Crypto Daybook Americas: Retail Shift to Riskier Tokens Jolts Bitcoin, Ether

Your day-ahead look for May 15, 2025

By Francisco Rodrigues (All times ET unless indicated otherwise)

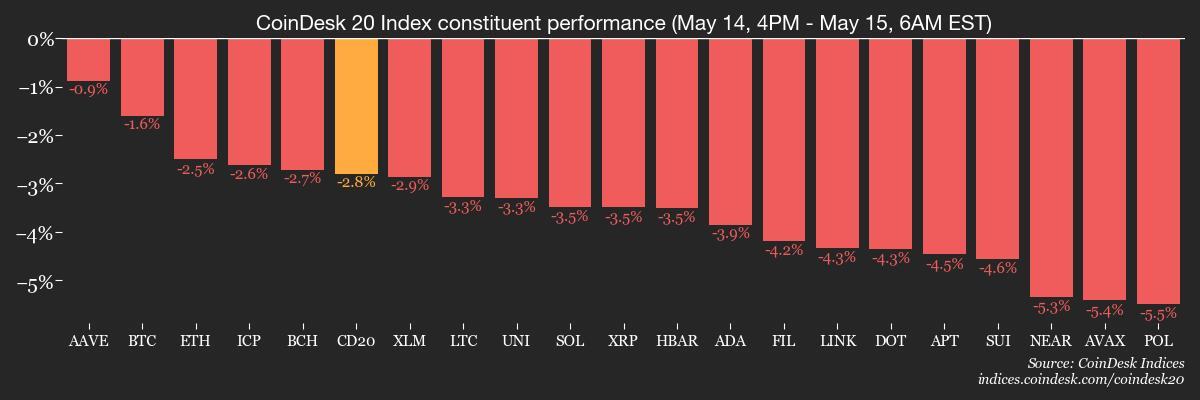

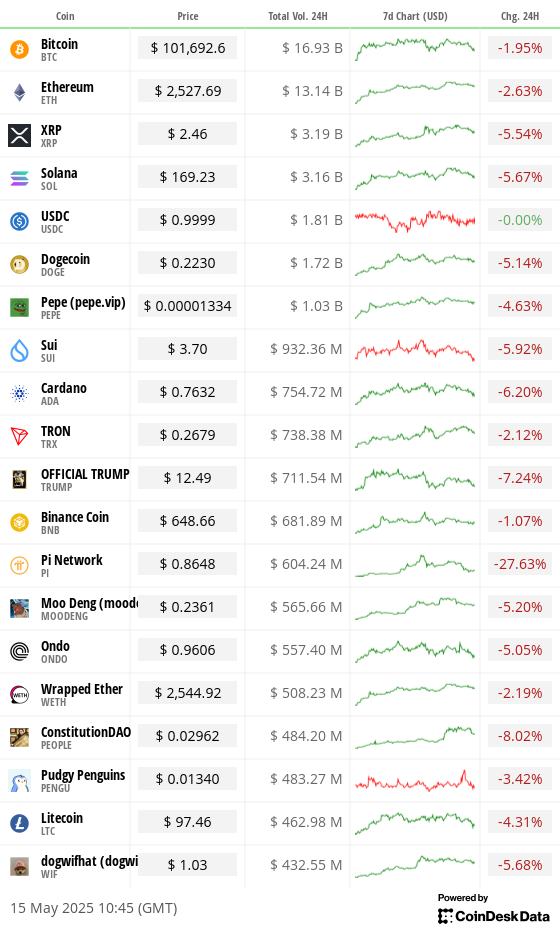

The cryptocurrency market pulled back over the last 24 hours, led by declines in major coins as retail investors switched out of large-cap tokens and into smaller, more speculative assets.

Both bitcoin BTC and ether ETH dropped around 2% and the CoinDesk 20 Index (CD20), a measure of the broad market, fell 2.7%.

"We’ve observed a significant week-on-week increase in retail participation, reinforcing the broader narrative of rising optimism," said Jake O., an over-the-counter trader at Wintermute. “The shift down the risk curve is most evident in retail screen flows.”

Institutional investors, for their part, have been more conservative. They're still stocking up on bitcoin, ether and XRP, while easing off positions in solana SOL which has faced “sustained pressures.”

“Some are viewing SOLETH underperformance as an opportunity to position for Solana topside,” Jake noted, pointing to steady buying in $200 Solana call options ahead of June and July.

Other options activity suggests traders are hedging for volatility ahead. Call spreads on ether were unwound and some traders moved into collar structures — strategies often used to protect against price swings — signaling caution after recent gains.

