Unlocking Liquidity: A Comprehensive Guide to Understanding Drip Network

Abstract: This post delves into the world of decentralized finance (DeFi) by exploring the liquidity model of the Drip Network. We cover its history, the underlying concepts such as liquidity pools, automated market makers (AMMs), yield farming, staking, and the blockchain’s role in ensuring price stability. We also discuss practical use cases, challenges like impermanent loss and regulatory hurdles, and a forward-looking outlook on innovations within the ecosystem. Throughout this post, we incorporate insights from industry experts, technical analyses, and authoritative resources to provide a holistic view of how the Drip Network is shaping the future of sustainable finance. Introduction In an era where decentralized finance (DeFi) is transforming traditional financial paradigms, the Drip Network stands out with its innovative approach to liquidity and passive income generation. At its core, the network offers a unique liquidity model driven by its native DRIP token on the Binance Smart Chain (BSC). With low transaction fees and fast processing times courtesy of BSC, the Drip Network provides a stable and secure environment for investors and liquidity providers. Liquidity is a crucial factor that determines how easily assets can be exchanged without significantly impacting their price. In DeFi, ensuring robust liquidity means enabling quick trades, reducing slippage, and fostering confidence among market participants. In this post, we explore the basics of liquidity in blockchain environments with a focus on the Drip Network, and discuss why its model is considered a cornerstone for sustainable crypto projects. Background and Context Before diving deep into the unique aspects of the Drip Network, it is important to understand the broader ecosystem it belongs to. A Brief History of DeFi and Liquidity Concepts DeFi Evolution: Decentralized finance has come a long way from simple token swaps to sophisticated ecosystems that include lending, borrowing, yield farming, and staking. The initial spark for DeFi was inspired by Bitcoin’s promise of decentralized monetary transactions. Over time, platforms on Ethereum, Binance Smart Chain, and other networks emerged, integrating liquidity pools and automated market making. Definition of Liquidity: In the blockchain context, liquidity refers to the ease with which an asset can be bought or sold at stable prices. It is an essential facet of any financial ecosystem: High liquidity minimizes price volatility. Low liquidity can lead to slippage and potential instability. To further your understanding of decentralized finance and project funding, consider exploring resources such as Decentralized Finance for Project Funding. Drip Network in a Nutshell The Drip Network is designed to generate passive income by leveraging liquidity mechanisms. With daily rewards akin to earning interest on a savings account, the network's user-friendly approach brings traditional finance concepts into the decentralized realm. The DRIP token operates as a BEP-20 token on BSC, enabling: Transaction facilitation with minimal fees, Stable price movements through liquidity pools and AMMs, and Attractive yield farming opportunities that incentivize liquidity providers. For further technical insights into how blockchain handles transaction costs, check out Blockchain Transaction Fees. Core Concepts and Features The innovative features of the Drip Network revolve around ensuring strong liquidity and a sustainable ecosystem. Let’s break down the key components: 1. Liquidity Pools and Automated Market Makers (AMMs) Liquidity pools are foundational to the Drip Network's operation. These pools consist of locked tokens in smart contracts that facilitate seamless trades, reducing uncertainty during token transfers. Automated Price Setting: AMMs are algorithms that automatically adjust token prices based on market conditions, ensuring continuous liquidity along with minimal slippage. This mechanism is the backbone of decentralized exchanges (DEXs). For more details on smart contract mechanisms in blockchain ecosystems, refer to Smart Contracts on Blockchain. 2. Yield Farming and Staking Strategies The Drip Network incentivizes liquidity providers with yield farming and staking rewards. Users who deposit DRIP tokens can compound their returns daily, making the network both sustainable and rewarding. Yield Farming: Investments in liquidity pools yield returns, which encourages users to keep their funds in the ecosystem. Staking Mechanisms: Through staking, participants can secure the network and earn additional rewards, an innovative approach that aligns interests across the community. Learn more about yield farming and its role in securing blockchain project funding by visiting Blockchain Project Funding Through Yield Farming. 3. Price Stability and Incentive Structures Robust l

Abstract:

This post delves into the world of decentralized finance (DeFi) by exploring the liquidity model of the Drip Network. We cover its history, the underlying concepts such as liquidity pools, automated market makers (AMMs), yield farming, staking, and the blockchain’s role in ensuring price stability. We also discuss practical use cases, challenges like impermanent loss and regulatory hurdles, and a forward-looking outlook on innovations within the ecosystem. Throughout this post, we incorporate insights from industry experts, technical analyses, and authoritative resources to provide a holistic view of how the Drip Network is shaping the future of sustainable finance.

