The Future of Trading: Why You Should Consider Trading Bot Development

Introduction In the fast-changing world of trading set against the backdrop of ever-evolving technology, traders today consider anything that can grant them an edge. Indeed, trading bots lead this change. Besides automating your strategies, building a trading bot offers further opportunities for efficiency and profitability. This blog discusses why now may be the best time to focus on trading bot development and its possible role in the next era of your trading journey. What Are The Trading Bots and How Do They Work? Trading bots are computer programs that are completely automated and enter the financial market with a user's authorization to buy and sell assets on behalf of the user according to various predefined strategies and rules. If you want greater control over your trading activities, one powerful option is to create your own crypto trading bot, tailored to your specific goals. Such bots help in analyzing market data, detecting reasonable price trends, and executing orders at much faster rates than any human being—with the possible exception of maybe a couple. They are active all day and all night—monitoring different markets at the same time—and can be programmed to enter and exit the market in accordance with pretty much any trading style imaginable, for instance, arbitrage, swing trades, or long-term investments. Trading bots can keep human emotions out of trading decisions, hence ensuring that strategies are executed consistently. How Trading Bots Are Changing the Game for Retail and Institutional Traders Both retail traders and most institutional traders have begun to rely on trading bots for competing with each other. Retail traders now have the tools commercialized by institutions available to them, hence competing with them. For the institutional trader, trading bots are a requirement for high-frequency trading as well as the execution of bigger orders. Bots improve efficiencies, allowing traders to seize micro opportunities that otherwise would have slipped by during manual trading. Essential Skills and Tools for Trading Bot Development The final skill set to be possessed, therefore, is really an ensemble set that marries finance, programming, and analytical skills. To start with, bot development requires expertise in programming. They are mainly written in one of the following: Python, JavaScript, or C++. In that Python is well known for its simplicity and for housing a multitude of libraries useful in finance and data science, it is most popular. A good understanding of APIs (Application Programming Interfaces) is crucial, as your bot would connect to exchanges to gather market data and to execute trades. Such knowledge, involving the mechanics of REST APIs, WebSocket APIs, and the workings of authentication-based protocols such as OAuth, is key in allowing seamless operations on trading platforms. Complementing the above foundations, a solid understanding of trading and financial markets is equally important. Your insights on how different markets operate-be it stocks, forex, or cryptocurrencies-will set the golden rule in your design of realistic and profitable strategies. Common Challenges in Building and Managing Trading Bots While building and managing a trading bot may sound exciting, an entire set of problems must be carefully studied and worked upon continuously. An important area of concern for developers is the conception of a profitable trading plan: it is quite easy to set up a bot that trades, but it is much harder to program one that does so profitably across different market situations. Many beginner bots are very profitable during backtesting while losing money from the very beginning in live markets; they become overfitted. Such is the pinpoint tuning of the behavior of a bot to previous data that little flexibility is left to adapt to real-time differences. Thus, a fine balancing act needs to be maintained between optimization and generality. Key Benefits of Developing Your Own Trading Bot Full Customization and Flexibility There are no limits in logic, strategy, and behavior when developing your own trading bot; you'd have all power to customize its working according to your trading style, risk profile, asset preferences, trading time frame, and market conditions. Competitive Advantage With your own bot, your strategies become uncommonly used. Others who use public bots face the same strategy, which becomes predictable and loses its profitability through the years. Enhanced Performance and Efficiency An appropriately coded trading bot works with tons of market data, fetching opportunities and executing trades at a speed far beyond human capability. Another great point is the capability of a trading bot to work 24/7 in several markets at the same time. Risk Management and Emotional Discipline Poor trading decisions are often made due to the emotions of fear and greed. A custom trading bot will

Introduction

In the fast-changing world of trading set against the backdrop of ever-evolving technology, traders today consider anything that can grant them an edge. Indeed, trading bots lead this change. Besides automating your strategies, building a trading bot offers further opportunities for efficiency and profitability. This blog discusses why now may be the best time to focus on trading bot development and its possible role in the next era of your trading journey.

What Are The Trading Bots and How Do They Work?

Trading bots are computer programs that are completely automated and enter the financial market with a user's authorization to buy and sell assets on behalf of the user according to various predefined strategies and rules. If you want greater control over your trading activities, one powerful option is to create your own crypto trading bot, tailored to your specific goals. Such bots help in analyzing market data, detecting reasonable price trends, and executing orders at much faster rates than any human being—with the possible exception of maybe a couple. They are active all day and all night—monitoring different markets at the same time—and can be programmed to enter and exit the market in accordance with pretty much any trading style imaginable, for instance, arbitrage, swing trades, or long-term investments. Trading bots can keep human emotions out of trading decisions, hence ensuring that strategies are executed consistently.

