Revolutionizing Blockchain Innovation: The Synergy of Bounty Programs and Project Grants

Abstract This blog post explores how bounty programs and project grants are revolutionizing blockchain innovation. By blending immediate community-driven responses with long‑term financial and technical support, these funding models fuel rapid development, enhance security, and drive decentralized governance. In this detailed guide, we explain the history, core concepts, and technical aspects of these models. We also dive into practical use cases, list challenges, and predict future trends in blockchain innovation such as enhanced interoperability, NFT integration, and advances in zero‑knowledge proofs. With supporting tables, bullet lists, and embedded authoritative resources such as Arbitrum and Ethereum Interoperability and Arbitrum and Community Governance, this post is designed for developers, investors, and blockchain enthusiasts eager to understand how innovative funding efforts drive the digital future. Introduction Blockchain technology has evolved rapidly since Bitcoin’s inception, now spanning complex ecosystems that require both agile and sustained funding. Bounty programs and project grants are two models that have emerged to support innovation in blockchain. Bounty programs reward immediate contributions like bug fixes and security enhancements, while project grants—such as the acclaimed Arbitrum Project Grants—provide long‑term support to develop scalable decentralized applications (dApps). This blog post provides a comprehensive look at these models, linking technical best practices to real‑world applications. Designed for human readers and optimized for search engines, the information is presented in clear, accessible language enriched with keywords such as blockchain innovation, decentralized governance, NFT integration, interoperability, and zero‑knowledge proofs. Background and Context The Evolution of Blockchain Funding Models Historically, blockchain projects were predominantly funded by traditional venture capital and initial coin offerings (ICOs). However, the limitations of these conventional methods led to the emergence of decentralized funding models. Early bounty programs, which incentivized software security research, have now expanded to reward contributions ranging from code enhancements to community educational efforts. Simultaneously, we’ve seen the need for sustained funding—paving the way for project grants that nurture promising projects over time. Key Ecosystem Elements Decentralized Governance: Empowering communities with transparent decision‑making. Interoperability: Bridging various platforms, as seen with Arbitrum and Ethereum Interoperability. Security and Compliance: Ensuring robust smart contract audits and adherence to regulations. Emerging Technologies: The use of zero‑knowledge proofs for privacy and scalability, and NFT integration for innovative funding approaches. Recent Developments Blockchain ecosystems now incorporate layer‑2 solutions (like Arbitrum) to resolve scalability pitfalls while lowering fees. With the growth of decentralized finance (DeFi), non‑fungible tokens (NFTs), and digital identity management, it is clear that a hybrid funding approach is the most effective model for sustained innovation. Additionally, regulatory bodies are increasingly embracing transparency through open‑source practices and robust security standards. Core Concepts and Features Bounty Programs Bounty programs are structured as task‑based incentives that motivate developers, security experts, and community members to actively contribute to projects. Key aspects include: Bug Detection: Rewarding individuals for identifying vulnerabilities in smart contracts. Code Contributions: Offering incentives for feature enhancements, performance optimization, and new functionality. Community Engagement: Encouraging the creation of documentation, tutorials, and outreach initiatives. These programs are inherently agile, ensuring that immediate and sometimes critical issues are resolved quickly. This is essential for projects dealing with high transaction volumes and complex protocols. Project Grants In contrast, project grants focus on long‑term ecosystem development. For example: Sustained Investment: Grants cover research costs, prototype development, and improvements necessary for scalability. Technical Mentorship: Coupling funds with expert advice, helping teams adhere to best practices. Open‑Source Commitment: Promoting transparency and community‑driven collaboration. The Arbitrum Project Grants are a prime example of this approach. They empower teams to build dApps that exploit layer‑2 scaling solutions, thereby reducing fees and increasing throughput. Overlapping Benefits and Synergies Although distinct in their focus, both funding models share several overlapping features that ensure robust system health and continuous innovation. The synerg

Abstract

This blog post explores how bounty programs and project grants are revolutionizing blockchain innovation. By blending immediate community-driven responses with long‑term financial and technical support, these funding models fuel rapid development, enhance security, and drive decentralized governance. In this detailed guide, we explain the history, core concepts, and technical aspects of these models. We also dive into practical use cases, list challenges, and predict future trends in blockchain innovation such as enhanced interoperability, NFT integration, and advances in zero‑knowledge proofs. With supporting tables, bullet lists, and embedded authoritative resources such as Arbitrum and Ethereum Interoperability and Arbitrum and Community Governance, this post is designed for developers, investors, and blockchain enthusiasts eager to understand how innovative funding efforts drive the digital future.

