Proposed law to tax short-term rentals in Washington fails to advance amid Airbnb pushback

A proposed tax on short-term rentals in Washington state that drew opposition from Airbnb did not move forward in the Legislature last week — but supporters plan to revisit the policy next year. Senate Bill 5576 would have allowed counties, cities and towns to impose a tax of up to 4% on short-term rentals used by vacation guests on platforms such as Airbnb and Vrbo. The bill was not called forward for a vote on the House floor prior to the April 16 cutoff and is dead for the session. Prime sponsor Sen. Liz Lovelett (D-Anacortes) attributed the bill stalling… Read More

A proposed tax on short-term rentals in Washington state that drew opposition from Airbnb did not move forward in the Legislature last week — but supporters plan to revisit the policy next year.

Senate Bill 5576 would have allowed counties, cities and towns to impose a tax of up to 4% on short-term rentals used by vacation guests on platforms such as Airbnb and Vrbo. The bill was not called forward for a vote on the House floor prior to the April 16 cutoff and is dead for the session.

Prime sponsor Sen. Liz Lovelett (D-Anacortes) attributed the bill stalling to timing, but told GeekWire she is hopeful that it will move forward next year in light of “increased member understanding” of the policy and support from Vrbo.

The bill aimed to balance the growing short-term rental economy in Washington with the need for affordable housing in popular vacation spots where locals struggle to keep up with rent and property costs.

The first draft of the bill proposed a 6% statewide tax on short-term rentals. Airbnb and the Washington Hosts Collaborative Alliance (WHCA) — an Airbnb-backed and host-led organization — railed against the bill in the first weeks of the legislative session. They voiced concerns that the tax would create an “unfair competitive disadvantage for Washingtonians who share their home to make ends meet.”

Airbnb spent more than $1.2 million through a political action committee called “Airbnb Helps Our State Thrive” in an effort to lobby against the proposal, according to the Washington state Public Disclosure Commission.

Amendments to the bill turned the tax into a local government option rather than a statewide option — in other words, local municipalities would have the option to enforce the tax. The bill was also amended to allow local governments enacting the tax to exclude short-term rentals in “common interest communities approved as a resort, second home, or vacation community,” among a handful of other exemptions.

Vrbo, owned by Seattle-based Expedia Group, supported the bill as a local tax option, calling it “limited and reasonable” while encouraging lawmakers to pass it during public testimony in the House Appropriations committee.

“This is an important pressure release valve that allows cities and governments to avoid reaching far more punitive policies like bans on short-term rentals,” said Expedia Group representative Brent Ludeman during his testimony.

Airbnb sent a letter to the House Appropriations committee in early April calling a 4% tax “exorbitant.” Airbnb detailed concerns that the policy would raise costs for travelers, harm hosts relying on supplemental income from short-term rentals, and would not raise enough revenue to have a “meaningful impact on affordable housing.”

Some cities across Washington have already enacted their own restrictions or regulations. The Seattle City Council approved taxes back in 2017 and the city requires licensing for hosts to operate. In other states, far harsher restrictions have been implemented, including an outright ban on short-term rentals in New York City.

If passed into law, the bill would have created an Essential Affordable Housing Local Assistance Account within the Department of Revenue. The enacting tax authority would be authorized to retain up to 15% of the revenues for direct and indirect administrative costs with all other revenue used for approved affordable needs including acquiring or constructing affordable housing and providing rental assistance.

The bill passed off the Senate floor along a 27-21 vote with two Democrats voting against. In the House, it made it out of both committees but was not called forward for a vote on the House floor in time.

“We’re grateful for the Legislature’s consideration of short-term rental host and guest concerns and will continue to work with the bill author and stakeholders to find legislative solutions that help bolster housing affordability without financially burdening Washington residents and travelers,” Airbnb policy manager Jordan Mitchell said in a statement.

Lovelett said this is her seventh year sponsoring a short-term rental tax proposal. She acknowledged that the rise of such rentals has allowed property owners to generate extra income and provided a “big boom” to the tourism industry.

“But over time as they became more popular and lucrative, they’ve had the net effect of displacing housing for people in those communities,” Lovelett said.

Short-term rentals and rising housing costs have made it difficult to recruit staff for the school district, fire department, and other country government positions on the San Juan Islands where Lovelett lives, she said.

Carl Florea, mayor of Leavenworth, said he’s testified in support of a bill to tax the local tourism economy every year. This year, he testified in support of Senate Bill 5576.

“We love to host our guests but if we don’t do something to keep a workforce here, we won’t have a community left to host them,” Florea said. Similar to Lovelett, he cited instances of young local workers including firefighters, teachers and nurses being “priced out” of the market.

Rep. Josh Penner (R-Orting) opposed the bill’s overall approach to addressing affordability issues in local communities. He also took specific issue with counties’ ability to implement the tax and said that to be a true local government tax, the authority should be granted to individual cities within their jurisdiction, rather than the 39 counties.

“That’s one of the big issues with this bill,” Penner said. “It kind of subverts local authority in many ways.”

