Understanding the Tax Implications of GitHub Sponsors: A Deep Dive

Abstract This post demystifies the tax implications of using GitHub Sponsors for open-source developers and sponsors. We explore the background and context of the platform, detail key tax considerations for individuals and businesses, and discuss the importance of proper record-keeping and professional guidance. We also look at practical use cases, examine challenges encountered by both developers and sponsors, and consider future trends that may reshape funding practices for open-source projects. Throughout, we provide structured data, bullet lists, tables, and relevant links to authoritative resources such as GitHub Sponsors, Sustainability of Open Source Through Tokenization, and more. Introduction GitHub Sponsors is a game-changing platform that empowers developers to garner financial support while contributing to open-source projects. As open-source becomes increasingly critical in modern software development, understanding the associated tax implications is essential for both developers and sponsors. In this post, we break down the complexities of taxation in this ecosystem, highlight best practices for compliance, and help readers understand how to plan effectively for sustainable funding. Our discussion is enriched with insights into blockchain-based funding models, integration with cryptocurrency systems, and alternative revenue strategies that contribute to open-source sustainability. Background and Context GitHub Sponsors was launched with the aim of bolstering open-source innovation by providing a means for supporters to contribute financially. Its global reach means that developers from diverse regions can receive recurring or one-time sponsorship payments. However, this welcome injection of funds also brings tax responsibilities. Various jurisdictions, especially in the U.S. and internationally, require careful record-keeping, reporting, and sometimes additional filings (such as IRS form 1099 in the U.S.). In the larger ecosystem: Open-source projects benefit from community engagement and financial backing. Blockchain technologies and tokenized funding models further strengthen the funding landscape. For instance, the article on Sustainability of Open Source Through Tokenization highlights how innovative blockchain solutions are integrated into open-source funding. The emergence of NFTs and alternative revenue models such as those discussed in Open Source Tools for Creating Musk-Themed NFTs provide additional avenues for developers. Core Concepts and Features 1. Tax Implications for Developers For developers, especially those who receive sponsorships as income, there are several tax obligations that must be considered: Income Recognition: Payments received via GitHub Sponsors are generally classified as taxable income. Self-Employment Tax: U.S.-based individual developers must account for self-employment tax. Detailed record-keeping is necessary for income and eligible expenses. Business Entity Deductions: If a developer operates under a business structure, they may be eligible for deductions that reduce taxable income. This requires additional documentation to justify business expenses. International Considerations: Developers residing outside the U.S. are potentially subject to local tax regulations, which may differ significantly from U.S. laws. Understanding international tax treaties and avoiding the pitfalls of dual taxation is critical. 2. Tax Considerations for Sponsors Sponsors, whether individuals or businesses, also have roles to play when it comes to taxation: Individual Sponsors: Generally, contributions made by individual sponsors are considered personal expenses. They are not typically deductible, though local laws may allow special considerations. Business Sponsors: Companies may deduct sponsorship expenses provided these expenses have a clear business purpose. It is crucial for business sponsors to maintain proper documentation to support their deductions. Documentation and Compliance: Both types of sponsors benefit from meticulous records and adherence to tax guidelines. 3. International Tax Considerations Given the global nature of GitHub Sponsors, both developers and sponsors must be mindful of: Dual taxation issues, which can arise when income is reportedly received in one country and subject to taxation in another. Local tax regulations that might differ from those in the U.S. International treaties that may provide tax relief under specific circumstances. A simplified table below illustrates how different tax regimes might view such sponsorship income: Jurisdiction Classification of Income Record-Keeping Requirements Potential Deductions United States Taxable (self-employment or business income) Detailed expense documentation; IRS form 1099 if applicable Business-related expenses European Union Varies by country; often taxable Certification and digital

Abstract

This post demystifies the tax implications of using GitHub Sponsors for open-source developers and sponsors. We explore the background and context of the platform, detail key tax considerations for individuals and businesses, and discuss the importance of proper record-keeping and professional guidance. We also look at practical use cases, examine challenges encountered by both developers and sponsors, and consider future trends that may reshape funding practices for open-source projects. Throughout, we provide structured data, bullet lists, tables, and relevant links to authoritative resources such as GitHub Sponsors, Sustainability of Open Source Through Tokenization, and more.

