OCR in Banking: Transforming Document Processing for Financial Institutions

OCR (Optical Character Recognition) has become an essential technology for the banking industry, simplifying the process of digitizing and extracting data from documents. As financial institutions process vast amounts of paperwork daily, OCR technology offers a way to streamline workflows, enhance accuracy, and reduce operational costs. This blog explores the role of OCR in banking, its benefits, and how financial institutions can integrate OCR to improve efficiency and customer experience. Key Takeaways: OCR in banking automates document processing and improves data accuracy. It significantly reduces manual data entry and operational costs. OCR enhances compliance by ensuring timely and accurate document verification. AI and machine learning integration make OCR smarter and more efficient. What Is OCR and Why Is It Important for Banks? OCR refers to the technology that converts various documents—such as scanned paper documents, PDFs, or images taken by a camera—into editable and searchable data. In the banking sector, OCR is particularly valuable because it automates the process of extracting data from forms like checks, invoices, loan applications, contracts, and customer identification documents. The traditional manual process of extracting data from such documents is time-consuming and prone to human error. Banks that still rely on manual data entry often face operational bottlenecks, delays, and high costs. OCR technology addresses these challenges by digitizing paper documents and enabling faster, more accurate data processing. To explore more about how OCR is transforming the banking industry, check out our comprehensive guide on OCR in Banking. How Does OCR Work in Banking? OCR works by scanning and analyzing the text in scanned or photographed documents, then converting that text into machine-readable data. Here’s how it works in the context of banking: Document Scanning: The document is scanned using a scanner or a camera to create a digital image. Text Recognition: OCR software analyzes the text within the image, recognizing characters and converting them into text. Data Extraction: Relevant data, such as customer names, addresses, account numbers, transaction details, etc., is extracted and stored in a structured format. Verification and Validation: The extracted data is cross-checked against existing systems, ensuring accuracy and compliance with regulatory standards. In banking, OCR is used for several purposes, such as processing checks, validating KYC documents, extracting data from loan applications, and automating accounts payable and receivable processes. For more details on the OCR process and how it can be applied in banking, visit KlearStack’s OCR in Banking Solution. Benefits of OCR in Banking Increased Efficiency and Speed: OCR speeds up document processing by eliminating the need for manual data entry. Banks can handle a larger volume of documents in less time, allowing for faster decision-making and improved operational efficiency. Reduced Errors: OCR reduces the risk of human errors associated with manual data entry. This leads to more accurate data, minimizing mistakes in customer records, financial transactions, and regulatory compliance Cost Savings: Automating document processing with OCR eliminates the need for extensive manual labor, reducing operational costs in the long term. Banks can reallocate resources to more value-added tasks, improving overall productivity. Better Compliance: Financial institutions are required to comply with numerous regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering). OCR helps ensure compliance by quickly and accurately extracting and verifying data from various documents, reducing the risk of regulatory violations and penalties. Improved Customer Experience: By automating document processing, OCR accelerates service delivery, providing customers with faster response times and smoother interactions. This leads to higher customer satisfaction. Key Technologies Behind OCR in Banking The success of OCR in banking is greatly enhanced by several complementary technologies that improve accuracy, speed, and functionality: AI and Machine Learning AI algorithms and machine learning models enhance OCR capabilities by improving text recognition, understanding handwriting, and learning from past data to improve accuracy over time. Natural Language Processing (NLP) NLP helps OCR software understand the context of the text, allowing it to extract meaning from documents and reducing the likelihood of errors when interpreting complex or handwritten information. Cloud Integration Cloud-based OCR solutions allow banks to process documents remotely, ensuring scalability, cost-effectiveness, and the ability to handle large volumes of documents across multiple locations. Data Encryption and Security Given the sensitive nature of finan

OCR (Optical Character Recognition) has become an essential technology for the banking industry, simplifying the process of digitizing and extracting data from documents. As financial institutions process vast amounts of paperwork daily, OCR technology offers a way to streamline workflows, enhance accuracy, and reduce operational costs. This blog explores the role of OCR in banking, its benefits, and how financial institutions can integrate OCR to improve efficiency and customer experience.

Key Takeaways:

OCR in banking automates document processing and improves data accuracy.

It significantly reduces manual data entry and operational costs.

OCR enhances compliance by ensuring timely and accurate document verification.

AI and machine learning integration make OCR smarter and more efficient.

What Is OCR and Why Is It Important for Banks?

OCR refers to the technology that converts various documents—such as scanned paper documents, PDFs, or images taken by a camera—into editable and searchable data. In the banking sector, OCR is particularly valuable because it automates the process of extracting data from forms like checks, invoices, loan applications, contracts, and customer identification documents.

The traditional manual process of extracting data from such documents is time-consuming and prone to human error. Banks that still rely on manual data entry often face operational bottlenecks, delays, and high costs. OCR technology addresses these challenges by digitizing paper documents and enabling faster, more accurate data processing.

To explore more about how OCR is transforming the banking industry, check out our comprehensive guide on OCR in Banking.

How Does OCR Work in Banking?

OCR works by scanning and analyzing the text in scanned or photographed documents, then converting that text into machine-readable data. Here’s how it works in the context of banking:

Document Scanning: The document is scanned using a scanner or a camera to create a digital image.