How Trading Bots Are Changing the Game for Retail and Institutional Traders

Both retail traders and most institutional traders have begun to rely on trading bots for competing with each other. Retail traders now have the tools commercialized by institutions available to them, hence competing with them. For the institutional trader, trading bots are a requirement for high-frequency trading as well as the execution of bigger orders. Bots improve efficiencies, allowing traders to seize micro opportunities that otherwise would have slipped by during manual trading.

Essential Skills and Tools for Trading Bot Development

The final skill set to be possessed, therefore, is really an ensemble set that marries finance, programming, and analytical skills. To start with, bot development requires expertise in programming. They are mainly written in one of the following: Python, JavaScript, or C++. In that Python is well known for its simplicity and for housing a multitude of libraries useful in finance and data science, it is most popular. A good understanding of APIs (Application Programming Interfaces) is crucial, as your bot would connect to exchanges to gather market data and to execute trades. Such knowledge, involving the mechanics of REST APIs, WebSocket APIs, and the workings of authentication-based protocols such as OAuth, is key in allowing seamless operations on trading platforms. Complementing the above foundations, a solid understanding of trading and financial markets is equally important. Your insights on how different markets operate-be it stocks, forex, or cryptocurrencies-will set the golden rule in your design of realistic and profitable strategies.

Common Challenges in Building and Managing Trading Bots

While building and managing a trading bot may sound exciting, an entire set of problems must be carefully studied and worked upon continuously. An important area of concern for developers is the conception of a profitable trading plan: it is quite easy to set up a bot that trades, but it is much harder to program one that does so profitably across different market situations. Many beginner bots are very profitable during backtesting while losing money from the very beginning in live markets; they become overfitted. Such is the pinpoint tuning of the behavior of a bot to previous data that little flexibility is left to adapt to real-time differences. Thus, a fine balancing act needs to be maintained between optimization and generality.

Key Benefits of Developing Your Own Trading Bot

Full Customization and Flexibility

There are no limits in logic, strategy, and behavior when developing your own trading bot; you'd have all power to customize its working according to your trading style, risk profile, asset preferences, trading time frame, and market conditions.

Competitive Advantage

With your own bot, your strategies become uncommonly used. Others who use public bots face the same strategy, which becomes predictable and loses its profitability through the years.

Enhanced Performance and Efficiency

An appropriately coded trading bot works with tons of market data, fetching opportunities and executing trades at a speed far beyond human capability. Another great point is the capability of a trading bot to work 24/7 in several markets at the same time.

Risk Management and Emotional Discipline

Poor trading decisions are often made due to the emotions of fear and greed. A custom trading bot will ensure discipline by executing the programmed rules without emotional interference. Besides that, you can program your personalized trading bot with advanced risk management systems like stop-loss, position sizing, and portfolio rebalancing in order to systematically safeguard your capital.

Cost-Effectiveness in the Long Run

The initial investment of time and resources to develop a bot may be considerable; however, in the long run, it usually pays back. Since you would avoid paying high subscription fees, commissions, and sharing a percentage on any profits a third-party bot may ask for.

Data Privacy and Security

When using a third party bot or trading service, users usually share sensitive information, such as account details or API keys, creating a risk. With an in house bot, everything is kept in house, thereby minimizing exposure to data breaches, unauthorized access, or third-party dependencies.