Introduction

GitHub Sponsors is a game-changing platform that empowers developers to garner financial support while contributing to open-source projects. As open-source becomes increasingly critical in modern software development, understanding the associated tax implications is essential for both developers and sponsors. In this post, we break down the complexities of taxation in this ecosystem, highlight best practices for compliance, and help readers understand how to plan effectively for sustainable funding. Our discussion is enriched with insights into blockchain-based funding models, integration with cryptocurrency systems, and alternative revenue strategies that contribute to open-source sustainability.

Background and Context

GitHub Sponsors was launched with the aim of bolstering open-source innovation by providing a means for supporters to contribute financially. Its global reach means that developers from diverse regions can receive recurring or one-time sponsorship payments. However, this welcome injection of funds also brings tax responsibilities. Various jurisdictions, especially in the U.S. and internationally, require careful record-keeping, reporting, and sometimes additional filings (such as IRS form 1099 in the U.S.).

In the larger ecosystem:

- Open-source projects benefit from community engagement and financial backing.

- Blockchain technologies and tokenized funding models further strengthen the funding landscape. For instance, the article on Sustainability of Open Source Through Tokenization highlights how innovative blockchain solutions are integrated into open-source funding.

- The emergence of NFTs and alternative revenue models such as those discussed in Open Source Tools for Creating Musk-Themed NFTs provide additional avenues for developers.

Core Concepts and Features

1. Tax Implications for Developers

For developers, especially those who receive sponsorships as income, there are several tax obligations that must be considered:

- Income Recognition: Payments received via GitHub Sponsors are generally classified as taxable income.

- Self-Employment Tax: U.S.-based individual developers must account for self-employment tax. Detailed record-keeping is necessary for income and eligible expenses.

- Business Entity Deductions: If a developer operates under a business structure, they may be eligible for deductions that reduce taxable income. This requires additional documentation to justify business expenses.

- International Considerations: Developers residing outside the U.S. are potentially subject to local tax regulations, which may differ significantly from U.S. laws. Understanding international tax treaties and avoiding the pitfalls of dual taxation is critical.

2. Tax Considerations for Sponsors

Sponsors, whether individuals or businesses, also have roles to play when it comes to taxation:

- Individual Sponsors: Generally, contributions made by individual sponsors are considered personal expenses. They are not typically deductible, though local laws may allow special considerations.

- Business Sponsors: Companies may deduct sponsorship expenses provided these expenses have a clear business purpose. It is crucial for business sponsors to maintain proper documentation to support their deductions.

- Documentation and Compliance: Both types of sponsors benefit from meticulous records and adherence to tax guidelines.

3. International Tax Considerations

Given the global nature of GitHub Sponsors, both developers and sponsors must be mindful of:

- Dual taxation issues, which can arise when income is reportedly received in one country and subject to taxation in another.

- Local tax regulations that might differ from those in the U.S.

- International treaties that may provide tax relief under specific circumstances.

