The Rise of Blockchain in the Financial Sector: A Deep Dive into Transformational Finance

Abstract: Blockchain is redefining how financial systems operate. This post delves into the fundamentals and wider applications of blockchain in finance through a technical yet accessible lens. From its decentralized architecture and smart contracts to its real-world applications in cryptocurrencies and financial services, we explore the benefits, challenges, and prospects of this revolutionary technology. Along the way, we integrate insights from leading resources—including License Token’s article, Investopedia, Deloitte, PwC, and McKinsey—and selected posts from Dev.to to provide a holistic view for both financial professionals and technology enthusiasts. Introduction Blockchain is not just a buzzword; it is a transformative technology that is reshaping the financial sector. With its roots in cryptocurrency, blockchain’s decentralized ledger system offers transparency, security, and efficiency in transactions. In finance, the demand for secure, automated, and low-cost solutions has opened the door for this innovation. In this blog post, we explore how blockchain is revolutionizing financial services. We will discuss the history, underlying principles, practical applications, and future outlook. Whether you are a developer, investor, or simply a tech enthusiast, understanding blockchain’s role in this new era is crucial. Background and Context Blockchain technology emerged from the need to manage financial transactions without a central authority. Its origin can be traced back to the launch of Bitcoin in 2009, where the concept of a distributed ledger came to life. Today, blockchain has evolved to encompass various applications in finance and beyond. Key Definitions and Ecosystem Distributed Ledger Technology (DLT): A system where transaction data is recorded across multiple nodes to ensure security and transparency. Smart Contracts: Self-executing contracts with the terms directly written into code. They automate agreements and reduce reliance on intermediaries. Decentralization: Unlike traditional financial systems, blockchain operates on a peer-to-peer network, removing single points of failure and increasing trust. For additional context on the core ideas, check out What is Blockchain and Smart Contracts on Blockchain. Ecosystem Growth Blockchain’s ecosystem has expanded quickly, impacting various sectors, including supply chain management, healthcare, and notably, the financial industry. The robust framework provided by blockchain has led financial giants and startups alike to experiment with new models, creating more secure and transparent financial infrastructures. Core Concepts and Features Blockchain technology offers multiple advantages that underpin its growing application in finance. Key features include: 1. Decentralization and Transparency Decentralization: Eliminates the need for a central authority, ensuring that all network participants have access to the same information. Transparency: Every transaction is visible to network participants, fostering trust in systems that historically have been opaque and prone to inconsistency. 2. Enhanced Security The cryptographic protocols that secure blockchain networks provide an extraordinary level of security. Each transaction is encrypted and linked in a chain, making tampering nearly impossible. Moreover, smart contracts automate and secure agreements without manual intervention. 3. Efficiency and Cost Reduction The automation of processes enables faster transactions, lower operational costs, and fewer intermediaries. Traditional finance often suffers from delays and high fees, problems that blockchain directly addresses. 4. Types of Blockchains Understanding the differences between blockchain systems is essential: Public Blockchains: Open to anyone, offering complete transparency. Private Blockchains: Controlled environments designed for businesses that require privacy along with efficiency. Consortium Blockchains: Managed by a group of organizations, these offer a balance between decentralization and regulatory approval. For a better breakdown of these blockchain variants, refer to Public vs Private Blockchains and Types of Blockchains. Applications and Use Cases Blockchain’s impact on finance is broad and multifaceted. Here are some of the most compelling practical examples: 1. Cryptocurrencies Cryptocurrencies like Bitcoin and Ethereum have pioneered blockchain use in digital finance. The decentralized and secure nature of these currencies has changed how money moves globally. Financial institutions are now exploring stablecoins and central bank digital currencies (CBDCs) as alternatives to traditional currencies. 2. Smart Contracts in Automated Finance Smart contracts have begun to replace traditional legal contracting in many financial transactions. For example, in ar

Abstract:

Blockchain is redefining how financial systems operate. This post delves into the fundamentals and wider applications of blockchain in finance through a technical yet accessible lens. From its decentralized architecture and smart contracts to its real-world applications in cryptocurrencies and financial services, we explore the benefits, challenges, and prospects of this revolutionary technology. Along the way, we integrate insights from leading resources—including License Token’s article, Investopedia, Deloitte, PwC, and McKinsey—and selected posts from Dev.to to provide a holistic view for both financial professionals and technology enthusiasts.