Because it is the first year of a biennium, the policy will retain its progress if revived next year.

.jpg)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![BPMN-procesmodellering [closed]](https://i.sstatic.net/l7l8q49F.png)

.jpg?#)

-All-will-be-revealed-00-35-05.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-All-will-be-revealed-00-17-36.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-Jack-Black---Steve's-Lava-Chicken-(Official-Music-Video)-A-Minecraft-Movie-Soundtrack-WaterTower-00-00-32_lMoQ1fI.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Weyo_alamy.png?width=1280&auto=webp&quality=80&disable=upscale#)

_Brain_light_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Releases Public Beta 2 of iOS 18.5, iPadOS 18.5, macOS Sequoia 15.5 [Download]](https://www.iclarified.com/images/news/97094/97094/97094-640.jpg)

![New M4 MacBook Air On Sale for $929 [Lowest Price Ever]](https://www.iclarified.com/images/news/97090/97090/97090-1280.jpg)

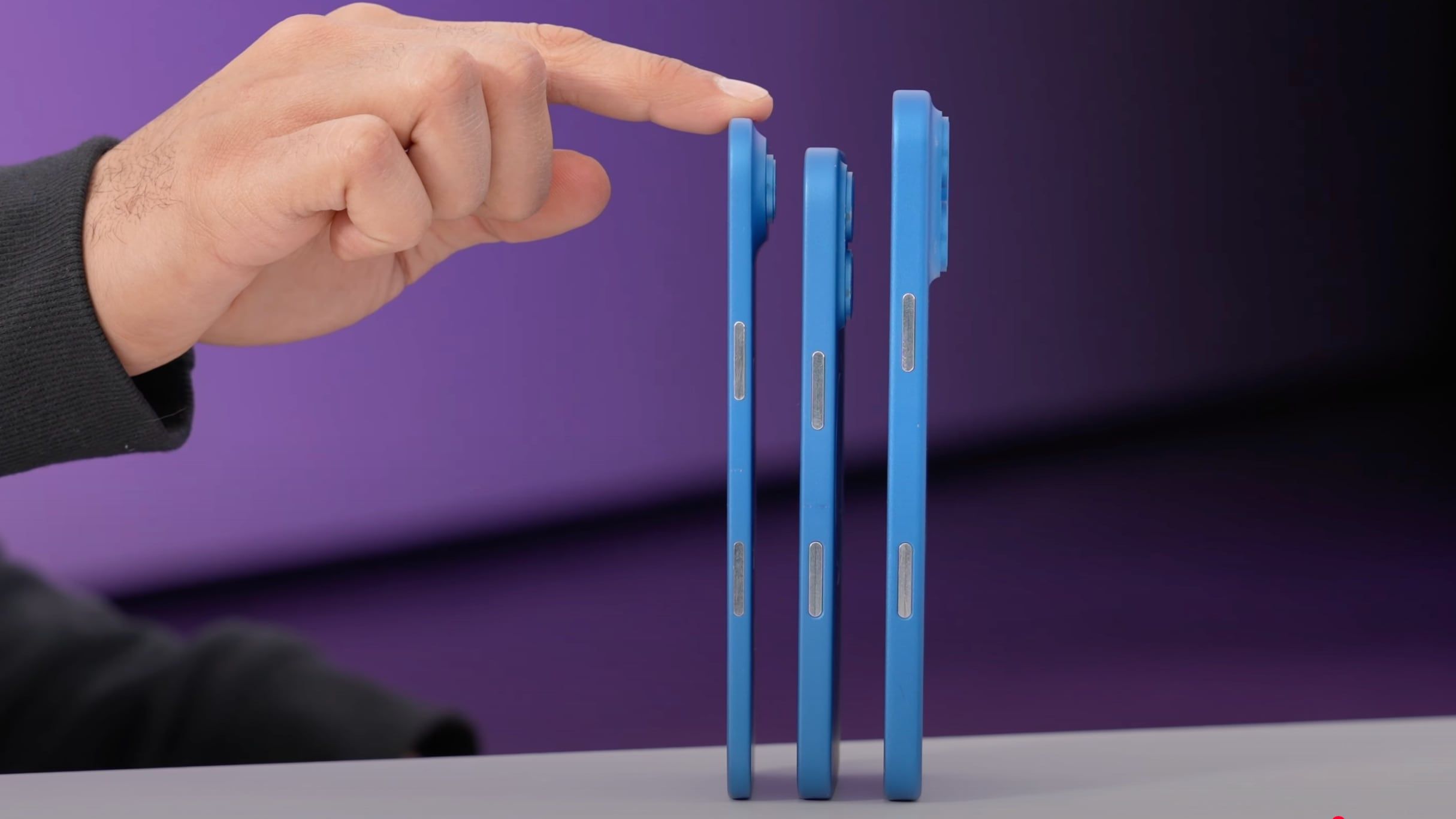

![Apple iPhone 17 Pro May Come in 'Sky Blue' Color [Rumor]](https://www.iclarified.com/images/news/97088/97088/97088-640.jpg)