Top Tech Stacks for Centralized Crypto Exchange Development in 2025

Introduction Introduction This grain of truth feeds on the greatest economic system revolution-the fast-changing crypto market ringed-in by centralized crypto exchanges (CEXs) immediately. Building a robust, secure, scalable centralized exchange in 2025 will definitely call for the right technology stack, with sharp competition and rising user expectations. Thus, the choice of right tools and frameworks is clear-it is not just for smooth performance and user experience but also for compliance, security, and future scalability. This blog shares into the top technology stacks meant for building a centralized crypto exchange with considerations towards the core components and future trends. Core Components of a Centralized Exchange At the heart of every centralized crypto exchange are several critical components. Each of these components must work together to deliver a better experience for traders while ensuring safety, efficiency, and compliance with the law. The selection of technology is important for to create centralized crypto exchanges. The components are: Frontend Technologies Backend Technologies Database and Storage Solutions Security Tech stack Infrastructure and Deployment Analytics and Monitoring Tools Top Tech Stacks for Centralized Crypto Exchange in 2025 Frontend Technologies Choosing a suitable technology stack is significant to each one of these components. For frontend technologies, the usual names in 2025 include React and Angular in combination with Vue.js. Such JavaScript frameworks can support the creation of dynamic as well as responsive user interfaces, offering features such as component-based architecture and efficient state management. For example, the virtual DOM of React can ameliorate the performance, whereas total framework of Angular provides a well-structured aspect to applications on a large scale. One thing that makes Vue.js very popular is the fact that it is progressive and easy to integrate. Backend Technologies Both the backend stacks provide the mainstay of the exchange. They will favor the performance and scalability of the enormous libraries that Go, Java, and Python have. Concurrency is one of the key strengths of Go that makes it feasible, as it allows for building engines that sign high-performance trading. It is safe to say that Java's robustness and a mature ecosystem can be described as suitable for organizing a complex financial system. However, the freedom and richness of frameworks in the middle of Django and Flask make it possible for rapid development using Python. The kinds of real time communications between front and back end that are possible use WebSockets. Database and Storage Solutions Such database and storage solutions should be able to support great deal of transactional data and therefore must be very sound and scalable. They can either be PostgreSQL or MySQL for relational databases, which are ACID compliant and data-consistent. In-memory databases like Redis and Memcached are made to cache hot data and improve the performance significantly. Security Tech Stack Security doesn't exist to dispute anymore about cryptocurrency exchange systems-the security tech stack has layers beyond layers of protection. The encryption is essential for private and secured communications. Hardware Security Modules (HSMs) secure private keys through key storage. Poly signature schemes raise yet another level of permission to use transactions. Regular security audits and penetration tests to determine vulnerabilities and remediate them are also important. There should also be technologies of scam detection in order to secure both the platform and the users. Infrastructure and Deployment Centralization forms the base of all infrastructure and deployment of a cryptocurrency exchange. Cloud infrastructure such as Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure create a very good foundation with on-demand computing resources, storage solutions, and networking capabilities that will exactly measure with the increase of the exchange. One feature taking advantage of load balancing sends traffic to multiple servers and can avoid a single point of failure and be responsive during heavy trading times. Analytics and Monitoring Tools Analysis and monitoring software constitute the most vital tool for effective operation and continual optimization of a centralized cryptocurrency exchange. Real-time monitoring tools, worth mentioning, would be Prometheus and Grafana, as they provide vital insights on different performance metrics within the exchange, such as server resource use (CPU, memory, network), application response time, and response times from APIs. This way, one could detect anomalies and potential problematic areas in real-time to address them quickly, ensuring system stability while increasing user satisfaction. Factors to Consider When Choosing The Tech Stack This has caused a cen

Introduction

Introduction This grain of truth feeds on the greatest economic system revolution-the fast-changing crypto market ringed-in by centralized crypto exchanges (CEXs) immediately. Building a robust, secure, scalable centralized exchange in 2025 will definitely call for the right technology stack, with sharp competition and rising user expectations. Thus, the choice of right tools and frameworks is clear-it is not just for smooth performance and user experience but also for compliance, security, and future scalability. This blog shares into the top technology stacks meant for building a centralized crypto exchange with considerations towards the core components and future trends.