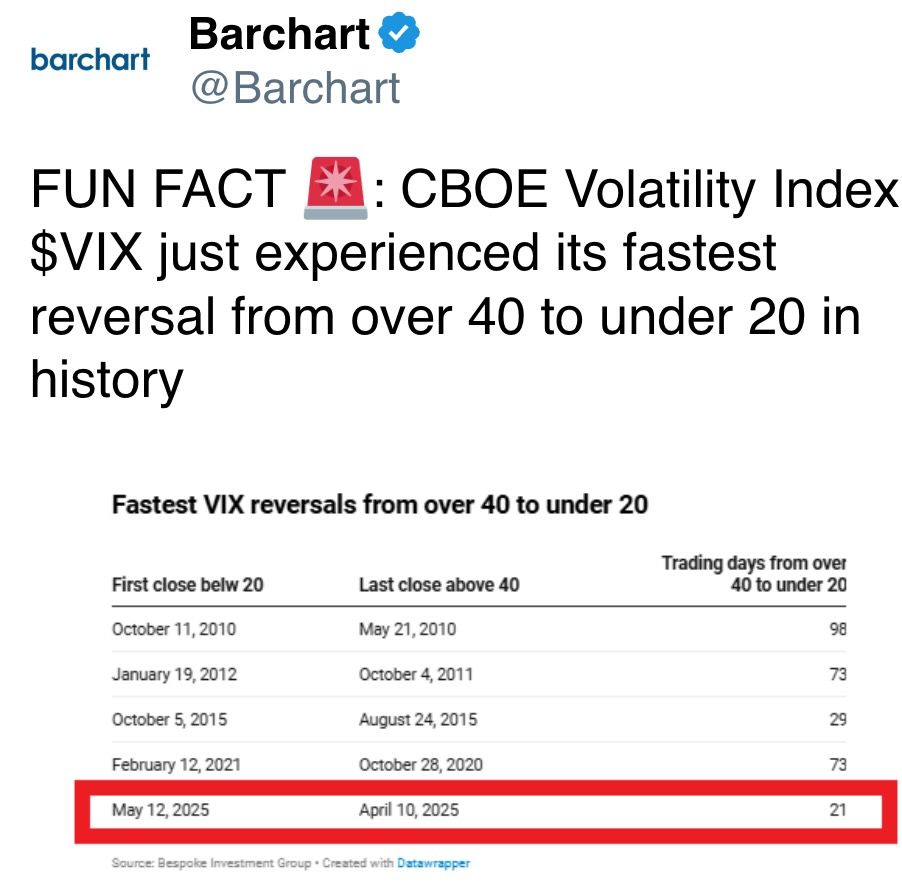

The growing hedging activity adds a note of caution to retail's swing to speculation. Economic uncertainty, lingering inflation pressures and U.S. tariff policy are all weighing on risk appetite in crypto as well as traditional markets.

Global asset managers, in fact, currently have their largest underweight position in the U.S. dollar in 19 years. Even though President Donald Trump secured a major investment deal with Qatar and a temporary reduction in U.S.-China tariffs, these outcomes may lead to further downside: Spanish bank Bankinter said in a note that the market has shown fatigue over the last trading session.

“We still think the damage is done: both EPS and prices should feel the strain, with rising inflationary pressures preventing the Fed from cutting rates as much as the market expects,” the bank’s analysts wrote. Market participants are set to now focus on producer price inflation and retail sales data, as well as on Fed Chair Jerome Powell’s speech later today.

For the crypto market, a re-test of the all-time high isn’t out of the picture.

“Looking ahead, we believe there is further room for digital assets to rally, especially as Coinbase’s inclusion into the S&P 500 on 19 May draws closer,” Singapore-based QCP Capital wrote. Stay alert!

What to Watch

- Crypto:

- May 16, 9:30 a.m.: Galaxy Digital Class A shares to begin trading on the Nasdaq under the ticker symbol GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) will replace Discover Financial Services (DFS) in the S&P 500, effective before the opening of trading.

- Macro

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail sales data.

- Retail Sales MoM Est. 1% vs. Prev. 0.5%

- Retail Sales YoY Est. -0.5% vs. Prev. 1.5%

- May 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April producer price inflation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.1%

- Core PPI YoY Est. 3.1% vs. Prev. 3.3%

- PPI MoM Est. 0.2% vs. Prev. -0.4%

- PPI YoY Est. 2.5% vs. Prev. 2.7%

- May 15, 8:30 a.m.: The U.S. Census Bureau releases April retail sales data.

- Retail Sales MoM Est. 0% vs. Prev. 1.5%

- Retail Sales YoY Prev. 4.9%

- May 15, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 10.

- Initial Jobless Claims Est. 229K vs. Prev. 228K

- May 15, 8:40 a.m.: Fed Chair Jerome H. Powell will deliver a speech ("Framework Review") in Washington. Livestream link.

- May 16, 10 a.m.: The University of Michigan releases (Preliminary) May U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 53 vs. Prev. 52.2

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail sales data.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 on Ethereum in Oku and add Unichain on Oku in a bid to enhance Uniswap’s reach and liquidity migration to V4. Voting ends May 18.

- May 15, 11 a.m.: Yield Guild Games to host a Q1 2025 community update Ask Me Anything (AMA) session.

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- May 21, 6 p.m.: Theta Network to host an Ask Me Anything session in a livestream.

- Unlocks

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $23.53 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating supply worth $14.22 million.

- May 16: Immutable (IMX) to unlock 1.35% of its circulating supply worth $17.8 million.

