber-attacks, and more. It’s designed to ensure that teams can bounce back quickly and maintain momentum, even when challenges arise. Key Elements of the Insurance Tech Failure Coverage: Covers interruptions due to software bugs, hardware breakdowns, or downtime. Employee Health & Burnout Prevention: Supports mental wellness programs, stress management, and flexible work policies. Cybersecurity Resilience: Protects sensitive systems and data from increasing digital threats. Data-Driven Productivity Monitoring: Real-time insights and performance metrics allow for immediate action when productivity dips. Why It Matters in 2025 As companies continue embracing hybrid and remote work models, consistent productivity is harder to track and maintain. This insurance model introduces a proactive approach — combining employee well-being, smart tech, and digital infrastructure under one policy. With AI-driven tools and productivity platforms increasingly integrated into workspaces, insurance providers can offer real-time assessments, predictive alerts, and tailored recovery plans to keep operations smooth. Looking Ahead Workplace productivity insurance could become a standard in modern business operations — not just as a protective layer, but as a strategic tool to stay competitive, sustainable, and resilient in the face of modern-day workplace challenges.

In the rapidly evolving work landscape of 2025, a new trend is making waves: Workplace Productivity Insurance. As organizations become increasingly digital and remote, the need to safeguard productivity against unexpected disruptions has never been greater.

What is Workplace Productivity Insurance?

This innovative concept provides a safety net for businesses, offering protection against productivity losses caused by factors like system outages, employee burnout, cyber-attacks, and more. It’s designed to ensure that teams can bounce back quickly and maintain momentum, even when challenges arise.

