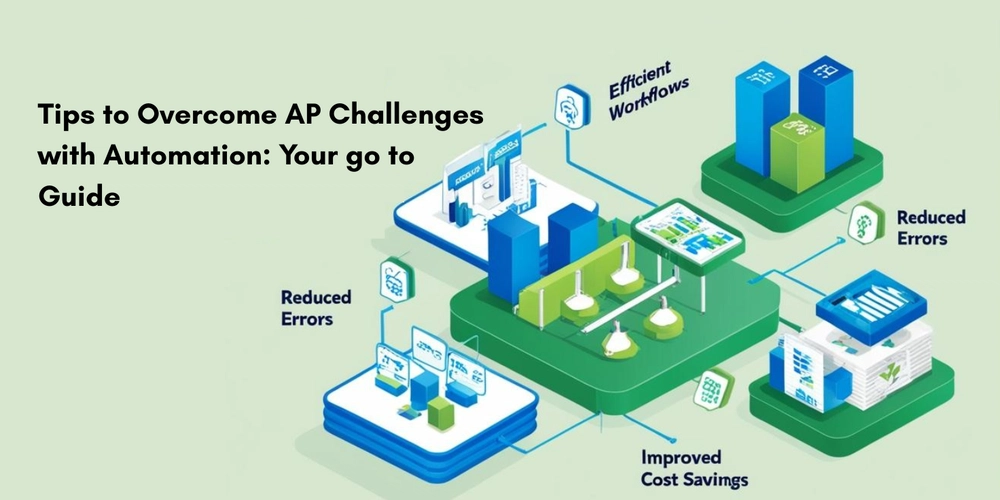

Tips to Overcome AP Challenges with Automation: Your go to Guide.

The accounts payable manager arrived at the desk to find a daunting reality: a towering stack of invoices, instantly shattering their hopes for a productive day. The best-laid plans soon become an exercise in futility because of the massive volume of work-thereby causing errors, delayed payments and frustrating vendors. They just can't find the right people to fill out their team and ease the load. They can only hope for some form of AP automation to help. If this is something you've struggled with, your situation is not unique. Across industries, AP departments are struggling and having difficulty hiring skilled AP professionals. Not only is the efficiency of the AP department impacted, but so is the overall financial health of the organization. What is Accounts Payable? Accounts Payable (AP) encloses the critical financial function within an organization which is accountable for managing the obligations incurred by the company for goods and services received from its suppliers and vendors. This implicates a meticulous process of receiving and verifying invoices, ensuring their accuracy by matching them with corresponding purchase orders and receiving documents, and obtaining necessary approvals before authorizing payments. Beyond, AP departments are responsible for issuing timely payments to vendors through various channels, negotiating vendor statements to identify and resolve any discrepancies, and maintaining comprehensive records of all transactions and vendor information. These activities are responsible for maintaining healthy cash flow, building strong relationships with your vendors, and ensuring the financial stability of the organization. Main Challenges in Accounts Payable Manual Processes Inefficiency There are still some organizations that rely on manual processes for invoice handling, leading to mistakes and errors. This old practice often results in payment delays and disrupted cash flow, making it difficult to manage financial operations. Inaccurate Information Mistakes in data entry and invoice processing are common, which results in payment inaccuracies and disputes with the suppliers. If you want to maintain a good vendor relationship, it's crucial to maintain integrity and accurate financial reporting. Extension in Clearing Dues Cash Flow Disruption Extended payment cycles can strain relationships with vendors and disrupt cash flow management. Companies often find themselves in fog while predicting cash flow accurately, complicating financial planning. Cybersecurity Threats Fraud Risks There is a rise in digital transactions, and AP departments have to go through increased risks of cyberattacks and fraud. Protecting sensitive financial information has become a top priority for AP leaders as they seek to safeguard against potential threats. Resource Constraints Limitation of Staff and Budget Many AP teams juggle a lot with the limited staff. Many times, they are asked to do more with less---to handle a growing number of invoices while their team size is small, and the budget stays the same. This can be really tough for the team, leading to burnout and making it harder for the staff to work efficiently. Poor Communication with Vendors Lack of Transparency Ineffective communication with the vendors can put you into deep trouble. That might result in misunderstandings regarding payments and documentation. This lack of clarity can turn a simple payment into a complex and time-consuming ordeal. Adapting to Growth Scalability Challenges As the business grows, the AP departments have to deal with more voluminous invoices and complex supplier relationships. Failure to adapt to processes may lead to some serious operational problems. Integration Issues Technology Compatibility Many organizations are facing difficulties in integrating new AP technologies into existing systems, which can hinder the adoption of automation tools that can streamline processes and enhance efficiency. The Good Part of Switching to AP Automation Switching to automated accounts payable process is one of the best decisions businesses can make. This revolution is a strong factor in bringing efficiency and effectiveness to financial operations. Below discussed are the key advantages of implementing vendor payment automation. 24/7 Remote Support The greatest benefits of AP automation is that invoices and payments can be approved from anywhere, anytime. Remote approval capabilities ensure the AP process runs smoothly, even if decision-makers are not in the office. It helps expedite payment cycles without delays. Reduced Reconciliation Effort AP payment automation reduces the reconciliation process as it automatically matches invoices with payments and purchase orders. This automatically cuts down the effort one puts in while manually tracking and verifying transactions, saving considerable time on reconciliation. Automated reconciliation is also error-free and maintains clean