Introduction

Blockchain technology has evolved rapidly since Bitcoin’s inception, now spanning complex ecosystems that require both agile and sustained funding. Bounty programs and project grants are two models that have emerged to support innovation in blockchain. Bounty programs reward immediate contributions like bug fixes and security enhancements, while project grants—such as the acclaimed Arbitrum Project Grants—provide long‑term support to develop scalable decentralized applications (dApps). This blog post provides a comprehensive look at these models, linking technical best practices to real‑world applications. Designed for human readers and optimized for search engines, the information is presented in clear, accessible language enriched with keywords such as blockchain innovation, decentralized governance, NFT integration, interoperability, and zero‑knowledge proofs.

Background and Context

The Evolution of Blockchain Funding Models

Historically, blockchain projects were predominantly funded by traditional venture capital and initial coin offerings (ICOs). However, the limitations of these conventional methods led to the emergence of decentralized funding models. Early bounty programs, which incentivized software security research, have now expanded to reward contributions ranging from code enhancements to community educational efforts. Simultaneously, we’ve seen the need for sustained funding—paving the way for project grants that nurture promising projects over time.

Key Ecosystem Elements

- Decentralized Governance: Empowering communities with transparent decision‑making.

- Interoperability: Bridging various platforms, as seen with Arbitrum and Ethereum Interoperability.

- Security and Compliance: Ensuring robust smart contract audits and adherence to regulations.

- Emerging Technologies: The use of zero‑knowledge proofs for privacy and scalability, and NFT integration for innovative funding approaches.

Recent Developments

Blockchain ecosystems now incorporate layer‑2 solutions (like Arbitrum) to resolve scalability pitfalls while lowering fees. With the growth of decentralized finance (DeFi), non‑fungible tokens (NFTs), and digital identity management, it is clear that a hybrid funding approach is the most effective model for sustained innovation. Additionally, regulatory bodies are increasingly embracing transparency through open‑source practices and robust security standards.

Core Concepts and Features

Bounty Programs

Bounty programs are structured as task‑based incentives that motivate developers, security experts, and community members to actively contribute to projects. Key aspects include:

- Bug Detection: Rewarding individuals for identifying vulnerabilities in smart contracts.

- Code Contributions: Offering incentives for feature enhancements, performance optimization, and new functionality.

- Community Engagement: Encouraging the creation of documentation, tutorials, and outreach initiatives.

These programs are inherently agile, ensuring that immediate and sometimes critical issues are resolved quickly. This is essential for projects dealing with high transaction volumes and complex protocols.

Project Grants

In contrast, project grants focus on long‑term ecosystem development. For example:

- Sustained Investment: Grants cover research costs, prototype development, and improvements necessary for scalability.

- Technical Mentorship: Coupling funds with expert advice, helping teams adhere to best practices.

- Open‑Source Commitment: Promoting transparency and community‑driven collaboration.

The Arbitrum Project Grants are a prime example of this approach. They empower teams to build dApps that exploit layer‑2 scaling solutions, thereby reducing fees and increasing throughput.

Overlapping Benefits and Synergies

Although distinct in their focus, both funding models share several overlapping features that ensure robust system health and continuous innovation. The synergy achieved by integrating both models ensures projects remain secure, scalable, and compliant with regulatory standards.

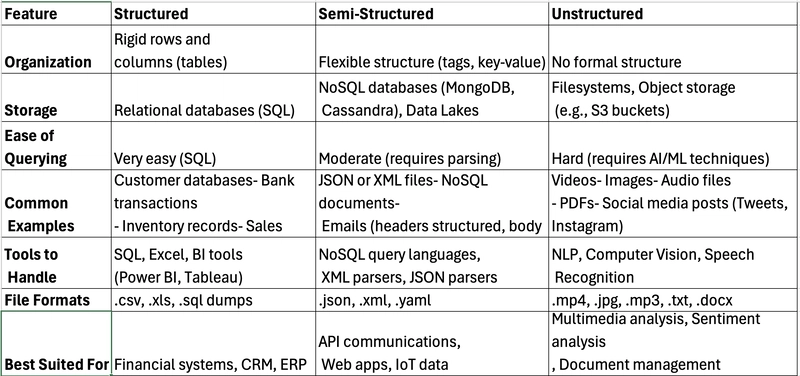

Below is a table summarizing key differences and overlapping elements:

| Aspect | Bounty Programs | Project Grants |

|---|---|---|

| Objective | Immediate bug fixes and enhancements | Long‑term development and ecosystem expansion |

| Reward Mechanism | Tokens, NFTs, and cash rewards | Financial support combined with mentorship |

| Focus Areas | Security audits and code improvements | dApp building, research, and infrastructure |

| Community Involvement | Broad, global participation | Core teams with specialized expertise |

| Governance | Task‑based and transparent criteria | Proposal‑driven with ongoing reporting |