Core Components of a Centralized Exchange

At the heart of every centralized crypto exchange are several critical components. Each of these components must work together to deliver a better experience for traders while ensuring safety, efficiency, and compliance with the law. The selection of technology is important for to create centralized crypto exchanges. The components are:

- Frontend Technologies

- Backend Technologies

- Database and Storage Solutions

- Security Tech stack

- Infrastructure and Deployment

- Analytics and Monitoring Tools

Top Tech Stacks for Centralized Crypto Exchange in 2025

Frontend Technologies

Choosing a suitable technology stack is significant to each one of these components. For frontend technologies, the usual names in 2025 include React and Angular in combination with Vue.js. Such JavaScript frameworks can support the creation of dynamic as well as responsive user interfaces, offering features such as component-based architecture and efficient state management. For example, the virtual DOM of React can ameliorate the performance, whereas total framework of Angular provides a well-structured aspect to applications on a large scale. One thing that makes Vue.js very popular is the fact that it is progressive and easy to integrate.

Backend Technologies

Both the backend stacks provide the mainstay of the exchange. They will favor the performance and scalability of the enormous libraries that Go, Java, and Python have. Concurrency is one of the key strengths of Go that makes it feasible, as it allows for building engines that sign high-performance trading. It is safe to say that Java's robustness and a mature ecosystem can be described as suitable for organizing a complex financial system. However, the freedom and richness of frameworks in the middle of Django and Flask make it possible for rapid development using Python. The kinds of real time communications between front and back end that are possible use WebSockets.

Database and Storage Solutions

Such database and storage solutions should be able to support great deal of transactional data and therefore must be very sound and scalable. They can either be PostgreSQL or MySQL for relational databases, which are ACID compliant and data-consistent. In-memory databases like Redis and Memcached are made to cache hot data and improve the performance significantly.

Security Tech Stack

Security doesn't exist to dispute anymore about cryptocurrency exchange systems-the security tech stack has layers beyond layers of protection. The encryption is essential for private and secured communications. Hardware Security Modules (HSMs) secure private keys through key storage. Poly signature schemes raise yet another level of permission to use transactions. Regular security audits and penetration tests to determine vulnerabilities and remediate them are also important. There should also be technologies of scam detection in order to secure both the platform and the users.

Infrastructure and Deployment

Centralization forms the base of all infrastructure and deployment of a cryptocurrency exchange. Cloud infrastructure such as Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure create a very good foundation with on-demand computing resources, storage solutions, and networking capabilities that will exactly measure with the increase of the exchange. One feature taking advantage of load balancing sends traffic to multiple servers and can avoid a single point of failure and be responsive during heavy trading times.