Future Trends: AI, Machine Learning, and Smart Bots

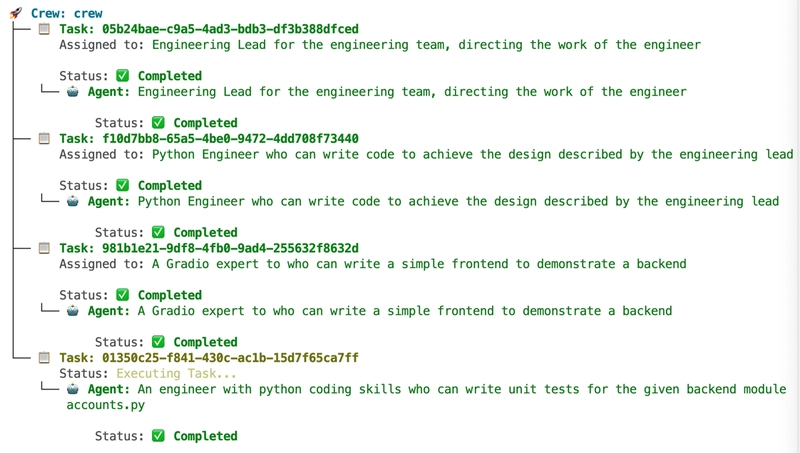

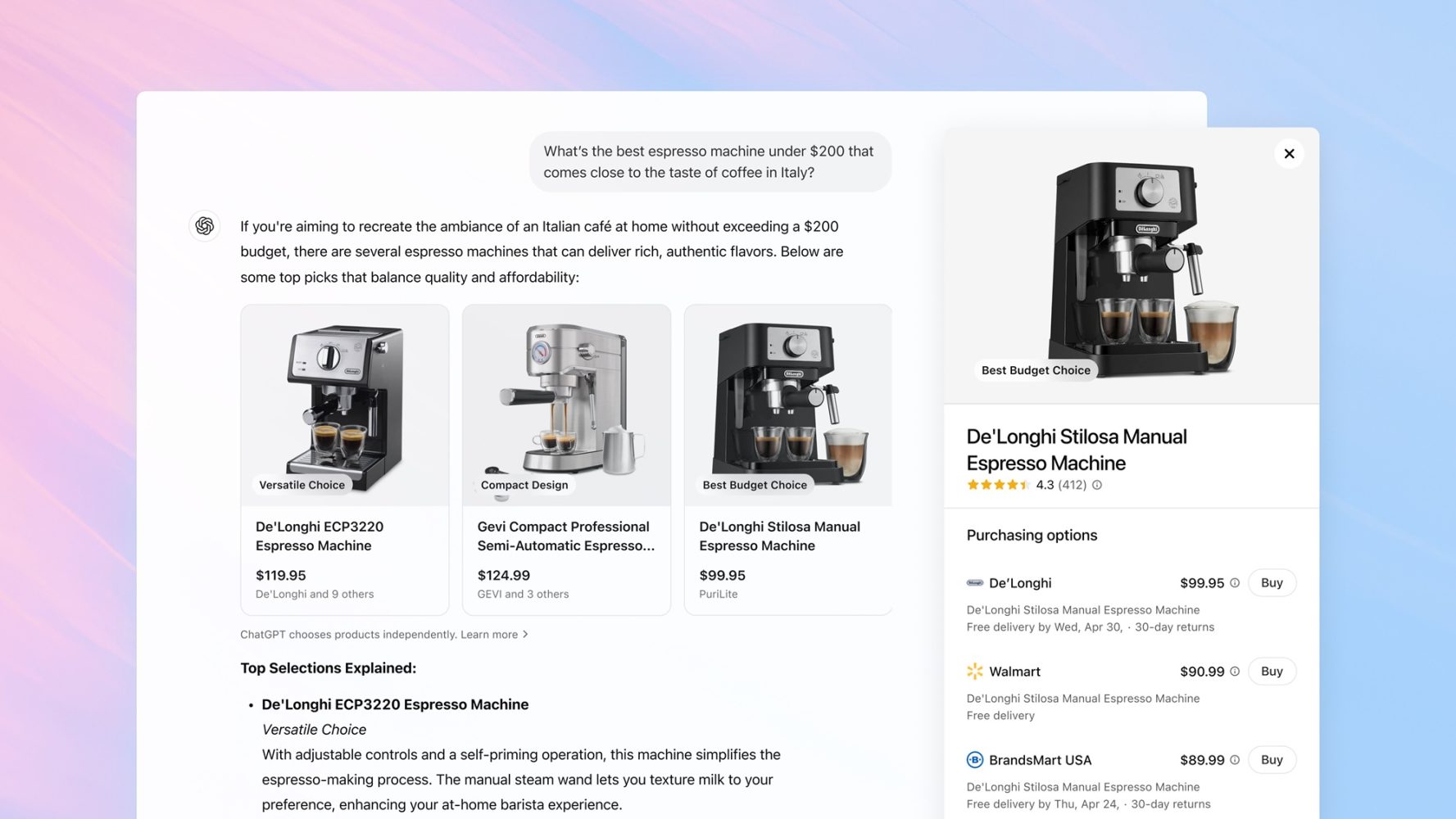

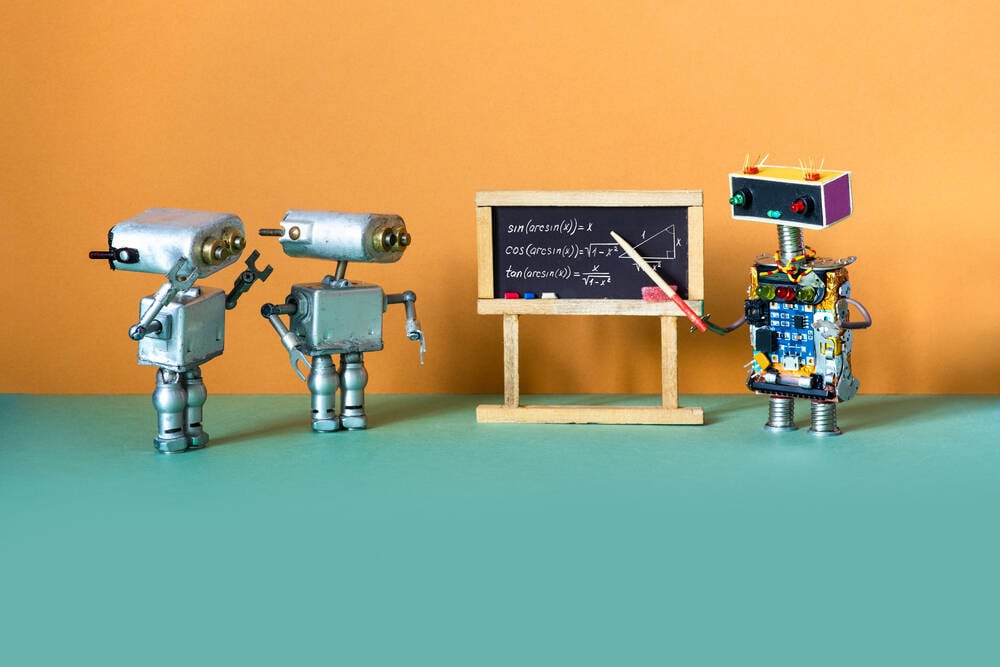

AI and ML breakthroughs are rapidly creating the future of trading bots, promising to change the existence of automated trading systems. Traditional bots rely on hard-coded rules, but AI bots learn from past data, adapt to evolving market conditions, and improve their strategies over time without human intervention. This allows for the emergence of exceedingly dynamic, responsive, and intelligent trading systems that align with rapid changes and complexities of the environment.

The use of machine learning models for predictive analysis is becoming one of the most significant emerging trends. Instead of just reacting to market movements as they happen, smart bots are beginning to forecast price trends, or market sentiment by vetting colossal datasets consisting of historical price data, order books, news feeds, and even social media chatter. Supervised learning, reinforcement learning, and deep learning are increasingly gaining traction as ways to build bots that could pick up on subtle patterns that even human traders or traditional algorithms might miss.

Why Now Is the Perfect Time to Start Developing Trading Bots

A very low barrier has emerged for anybody who wants to venture into bot trading development. There are open-source libraries available today, good courses for learning left and right on the Internet, and APIs one can use to build a bot with. The development of the algorithmic trading industry and its acceptance by individuals and institutions also create an encouraging time to delve into it. With more and more complicated markets, the traders with so-called tunable automation will reap rich rewards.