Bullet List: Critical Benefits Across Both Models

- Immediate Innovation: Rapid response to issues creates a secure and dynamic blockchain environment.

- Long‑Term Sustainability: Continued funding ensures scalable growth and in-depth research.

- Decentralized Collaboration: A diverse pool of contributors enhances creativity and problem‑solving.

- Regulatory Compliance: Built‑in legal checks and transparent operations instill trust.

- Enhanced Interoperability: Collaborative efforts drive cross‑chain integration and smoother user experiences.

Applications and Use Cases

Use Case 1: DeFi Security Enhancements

A notable decentralized finance protocol integrated both bounty programs and project grants to bolster its security framework:

- Bounty Programs: Launched initiatives to detect vulnerabilities in smart contracts, significantly reducing risk.

- Project Grants: Secured funding to integrate advanced risk management tools and commission independent audits.

- Outcome: The dual approach improved user confidence, increased liquidity, and attracted a broader investor base.

Use Case 2: Accelerated dApp Development on Arbitrum

A decentralized exchange (DEX) on the Arbitrum network demonstrated the power of blending immediate rewards with long‑term support:

- Project Grants: The development team received funding to innovate on trading mechanisms, design user‑friendly interfaces, and minimize transaction fees.

- Bounty Programs: Parallel initiatives ensured the underlying smart contracts were secure and bug‑free.

- Outcome: The DEX rapidly gained adoption due to low fees and high throughput, highlighting the combined benefits of both models.

Use Case 3: NFT Marketplace Scalability

An NFT marketplace project embraced a hybrid funding approach:

- Bounty Programs: Rewarded contributions for optimizing the minting process and contract audit processes.

- Project Grants: Provided supplementary funding for cross‑chain compatibility and enhanced user experience initiatives.

- Outcome: The project not only attracted a vibrant community of digital artists and collectors but also set new benchmarks in security and scalability—demonstrating how integrated funding resolves both immediate technical challenges and long‑term strategic goals.

For further insights into cross‑chain operations, check out Arbitrum and Blockchain Interoperability.

Challenges and Limitations

Despite their significant advantages, both bounty programs and project grants are not without challenges.

Technical Challenges

- Incomplete Vulnerability Detection: While bounty programs quickly identify many issues, not all vulnerabilities are caught before they are exploited. Continuous monitoring and periodic audits are essential.

- Integration Complexities: Implementing layer‑2 solutions, such as those provided by Arbitrum, may face hurdles like transaction finality and compatibility with the Ethereum mainnet.

- Scalability Trade‑Offs: Balancing high throughput with decentralization remains a delicate technical issue that requires careful design.

Adoption and Implementation Challenges

- Quality vs. Quantity of Submissions: Not every submitted contribution meets the high standards required by these protocols. Establishing stringent review and validation processes is vital.

- Regulatory Uncertainty: Tokenized rewards and NFT integrations can complicate compliance. It is critical to involve legal advisors and stay updated on regulatory changes.

- Sustaining Funding: Although project grants provide substantial initial support, long‑term sustainability depends on diversified funding channels and continuing community engagement.

- Interoperability Barriers: Despite progress, interoperability across multiple blockchains is complex and requires continuous innovation in cross‑chain protocols.

Mitigation Strategies (Bullet List)

- Enhanced Auditing: Regular third‑party audits can help catch vulnerabilities that bounty programs might miss.

- Clear Submission Guidelines: Establishing robust criteria ensures high‑quality contributions.

- Legal and Regulatory Monitoring: Collaborate with legal experts to maintain compliance across jurisdictions.

- Diversified Funding: Explore corporate sponsorships, community tokens, and other revenue streams to maintain ongoing support.

- Cross‑Chain Protocol Innovation: Foster research and development to resolve interoperability challenges.

For more information on overcoming these challenges, you may enjoy reading Arbitrum and Network Upgrades.