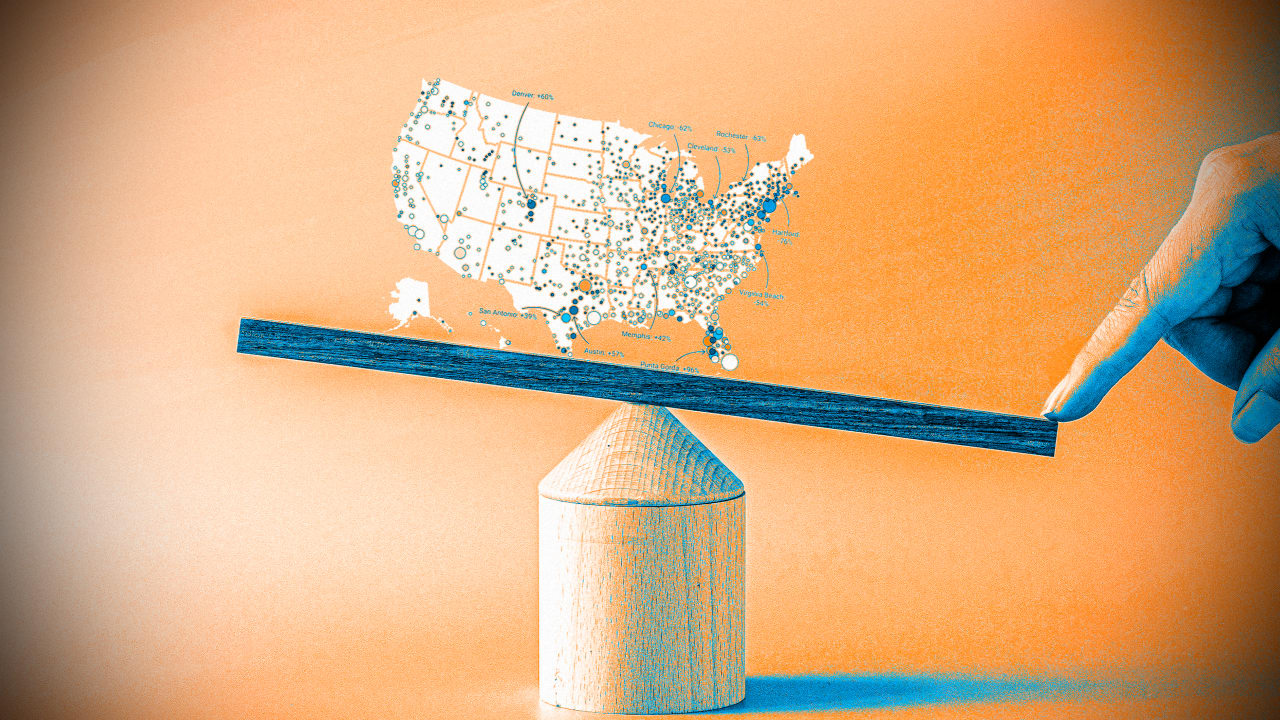

A simplified table below illustrates how different tax regimes might view such sponsorship income:

| Jurisdiction | Classification of Income | Record-Keeping Requirements | Potential Deductions |

|---|---|---|---|

| United States | Taxable (self-employment or business income) | Detailed expense documentation; IRS form 1099 if applicable | Business-related expenses |

| European Union | Varies by country; often taxable | Certification and digital records recommended | Varies by local law |

| Asia-Pacific | Generally taxable; may offer incentives | Strict adherence to local filing timelines | Special deductions for technology funding |

4. Record-Keeping and Professional Advice

Both developers and sponsors must emphasize:

- Detailed record-keeping: Tracking every transaction, including contributions and expenses, is essential for transparency and compliance.

- Professional tax planning: Consulting with a professional tax advisor can help optimize outcomes and mitigate potential liabilities.

Key recommendations include:

- Keeping digital copies of all invoices and receipts.

- Using accounting software to aggregate data.

- Periodic reviews with professional advisors to remain compliant with evolving tax laws.

Applications and Use Cases

Let's explore a few practical examples illustrating how GitHub Sponsors comes into play:

Use Case 1: Individual Developer in the U.S.

An individual developer based in the United States receives monthly sponsorship payments. The developer:

- Recognizes the sponsorship income as self-employment income.

- Maintains detailed records of business expenses related to development tools, cloud hosting fees, and travel for conferences.

- Consults with a tax professional to ensure that deductions maximize net income while meeting IRS requirements.

- For further insights into self-employed income—see Benefits of GitHub Sponsors for Developers.

Use Case 2: Business Entity Sponsoring Open-Source Developers

A tech company sponsors several projects through GitHub Sponsors as part of its corporate social responsibility initiative. The company:

- Justifies these sponsorships as part of its marketing and community outreach spending.

- Deduces these contributions as business expenses contingent upon maintaining appropriate documentation.

- Uses this support not only to improve public relations but also to foster the development of technologies that might benefit its software products.

- Learn more about sponsorship models in Open Source Sponsorship.

Use Case 3: International Developer Navigating Dual Taxation

An international developer collaborates with a U.S.-based sponsor and receives multi-currency payments. The developer:

- Consults tax advisors in both jurisdictions.

- Leverages available tax treaties to mitigate dual taxation.

- Adjusts record-keeping practices specific to each country’s requirements.

- For broader context on cross-border challenges, exploring literature on revenue models such as Open Source Project Revenue Models is recommended.

