Driving Innovation: Blockchain Funding and Token Incentives

Abstract: This post takes an in‐depth look at the evolving landscape of blockchain funding mechanisms and token incentives. We explore key concepts such as ICOs, STOs, DAOs, and IDOs as methods of raising capital for blockchain projects while examining the role of various tokens – from utility and governance tokens to staking and security tokens – in fueling blockchain ecosystems. The article also reviews regulatory challenges, user adoption issues, and offers a future outlook on streamlining funding and compliance in a decentralized world. Drawing on insights from original resources like Driving Innovation: Blockchain Funding and Token Incentives, as well as expert commentary from Dev.to and License Token’s ecosystem, we offer a holistic overview enriched with tables, bullet lists, and clear examples to help technical and nontechnical readers navigate this dynamic space. Introduction Blockchain technology has emerged as a transformative force in many industries. One of its most significant advantages is its ability to provide disruptive funding solutions through decentralization. Instead of relying solely on traditional venture capital, blockchain projects can raise funds via innovative methods such as Initial Coin Offerings (ICOs), Security Token Offerings (STOs), Decentralized Autonomous Organizations (DAOs), and Initial DEX Offerings (IDOs). Alongside these methods, token incentives like utility tokens, governance tokens, security tokens, and staking tokens are key to unlocking engagement and liquidity in these ecosystems. In this article, we explore these blockchain funding mechanisms and token incentive models in detail. We also discuss the challenges facing blockchain funding such as regulatory compliance, technical complexity, and adoption rates. Moreover, we consider the future trends and innovations that might draw more developers and investors into this space. Background and Context Blockchain project funding has come a long way since the early days of Bitcoin. Today, various complementary models have emerged: Initial Coin Offerings (ICOs): ICOs provided the groundwork for blockchain projects to raise capital by issuing tokens. By allowing early investors to finance projects in exchange for tokens, ICOs democratized the fundraising process. Learn more about ICOs in detail on Investopedia. Security Token Offerings (STOs): STOs bring a more regulated approach to fundraising by offering tokens that represent tangible, real-world assets. This model helps align with securities laws and provides investors with an added degree of protection. Further details are available on Investopedia. Decentralized Autonomous Organizations (DAOs): DAOs empower community-driven decision making and funding using smart contracts. The collective governance model enables stakeholders to participate and vote in critical project decisions. Explore the role of DAOs on CoinDesk. Initial DEX Offerings (IDOs): IDOs leverage decentralized exchanges, improving liquidity and lowering entry barriers. This model offers near-instant token listings and efficient fundraising methods. More on the IDO process can be read at Investopedia. Alongside these funding models, tokens play an essential role in the success of blockchain projects: Utility Tokens: These tokens incentivize users by providing benefits or services within the ecosystem. They are crucial in driving user engagement and network use. Read about utility tokens on Forbes Advisor. Governance Tokens: Governance tokens grant the right to participate in the decision-making process, enabling holders to vote on proposals. They reinforce community ownership and project direction. For more insights into governance tokens, visit Decrypt. Security Tokens: These tokens represent real-world assets or securities and provide a means for asset tokenization. They open up new investment opportunities and offer regulatory clarity. Explore their benefits on CoinDesk. Staking Tokens: Staking tokens are used to secure blockchain networks, especially in Proof of Stake (PoS) systems, while rewarding participants through staking rewards. Additional information is available on Ethereum.org. This rich diversity in funding and token frameworks allows projects to match their business models with the right financing strategy and incentive structure. However, aligning regulatory requirements with decentralized innovation remains a crucial challenge. Core Concepts and Features Understanding blockchain funding and token incentives involves examining how each method and token type contributes to the ecosystem. Below, we detail the core concepts: Funding Mechanisms ICOs and STOs: ICOs: Pros: Open fundraising, early adoption incentives, and rapid capital accumulation. Cons: Regulatory uncertainty, potential for scams, and volatile market conditions. STOs: Pros: Improved regulatory compliance, asset-backed tokens, and increased investor c

Abstract:

This post takes an in‐depth look at the evolving landscape of blockchain funding mechanisms and token incentives. We explore key concepts such as ICOs, STOs, DAOs, and IDOs as methods of raising capital for blockchain projects while examining the role of various tokens – from utility and governance tokens to staking and security tokens – in fueling blockchain ecosystems. The article also reviews regulatory challenges, user adoption issues, and offers a future outlook on streamlining funding and compliance in a decentralized world. Drawing on insights from original resources like Driving Innovation: Blockchain Funding and Token Incentives, as well as expert commentary from Dev.to and License Token’s ecosystem, we offer a holistic overview enriched with tables, bullet lists, and clear examples to help technical and nontechnical readers navigate this dynamic space.

Introduction

Blockchain technology has emerged as a transformative force in many industries. One of its most significant advantages is its ability to provide disruptive funding solutions through decentralization. Instead of relying solely on traditional venture capital, blockchain projects can raise funds via innovative methods such as Initial Coin Offerings (ICOs), Security Token Offerings (STOs), Decentralized Autonomous Organizations (DAOs), and Initial DEX Offerings (IDOs). Alongside these methods, token incentives like utility tokens, governance tokens, security tokens, and staking tokens are key to unlocking engagement and liquidity in these ecosystems.

In this article, we explore these blockchain funding mechanisms and token incentive models in detail. We also discuss the challenges facing blockchain funding such as regulatory compliance, technical complexity, and adoption rates. Moreover, we consider the future trends and innovations that might draw more developers and investors into this space.

Background and Context

Blockchain project funding has come a long way since the early days of Bitcoin. Today, various complementary models have emerged:

Initial Coin Offerings (ICOs): ICOs provided the groundwork for blockchain projects to raise capital by issuing tokens. By allowing early investors to finance projects in exchange for tokens, ICOs democratized the fundraising process. Learn more about ICOs in detail on Investopedia.

Security Token Offerings (STOs): STOs bring a more regulated approach to fundraising by offering tokens that represent tangible, real-world assets. This model helps align with securities laws and provides investors with an added degree of protection. Further details are available on Investopedia.

Decentralized Autonomous Organizations (DAOs): DAOs empower community-driven decision making and funding using smart contracts. The collective governance model enables stakeholders to participate and vote in critical project decisions. Explore the role of DAOs on CoinDesk.

Initial DEX Offerings (IDOs): IDOs leverage decentralized exchanges, improving liquidity and lowering entry barriers. This model offers near-instant token listings and efficient fundraising methods. More on the IDO process can be read at Investopedia.

Alongside these funding models, tokens play an essential role in the success of blockchain projects:

Utility Tokens: These tokens incentivize users by providing benefits or services within the ecosystem. They are crucial in driving user engagement and network use. Read about utility tokens on Forbes Advisor.

Governance Tokens: Governance tokens grant the right to participate in the decision-making process, enabling holders to vote on proposals. They reinforce community ownership and project direction. For more insights into governance tokens, visit Decrypt.

Security Tokens: These tokens represent real-world assets or securities and provide a means for asset tokenization. They open up new investment opportunities and offer regulatory clarity. Explore their benefits on CoinDesk.

Staking Tokens: Staking tokens are used to secure blockchain networks, especially in Proof of Stake (PoS) systems, while rewarding participants through staking rewards. Additional information is available on Ethereum.org.

This rich diversity in funding and token frameworks allows projects to match their business models with the right financing strategy and incentive structure. However, aligning regulatory requirements with decentralized innovation remains a crucial challenge.

