Nvidia’s $5.5B China chip charge rattles markets, pulls Bitcoin below $84K

A late-session shockwave from chip giant Nvidia sent tremors through both equity and cryptocurrency markets on Wednesday, souring investor sentiment and triggering a pullback in digital assets as traders digested the implications of a significant financial hit tied to US trade policy. Nvidia’s costly China chip ban The mood shift followed Nvidia’s disclosure in a […] The post Nvidia’s $5.5B China chip charge rattles markets, pulls Bitcoin below $84K appeared first on CoinJournal.

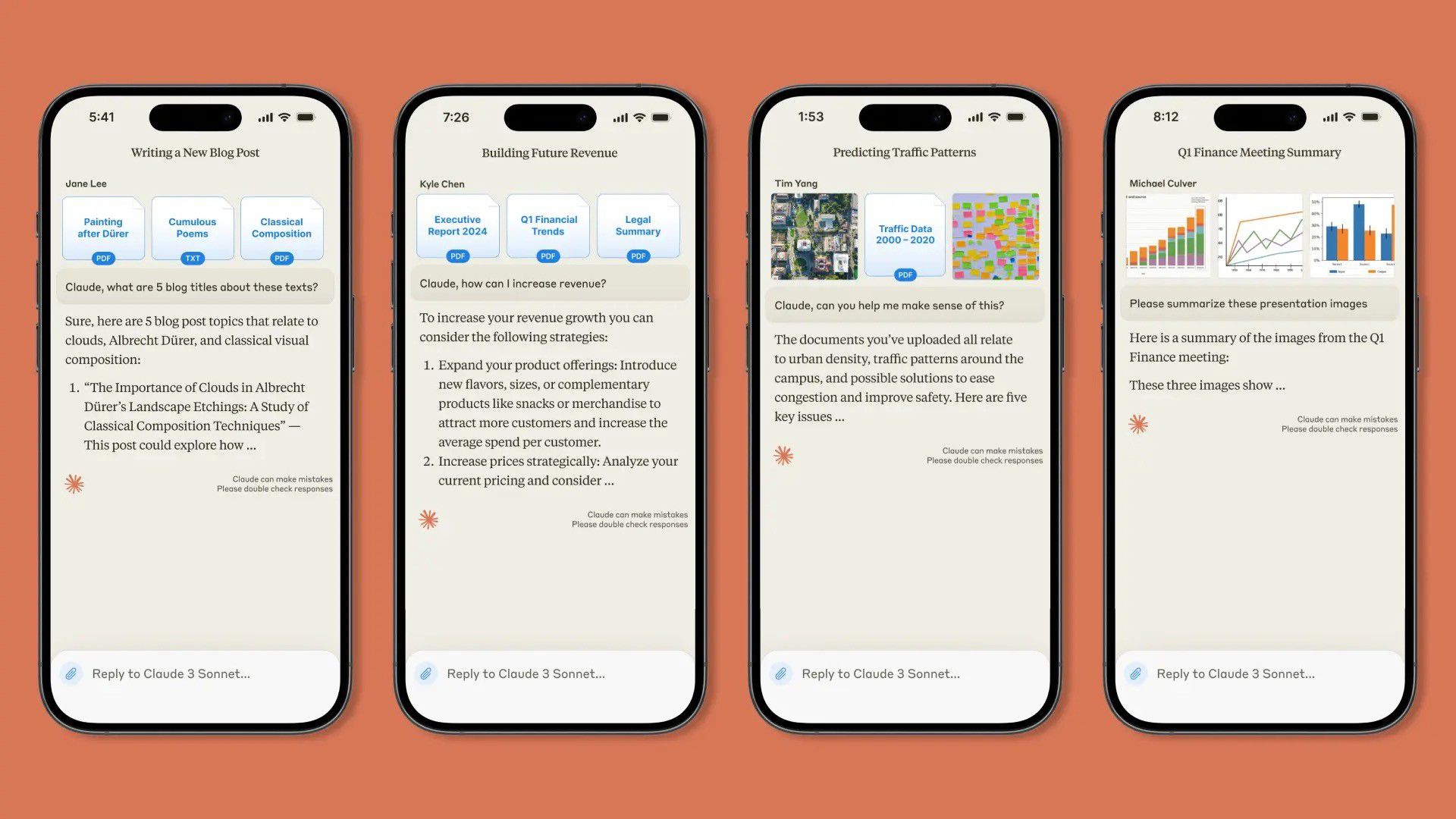

A late-session shockwave from chip giant Nvidia sent tremors through both equity and cryptocurrency markets on Wednesday, souring investor sentiment and triggering a pullback in digital assets as traders digested the implications of a significant financial hit tied to US trade policy.