Text Recognition: OCR software analyzes the text within the image, recognizing characters and converting them into text.

Data Extraction: Relevant data, such as customer names, addresses, account numbers, transaction details, etc., is extracted and stored in a structured format.

Verification and Validation: The extracted data is cross-checked against existing systems, ensuring accuracy and compliance with regulatory standards.

In banking, OCR is used for several purposes, such as processing checks, validating KYC documents, extracting data from loan applications, and automating accounts payable and receivable processes.

For more details on the OCR process and how it can be applied in banking, visit KlearStack’s OCR in Banking Solution.

Benefits of OCR in Banking

Increased Efficiency and Speed: OCR speeds up document processing by eliminating the need for manual data entry. Banks can handle a larger volume of documents in less time, allowing for faster decision-making and improved operational efficiency.

Reduced Errors: OCR reduces the risk of human errors associated with manual data entry. This leads to more accurate data, minimizing mistakes in customer records, financial transactions, and regulatory compliance

Cost Savings: Automating document processing with OCR eliminates the need for extensive manual labor, reducing operational costs in the long term. Banks can reallocate resources to more value-added tasks, improving overall productivity.

Better Compliance: Financial institutions are required to comply with numerous regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering). OCR helps ensure compliance by quickly and accurately extracting and verifying data from various documents, reducing the risk of regulatory violations and penalties.

Improved Customer Experience: By automating document processing, OCR accelerates service delivery, providing customers with faster response times and smoother interactions. This leads to higher customer satisfaction.

Key Technologies Behind OCR in Banking

The success of OCR in banking is greatly enhanced by several complementary technologies that improve accuracy, speed, and functionality:

AI and Machine Learning

AI algorithms and machine learning models enhance OCR capabilities by improving text recognition, understanding handwriting, and learning from past data to improve accuracy over time.

Natural Language Processing (NLP)

NLP helps OCR software understand the context of the text, allowing it to extract meaning from documents and reducing the likelihood of errors when interpreting complex or handwritten information.

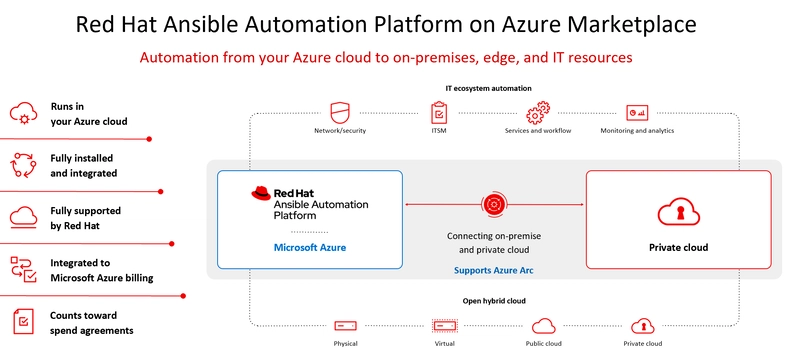

Cloud Integration

Cloud-based OCR solutions allow banks to process documents remotely, ensuring scalability, cost-effectiveness, and the ability to handle large volumes of documents across multiple locations.

Data Encryption and Security

Given the sensitive nature of financial data, OCR solutions in banking are equipped with robust security features, including data encryption, to protect customer information and ensure compliance with privacy regulations.

Why Should You Choose KlearStack for OCR in Banking?

KlearStack offers a comprehensive OCR solution tailored to the needs of financial institutions, helping banks digitize and automate document processing while ensuring accuracy and security.

Key Features of KlearStack’s OCR Solution:

- AI-Powered Data Extraction: Our OCR solution uses AI to extract data from a variety of documents, ensuring high accuracy and fast processing.

99% Accuracy: With KlearStack’s OCR, you can achieve near-perfect data extraction accuracy, minimizing the risk of errors in customer records and financial transactions.

Seamless Integration: KlearStack integrates seamlessly with your existing banking systems, making the transition to automation smooth and hassle-free.

Regulatory Compliance: Stay compliant with global financial regulations by automating KYC, AML, and other essential document processing workflows.

Scalability: KlearStack’s OCR platform scales to meet the demands of banks of all sizes, from small institutions to large multinational organizations.

KlearStack’s OCR solution can help you streamline operations, reduce costs, and enhance customer experience. Book a Free Demo to see how KlearStack can transform your banking operations.

Conclusion

OCR technology is transforming the way banks process documents, offering enhanced efficiency, reduced errors, and better compliance. By automating data extraction, financial institutions can process large volumes of documents quickly and accurately, saving time and money.

With KlearStack’s AI-powered OCR solution, banks can improve their document processing capabilities, reduce operational costs, and ensure regulatory compliance while providing a better customer experience.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Apple Releases Public Betas of iOS 18.5, iPadOS 18.5, macOS Sequoia 15.5 [Download]](https://www.iclarified.com/images/news/97024/97024/97024-640.jpg)

![Apple to Launch In-Store Recycling Promotion Tomorrow, Up to $20 Off Accessories [Gurman]](https://www.iclarified.com/images/news/97023/97023/97023-640.jpg)