Future Outlook and Innovations

The future for blockchain funding models looks promising, with several emerging trends set to further reshape the landscape.

Key Future Trends

- Zero‑Knowledge Proofs: As privacy and blockchain security become even more critical, zero‑knowledge proofs will play an essential part in enhancing both security and scalability.

- Enhanced Cross‑Chain Interoperability: The push for seamless integration across multiple blockchains will unlock new financial flows and improved user experiences.

- NFT Integration and Tokenized Funding: The use of NFTs as unique, tokenized rewards will revolutionize funding strategies, offering novel ways to demonstrate intellectual property and contribution value.

- Advanced Decentralized Governance: Future models will incorporate even more sophisticated governance structures to ensure that community voting and participation remain transparent and inclusive.

- Institutional Involvement: More corporate and institutional investors are likely to embrace hybrid funding models, merging traditional finance with decentralized, community‑driven innovation.

Emerging Technologies to Watch

- Layer‑3 Solutions: As research evolves, new layers beyond layer‑2 may emerge that better integrate both immediate rewards and long‑term development strategies.

- AI and Data Analytics: Improved data analysis will optimize bounty program submissions and ensure that high‑priority vulnerabilities are addressed faster.

- Smart Contract Automation: Enhanced automation in code review and deployment processes will reduce the cost and time required for audits.

For further reading on blockchain innovation and open‑source funding, check out the insightful discussion on Blockchain and DeFi Yield.

Summary

In summary, the synergy between bounty programs and project grants represents one of the most dynamic forces driving sustainable blockchain innovation today. While bounty programs provide swift, community‑driven solutions to immediate technical challenges, project grants offer the deep, long‑term support necessary for developing scalable, secure, and user‑friendly applications. Together, these models promote decentralized governance, foster transparency, and enable interoperable solutions that traverse multiple blockchains.

Key takeaways include:

- Bounty Programs: Agile, task‑based contributions that reward immediate innovations.

- Project Grants: Comprehensive, long‑term funding solutions that support ecosystem development.

- Combined Advantages: Enhanced security, improved scalability, and inbuilt regulatory compliance.

- Future Innovations: Trends such as zero‑knowledge proofs, NFT‑based funding, and advanced cross‑chain interoperability will continue to redefine blockchain success.

As blockchain technology continues its rapid evolution, embracing these innovative funding models is essential for stakeholders, developers, and investors alike. Whether you are building the next revolutionary dApp or seeking to secure your existing platform, integrating bounty programs with project grants offers a powerful way to harness community talent and drive sustainable, long‑term innovation.

For further insights, check out the comprehensive original article on Bounty Programs for Blockchain Development. Additionally, you might find these related discussions from Dev.to valuable: Unveiling the Success Behind Spring Security Open Source Business Models – Funding and Community and Navigating Open Source Funding for Startups: Opportunities and Challenges.

By understanding and leveraging the power of these dual funding strategies, the blockchain community is better positioned to build a more secure, robust, and inclusive digital future.

Embrace transparency. Invest in innovation. And let community-driven efforts pave the way for the next era of blockchain technology.

![[Free Webinar] Guide to Securing Your Entire Identity Lifecycle Against AI-Powered Threats](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjqbZf4bsDp6ei3fmQ8swm7GB5XoRrhZSFE7ZNhRLFO49KlmdgpIDCZWMSv7rydpEShIrNb9crnH5p6mFZbURzO5HC9I4RlzJazBBw5aHOTmI38sqiZIWPldRqut4bTgegipjOk5VgktVOwCKF_ncLeBX-pMTO_GMVMfbzZbf8eAj21V04y_NiOaSApGkM/s1600/webinar-play.jpg?#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![Google Home app fixes bug that repeatedly asked to ‘Set up Nest Cam features’ for Nest Hub Max [U]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2022/08/youtube-premium-music-nest-hub-max.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![New Hands-On iPhone 17 Dummy Video Shows Off Ultra-Thin Air Model, Updated Pro Designs [Video]](https://www.iclarified.com/images/news/97171/97171/97171-640.jpg)

![Epic Games Wins Major Victory as Apple is Ordered to Comply With App Store Anti-Steering Injunction [Updated]](https://images.macrumors.com/t/Z4nU2dRocDnr4NPvf-sGNedmPGA=/2250x/article-new/2022/01/iOS-App-Store-General-Feature-JoeBlue.jpg)