Conclusion

Trading bot development represents one of the most exciting frontiers in modern finance. The combination of some technical skills and some market knowledge allows you to build a tool that works diligently to maximize your trading potential. With the introduction of AI, machine learning, and ever-increasing availability of tools, the time is now for you to holiday to build your trading bot. So welcome to the future of trading — your success is probably just one smart algorithm away.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

_Muhammad_R._Fakhrurrozi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![macOS 15.5 beta 4 now available for download [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/macOS-Sequoia-15.5-b4.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![AirPods Pro 2 With USB-C Back On Sale for Just $169! [Deal]](https://www.iclarified.com/images/news/96315/96315/96315-640.jpg)

![Apple Releases iOS 18.5 Beta 4 and iPadOS 18.5 Beta 4 [Download]](https://www.iclarified.com/images/news/97145/97145/97145-640.jpg)

![Apple Seeds watchOS 11.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97147/97147/97147-640.jpg)

![Apple Seeds visionOS 2.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97150/97150/97150-640.jpg)

![Apple Seeds Fourth Beta of iOS 18.5 to Developers [Update: Public Beta Available]](https://images.macrumors.com/t/uSxxRefnKz3z3MK1y_CnFxSg8Ak=/2500x/article-new/2025/04/iOS-18.5-Feature-Real-Mock.jpg)

![Apple Seeds Fourth Beta of macOS Sequoia 15.5 [Update: Public Beta Available]](https://images.macrumors.com/t/ne62qbjm_V5f4GG9UND3WyOAxE8=/2500x/article-new/2024/08/macOS-Sequoia-Night-Feature.jpg)