The accounts payable manager arrived at the desk to find a daunting reality: a towering stack of invoices, instantly shattering their hopes for a productive day. The best-laid plans soon become an exercise in futility because of the massive volume of work-thereby causing errors, delayed payments and frustrating vendors. They just can't find the right people to fill out their team and ease the load. They can only hope for some form of AP automation to help.

If this is something you've struggled with, your situation is not unique.

Across industries, AP departments are struggling and having difficulty hiring skilled AP professionals. Not only is the efficiency of the AP department impacted, but so is the overall financial health of the organization.

What is Accounts Payable?

Accounts Payable (AP) encloses the critical financial function within an organization which is accountable for managing the obligations incurred by the company for goods and services received from its suppliers and vendors. This implicates a meticulous process of receiving and verifying invoices, ensuring their accuracy by matching them with corresponding purchase orders and receiving documents, and obtaining necessary approvals before authorizing payments.

Beyond, AP departments are responsible for issuing timely payments to vendors through various channels, negotiating vendor statements to identify and resolve any discrepancies, and maintaining comprehensive records of all transactions and vendor information. These activities are responsible for maintaining healthy cash flow, building strong relationships with your vendors, and ensuring the financial stability of the organization.

Main Challenges in Accounts Payable

Manual Processes

Inefficiency

There are still some organizations that rely on manual processes for invoice handling, leading to mistakes and errors. This old practice often results in payment delays and disrupted cash flow, making it difficult to manage financial operations.

Inaccurate Information

Mistakes in data entry and invoice processing are common, which results in payment inaccuracies and disputes with the suppliers. If you want to maintain a good vendor relationship, it's crucial to maintain integrity and accurate financial reporting.

Extension in Clearing Dues

Cash Flow Disruption

Extended payment cycles can strain relationships with vendors and disrupt cash flow management. Companies often find themselves in fog while predicting cash flow accurately, complicating financial planning.

Cybersecurity Threats

Fraud Risks

There is a rise in digital transactions, and AP departments have to go through increased risks of cyberattacks and fraud. Protecting sensitive financial information has become a top priority for AP leaders as they seek to safeguard against potential threats.

Resource Constraints

Limitation of Staff and Budget

Many AP teams juggle a lot with the limited staff. Many times, they are asked to do more with less---to handle a growing number of invoices while their team size is small, and the budget stays the same. This can be really tough for the team, leading to burnout and making it harder for the staff to work efficiently.

Poor Communication with Vendors

Lack of Transparency

Ineffective communication with the vendors can put you into deep trouble. That might result in misunderstandings regarding payments and documentation. This lack of clarity can turn a simple payment into a complex and time-consuming ordeal.

Adapting to Growth

Scalability Challenges

As the business grows, the AP departments have to deal with more voluminous invoices and complex supplier relationships. Failure to adapt to processes may lead to some serious operational problems.

Integration Issues

Technology Compatibility

Many organizations are facing difficulties in integrating new AP technologies into existing systems, which can hinder the adoption of automation tools that can streamline processes and enhance efficiency.

The Good Part of Switching to AP Automation

Switching to automated accounts payable process is one of the best decisions businesses can make. This revolution is a strong factor in bringing efficiency and effectiveness to financial operations. Below discussed are the key advantages of implementing vendor payment automation.