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating supply worth $39.06 million.

- May 17: Avalanche (AVAX) to unlock 0.4% of its circulating supply worth $42.84 million.

- Token Launches

- May 15: RIZE (RIZE) to list on Kraken.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of 3: CoinDesk's Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

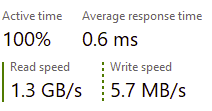

Derivatives Positioning

- BTC and ETH perpetual futures open interest ticked up alongside an overnight spot price pullback, but funding rates remain positive. Perhaps traders are buying the dip.

- Open interest in XRP perpetual futures has dropped, signaling an unwinding of longs.

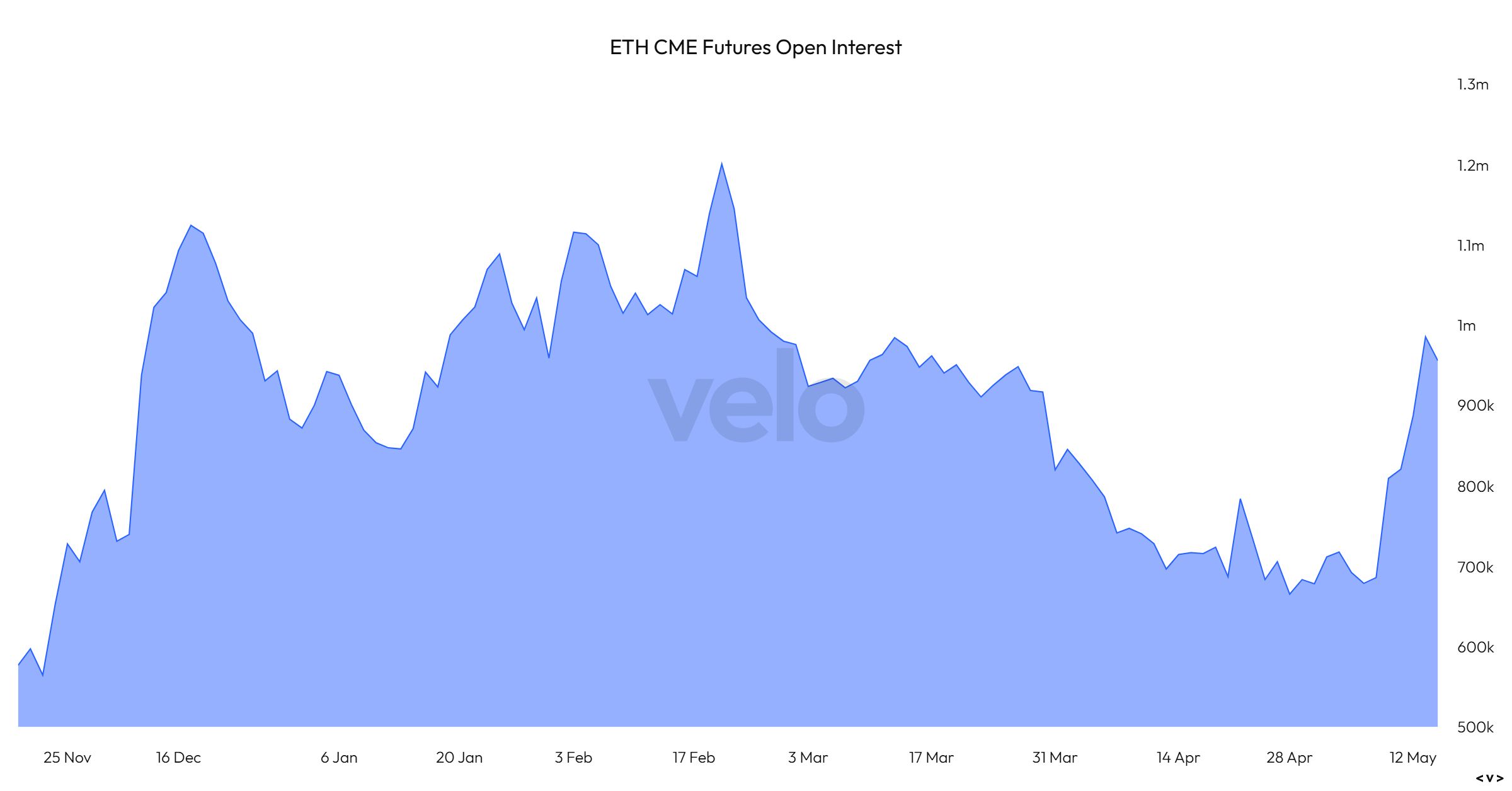

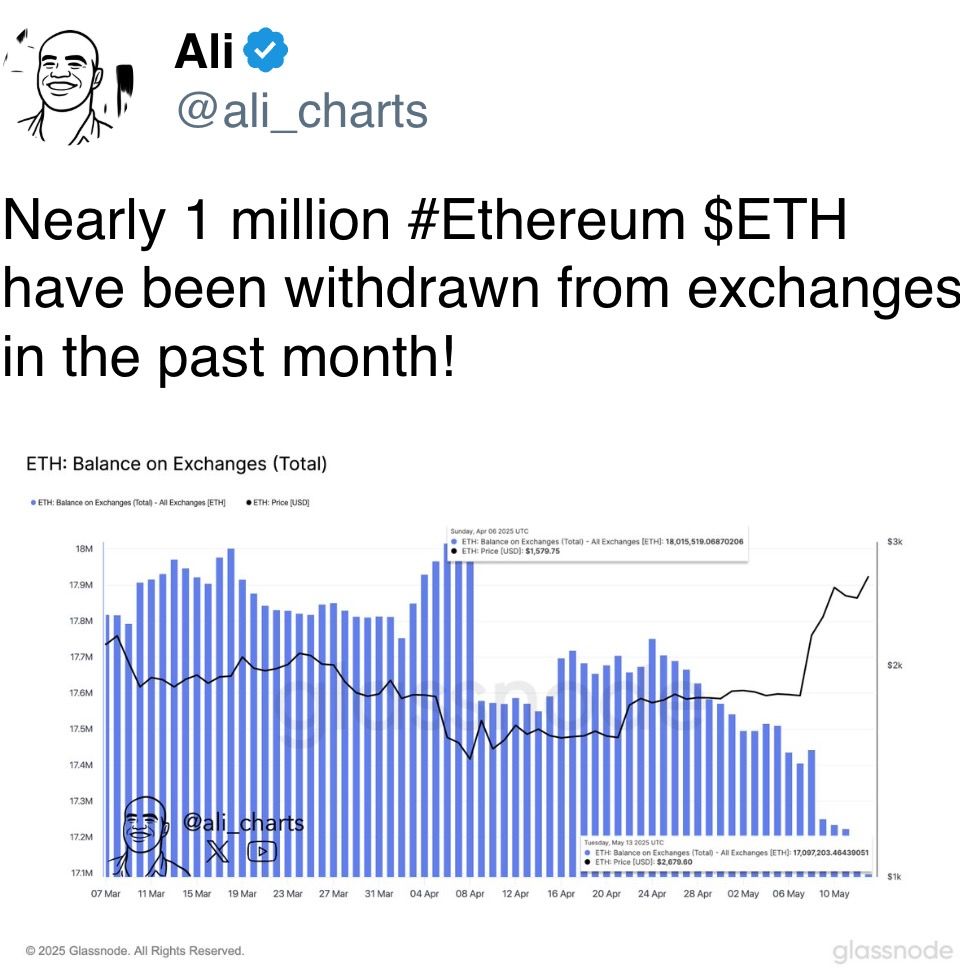

- Ether futures open interest on the CME has increased from roughly 685K ETH to 955K ETH in a week, reaching the highest since March 11. BTC CME futures have yet to see a similar uptick.

- On Deribit, ETH risk reversals at the front-end have flipped negative to show bias for puts, or downside protection. BTC calls continue to trade at a premium.

- OTC tech platform Paradigm noted mixed flows, with OTM BTC put spreads both bought and sold, while ETH OTM call spreads continued to be lifted.

