Navigating Blockchain Project Funding Challenges

Abstract: This post explores the intricate landscape of blockchain project funding challenges. It covers regulatory uncertainty, market volatility, technological complexity, and the oversaturated blockchain market. We outline the background, core concepts, and practical use cases while suggesting strategic approaches such as strong networking, partnerships, leveraging incubators, and transparent funding practices. With additional insights drawn from industry best practices and related funding models—including venture capital, crowdfunding, and DAO-based investments—we also analyze future trends and innovations shaping blockchain funding. Links to authoritative sources such as CoinDesk, Investopedia, and several curated resources on blockchain funding challenges ensure that readers may dive deeper into each subject. In addition, we provide useful tables and bullet lists to enhance clarity and improve scannability for both human readers and search engines. Introduction Blockchain technology holds transformative potential across industries from finance to supply chain, healthcare, and digital media. However, securing funds for blockchain projects comes with unique hurdles. This blog post delves into these issues, offering a comprehensive overview of the blockchain funding ecosystem. By discussing regulatory uncertainties, market volatility, technical complexities, and stiff competition, we guide you through strategies designed to overcome these barriers. Whether you are an entrepreneur, investor, or blockchain developer, understanding these challenges is crucial in forging a path to success. Background and Context Blockchain emerged as a disruptive technology initially powering cryptocurrencies. Its decentralized nature, immutability, and transparency soon made it attractive for a wide variety of applications. However, the unique qualities that set blockchain apart also complicate the funding process. Particularly, the evolving global regulatory environment poses compliance concerns, while investor uncertainty arises from market volatility and technological complexity. Key Historical Moments: The Bitcoin phenomenon and subsequent crypto boom initiated interest in token-based fundraising. The introduction of ICOs (Initial Coin Offerings) opened new capital avenues while simultaneously attracting regulatory scrutiny. Decentralized approaches such as DAOs (Decentralized Autonomous Organizations) and crowdfunding have further diversified funding sources. Definitions and Terms: Tokenization: The process of converting rights to an asset into a digital token on a blockchain. Stablecoins: Cryptocurrencies pegged to stable assets such as fiat currencies to mitigate volatility. DAO: Organizations that run on blockchain protocols with decisions made by the consensus of community members. Regulatory Compliance: Adherence to legal frameworks that govern securities, anti-money laundering, and other financial practices. The intricate interplay between these factors shapes the current funding landscape. For more detailed insights on regulatory updates, you can refer to Blockchain Regulation. Core Concepts and Features To successfully navigate blockchain project funding, one must understand several interlocking concepts: 1. Regulatory Uncertainty and Compliance Blockchain projects must reconcile differences in securities laws across jurisdictions, creating a compliance labyrinth. Failure to meet regulatory standards can lead to project delays or shutdowns. Companies are now prioritizing closer liaison with legal experts and staying informed with resources such as CoinDesk Regulation. 2. Market Volatility Cryptocurrencies are inherently volatile, affecting investor sentiment and funding stability. To overcome this, projects often: Diversify funding channels (e.g., mixing stablecoins and fiat currency investments). Implement robust risk management strategies (find more strategies here). 3. Technological Complexity The intricacy of blockchain systems may alienate potential non-technical investors. Simplified explanations, investor education initiatives, and transparent communication help demystify these systems. Beginners can start by reading What is Blockchain? on Investopedia. 4. Overcrowded Market and Competition As more players enter the blockchain space, distinguishing a project becomes critical. Projects that articulate unique value propositions and clearly communicate their technical benefits are better positioned to secure investment. Comprehensive market data can be obtained from CoinGecko. 5. Transparency and Ethics In an ecosystem marred by scams and negative perceptions, ethical conduct and transparency are essential. Engaging communities through platforms like Medium and adhering to ethical funding methods (ethical funding methods) promote trust. Applications and Use Cases

Abstract:

This post explores the intricate landscape of blockchain project funding challenges. It covers regulatory uncertainty, market volatility, technological complexity, and the oversaturated blockchain market. We outline the background, core concepts, and practical use cases while suggesting strategic approaches such as strong networking, partnerships, leveraging incubators, and transparent funding practices. With additional insights drawn from industry best practices and related funding models—including venture capital, crowdfunding, and DAO-based investments—we also analyze future trends and innovations shaping blockchain funding. Links to authoritative sources such as CoinDesk, Investopedia, and several curated resources on blockchain funding challenges ensure that readers may dive deeper into each subject. In addition, we provide useful tables and bullet lists to enhance clarity and improve scannability for both human readers and search engines.