24/7 Remote Support

The greatest benefits of AP automation is that invoices and payments can be approved from anywhere, anytime. Remote approval capabilities ensure the AP process runs smoothly, even if decision-makers are not in the office. It helps expedite payment cycles without delays.

Reduced Reconciliation Effort

AP payment automation reduces the reconciliation process as it automatically matches invoices with payments and purchase orders. This automatically cuts down the effort one puts in while manually tracking and verifying transactions, saving considerable time on reconciliation. Automated reconciliation is also error-free and maintains clean financial records, which facilitates audit and financial review processes.

Digital Payment Options

Automation enables businesses to benefit from digital means of payments such as virtual cards, ACH payments, etc. Digital payment methods are faster and far safer than checks. Thus, the two can be labeled as the most important savings.

Faster Invoice Processing

Businesses can accelerate the entire AP cycle by automating invoice processing. Automation reduces time spent in such areas as manual data entry, approval workflows, and error correction. Faster processing helps ensure prompt payments of invoices, so early-payment discounts are captured while good vendor relationships are not adversely affected.

Enhanced Payment Security

Advanced security features such as encryption and tokenization are incorporated into automated systems, which protect sensitive payment information from fraud and data breaches. Enhanced security measures ensure that payments are processed safely, comply with industry standards, and safeguard the business's financial integrity.

With remote approval, improved security, and other benefits, these above advantages can depict the transformation to help create a more efficient and secure financial operation.

Practical Steps to Implement AP Automation

The task of implementing AP automation can seem unconquerable, but if you are doing it properly and with care, businesses can seamlessly transition to such a process. Here are the practical steps toward guiding the implementation of AP automation:

Evaluate current AP process

Analyze the existing process to understand inefficiencies and bottlenecks. Map the AP workflow — from receipt of invoice to processing of payment — to understand which areas would have the greatest potential impact.

Gather feedback from AP staff to understand common challenges and pain points. Look for areas with high error rates, time-consuming tasks and repetitive manual work that can benefit from automation.

Define Goals and Requirements

Define specific goals for the vendor payment automation project, such as to cut down the processing time, improving accuracy or enhancing visibility. Establish key performance indicators to measure the implementation’s success.

Identify the features and capabilities needed in an AP automation solution to meet your objectives. Consider factors such as integration with existing systems, real-time tracking and reporting capabilities.

Select and Integrate an AP Automated Solution

Research different AP solutions and evaluate them based on your requirements. Look for providers with a proven track record, positive customer reviews and robust support services.

Develop a detailed integration plan to ensure a smooth transition from manual to automated processes. Work closely with your chosen provider to understand the integration requirements and timeline.

Train Staff and Manage the Transition

Offer training sessions for AP staff to familiarize themselves with the new automation system. Ensure all team members understand how to use the new tools and processes.

Continuously monitor the performance of the system and gather feedback from users. Optimize the system and address any issues that arise during the initial implementation phase.

Conclusion

Automating accounts payable process plays an important role in maintaining the financial stability and credibility of an organization. From handling invoices and maintaining vendor relationships to ensuring compliance and optimizing workflows, their contributions are invaluable.

By tackling common challenges with automation, companies can achieve higher efficiency, accuracy, and cost savings. Mastering accounts payable ensures a robust and transparent financial system that will support the organization's growth and success.

![[Free Webinar] Guide to Securing Your Entire Identity Lifecycle Against AI-Powered Threats](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjqbZf4bsDp6ei3fmQ8swm7GB5XoRrhZSFE7ZNhRLFO49KlmdgpIDCZWMSv7rydpEShIrNb9crnH5p6mFZbURzO5HC9I4RlzJazBBw5aHOTmI38sqiZIWPldRqut4bTgegipjOk5VgktVOwCKF_ncLeBX-pMTO_GMVMfbzZbf8eAj21V04y_NiOaSApGkM/s1600/webinar-play.jpg?#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_Tanapong_Sungkaew_via_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Restructures Global Affairs and Apple Music Teams [Report]](https://www.iclarified.com/images/news/97162/97162/97162-640.jpg)

![New iPhone Factory Goes Live in India, Another Just Days Away [Report]](https://www.iclarified.com/images/news/97165/97165/97165-640.jpg)