Introduction

In an era where decentralized finance (DeFi) is transforming traditional financial paradigms, the Drip Network stands out with its innovative approach to liquidity and passive income generation. At its core, the network offers a unique liquidity model driven by its native DRIP token on the Binance Smart Chain (BSC). With low transaction fees and fast processing times courtesy of BSC, the Drip Network provides a stable and secure environment for investors and liquidity providers.

Liquidity is a crucial factor that determines how easily assets can be exchanged without significantly impacting their price. In DeFi, ensuring robust liquidity means enabling quick trades, reducing slippage, and fostering confidence among market participants. In this post, we explore the basics of liquidity in blockchain environments with a focus on the Drip Network, and discuss why its model is considered a cornerstone for sustainable crypto projects.

Background and Context

Before diving deep into the unique aspects of the Drip Network, it is important to understand the broader ecosystem it belongs to.

A Brief History of DeFi and Liquidity Concepts

DeFi Evolution:

Decentralized finance has come a long way from simple token swaps to sophisticated ecosystems that include lending, borrowing, yield farming, and staking. The initial spark for DeFi was inspired by Bitcoin’s promise of decentralized monetary transactions. Over time, platforms on Ethereum, Binance Smart Chain, and other networks emerged, integrating liquidity pools and automated market making.

Definition of Liquidity:

In the blockchain context, liquidity refers to the ease with which an asset can be bought or sold at stable prices. It is an essential facet of any financial ecosystem:

- High liquidity minimizes price volatility.

- Low liquidity can lead to slippage and potential instability.

To further your understanding of decentralized finance and project funding, consider exploring resources such as Decentralized Finance for Project Funding.

Drip Network in a Nutshell

The Drip Network is designed to generate passive income by leveraging liquidity mechanisms. With daily rewards akin to earning interest on a savings account, the network's user-friendly approach brings traditional finance concepts into the decentralized realm. The DRIP token operates as a BEP-20 token on BSC, enabling:

- Transaction facilitation with minimal fees,

- Stable price movements through liquidity pools and AMMs, and

- Attractive yield farming opportunities that incentivize liquidity providers.

For further technical insights into how blockchain handles transaction costs, check out Blockchain Transaction Fees.

Core Concepts and Features

The innovative features of the Drip Network revolve around ensuring strong liquidity and a sustainable ecosystem. Let’s break down the key components:

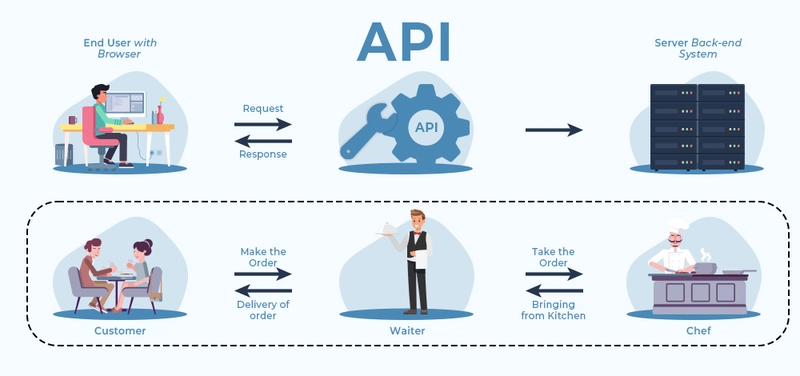

1. Liquidity Pools and Automated Market Makers (AMMs)

Liquidity pools are foundational to the Drip Network's operation. These pools consist of locked tokens in smart contracts that facilitate seamless trades, reducing uncertainty during token transfers.