Challenges and Limitations

While GitHub Sponsors provides a much-needed funding mechanism for developers, several challenges remain:

- Complexity of Tax Codes: The varying tax laws across different countries make it challenging for developers and sponsors to navigate compliance requirements.

- Record-Keeping Burdens: The necessity for meticulous documentation can be daunting, especially for solo developers who may not have access to sophisticated accounting tools.

- Limited Deductibility for Individuals: Individual sponsors and even some developers may find few opportunities for deductions, reducing the overall financial benefit.

- Evolving Regulations: Tax laws, particularly those concerning digital and decentralized revenue models, are rapidly evolving, requiring stakeholders to remain vigilant.

- Interplay with Emerging Technologies: As blockchain, cryptocurrency, and NFT funding models intersect with traditional taxation methods, a hybrid approach becomes necessary. Discussions around future cross-chain funding solutions may offer new frameworks for understanding these interactions—see emerging discussions on Open Source Funding Through Tokenization.

A bullet list summarizing major challenges:

- Complex and varying tax codes

- High documentation and record-keeping demands

- Navigating international tax treaties

- Staying current with evolving regulations

- Integration challenges with emerging blockchain and NFT funding

Future Outlook and Innovations

The landscape of open-source funding is dynamic, with several forecasts suggesting shifting paradigms in the near future:

Trends to Watch

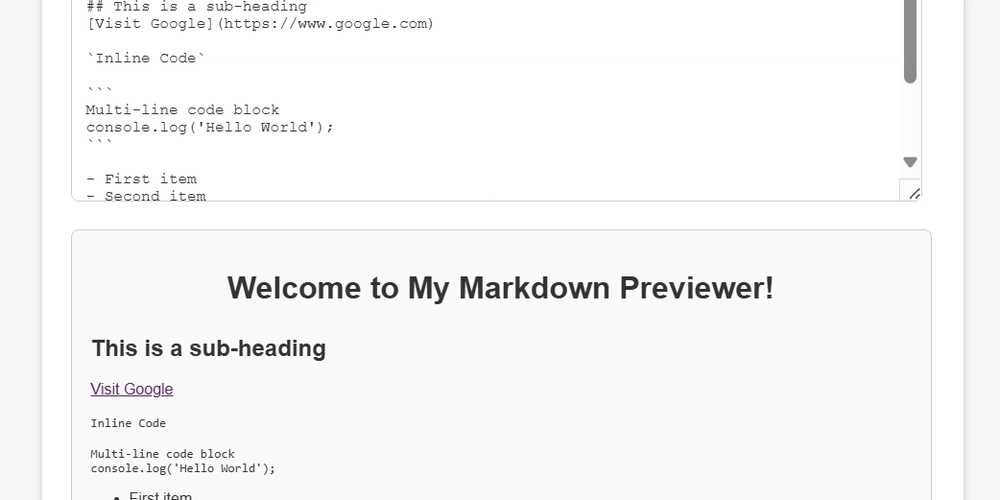

- Enhanced Digital Record-Keeping: With advances in blockchain and decentralized ledger technologies, developers may soon use tamper-proof digital ledgers to manage tax records.

- Regulatory Harmonization: Increased international cooperation could lead to standardized guidelines for digital income and open-source funding, which would reduce the burden on both developers and sponsors.

- Expansion of NFT and Tokenized Funding: As detailed in posts exploring Open Source Tools for Creating Musk-Themed NFTs, tokenization is expected to further diversify open-source revenue streams.

- Integration of AI and Automated Tax Filing: It is likely that Artificial Intelligence (AI) tools will soon help automate record-keeping and tax filing processes. This automation can drastically streamline compliance tasks for both individuals and large organizations.

- Community-Driven Funding Models: The future of open-source might include hybrid models where community contributions, corporate sponsorships, and governmental grants work together to support innovations sustainably.

Innovations in Funding Models

Looking at the current funding ecosystem, some innovative models are emerging:

| Feature | Traditional Sponsorship Model | Emerging Tokenized/Sustainable Model |

|---|---|---|

| Income Reporting | Manual record-keeping and periodic filing | Automated blockchain-based transaction logging |

| Deductions | Limited to advertised business expenses | Enhanced with integrated smart-contract-based verifications |

| Global Compatibility | Varies with jurisdiction, leading to dual-tax challenges | Streamlined using international blockchain standards |

| Community Contributions | Mostly individual contributions with little transparency | Transparent, auditable, and tied to tokenized rewards |

For more discussions on sustainability and innovative revenue models, refer to Open Source Project Revenue Models.