Introduction

Blockchain is not just a buzzword; it is a transformative technology that is reshaping the financial sector. With its roots in cryptocurrency, blockchain’s decentralized ledger system offers transparency, security, and efficiency in transactions. In finance, the demand for secure, automated, and low-cost solutions has opened the door for this innovation.

In this blog post, we explore how blockchain is revolutionizing financial services. We will discuss the history, underlying principles, practical applications, and future outlook. Whether you are a developer, investor, or simply a tech enthusiast, understanding blockchain’s role in this new era is crucial.

Background and Context

Blockchain technology emerged from the need to manage financial transactions without a central authority. Its origin can be traced back to the launch of Bitcoin in 2009, where the concept of a distributed ledger came to life. Today, blockchain has evolved to encompass various applications in finance and beyond.

Key Definitions and Ecosystem

- Distributed Ledger Technology (DLT): A system where transaction data is recorded across multiple nodes to ensure security and transparency.

- Smart Contracts: Self-executing contracts with the terms directly written into code. They automate agreements and reduce reliance on intermediaries.

- Decentralization: Unlike traditional financial systems, blockchain operates on a peer-to-peer network, removing single points of failure and increasing trust.

For additional context on the core ideas, check out What is Blockchain and Smart Contracts on Blockchain.

Ecosystem Growth

Blockchain’s ecosystem has expanded quickly, impacting various sectors, including supply chain management, healthcare, and notably, the financial industry. The robust framework provided by blockchain has led financial giants and startups alike to experiment with new models, creating more secure and transparent financial infrastructures.

Core Concepts and Features

Blockchain technology offers multiple advantages that underpin its growing application in finance. Key features include:

1. Decentralization and Transparency

- Decentralization: Eliminates the need for a central authority, ensuring that all network participants have access to the same information.

- Transparency: Every transaction is visible to network participants, fostering trust in systems that historically have been opaque and prone to inconsistency.

2. Enhanced Security

The cryptographic protocols that secure blockchain networks provide an extraordinary level of security. Each transaction is encrypted and linked in a chain, making tampering nearly impossible. Moreover, smart contracts automate and secure agreements without manual intervention.

3. Efficiency and Cost Reduction

The automation of processes enables faster transactions, lower operational costs, and fewer intermediaries. Traditional finance often suffers from delays and high fees, problems that blockchain directly addresses.

4. Types of Blockchains

Understanding the differences between blockchain systems is essential:

- Public Blockchains: Open to anyone, offering complete transparency.

- Private Blockchains: Controlled environments designed for businesses that require privacy along with efficiency.

- Consortium Blockchains: Managed by a group of organizations, these offer a balance between decentralization and regulatory approval.

For a better breakdown of these blockchain variants, refer to Public vs Private Blockchains and Types of Blockchains.

Applications and Use Cases

Blockchain’s impact on finance is broad and multifaceted. Here are some of the most compelling practical examples:

1. Cryptocurrencies

Cryptocurrencies like Bitcoin and Ethereum have pioneered blockchain use in digital finance. The decentralized and secure nature of these currencies has changed how money moves globally. Financial institutions are now exploring stablecoins and central bank digital currencies (CBDCs) as alternatives to traditional currencies.

2. Smart Contracts in Automated Finance

Smart contracts have begun to replace traditional legal contracting in many financial transactions. For example, in areas such as insurance and syndicated loans, smart contracts are used to automate claims processing and settlement, reducing human error and administrative costs.