Market Movements

- BTC is down 1.49% from 4 p.m. ET Wednesday at $101,906.02 (24hrs: -1.52%)

- ETH is down 2.54% at $2,540.80 (24hrs: -2.58%)

- CoinDesk 20 is down 2.79% at 3,204.04 (24hrs: -3.66%)

- Ether CESR Composite Staking Rate is down 1 bps at 3.11%

- BTC funding rate is at 0.0045% (4.8968% annualized) on Binance

- DXY is down 0.29% at 100.75

- Gold is down 0.59% at $3,168.30/oz

- Silver is down 0.85% at $32/oz

- Nikkei 225 closed -0.98% at 37,755.51

- Hang Seng closed -0.79% at 23,453.16

- FTSE is up 0.14% at 8,596.60

- Euro Stoxx 50 is down 0.54% at 5,374.02

- DJIA closed on Wednesday -0.21% at 42,051.06

- S&P 500 closed +0.1% at 5,892.58

- Nasdaq closed +0.72% at 19,146.81

- S&P/TSX Composite Index closed +0.3% at 25,692.45

- S&P 40 Latin America closed +0.18% at 2,645.42

- U.S. 10-year Treasury rate is down 3 bps at 4.51%

- E-mini S&P 500 futures are down 0.51% at 5,878.25

- E-mini Nasdaq-100 futures are down 0.72% at 21,239.50

- E-mini Dow Jones Industrial Average Index futures are down 0.32% at 41,982.00

Bitcoin Stats

- BTC Dominance: 62.77 (+0.31%)

- Ethereum to bitcoin ratio: 0.02490 (-1.23%)