Introduction

Blockchain technology holds transformative potential across industries from finance to supply chain, healthcare, and digital media. However, securing funds for blockchain projects comes with unique hurdles. This blog post delves into these issues, offering a comprehensive overview of the blockchain funding ecosystem. By discussing regulatory uncertainties, market volatility, technical complexities, and stiff competition, we guide you through strategies designed to overcome these barriers. Whether you are an entrepreneur, investor, or blockchain developer, understanding these challenges is crucial in forging a path to success.

Background and Context

Blockchain emerged as a disruptive technology initially powering cryptocurrencies. Its decentralized nature, immutability, and transparency soon made it attractive for a wide variety of applications. However, the unique qualities that set blockchain apart also complicate the funding process. Particularly, the evolving global regulatory environment poses compliance concerns, while investor uncertainty arises from market volatility and technological complexity.

Key Historical Moments:

- The Bitcoin phenomenon and subsequent crypto boom initiated interest in token-based fundraising.

- The introduction of ICOs (Initial Coin Offerings) opened new capital avenues while simultaneously attracting regulatory scrutiny.

- Decentralized approaches such as DAOs (Decentralized Autonomous Organizations) and crowdfunding have further diversified funding sources.

Definitions and Terms:

- Tokenization: The process of converting rights to an asset into a digital token on a blockchain.

- Stablecoins: Cryptocurrencies pegged to stable assets such as fiat currencies to mitigate volatility.

- DAO: Organizations that run on blockchain protocols with decisions made by the consensus of community members.

- Regulatory Compliance: Adherence to legal frameworks that govern securities, anti-money laundering, and other financial practices.

The intricate interplay between these factors shapes the current funding landscape. For more detailed insights on regulatory updates, you can refer to Blockchain Regulation.

Core Concepts and Features

To successfully navigate blockchain project funding, one must understand several interlocking concepts:

1. Regulatory Uncertainty and Compliance

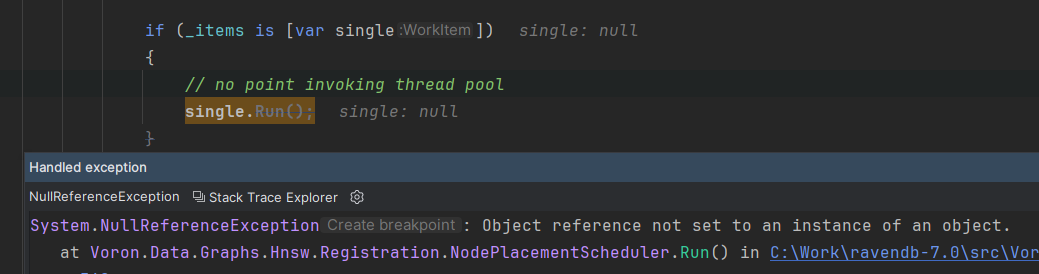

Blockchain projects must reconcile differences in securities laws across jurisdictions, creating a compliance labyrinth. Failure to meet regulatory standards can lead to project delays or shutdowns. Companies are now prioritizing closer liaison with legal experts and staying informed with resources such as CoinDesk Regulation.

2. Market Volatility

Cryptocurrencies are inherently volatile, affecting investor sentiment and funding stability. To overcome this, projects often:

- Diversify funding channels (e.g., mixing stablecoins and fiat currency investments).

- Implement robust risk management strategies (find more strategies here).