Key Elements of the Insurance

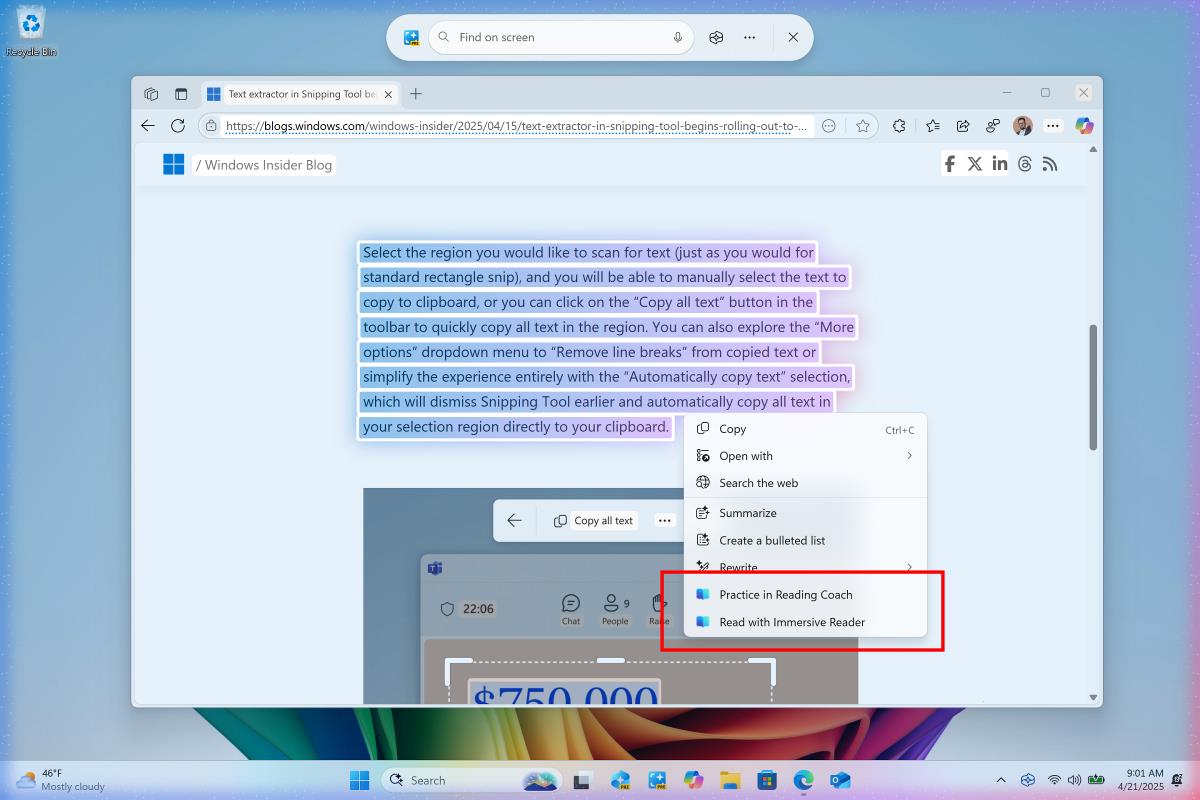

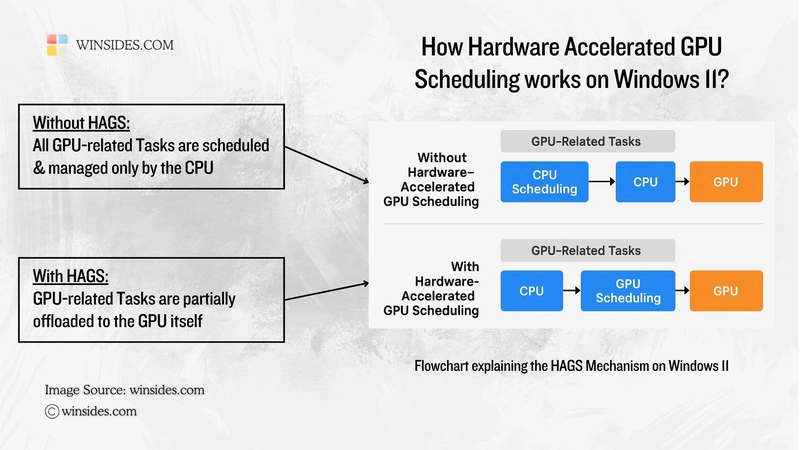

Tech Failure Coverage: Covers interruptions due to software bugs, hardware breakdowns, or downtime.

Employee Health & Burnout Prevention: Supports mental wellness programs, stress management, and flexible work policies.

Cybersecurity Resilience: Protects sensitive systems and data from increasing digital threats.

Data-Driven Productivity Monitoring: Real-time insights and performance metrics allow for immediate action when productivity dips.