Analytics and Monitoring Tools

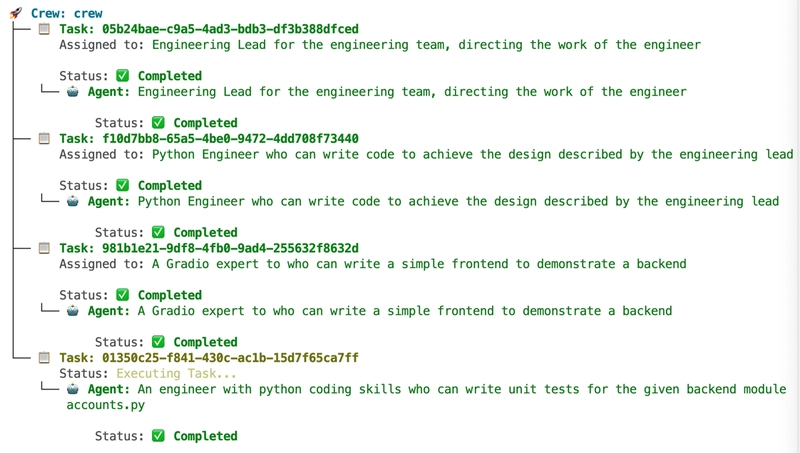

Analysis and monitoring software constitute the most vital tool for effective operation and continual optimization of a centralized cryptocurrency exchange. Real-time monitoring tools, worth mentioning, would be Prometheus and Grafana, as they provide vital insights on different performance metrics within the exchange, such as server resource use (CPU, memory, network), application response time, and response times from APIs. This way, one could detect anomalies and potential problematic areas in real-time to address them quickly, ensuring system stability while increasing user satisfaction.

Factors to Consider When Choosing The Tech Stack

This has caused a centralized crypto exchange to be built using technology stack selections. This technology stack is strategic in determining the performance, efficiency, and long term viability of the platform. However, one of the first considerations is the project's scope and complexity; that is, a large exchange with facilities such as margin trading, advanced charting tools, or high frequency trading support requires a more measurable architecture. Other issues are related to the number of transactions and concurrency requirements since the system would have to be capable of processing thousands of transactions per second with very low latencies and high uptime. Security is high up the list as well; with exchanges consistently becoming prime targets for cyberattacks in the crypto space, the stack should ideally come with built-in security best practices, encryption support, and integration with identity verification and threat detection tools.