3. Identity Verification and Fraud Detection

Blockchain’s immutable ledger makes it a powerful tool for identity verification. By establishing a verifiable digital identity, financial institutions can significantly reduce fraud. This application is already influencing KYC (Know Your Customer) processes in banks and fintech startups.

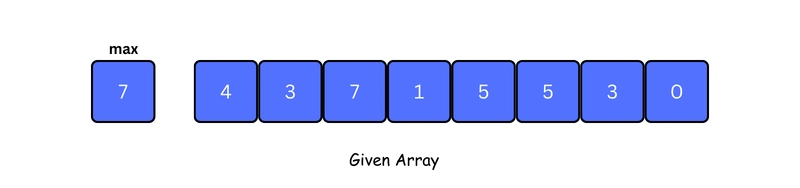

Table: Blockchain in Finance — Key Applications

| Application | Key Benefits | Example Use Case |

|---|---|---|

| Cryptocurrencies | Decentralization, Transparency, Global transactions | Trading, cross-border remittances |

| Smart Contracts | Automation, Reduced intermediaries, Security | Insurance claims processing, syndicated loans |

| Identity Verification | Fraud reduction, Secure data management | KYC processes, digital identity systems |

| Decentralized Finance (DeFi) | Lower fees, Enhanced access, Financial inclusion | Peer-to-peer lending platforms, liquidity pools |

For further insights on how blockchain is being integrated into traditional finance, review this PwC report on blockchain in financial services and Deloitte’s study on its impacts here.

Challenges and Limitations

While blockchain promises significant advances, there are challenges that must be addressed before widespread adoption:

Scalability:

Many blockchain networks face issues with processing speed and transaction limits. The need for scalability solutions is paramount to meet the demands of the global financial system. For detailed strategies, see Blockchain Scalability Solutions.Regulatory Uncertainty:

Governments and regulators are still formulating policies in response to the rapid advancement of blockchain technology. Compliance with existing financial regulations remains a significant obstacle for many blockchain projects.Security Vulnerabilities:

Despite high encryption standards, some blockchain networks have experienced hacks or exploitative smart contract vulnerabilities. Continuous security audits and updates are necessary to maintain trust.Energy Consumption:

Many blockchain networks, particularly those using proof-of-work (PoW), require significant energy resources. This has spurred a search for more sustainable consensus mechanisms.

A recent article on arbitrum challenges addresses some of these limitations in the context of layer-2 blockchain solutions.

Future Outlook and Innovations

Blockchain technology is evolving at a rapid pace. Financial institutions can expect several disruptive trends over the next few years:

1. Increased Institutional Adoption

Major banks are already testing blockchain-based platforms for trading, clearing, and settlement. As these technologies mature, blockchain is expected to become a staple in modern financial infrastructures.

2. Interoperability and Multi-Chain Support

Solutions that enable different blockchain systems to interoperate are gaining traction. This will vastly improve the scalability and efficiency of decentralized financial systems. Look for emerging projects that focus on blockchain interoperability.

3. Advancements in Consensus Mechanisms

New consensus models such as Proof-of-Stake (PoS) are addressing many of the energy and scalability challenges posed by earlier blockchain systems. These advancements promise to make blockchain even more attractive for financial applications.

4. Integration with Emerging Technologies

Blockchain is increasingly being combined with other exciting technologies such as artificial intelligence (AI) and the Internet of Things (IoT). This integration will likely innovate traditional finance further by enabling automated decision-making and real-time data sharing.

Dev.to Insights on Future Trends

For further in-depth perspectives, check out these highly informative Dev.to posts:

- Unveiling the X Consortium License: A New Era of Fair Code

- Exploring Cardano Java: A Gateway to Open Source Blockchain Innovation

- Understanding Financial Growth in Open Source Projects

These articles shed light on how open source principles are merging with blockchain innovation to fuel future growth.