3. Technological Complexity

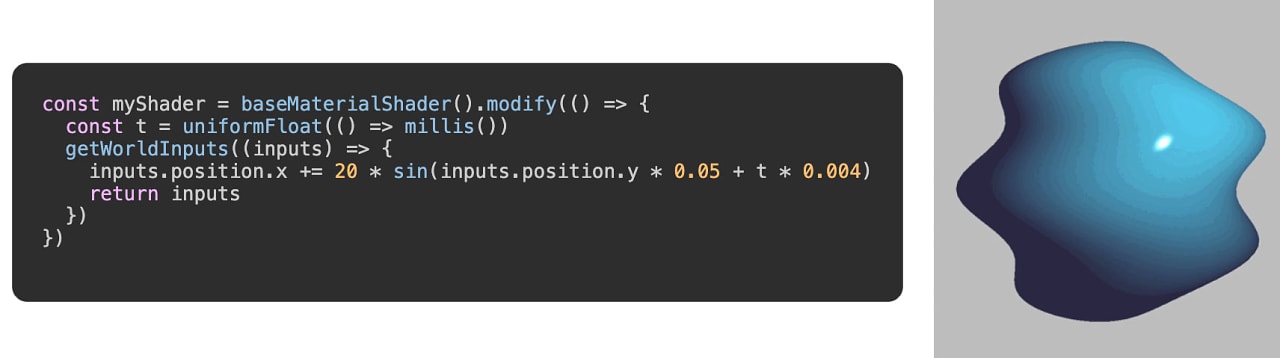

The intricacy of blockchain systems may alienate potential non-technical investors. Simplified explanations, investor education initiatives, and transparent communication help demystify these systems. Beginners can start by reading What is Blockchain? on Investopedia.

4. Overcrowded Market and Competition

As more players enter the blockchain space, distinguishing a project becomes critical. Projects that articulate unique value propositions and clearly communicate their technical benefits are better positioned to secure investment. Comprehensive market data can be obtained from CoinGecko.

5. Transparency and Ethics

In an ecosystem marred by scams and negative perceptions, ethical conduct and transparency are essential. Engaging communities through platforms like Medium and adhering to ethical funding methods (ethical funding methods) promote trust.

Applications and Use Cases

Blockchain funding challenges and their solutions are not just theoretical—they directly impact practical scenarios. Here are some real-world examples:

Use Case 1: Decentralized Finance (DeFi) Projects

DeFi projects harness blockchain to disrupt traditional financial systems. They may face funding challenges due to market volatility and complex regulatory landscapes. In response, many have turned to DAO-based funding models. For example, funding for DeFi projects is being streamlined through innovative protocols like those discussed in Blockchain Project Funding for DeFi. These projects use token distributions to build communities and raise capital simultaneously.

Use Case 2: Blockchain in Supply Chain and Healthcare

Projects targeting supply chain transparency or healthcare data integrity demand high levels of trust and regulatory compliance. By incorporating clear governance and transparent audit trails, these projects attract both venture capital and government funding. Investors reviewing market trends from sources like CryptoCompare are encouraged by clear risk mitigation measures.

Use Case 3: Crowdfunding and Community Tokens

Blockchain projects increasingly rely on diversified funding strategies. Combining traditional venture capital with crowdfunding initiatives provides a balanced approach. Platforms like Kickstarter have inspired blockchain startup crowdfunding models, ensuring that projects not only get financial backing but also foster vibrant community involvement. For further reading on community-based funding, see Crowdfunding for Blockchain Startups.

Challenges and Limitations

Despite promising innovations, several challenges persist in blockchain project funding:

Regulatory and Legal Hurdles

- Global Regulatory Divergence: Projects must navigate multiple legal frameworks that differ from one country to another.

-

Compliance Costs: The expense of ensuring compliance can significantly strain early-stage projects.

- Tip: Develop a comprehensive legal roadmap early.

Market Uncertainty

- High Volatility: Rapid fluctuations in crypto markets introduce significant risk.

- Investor Skepticism: Past incidents of fraud and poorly managed projects raise caution among potential backers.

Technological Challenges

- Complexity for Investors: Non-technical stakeholders might struggle to understand the nuances of blockchain technology.

- Integration Hurdles: Legacy systems require complex integrations with new blockchain solutions.

Competitive Market Environment

- Overcrowded Ecosystem: With numerous projects vying for attention, distinguishing your project becomes highly challenging.

- Misinformation: Negative perceptions and scams contribute to investor wariness.

Summary of Key Challenges in a Bullet List:

- Regulatory Uncertainty

- Inherent Market Volatility

- Technological Complexity

- High Competition and Misinformation

- Integration and Scalability Issues

Future Outlook and Innovations

Looking ahead, several trends promise to redefine blockchain funding:

Increased Regulatory Clarity

As governments worldwide refine their legal frameworks, projects will benefit from clearer guidelines. This increased clarity is expected to reduce compliance costs and attract more institutional investors. For real-time updates, check Blockchain Regulation.