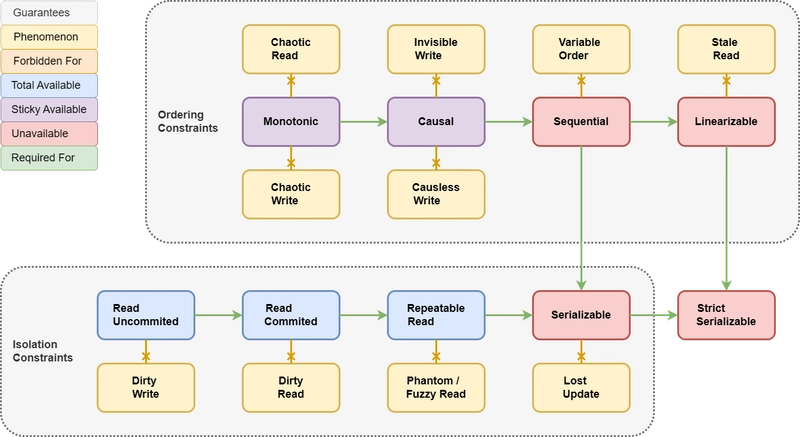

Core Concepts and Features

Understanding blockchain funding and token incentives involves examining how each method and token type contributes to the ecosystem. Below, we detail the core concepts:

Funding Mechanisms

-

ICOs and STOs:

- ICOs: Pros: Open fundraising, early adoption incentives, and rapid capital accumulation. Cons: Regulatory uncertainty, potential for scams, and volatile market conditions.

- STOs: Pros: Improved regulatory compliance, asset-backed tokens, and increased investor confidence. Cons: Additional oversight, higher costs, and slower fundraising dynamics.

-

DAOs & IDOs:

- DAOs: By allowing token holders to participate in decision-making, DAOs improve transparency and community engagement. Challenges include coordination difficulties and vulnerability to governance attacks.

- IDOs: IDOs offer speed and liquidity by listing tokens directly on decentralized exchanges. However, they require robust security measures and careful liquidity management.

Token Incentives

-

Utility Tokens:

- Function as the "fuel" of the ecosystem.

- Offer in-app benefits that drive real usage and service adoption.

-

Governance Tokens:

- Enable decentralized decision making.

- Allow the community to have a voice in project evolution, ensuring that the system adapts to user feedback.

-

Security Tokens:

- Offer regulated ways for investors to participate in the project's economy.

- Often represent ownership interests, dividends, or claims on assets.

-

Staking Tokens:

- Serve dual purposes: securing the network and rewarding those who invest in its security.

- Encourage long-term holding and participation, which contributes to network stability.

Table: Comparison of Blockchain Funding Mechanisms

| Funding Mechanism | Key Features | Regulatory Considerations |

|---|---|---|

| ICOs | Rapid capital access, early adopter benefits | Often unregulated, high risk of fraud |

| STOs | Asset-backed, investor protection | Compliant with securities laws; more oversight |

| DAOs | Community-driven, decentralized governance | Complex legal frameworks; evolving regulations |

| IDOs | Decentralized exchange listing, liquidity enhancement | Requires rigorous security protocols; lower standardization |

Applications and Use Cases

Blockchain funding models and token incentives are not only theoretical constructs but have practical applications that disrupt traditional financial landscapes. Here are several real-world examples:

Decentralized Finance (DeFi):

DeFi platforms use staking tokens extensively to secure networks and reward users. For example, projects built on Ethereum leverage staking and governance tokens to offer lending, borrowing, and yield farming. Further insights about DeFi can be cross-referenced with arbitrum-and-de-fi-yield.Tokenized Asset Platforms:

With security tokens representing shares in real-world assets, platforms can democratize investments. These platforms benefit from regulatory-approved STO frameworks, which boost investor confidence and access, aligning with the industry’s move toward more compliant funding approaches.Community-Driven Projects:

DAOs enable community-managed projects where every token holder has a say in the project’s roadmap. Initiatives like License Token’s approach demonstrate how community engagement can lead to innovative outcomes, including open source contributions and scalability improvements.Crowdfunding and Open-Source Funding:

Projects built on blockchain can use hybrid models combining ICOs and innovative token incentive schemes to raise funds. Crowdfunding in this manner offers an alternative to traditional venture capital and is discussed in depth on The Future of Crowdfunding Open Source Projects With Blockchain.