- Automated Price Setting: AMMs are algorithms that automatically adjust token prices based on market conditions, ensuring continuous liquidity along with minimal slippage. This mechanism is the backbone of decentralized exchanges (DEXs).

For more details on smart contract mechanisms in blockchain ecosystems, refer to Smart Contracts on Blockchain.

2. Yield Farming and Staking Strategies

The Drip Network incentivizes liquidity providers with yield farming and staking rewards. Users who deposit DRIP tokens can compound their returns daily, making the network both sustainable and rewarding.

- Yield Farming: Investments in liquidity pools yield returns, which encourages users to keep their funds in the ecosystem.

- Staking Mechanisms: Through staking, participants can secure the network and earn additional rewards, an innovative approach that aligns interests across the community.

Learn more about yield farming and its role in securing blockchain project funding by visiting Blockchain Project Funding Through Yield Farming.

3. Price Stability and Incentive Structures

Robust liquidity decreases price volatility. The Drip Network uses a mix of liquidity pools, AMM technology, and innovative incentive strategies to ensure that investors see a stable token value over extended periods. In addition:

- Token Burn Mechanisms: These may be employed to reduce circulating supply, thereby increasing scarcity.

- Regular Audits: The network emphasizes security and transparency through regular smart contract audits, ensuring that vulnerabilities are addressed proactively.

For a comprehensive take on how blockchain facilitates stablecoins and price consistency, check Blockchain and Stablecoins.

Applications and Use Cases

The unique liquidity model of the Drip Network has far-reaching implications in the wider DeFi space. Here are a few practical examples:

Case Study 1: Enhancing Trading Efficiency

Scenario:

An investor who holds DRIP tokens can quickly convert tokens to other cryptocurrencies on decentralized exchanges without experiencing significant slippage. The use of liquidity pools ensures fast execution and maintains stable prices.

Use-Case Benefits:

- Quick transaction settlement

- Reduced fees on the Binance Smart Chain

- High fidelity in price execution

Case Study 2: Passive Income Generation through Yield Farming

Scenario:

A user deposits DRIP tokens and participates in staking and yield farming. Over time, accrued rewards compound, generating a regular daily income stream. This mechanism supports long-term investments and community growth.

Use-Case Benefits:

- Steady returns

- Compounding interest advantages

- Alignment with sustainable financial models

Case Study 3: Cross-Chain Liquidity Integration

Scenario:

Looking ahead, the Drip Network may integrate cross-chain liquidity solutions. This would enable liquidity providers to earn rewards across multiple blockchain platforms, enhancing the overall ecosystem's reach and robustness.

Use-Case Benefits:

- Broader asset interoperability

- Enhanced network scalability

- Increased incentive structures

Below is a table summarizing key features and examples of use cases:

| Feature | Description | Example Application |

|---|---|---|

| Liquidity Pools | Locked token reserves in smart contracts that facilitate trading | Trading on DEXs with minimal slippage |

| AMM Technology | Algorithmic pricing to automatically adjust token values based on supply and demand | Consistent and stable token exchange rates |

| Yield Farming | Earning rewards by contributing to liquidity pools | Regular passive income generation |

| Staking | Locking tokens to support network security in exchange for rewards | Long-term investment and network stability |

| Cross-Chain Integration | Future prospects to work seamlessly across different blockchain networks | Broader ecosystem interoperability |

Challenges and Limitations

Despite the innovative design of the Drip Network, there are certain challenges that remain:

Technical Challenges:

Impermanent Loss:

Liquidity providers face the risk of impermanent loss if token prices diverge significantly. This is a common issue in volatile markets where changes in token ratios can lead to reduced overall value.Smart Contract Vulnerabilities:

While regular audits help mitigate risks, smart contracts remain potential points of failure that need constant monitoring.

Adoption and Regulatory Challenges:

Evolving Regulatory Landscape:

With global regulatory frameworks continuously adapting to crypto innovations, the Drip Network must navigate compliance complexities to ensure longevity. For more details on these dynamics, check Blockchain Regulation.Market Adoption:

For any DeFi project, community engagement and trust are crucial for adoption. General market sentiment and the integration of new technologies affect how quickly platforms like Drip can scale.