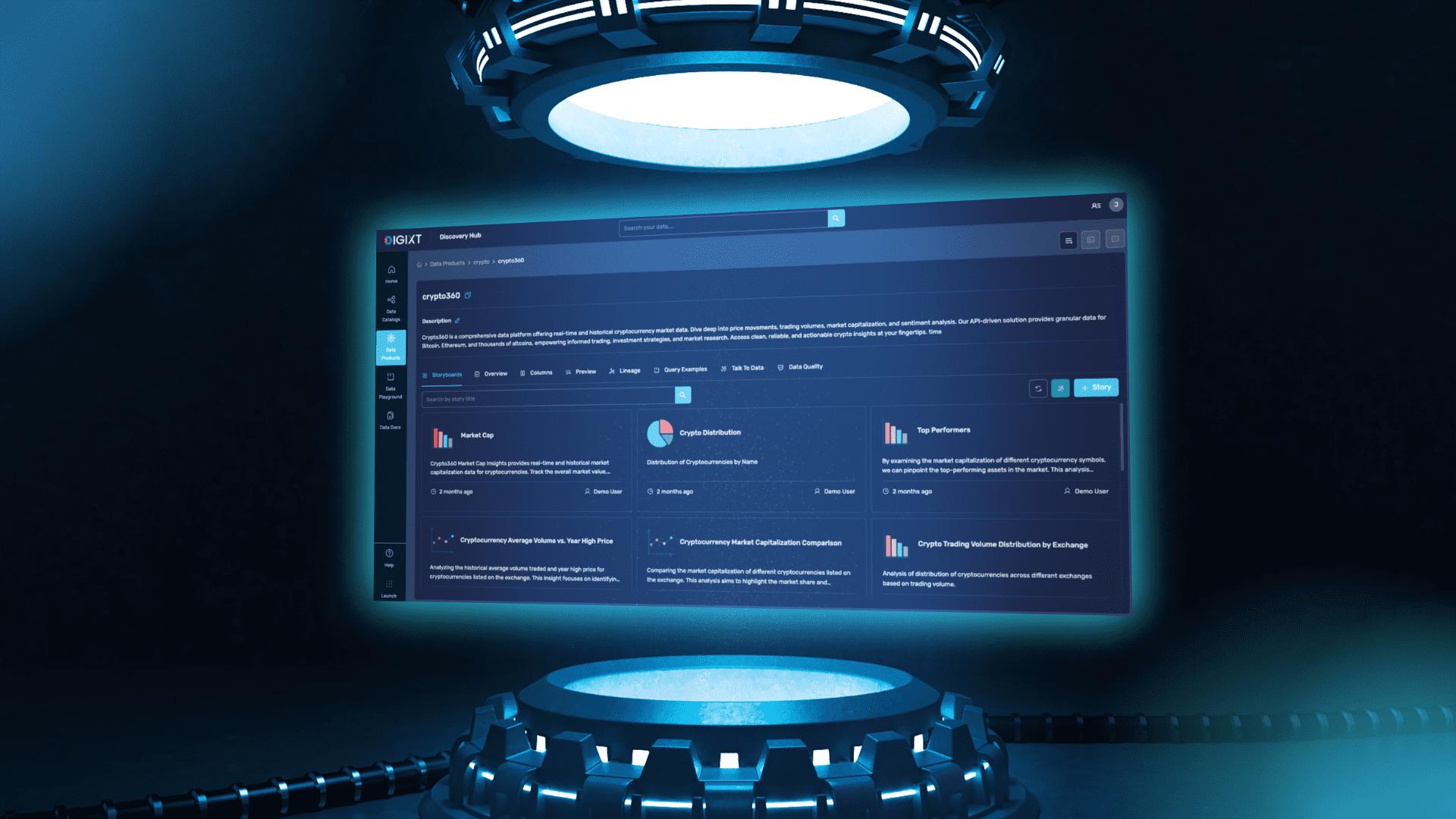

Growth in Decentralized Funding Models

DAO-based funding and community token initiatives are gaining traction. These models promote transparency and inclusivity, making them attractive alternatives to traditional funding. Innovations such as these are documented in the recent trends outlined in Blockchain Project Funding Trends.