Additional Insights from Community Discussions

The evolving narrative around GitHub Sponsors has sparked broader discussions on platforms like Dev.to. For example:

- In GitHub Sponsors: Navigating Privacy and Security, the focus is on how privacy and security concerns can be balanced with the need for transparency in sponsorship.

- Discussions on Sustainable Funding for Open Source provide expert opinions on how open-source communities can adapt to changing revenue streams.

- Posts such as Understanding Blockchain Transaction Fees help contextualize how emerging technologies may further influence traditional tax systems.

Practical Guidance for Stakeholders

For those new to the landscape of GitHub Sponsors and tax management, here are some key actionable recommendations:

- Consult a Tax Professional: Seek guidance from experienced tax advisors, especially if you’re handling cross-border or business income.

-

Implement Robust Record-Keeping Practices:

Utilize digital tools and accounting software to document sponsorship transactions.

- Keep invoices

- Maintain digital copies of receipts

- Organize contributions chronologically

-

Stay Updated with Regulatory Changes:

Monitor changes in tax laws at both national and international levels.

- Subscribe to newsletters from reputable tax advisory services.

- Follow industry blogs and communities such as GitHub Sponsors Tax Implications for regular updates.

- Explore Automated Solutions: Investigate blockchain and AI-based tools that aid in compliance and transparency.

- Engage with Community Forums: Learn from other developers and sponsors by participating in discussions on platforms like Dev.to and GitHub.

Summary

GitHub Sponsors stands at the intersection of open-source funding and modern financial technology. Its potential to empower developers is immense, but so too are the challenges associated with tax compliance. This post has outlined the core tax implications for both individual developers and business sponsors, examined international complexities, and highlighted the essential role of proper record-keeping and professional tax advice.

As the funding ecosystem continues to evolve—with the integration of blockchain, tokenization, and automated record-keeping systems—the future of sustainable open-source innovation appears brighter. Whether you are a solo developer, a business entity, or an international sponsor, staying informed and agile is key to navigating the terrain of tax regulations successfully.

As open-source projects continue to drive innovation across industries, platforms like GitHub Sponsors ensure that the community remains vibrant and funded. By adopting best practices in tax planning, record-keeping, and compliance, both developers and sponsors can focus on what truly matters: building a sustainable, innovative future through open collaboration.

For further reading on related topics, you might explore:

- GitHub Sponsors vs. Patreon

- Open Source Sponsorship

- Sustainability of Open Source Through Tokenization

Stay tuned for more updates as the industry continues to transform, and remember: proper planning today leads to a compliant and sustainable tomorrow.

This post is intended for informational purposes and does not constitute legal or tax advice. Always consult with a qualified professional for personalized guidance.

Happy sponsoring and coding!

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Microsoft 365: 1-Year Subscription (Family/Up to 6 Users) (23% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Art School Drop-out to Microsoft Engineer with Shashi Lo [Podcast #170]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746203291209/439bf16b-c820-4fe8-b69e-94d80533b2df.png?#)

(1).jpg?#)

_Inge_Johnsson-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple to Split iPhone Launches Across Fall and Spring in Major Shakeup [Report]](https://www.iclarified.com/images/news/97211/97211/97211-640.jpg)

![Apple to Move Camera to Top Left, Hide Face ID Under Display in iPhone 18 Pro Redesign [Report]](https://www.iclarified.com/images/news/97212/97212/97212-640.jpg)

![Apple Developing Battery Case for iPhone 17 Air Amid Battery Life Concerns [Report]](https://www.iclarified.com/images/news/97208/97208/97208-640.jpg)

![AirPods 4 On Sale for $99 [Lowest Price Ever]](https://www.iclarified.com/images/news/97206/97206/97206-640.jpg)

![[Updated] Samsung’s 65-inch 4K Smart TV Just Crashed to $299 — That’s Cheaper Than an iPad](https://www.androidheadlines.com/wp-content/uploads/2025/05/samsung-du7200.jpg)