Future Ready Tech Trends

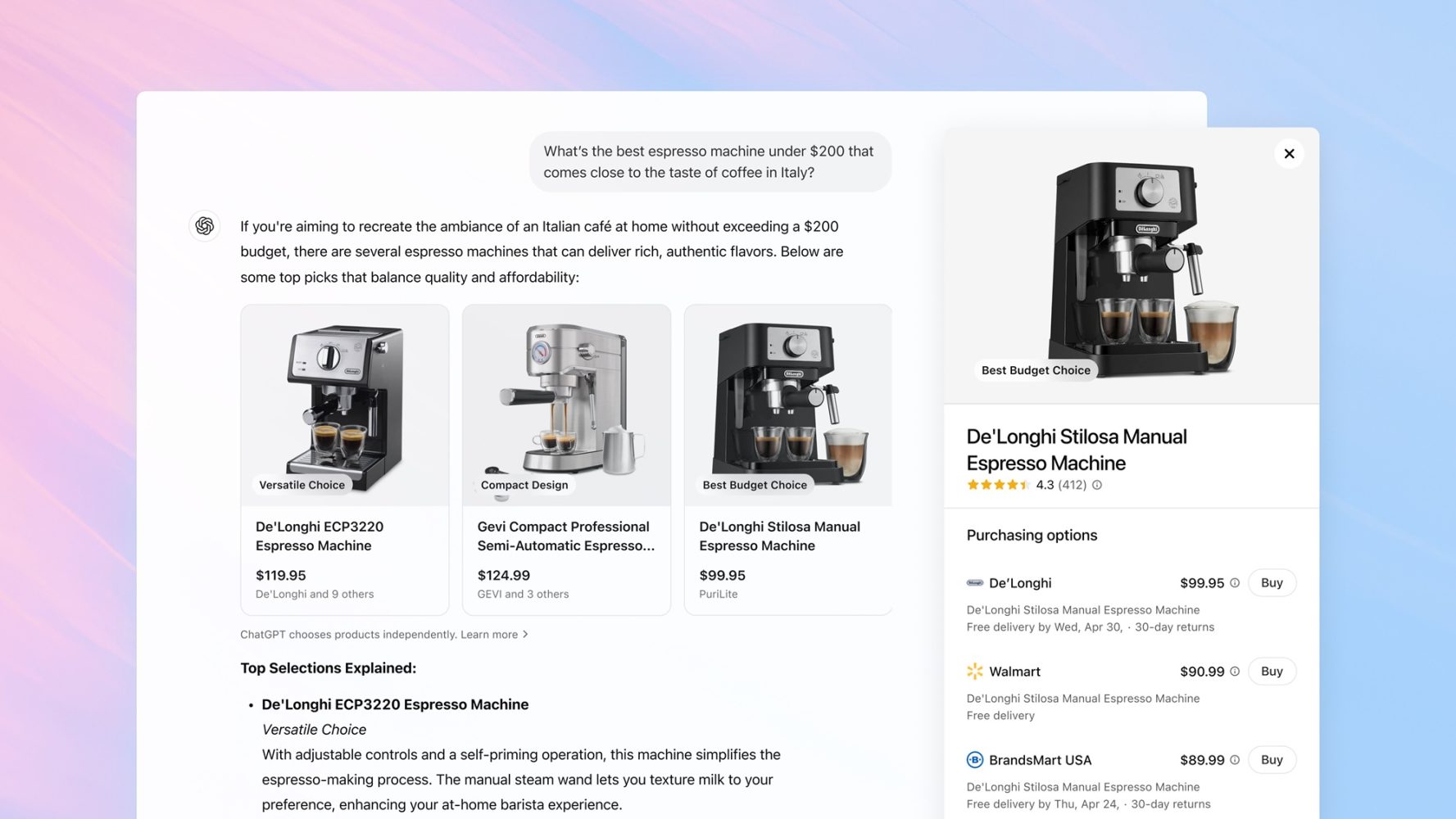

Artificial Intelligence and Machine Learning will be more integrated in spam detection and trade prediction. They are also infusing the development of Web3 compatibility, zero-trust security models, and quantum-resistant encryption. It's also being worked on around modular blockchain integrations, multi-chain support, and decentralized identity (DID) solutions, which are the contours of centralization and decentralization in finance ecosystems. Developments in blockchain interoperability make seamless trading of assets possible across different blockchains. AI and ML technologies are useful for minimizing fraud risks and providing tailored user experience initiatives.

Conclusion

A technology stack can make or break a centralized cryptocurrency exchange. Speed, security, and scalability will be more crucial than ever as we welcome the year 2025. Developers must stay ahead by adopting cutting-edge tools and frameworks that are in sync with their business needs and market trends as these evolve. The best technology stacks have built a strong foundation that allows exchanges to be trusted by their users and to scale according to best practice in delivering mission-critical services in a dynamic digital assets world. Developers can create robust, secure, and scalable platforms that will respond to the changing needs of the cryptocurrency market by carefully weighing the components and keeping an eye to futurist thought as they evaluate different technology stacks.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

_Muhammad_R._Fakhrurrozi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![macOS 15.5 beta 4 now available for download [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/macOS-Sequoia-15.5-b4.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![AirPods Pro 2 With USB-C Back On Sale for Just $169! [Deal]](https://www.iclarified.com/images/news/96315/96315/96315-640.jpg)

![Apple Releases iOS 18.5 Beta 4 and iPadOS 18.5 Beta 4 [Download]](https://www.iclarified.com/images/news/97145/97145/97145-640.jpg)

![Apple Seeds watchOS 11.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97147/97147/97147-640.jpg)

![Apple Seeds visionOS 2.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97150/97150/97150-640.jpg)

![Apple Seeds Fourth Beta of iOS 18.5 to Developers [Update: Public Beta Available]](https://images.macrumors.com/t/uSxxRefnKz3z3MK1y_CnFxSg8Ak=/2500x/article-new/2025/04/iOS-18.5-Feature-Real-Mock.jpg)

![Apple Seeds Fourth Beta of macOS Sequoia 15.5 [Update: Public Beta Available]](https://images.macrumors.com/t/ne62qbjm_V5f4GG9UND3WyOAxE8=/2500x/article-new/2024/08/macOS-Sequoia-Night-Feature.jpg)