Master the Oracle Payroll Cloud 2024 Implementation Professional Exam – Ultimate Guide

Are you aiming to boost your career in cloud-based payroll solutions? The Oracle Payroll Cloud 2024 Implementation Professional certification might be your golden ticket. This credential validates your expertise in deploying, configuring, and managing Oracle Payroll Cloud solutions—a skill set in high demand as businesses shift to automated payroll systems. But how do you conquer the Payroll Cloud Implementation Professional exam? This ultimate guide breaks down everything you need to know to prepare effectively and pass with confidence. Understanding the Oracle Payroll Cloud 2024 Exam Before diving into preparation, understand what the exam entails. The Oracle Payroll Cloud 2024 Implementation Professional test evaluates your ability to implement payroll solutions using Oracle Cloud. It covers payroll setup, calculations, reporting, compliance, and integration with other Oracle HCM modules. The exam typically includes multiple-choice, scenario-based, and hands-on lab questions to test practical skills. Key Details: Exam Format: Mix of theory and practical tasks. Duration: Around 120 minutes (varies by region). Passing Score: Usually 65-70%, but confirm with Oracle’s latest guidelines. Step 1: Know the Exam Objectives Start by reviewing the official exam blueprint from Oracle. The Payroll Cloud Implementation Professional exam focuses on these core areas: Payroll Setup and Configuration: Learn to create payroll definitions, calendars, and earnings/deductions. Payroll Calculations: Master gross-to-net calculations, batch processing, and troubleshooting errors. Tax Reporting and Compliance: Understand tax regulations, year-end reporting, and legal updates. Integrations: Connect Payroll Cloud with Oracle HCM, Time & Labor, and third-party systems. Reporting and Analytics: Generate payroll reports and use BI tools for data insights. Focus on these topics to build a strong foundation. Step 2: Use Official Study Resources Oracle provides tailored materials for the Oracle Payroll Cloud 2024 exam. Prioritize these resources: Oracle University Courses: Enroll in instructor-led training like Oracle Payroll Cloud Implementation Essentials. Documentation: Study the Oracle Payroll Cloud User Guide and Implementation Guide. Practice Tests: Simulate exam conditions with Oracle’s practice exams to identify weak spots. Supplement these with community forums like Oracle’s Customer Connect, where professionals share tips and clarify doubts. Step 3: Get Hands-On Practice Theory alone won’t cut it—the exam tests real-world skills. If your company uses Oracle Payroll Cloud, volunteer for implementation projects. No access? Use Oracle’s free trial or sandbox environments to practice: Configure payroll elements and calculation rules. Run payroll batches and resolve common errors. Generate tax reports and integrate data with other modules. Hands-on experience builds muscle memory for tackling lab questions quickly. Step 4: Master Payroll Calculations and Compliance A huge chunk of the exam revolves around payroll calculations. Drill into these areas: Gross-to-Net Calculations: Understand how earnings, deductions, taxes, and benefits affect net pay. Retroactive Payments: Learn to process adjustments for backdated salary changes. Multi-Country Compliance: Study tax laws, social security, and statutory requirements for different regions. Use flashcards or spreadsheets to memorize formulas and tax rates. Step 5: Focus on Integrations and Reporting Oracle Payroll Cloud rarely works in isolation. You’ll need to integrate it with: Oracle HCM Cloud: Sync employee data, absences, and time entries. Third-Party Systems: Set up APIs or file-based feeds for banking or benefits providers. Additionally, practice creating payroll reports (e.g., payroll registers, tax summaries) and using OTBI (Oracle Transactional Business Intelligence) for analytics. Step 6: Join Study Groups Connect with peers preparing for the same exam. Join LinkedIn groups, Reddit forums, or local Oracle user communities. Discussing complex topics like “how to handle payroll reversals” or “best practices for year-end reporting” can deepen your understanding. Step 7: Take Mock Exams Seriously Mock tests do more than assess readiness—they train you to manage time and pressure. Aim to score 80%+ consistently on practice tests before booking the real exam. Analyze mistakes and revisit study materials to fill knowledge gaps. Exam Day Tips Read Questions Carefully: Scenario-based questions often include distractors. Identify keywords like “best,” “first,” or “most likely.” Prioritize Lab Tasks: If the exam includes labs, tackle them early while your mind is fresh. Flag and Review: Skip tricky questions and return to them later. Why This Certification Matters Earning the Oracle Payroll Cloud 2024 Implementation Professional title proves you can deliver end