Why It Matters in 2025

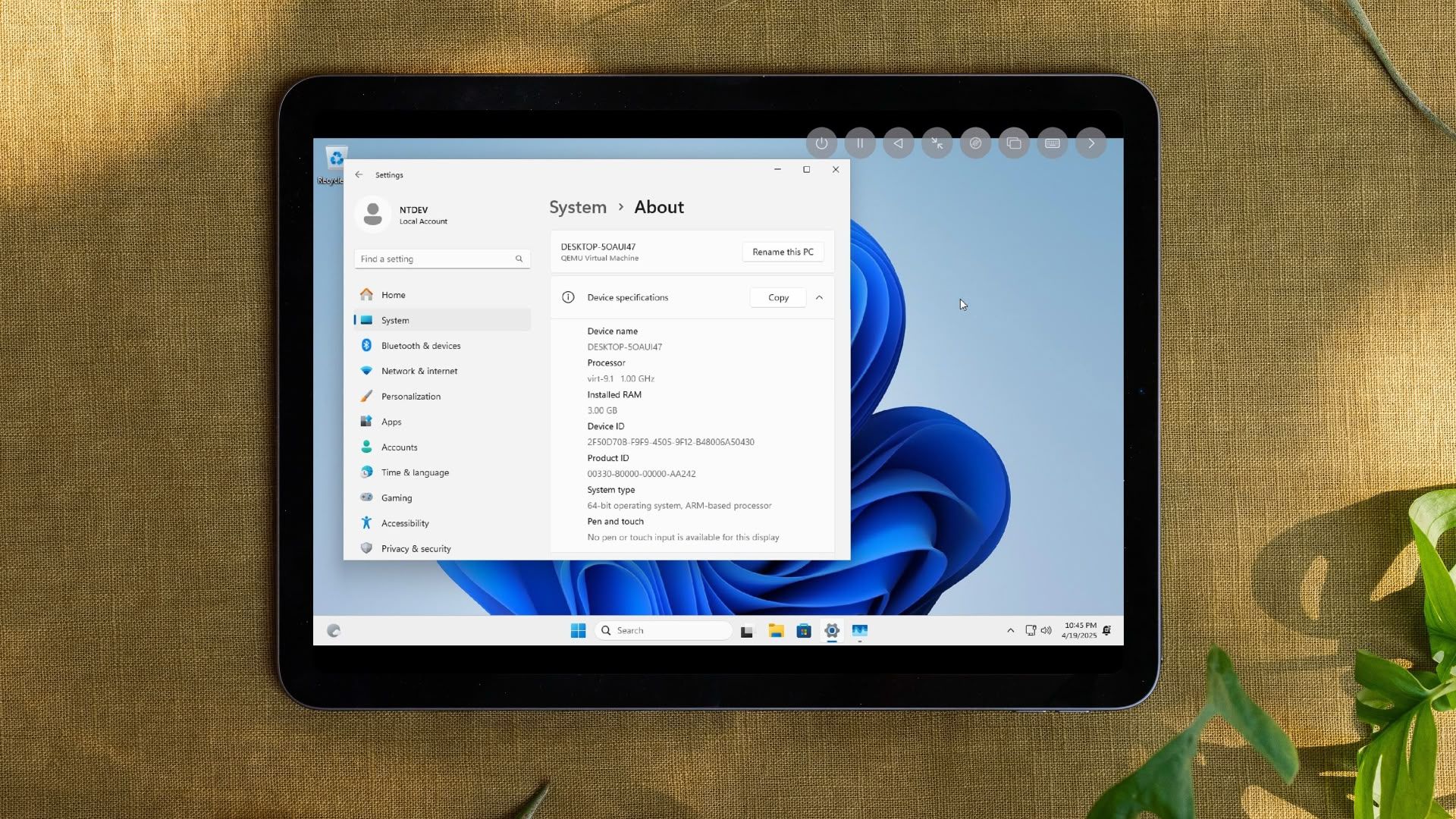

As companies continue embracing hybrid and remote work models, consistent productivity is harder to track and maintain. This insurance model introduces a proactive approach — combining employee well-being, smart tech, and digital infrastructure under one policy.

With AI-driven tools and productivity platforms increasingly integrated into workspaces, insurance providers can offer real-time assessments, predictive alerts, and tailored recovery plans to keep operations smooth.

Looking Ahead

Workplace productivity insurance could become a standard in modern business operations — not just as a protective layer, but as a strategic tool to stay competitive, sustainable, and resilient in the face of modern-day workplace challenges.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![From fast food worker to cybersecurity engineer with Tae'lur Alexis [Podcast #169]](https://cdn.hashnode.com/res/hashnode/image/upload/v1745242807605/8a6cf71c-144f-4c91-9532-62d7c92c0f65.png?#)

![BPMN-procesmodellering [closed]](https://i.sstatic.net/l7l8q49F.png)

-Jack-Black---Steve's-Lava-Chicken-(Official-Music-Video)-A-Minecraft-Movie-Soundtrack-WaterTower-00-00-32_lMoQ1fI.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Brain_light_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Mac Shipments Up 17% in Q1 2025 Fueled by New M4 MacBook Air [Chart]](https://www.iclarified.com/images/news/97086/97086/97086-640.jpg)

![Next Generation iPhone 17e Nears Trial Production [Rumor]](https://www.iclarified.com/images/news/97083/97083/97083-640.jpg)

![Apple Releases iOS 18.5 Beta 3 and iPadOS 18.5 Beta 3 [Download]](https://www.iclarified.com/images/news/97076/97076/97076-640.jpg)

![Apple Seeds visionOS 2.5 Beta 3 to Developers [Download]](https://www.iclarified.com/images/news/97077/97077/97077-640.jpg)