Challenges and Limitations

Despite its promising potential, blockchain project funding and token Incentives face several hurdles:

Regulatory Uncertainty:

The decentralized nature of blockchain challenges conventional regulatory frameworks. Projects must navigate evolving rules while ensuring investor protection. For example, arbitrum-and-regulatory-compliance offers insights into the measures taken by projects to meet compliance standards.Technical Complexity:

Implementing smart contracts, establishing secure token frameworks, and integrating with decentralized platforms require technical expertise. Missteps can result in vulnerabilities—this is why smart contract audits (explored at arbitrum-and-smart-contract-audits) are critical.Market Volatility:

Token prices can be highly volatile. This instability may deter mainstream investors and complicate long-term planning for projects relying on token incentives.Adoption and Scalability Issues:

Even with smart contracts and efficient token models, achieving widespread adoption is a prolonged process that may be hampered by network congestion and scalability challenges.User Education and Financial Literacy:

For many potential users and investors, blockchain funding models can be complex. Building financial literacy and comprehensive educational tools is essential for broader adoption.

Key challenges include:

- Regulatory compliance

- Cybersecurity risks

- Technical integration

- Market and liquidity management

Future Outlook and Innovations

Looking ahead, blockchain funding and token incentives are poised for further innovation. Here are a few future trends:

Increased Regulatory Maturity:

As regulators work closely with blockchain innovators, compliance standards will improve. Enhanced frameworks could lead to more secure and investor-friendly platforms similar to those discussed in arbitrum-and-regulatory-compliance.Enhanced Security through Audits and Standards:

With more robust smart contract audits as part of project protocols—as seen on arbitrum-and-smart-contract-audits—projects will likely minimize vulnerabilities and attract institutional investors.Interoperability and Multi-Chain Support:

Future platforms will likely support multi-chain operations to improve asset liquidity and user experience. Interoperability between blockchain networks can drive tremendous growth.Broader Adoption through Education:

Initiatives to educate developers and investors, such as open source funding workshops and developer stipends, will help lower the barrier to entry. For instance, discussions on License Token’s innovative approaches highlight how transparency and education can accelerate technological adoption.Token Economics and New Incentive Models:

As the ecosystem matures, token models will become more sophisticated. Projects may introduce hybrid tokens, dynamic staking rewards, and long-term incentive models to ensure sustained network growth and stability.

Summary

Blockchain funding mechanisms and token incentives represent a profound shift in how projects raise capital and engage communities. By leveraging methods such as ICOs, STOs, DAOs, and IDOs, blockchain projects can bypass traditional funding barriers and reach diverse investor bases. Meanwhile, token incentives—whether they are utility, governance, security, or staking tokens—serve as powerful tools to foster community participation, maintain network security, and incentivize innovation.

To summarize, the key takeaways include:

- Funding Diversity: Blockchain projects can choose from multiple funding models, each with its benefits and regulatory considerations.

- Token Incentives: A variety of tokens drive ecosystem engagement and offer practical benefits from utility to governance.

- Challenges: Regulatory uncertainty, technical complexity, market volatility, and user education remain significant hurdles.

- Future Direction: Improvements in regulatory frameworks, security audits, multi-chain interoperability, and education are paving the way for broader adoption and sustained innovation.

By addressing these challenges and building on current successes, the blockchain space is poised to continue growing as a cornerstone of decentralized finance and open source innovation.

For additional insights and detailed analysis, explore these reputable resources:

- Driving Innovation: Blockchain Funding and Token Incentives

- arbitrum-and-regulatory-compliance

- arbitrum-and-de-fi-yield

- arbitrum-and-smart-contract-audits

- arbitrum-and-token-standards

Additionally, check out expert perspectives on Dev.to:

- License Token: How Technology Is Revolutionizing Open Source Compliance

- The Future of Crowdfunding Open Source Projects With Blockchain

- License Token: Revolutionizing Open Source Licensing

By understanding the multifaceted nature of blockchain funding and token incentives, developers, investors, and enthusiasts can better navigate and contribute to this ever-evolving ecosystem. As the industry matures, the symbiosis of technology, regulation, and community engagement will continue to drive innovation and redefine capital formation in the digital age.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_Tanapong_Sungkaew_via_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Restructures Global Affairs and Apple Music Teams [Report]](https://www.iclarified.com/images/news/97162/97162/97162-640.jpg)

![New iPhone Factory Goes Live in India, Another Just Days Away [Report]](https://www.iclarified.com/images/news/97165/97165/97165-640.jpg)