Advanced Risk Management Techniques

New risk management tools will emerge to address market volatility and technical risks. Investors and developers will increasingly rely on sophisticated analytical tools and statistical models to forecast market trends and protect investments.

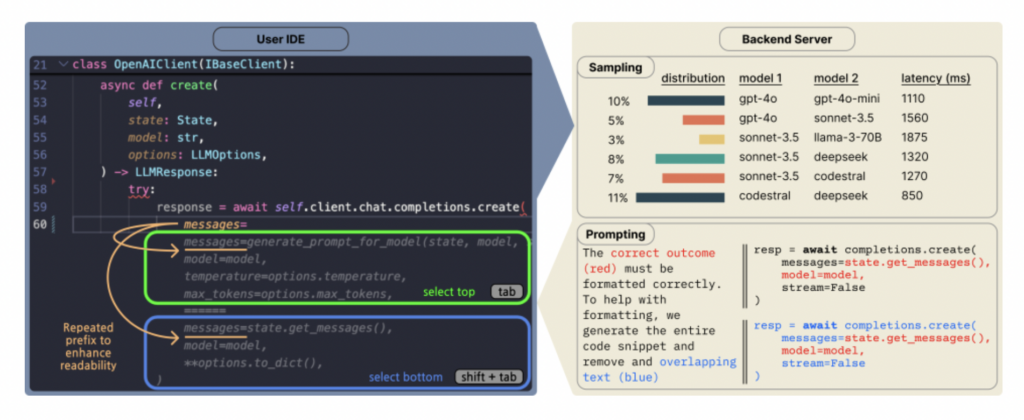

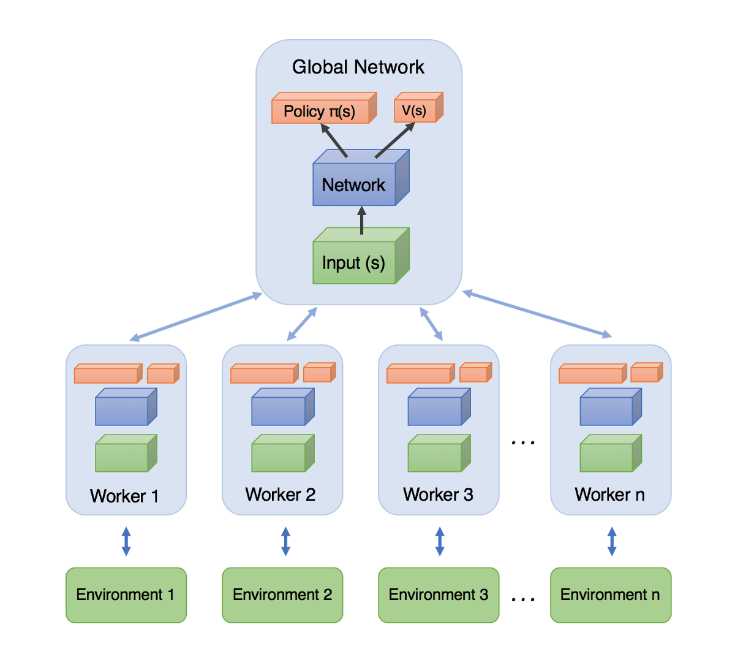

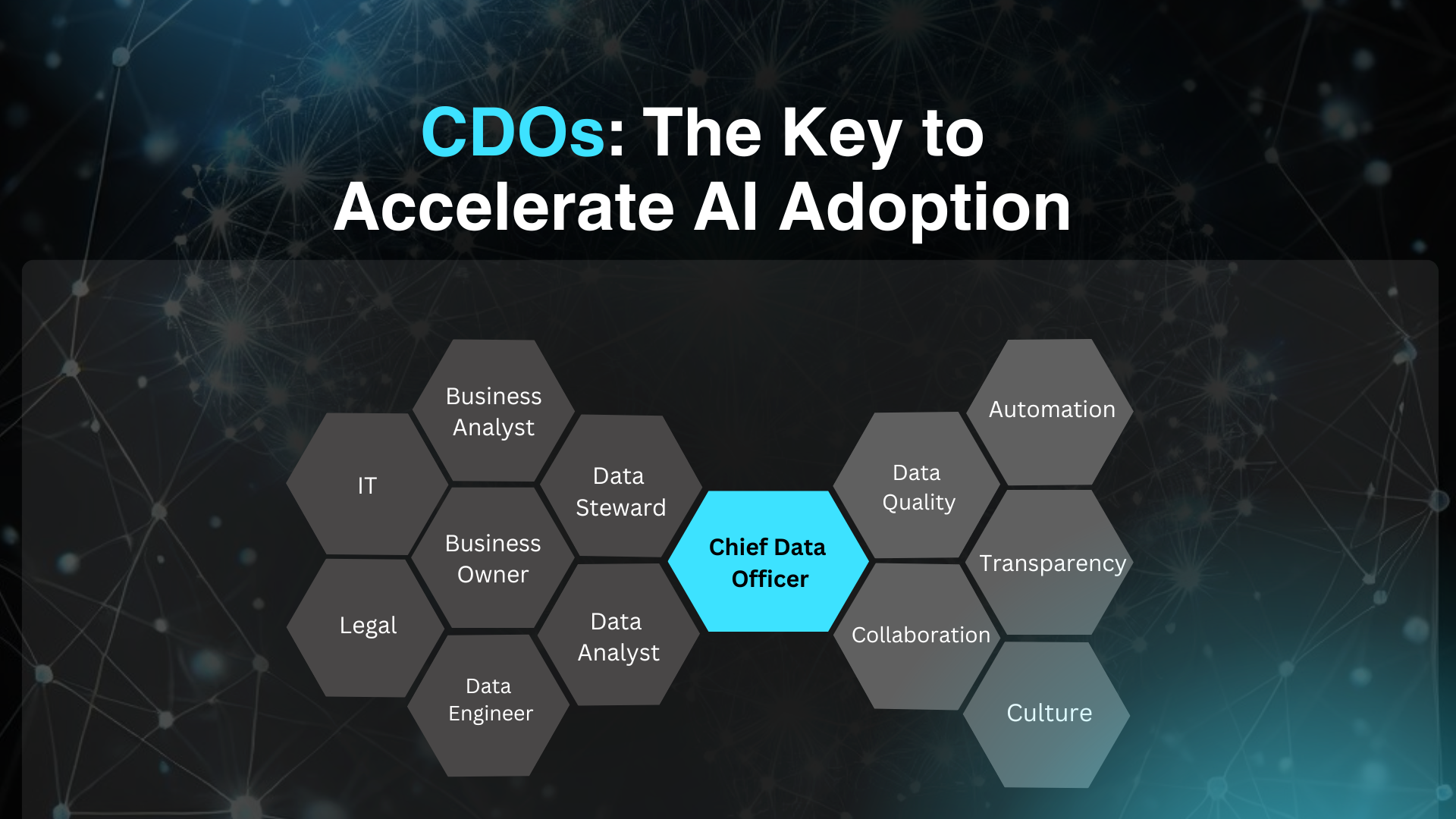

Synergies of Blockchain and AI

With the convergence of blockchain and artificial intelligence, innovative projects are emerging. AI-driven analytics can enhance blockchain network security, optimize smart contracts, and even predict market movements with greater accuracy. This synergy promises to usher in a new era of efficiency in blockchain governance and funding.

Integration with Traditional Finance

Institutional adoption of blockchain technology is steadily increasing as traditional financial institutions explore blockchain-based solutions. The integration of blockchain with established financial systems has the potential to unlock new capital streams and broaden access to funding for projects.

Strategic Approaches to Overcoming Funding Challenges

The key to surmounting funding challenges lies in strategic planning and robust execution. Below are some well-regarded strategies:

Building Strong Networks and Partnerships

- Networking Events: Participate in industry events such as Eventbrite Blockchain Events.

- Partnerships: Form alliances with leading industry players and leverage their expertise to boost project credibility.

- Angel Investors: Engage with Angel Investors in Blockchain who understand the nuances of blockchain.

Leveraging Incubators and Accelerators

- Accelerators: Programs like Techstars provide mentorship, funding, and exposure.

- Funding Grants: Explore emerging accelerator programs specific to blockchain startups.

- Community Funding: Utilize platforms that enable community-based funding and token-based incentives.

Emphasizing Transparency and Compliance

- Clear Communication: Maintain open channels with investors, documenting progress and challenges.