Nvidia’s costly China chip ban

The mood shift followed Nvidia’s disclosure in a regulatory filing of an anticipated $5.5 billion charge for its fiscal first quarter.

This substantial write-down stems directly from the Trump administration’s decision to restrict the export of the company’s advanced H20 artificial intelligence chips to China.

The news landed heavily in after-hours trading, sending Nvidia (NVDA) shares tumbling 8% to $89.10 and validating unusual bearish activity observed in NVDA put options just a day prior, which had hinted at an impending market downturn.

The fallout also weighed particularly on cryptocurrencies associated with the artificial intelligence (AI) narrative, which underperformed the broader market.

Crypto markets follow suit

Reflecting the soured risk appetite, Bitcoin (BTC), the market’s dominant cryptocurrency, reversed its earlier gains.

Having touched a two-week high of $86,440 earlier in the day, Bitcoin slid back towards $83,600, according to CoinDesk data.

Other major cryptocurrencies mirrored this retreat; the payments-oriented token XRP dipped over 2% to $2.08, while Cardano’s ADA token shed 4% to trade at $0.61.

The CoinDesk 20 Index, a measure of the broader digital asset market, registered a decline of more than 2%, indicating widespread weakness.

Broader market jitters emerge

The pessimism extended beyond crypto into traditional equity futures. Contracts tied to the tech-heavy Nasdaq index fell over 1%, signaling negative expectations for the upcoming trading session and reinforcing the risk-off sentiment across asset classes.

Against this backdrop of heightened sensitivity, market participants are now turning their attention to crucial upcoming economic indicators and central bank commentary.

The US retail sales report for March, due Wednesday morning Eastern time, is highly anticipated. Economists polled by Dow Jones forecast a 1.2% month-over-month increase in consumer spending, a significant acceleration from February’s 0.2% rise.

A stronger-than-expected retail sales figure could potentially alleviate some fears of an impending recession, fears that have been stoked by President Donald Trump’s ongoing trade conflicts.

However, analysts caution that the market might discount robust data as “backward-looking,” potentially failing to capture the impact of the significant escalation in trade tensions witnessed throughout April.

Powell’s outlook under scrutiny

Adding to the anticipation, Federal Reserve Chairman Jerome Powell is scheduled to deliver remarks on his outlook for the US economy at the Economic Club of Chicago on Wednesday.

His comments will be intensely scrutinized for any hints regarding the future path of monetary policy. “All eyes are on Powell. Markets are holding their breath for Powell on Wednesday,” noted Secure Digital Markets in a research note Tuesday.

Between the trade war and rising recession chatter, traders are watching for any hint the Fed might be forced to cut sooner than expected.

The potential for rate cuts has gained traction as forward-looking indicators like inflation breakevens have declined amidst the trade turmoil, suggesting a disinflationary impact from tariffs that could give the Fed room to ease policy.

This aligns with recent comments from Federal Reserve Governor Christopher Waller, who stated earlier this week that the central bank might need to implement a series of rapid “bad news” rate cuts should President Trump reimpose the broad tariffs unveiled on April 2 (most of which were subsequently suspended for 90 days, excluding those on China).

The confluence of corporate earnings shocks, trade policy uncertainty, and upcoming macroeconomic signals leaves markets in a state of heightened alert.

The post Nvidia’s $5.5B China chip charge rattles markets, pulls Bitcoin below $84K appeared first on CoinJournal.

.jpg)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Daredevil Born Again season 1 ending explained: does [spoiler] show up, when does season 2 come out, and more Marvel questions answered](https://cdn.mos.cms.futurecdn.net/i8Lf25QWuSoxWKGxWMLaaA.jpg?#)