Why Ethereum price may be on its way up after a disappointing quarter

Ethereum (ETH) price is showing recovery after falling to a low of $1,415. Bullish patterns and DEX strength signal a potential ETH price rebound. The upcoming Pectra update may drive ETH to $2,140. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has endured a tough quarter, with its price recently dipping to $1,415, reflecting a […] The post Why Ethereum price may be on its way up after a disappointing quarter appeared first on CoinJournal.

- Ethereum (ETH) price is showing recovery after falling to a low of $1,415.

- Bullish patterns and DEX strength signal a potential ETH price rebound.

- The upcoming Pectra update may drive ETH to $2,140.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has endured a tough quarter, with its price recently dipping to $1,415, reflecting a steep 61% drop from its December peak.

This significant decline has cast Ethereum as a notable underperformer in the crypto market, sparking unease among investors and analysts.

However, after hitting a low of $1,415, the price has shown signs of recovery, climbing to around $1,623.42, hinting at a potential shift in momentum.

What caused the ETH price to drop this low?

The downturn in Ethereum’s price stems partly from internal problems, with David Hoffman, co-founder of Bankless, calling out the community’s leadership for alienating users and builders.

Hoffman points to hostile attitudes, like shaming the staking platform Lido Finance and criticizing certain traders, which may have shaken confidence in the ecosystem.

Everyone is midcurving why ETH’s price performance has sucked

Ethereum leadership and culture have alienated users and builders by being hostile to its own app layer.

We publicly exorcised @LidoFinance. We’ve shunned traders and degens.

On a permissionless chain, we’ve tried…

— David Hoffman (@TrustlessState) April 12, 2025

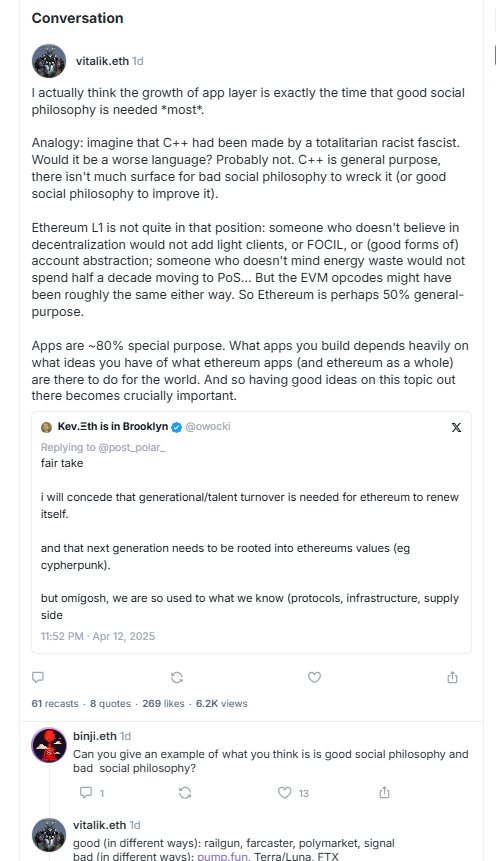

Ethereum Co-founder Vitalik Buterin, in an April 12 post on Warpcast, also emphasized the need for a strong social philosophy in Ethereum’s application layer to guide developers in building decentralized apps that align with its core values, citing projects like Railgun and Farcaster as positive examples.

Beyond internal strife, Ethereum’s Layer 1 infrastructure has struggled to keep pace with newer blockchains, adding pressure to its valuation.

External forces, such as market volatility triggered by President Trump’s tariff announcements, have also fueled sell-offs across cryptocurrencies, dragging Ethereum down further.

Technical analysis signals a price rebound for Ethereum (ETH)

Despite the rocky 2025 start, several factors suggest that Ethereum could be gearing up for a rebound, offering hope to those watching its trajectory.

Technical analysis, however, paints a more optimistic picture, as chart patterns signal a possible reversal in Ethereum’s fortunes.

A falling wedge pattern has emerged on both daily and weekly charts, nearing a confluence level that often precedes a bullish breakout.

Should this pattern play out, Ethereum (ETH) could climb to $2,140, a 35% jump from its current price.

An inverse head-and-shoulders pattern, another bullish indicator, is also taking shape on the one-day chart, strengthening the case for an upward move in the near term.

The RSI indicator also recently rebounded from the oversold region, signaling that the token could be on a bullish rebound, which could last for a while.

The Market Value to Realized Value (MVRV) Z-score dipped to -0.832 before rebounding to around 0.98 at press time, indicating Ethereum is trading well below its historical average.

This metric implies that the cryptocurrency may be a bargain for investors, potentially sparking buying interest that could lift its price.

Historically, such undervaluation has often preceded periods of price appreciation, adding weight to the bullish outlook.

Ethereum-based DEXs outpacing rivals

Ethereum’s decentralized exchange (DEX) network continues to demonstrate resilience, providing another reason for optimism.

Despite competition from blockchains like Solana and Arbitrum, Ethereum’s DEXs processed over $17 billion in volume in the past week, outpacing rivals, according to data from DefiLlama.

This sustained activity highlights Ethereum’s ability to retain users and liquidity, even with higher fees, reinforcing its foundational strength.

Such robust performance suggests the network remains a cornerstone of the decentralized finance space, capable of weathering competitive pressures.

Valuation metrics further bolster the argument that Ethereum is primed for a recovery, as its current price appears undervalued.

The upcoming Ethereum Pectra update

Looking forward, the Pectra update, slated for May 7, 2025, promises to enhance Ethereum’s network, potentially reversing some of its recent setbacks.

This upgrade aims to tackle Layer 1 challenges, improving scalability and efficiency, which could restore faith among investors and developers.

A successful rollout might serve as a catalyst, driving Ethereum’s price higher as the market anticipates a more competitive blockchain.

Scheduled improvements like these signal Ethereum’s commitment to evolving, a factor that could reignite enthusiasm.

The combination of bullish technical patterns, a strong DEX ecosystem, undervaluation, and the promise of the Pectra update builds a solid case for recovery.

Investors would do well to keep an eye on resistance levels and sentiment shifts, yet the evidence points to Ethereum potentially rising from its disappointing quarter.

The post Why Ethereum price may be on its way up after a disappointing quarter appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

.jpg?#)

.png?#)

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_Aleksey_Funtap_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![‘Samsung Auto’ is an Android Auto alternative for Galaxy phones you can’t use [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/04/samsung-auto-12.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Taps Samsung as Exclusive OLED Supplier for Foldable iPhone [Report]](https://www.iclarified.com/images/news/97020/97020/97020-640.jpg)

![Apple's Foldable iPhone Won't Have Face ID for Under-Display Camera [Rumor]](https://www.iclarified.com/images/news/97017/97017/97017-640.jpg)