Are you aiming to boost your career in cloud-based payroll solutions? The Oracle Payroll Cloud 2024 Implementation Professional certification might be your golden ticket. This credential validates your expertise in deploying, configuring, and managing Oracle Payroll Cloud solutions—a skill set in high demand as businesses shift to automated payroll systems. But how do you conquer the Payroll Cloud Implementation Professional exam? This ultimate guide breaks down everything you need to know to prepare effectively and pass with confidence.

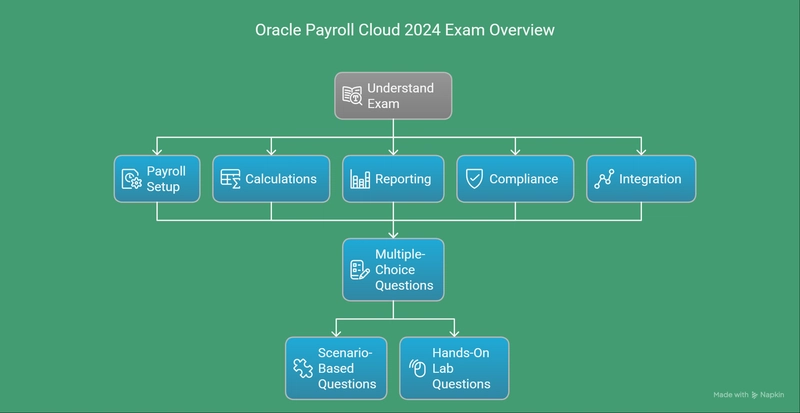

Understanding the Oracle Payroll Cloud 2024 Exam

Before diving into preparation, understand what the exam entails. The Oracle Payroll Cloud 2024 Implementation Professional test evaluates your ability to implement payroll solutions using Oracle Cloud. It covers payroll setup, calculations, reporting, compliance, and integration with other Oracle HCM modules. The exam typically includes multiple-choice, scenario-based, and hands-on lab questions to test practical skills.

Key Details:

- Exam Format: Mix of theory and practical tasks.

- Duration: Around 120 minutes (varies by region).

- Passing Score: Usually 65-70%, but confirm with Oracle’s latest guidelines.

Step 1: Know the Exam Objectives

Start by reviewing the official exam blueprint from Oracle. The Payroll Cloud Implementation Professional exam focuses on these core areas:

- Payroll Setup and Configuration: Learn to create payroll definitions, calendars, and earnings/deductions.

- Payroll Calculations: Master gross-to-net calculations, batch processing, and troubleshooting errors.

- Tax Reporting and Compliance: Understand tax regulations, year-end reporting, and legal updates.

- Integrations: Connect Payroll Cloud with Oracle HCM, Time & Labor, and third-party systems.

- Reporting and Analytics: Generate payroll reports and use BI tools for data insights. Focus on these topics to build a strong foundation.

Step 2: Use Official Study Resources

Oracle provides tailored materials for the Oracle Payroll Cloud 2024 exam. Prioritize these resources:

- Oracle University Courses: Enroll in instructor-led training like Oracle Payroll Cloud Implementation Essentials.

- Documentation: Study the Oracle Payroll Cloud User Guide and Implementation Guide.

- Practice Tests: Simulate exam conditions with Oracle’s practice exams to identify weak spots. Supplement these with community forums like Oracle’s Customer Connect, where professionals share tips and clarify doubts.

Step 3: Get Hands-On Practice

Theory alone won’t cut it—the exam tests real-world skills. If your company uses Oracle Payroll Cloud, volunteer for implementation projects. No access? Use Oracle’s free trial or sandbox environments to practice:

- Configure payroll elements and calculation rules.