- Hashrate (seven-day moving average): 861 EH/s

- Hashprice (spot): $54.63

- Total Fees: 7.21 BTC / $747,357.79

- CME Futures Open Interest: 149,720 BTC

- BTC priced in gold: 31.9 oz

- BTC vs gold market cap: 9.04%

Technical Analysis

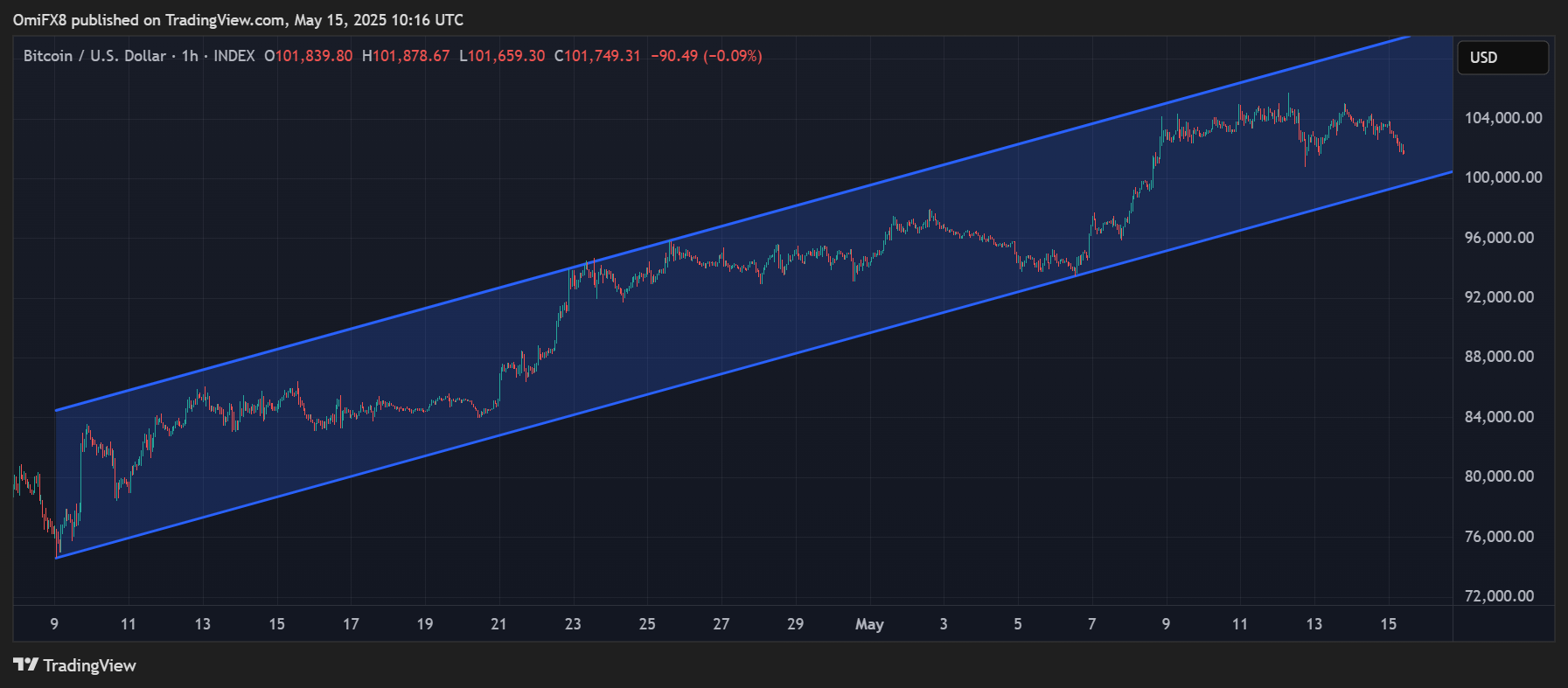

- While BTC has pulled back from the recent high of $105,700 to under $102,000, it's broader upward trajectory remains intact.

- A break below $100,000 would invalidate the trend channel from April 9 lows, potentially leading to a deeper pullback.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $416.75 (-1.15%), down 2.35% at $406.95 in pre-market

- Coinbase Global (COIN): closed at $263.41 (+2.53%), down 3.39% at $254.48

- Galaxy Digital Holdings (GLXY): closed at $31.96 (+8.74%)

- MARA Holdings (MARA): closed at $15.87 (-3.05%), down 2.52% at $15.47

- Riot Platforms (RIOT): closed at $8.91 (-1.66%), down 2.24% at $8.71

- Core Scientific (CORZ): closed at $10.32 (+0.78%), down 1.55% at $10.16

- CleanSpark (CLSK): closed at $9.61 (-3.9%), down 2.29% at $9.39

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.95 (-1.45%), down 1.71% at $16.66

- Semler Scientific (SMLR): closed at $32.54 (-11.34%), down 1.72% at $31.98

- Exodus Movement (EXOD): closed at $34.88 (-17.03%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

- Daily net flow: $319.5 million

- Cumulative net flows: $41.37 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily net flow: $63.5 million