- Legal Adherence: Prioritize regulatory compliance to build trust. Learn more about transparent practices via Blockchain Project Funding and Regulatory Compliance.

Utilizing Multiple Funding Sources

- Venture Capital: Combine venture capital with crowdfunding to diversify risk.

- Crowdfunding: Platforms like Kickstarter can be an effective complement to traditional financing.

- DAO Funding: Exploit decentralized funding mechanisms such as Blockchain Project Funding Through DAOs.

Table: Comparison of Funding Strategies

| Funding Strategy | Key Benefits | Primary Challenges |

|---|---|---|

| Venture Capital | Large sums, industry expertise | Strict terms, loss of control |

| Crowdfunding | Community involvement, early market testing | Limited capital, regulatory hurdles |

| DAO-based Funding | Transparency, decentralized decision-making | Complex governance, regulatory uncertainty |

| Stablecoin/Fiat Funding | Reduced market volatility | Lower growth potential, exchange fees |

| Angel Investments | Flexible terms, mentorship opportunities | Limited scalability, personal biases |

Table Note: This table summarizes various funding options available to blockchain projects. Evaluating these strategies in light of project-specific needs is critical for long-term success.

Additional Resources and Related Links

For further reading and exploration of effective funding mechanisms, check out the following resources:

- Blockchain Project Funding Trends

- Blockchain Project Funding for DeFi

- Angel Investors in Blockchain

- Blockchain Project Funding Through DAOs

Also, for community discussions and expert insights, explore these Dev.to posts:

- Navigating the World of Open Source Licenses

- Bolstering Open Source with GitHub Sponsors: The Impact of Matching Funds

- Unveiling a New Era in Open Source Licensing

- Blockchain and Digital Signatures: Enhancing Security in the Digital Age

For a broader perspective on funding in emerging markets, you may also consider browsing insightful content on CryptoCompare.

Summary

Blockchain project funding is an evolving landscape marked by regulatory challenges, market uncertainties, and technological complexities. By understanding the core concepts—including regulatory compliance, market volatility, and the importance of clear communication—projects can strategically navigate funding challenges.

Strategic approaches such as building robust networks, leveraging incubators and accelerator programs, embracing DAO-based funding techniques, and combining multiple funding streams are critical steps in overcoming these barriers. Furthermore, transparency and strong ethical conduct can significantly boost investor confidence.

As blockchain technology further integrates with traditional finance and AI, the future of funding holds promise, with regulatory clarity and innovative risk management acting as key drivers. For anyone involved in blockchain projects—from developers and entrepreneurs to investors—staying ahead of these trends is essential for long-term success.

For the original detailed discussion on this subject, refer to the Navigating Blockchain Project Funding Challenges article.

By understanding these dynamics and utilizing the outlined strategies, blockchain innovators can better position themselves in today’s crowded and challenging market. Moving forward, adaptation, transparency, and fostering strong industry partnerships will be essential ingredients for sustainable growth.

Happy innovating and funding!

![[Free Webinar] Guide to Securing Your Entire Identity Lifecycle Against AI-Powered Threats](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjqbZf4bsDp6ei3fmQ8swm7GB5XoRrhZSFE7ZNhRLFO49KlmdgpIDCZWMSv7rydpEShIrNb9crnH5p6mFZbURzO5HC9I4RlzJazBBw5aHOTmI38sqiZIWPldRqut4bTgegipjOk5VgktVOwCKF_ncLeBX-pMTO_GMVMfbzZbf8eAj21V04y_NiOaSApGkM/s1600/webinar-play.jpg?#)

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_Jochen_Tack_Alamy.png?width=1280&auto=webp&quality=80&disable=upscale#)

![New Hands-On iPhone 17 Dummy Video Shows Off Ultra-Thin Air Model, Updated Pro Designs [Video]](https://www.iclarified.com/images/news/97171/97171/97171-640.jpg)

![Apple Shares Trailer for First Immersive Feature Film 'Bono: Stories of Surrender' [Video]](https://www.iclarified.com/images/news/97168/97168/97168-640.jpg)

![Apple Restructures Global Affairs and Apple Music Teams [Report]](https://www.iclarified.com/images/news/97162/97162/97162-640.jpg)

![New iPhone Factory Goes Live in India, Another Just Days Away [Report]](https://www.iclarified.com/images/news/97165/97165/97165-640.jpg)