Key Takeaways

To summarize, here are the essential points:

- Blockchain Fundamentals: A disruptive technology that offers decentralization, transparency, and security.

- Applications in Finance: Ranging from cryptocurrencies and smart contracts to fraud reduction and digital identity verification.

- Challenges: Include scalability issues, regulatory hurdles, energy consumption, and the need for robust security.

- Future Trends: Enhanced institutional adoption, improved interoperability, and innovation through integration with emerging technologies.

Bullet List of Key Benefits:

- Transparency: Improved trust and data integrity.

- Efficiency: Faster transactions with fewer intermediaries.

- Security: Reduced risk of fraud and data breaches.

- Cost Reduction: Lower transaction fees and operational costs.

Summary

Blockchain has moved from a niche technology associated with cryptocurrencies to a cornerstone of modern financial services. Its promise of decentralized control, transparency, and cost efficiency is already reshaping industries. However, challenges like scalability, regulatory complexity, and energy consumption must be overcome to unlock its full potential.

By exploring the core concepts of blockchain, its applications in finance, and the challenges ahead, we recognize the enormous potential of this technology. The future holds many opportunities for integrating blockchain with artificial intelligence, IoT, and other digital innovations—paving the way for a more secure, efficient, and transparent financial infrastructure.

For a comprehensive understanding, revisit The Rise of Blockchain in the Financial Sector on License Token’s wiki and reference resources like Investopedia’s Blockchain Guide and McKinsey’s Insights.

Final Thoughts

As blockchain technology continues to evolve, its influence in the financial sector is only set to increase. With developments in scalability, interoperability, and regulatory clarity, blockchain is poised to solve many of the challenges that have long plagued traditional finance. Embracing this technology not only unlocks tremendous efficiency but also sets the stage for a future where financial operations are governed by trust, transparency, and automation.

Staying informed about these trends is essential for anyone involved in financial services or emerging technology sectors. The blockchain revolution is here, and its transformative power is reshaping our financial world—one block at a time.

Additional Resources and Further Reading:

- What is Blockchain? – License Token’s Guide

- Smart Contracts on Blockchain – Learn More

- Public vs Private Blockchains – Explore Differences

- Types of Blockchains – Detailed Overview

- Blockchain Scalability Solutions – Challenges and Strategies

By harnessing these insights, financial professionals and developers alike can navigate the complexities of blockchain technology and contribute to building a more innovative and secure financial future.

This post is optimized for both human readers and search engines, making extensive use of structured headings, **bold* key terms, italicized emphasis, bullet lists, and tables to ensure clarity, readability, and ease of crawling by AIs.*

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

_Muhammad_R._Fakhrurrozi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![macOS 15.5 beta 4 now available for download [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/macOS-Sequoia-15.5-b4.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![AirPods Pro 2 With USB-C Back On Sale for Just $169! [Deal]](https://www.iclarified.com/images/news/96315/96315/96315-640.jpg)

![Apple Releases iOS 18.5 Beta 4 and iPadOS 18.5 Beta 4 [Download]](https://www.iclarified.com/images/news/97145/97145/97145-640.jpg)

![Apple Seeds watchOS 11.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97147/97147/97147-640.jpg)

![Apple Seeds visionOS 2.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97150/97150/97150-640.jpg)

![Apple Seeds Fourth Beta of iOS 18.5 to Developers [Update: Public Beta Available]](https://images.macrumors.com/t/uSxxRefnKz3z3MK1y_CnFxSg8Ak=/2500x/article-new/2025/04/iOS-18.5-Feature-Real-Mock.jpg)

![Apple Seeds Fourth Beta of macOS Sequoia 15.5 [Update: Public Beta Available]](https://images.macrumors.com/t/ne62qbjm_V5f4GG9UND3WyOAxE8=/2500x/article-new/2024/08/macOS-Sequoia-Night-Feature.jpg)