- Cumulative net flows: $2.55 billion

- Total ETH holdings ~ 3.44 million

Source: Farside Investors

Overnight Flows

Chart of the Day

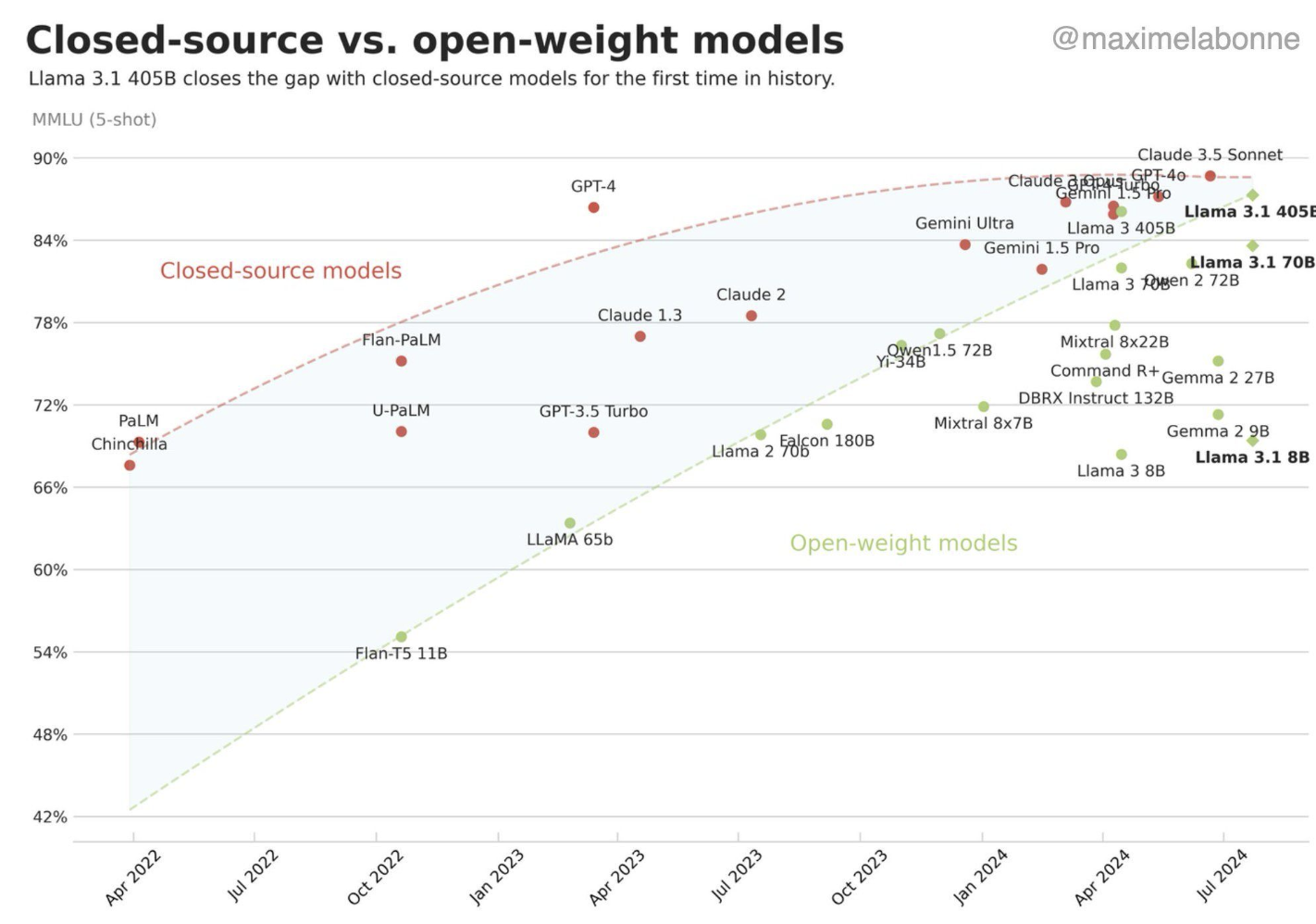

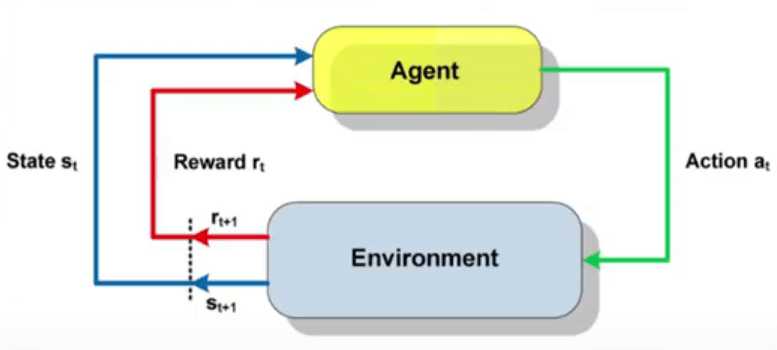