- Run payroll batches and resolve common errors.

- Generate tax reports and integrate data with other modules.

- Hands-on experience builds muscle memory for tackling lab questions quickly.

Step 4: Master Payroll Calculations and Compliance

A huge chunk of the exam revolves around payroll calculations. Drill into these areas:

- Gross-to-Net Calculations: Understand how earnings, deductions, taxes, and benefits affect net pay.

- Retroactive Payments: Learn to process adjustments for backdated salary changes.

- Multi-Country Compliance: Study tax laws, social security, and statutory requirements for different regions. Use flashcards or spreadsheets to memorize formulas and tax rates.

Step 5: Focus on Integrations and Reporting

Oracle Payroll Cloud rarely works in isolation. You’ll need to integrate it with:

- Oracle HCM Cloud: Sync employee data, absences, and time entries.

- Third-Party Systems: Set up APIs or file-based feeds for banking or benefits providers. Additionally, practice creating payroll reports (e.g., payroll registers, tax summaries) and using OTBI (Oracle Transactional Business Intelligence) for analytics.

Step 6: Join Study Groups

Connect with peers preparing for the same exam. Join LinkedIn groups, Reddit forums, or local Oracle user communities. Discussing complex topics like “how to handle payroll reversals” or “best practices for year-end reporting” can deepen your understanding.

Step 7: Take Mock Exams Seriously

Mock tests do more than assess readiness—they train you to manage time and pressure. Aim to score 80%+ consistently on practice tests before booking the real exam. Analyze mistakes and revisit study materials to fill knowledge gaps.

Exam Day Tips

- Read Questions Carefully: Scenario-based questions often include distractors. Identify keywords like “best,” “first,” or “most likely.”

- Prioritize Lab Tasks: If the exam includes labs, tackle them early while your mind is fresh.

- Flag and Review: Skip tricky questions and return to them later.

- Why This Certification Matters Earning the Oracle Payroll Cloud 2024 Implementation Professional title proves you can deliver end-to-end payroll solutions in the cloud. Organizations value this expertise to ensure accurate, compliant, and efficient payroll operations. Plus, certified professionals often command higher salaries and land roles like Payroll Manager, Cloud Consultant, or HCM Specialist.

Final Thoughts

Passing the Payroll Cloud Implementation Professional exam requires a mix of structured study, hands-on practice, and strategic test-taking. Use this guide to stay organized, focus on high-impact topics, and approach the exam with confidence. Remember, persistence pays off—literally!

Ready to become an Oracle Payroll Cloud expert? Start your journey today, and unlock new career opportunities in the fast-growing cloud payroll landscape.

![[Free Webinar] Guide to Securing Your Entire Identity Lifecycle Against AI-Powered Threats](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjqbZf4bsDp6ei3fmQ8swm7GB5XoRrhZSFE7ZNhRLFO49KlmdgpIDCZWMSv7rydpEShIrNb9crnH5p6mFZbURzO5HC9I4RlzJazBBw5aHOTmI38sqiZIWPldRqut4bTgegipjOk5VgktVOwCKF_ncLeBX-pMTO_GMVMfbzZbf8eAj21V04y_NiOaSApGkM/s1600/webinar-play.jpg?#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_Jochen_Tack_Alamy.png?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple testing Stage Manager for iPhone, Photographic Styles for video, and more [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/iOS-Decoded-iOS-18.5.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![New Hands-On iPhone 17 Dummy Video Shows Off Ultra-Thin Air Model, Updated Pro Designs [Video]](https://www.iclarified.com/images/news/97171/97171/97171-640.jpg)

![Apple Shares Trailer for First Immersive Feature Film 'Bono: Stories of Surrender' [Video]](https://www.iclarified.com/images/news/97168/97168/97168-640.jpg)

![Apple Restructures Global Affairs and Apple Music Teams [Report]](https://www.iclarified.com/images/news/97162/97162/97162-640.jpg)