Security Considerations:

- Cybersecurity Threats: As highlighted in various sources, ensuring the security of funds and smart contracts is paramount. Continuous improvements and robust testing frameworks are required to prevent cyber-attacks. Take a deeper look at Blockchain Security for further reading.

Key Challenges (Bullet List):

- Impermanent Loss Risks

- Smart Contract Vulnerabilities

- Regulatory Uncertainties

- Market Volatility

- Adoption and Community Trust

For additional industry perspectives, you might be interested in the comprehensive analysis from Understanding the Security of Drip Network: A Comprehensive Overview.

Future Outlook and Innovations

The Drip Network is continually evolving, and its future holds several promising enhancements:

1. Cross-Chain Liquidity Solutions

The ability to integrate liquidity across multiple blockchains will be a game-changer. Cross-chain protocols enable tokens from different networks to interact securely, which may lead to:

- Greater market reach and diversified liquidity sources.

- Enhanced user experience by reducing dependency on a single blockchain.

2. Advanced Incentive Mechanisms

Innovations in reward distribution and security incentives can attract more liquidity providers. Future improvements may include:

- Dynamic reward adjustments

- Tiered incentive structures based on participation levels

- Innovative token burn strategies to manage supply

3. Community and Developer Empowerment

With projects like these, community engagement is crucial. Future prospects include:

- Educational initiatives to inform liquidity providers on best practices.

- Increased developer partnerships that explore ingenious DeFi solutions.

- Collaboration with other open-source projects—see also Decentralized Finance for Project Funding for more context.

4. Integration with Emerging Technologies

The growing trend of utilizing artificial intelligence (AI) and blockchain interoperability presents unique opportunities:

- AI-driven liquidity management to optimize trading parameters.

- Enhanced data analytics for monitoring network health and identifying vulnerabilities.

- Integration with NFTs, as explored by communities around NFT Treasure Liquidity Pools, to combine digital art with financial incentives.

For further insights into cross-chain integration and tokenomics innovations, see related articles on Blockchain and Stablecoins and Blockchain Project Funding Through Yield Farming.

Summary and Conclusion

The Drip Network is an excellent example of how innovative liquidity models can drive sustainability in the decentralized finance ecosystem. With its core components—liquidity pools, automated market makers, yield farming, and staking—the network provides users with a stable, efficient, and rewarding platform.

Key Takeaways:

- The liquidity model ensures quick, low-fee transactions with minimal slippage.

- Yield farming and staking create opportunities for passive income and encourage long-term community engagement.

- Challenges such as impermanent loss, smart contract vulnerabilities, and regulatory hurdles highlight the need for continuous innovation.

- Future enhancements like cross-chain liquidity, advanced incentive mechanisms, and integration with AI technologies promise to further revolutionize DeFi.

In conclusion, by embracing innovation and community-led growth, the Drip Network is positioned to redefine liquidity paradigms in DeFi. For more detailed perspectives, consider reading the original article on Drip Network Liquidity and get connected with related discussions on Drip Community.

Additional Resources and Further Reading

- Decentralized Finance for Project Funding

- Blockchain Transaction Fees

- Smart Contracts on Blockchain

- Blockchain Security

- Blockchain Regulation

For insights from industry experts on topic intersections, explore the detailed analysis in posts like Exploring the Drip Network: A Deep Dive into DeFi, NFTs, and Tokenomics.

By understanding the technical underpinnings and future implications of liquid asset management in DeFi, readers can gain valuable insights into how platforms like the Drip Network are paving the way for a more sustainable and inclusive financial future. The combination of detailed blockchain mechanisms, real-world use cases, and future-oriented innovations signals that the liquidity paradigm is evolving rapidly—an evolution that will continue to shape the landscape of decentralized finance for years to come.

_courtesy_VERTICAL.jpg)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Mail Backup X Individual Edition: Lifetime Subscription (72% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Ships 55 Million iPhones, Claims Second Place in Q1 2025 Smartphone Market [Report]](https://www.iclarified.com/images/news/97185/97185/97185-640.jpg)