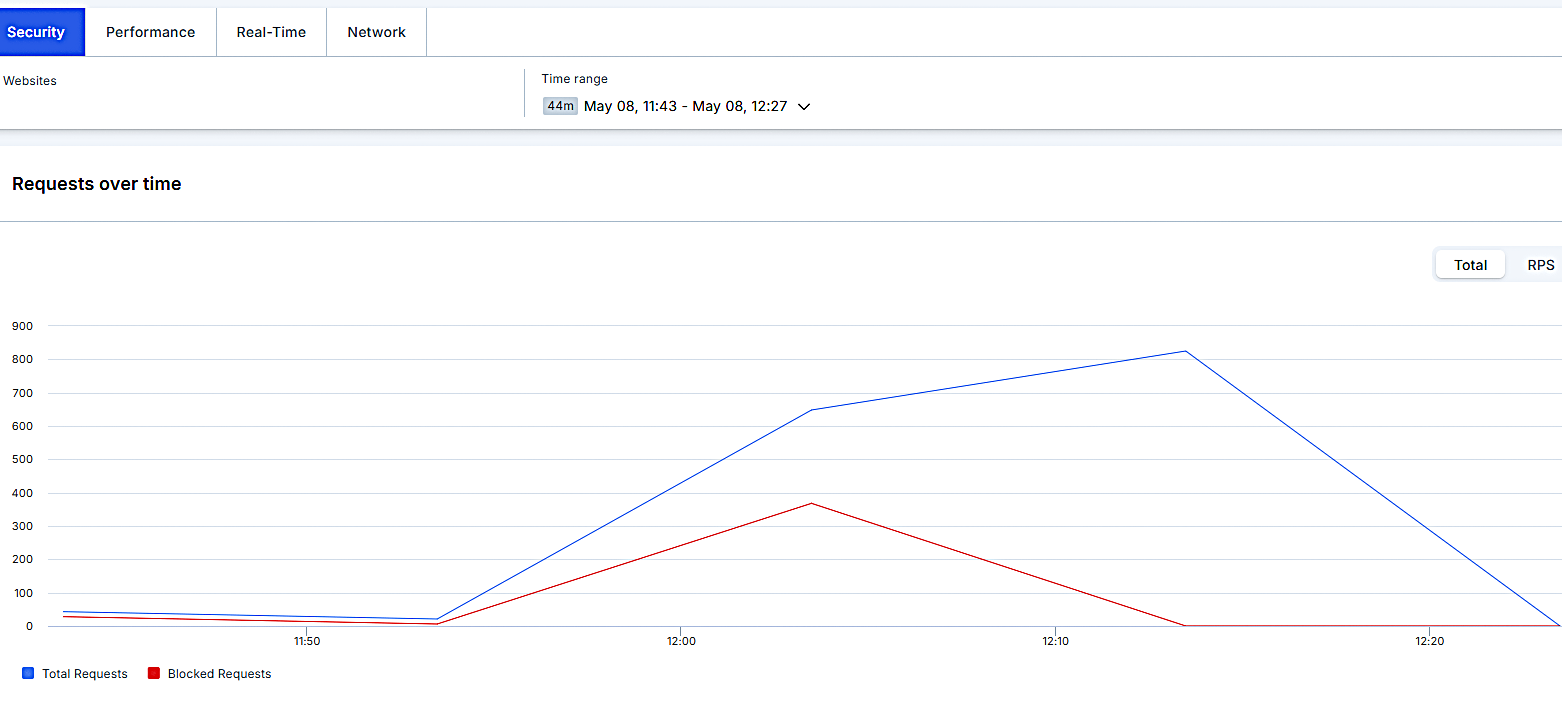

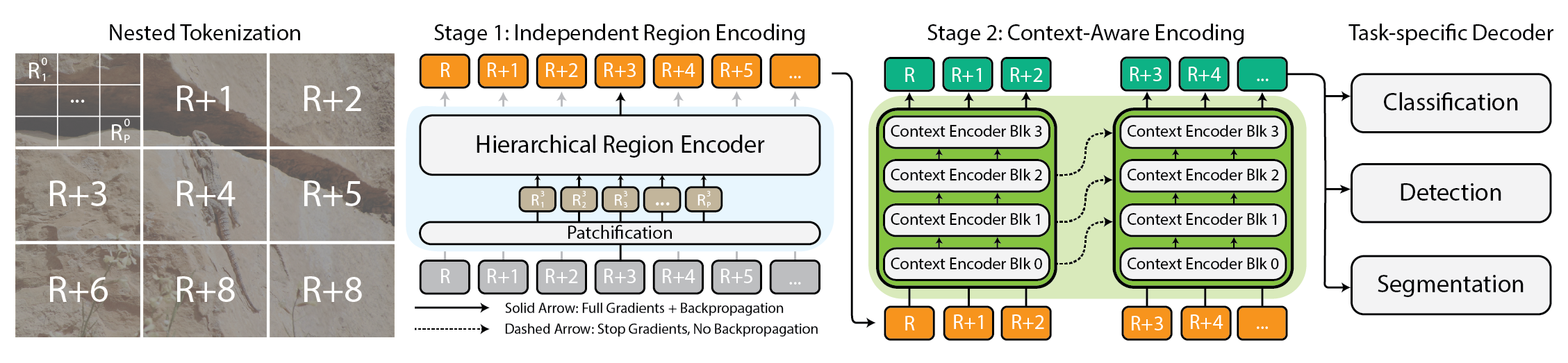

- The chart shows a sharp rise in the number of open ETH futures bets on the Chicago Mercantile Exchange.

- The surge indicates growing institutional participation in the second-largest cryptocurrency.

While You Were Sleeping

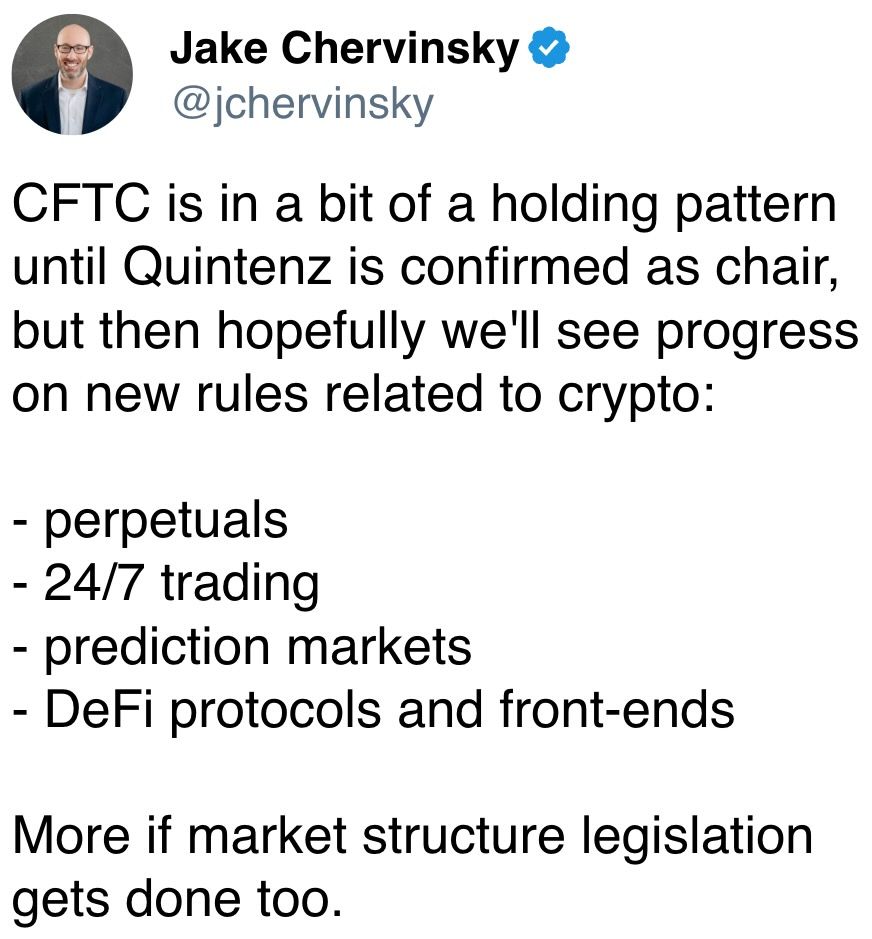

- CFTC's Pham Said to Plot Exit, Agency May Be Left Without a Party Majority (CoinDesk): If Brian Quintenz is confirmed as CFTC chair, he would replace a departing Democrat, while two Republicans also plan to leave, potentially reducing the five-member agency to just two commissioners.

- Altcoin Season Could Heat Up in June and Drain Part of Bitcoin’s $2T Market Cap, Analyst Says (CoinDesk): Bitcoin’s dominance rate fell from 65% to 62% in a week, signaling a shift toward altcoins. Analyst Joao Wedson says dominance will drop further.

- Trump Says U.S. Close to a Nuclear Deal With Iran (Reuters): Talks remain complicated by sharp disagreements and Tehran’s continued uranium enrichment.

- Group of 21 Economies — Including U.S. and China — Warns of Growth Slowdown Over Trade Tensions (CNBC): The Asia Pacific Economic Cooperation (APEC) forecasts growth will slow to 2.6% this year from 3.6% in 2024, citing tariffs and non-tariff barriers as factors undermining business confidence.

- ARK Invest Bought $9.4M Worth of eToro Shares on Trading Platform's Debut (CoinDesk): Cathie Wood’s firm bought 140,000 ETOR shares as the stock jumped 29% from its $52 open on stronger-than-expected demand.

- U.K. Economy Raced at Start of Year but Slowdown Looms (The Wall Street Journal): Despite outpacing the U.S. and eurozone with 0.7% first-quarter growth, rising employer taxes and wage costs have dented business confidence, pointing to weaker performance later this year and in 2026.

In the Ether

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

![How to Enable Remote Access on Windows 10 [Allow RDP]](https://bigdataanalyticsnews.com/wp-content/uploads/2025/05/remote-access-windows.jpg)

![[DEALS] The 2025 Ultimate GenAI Masterclass Bundle (87% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Legends Reborn tier list of best heroes for each class [May 2025]](https://media.pocketgamer.com/artwork/na-33360-1656320479/pg-magnum-quest-fi-1.jpeg?#)

-Olekcii_Mach_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Watch Aston Martin and Top Gear Show Off Apple CarPlay Ultra [Video]](https://www.iclarified.com/images/news/97336/97336/97336-640.jpg)