Medikabazaar’s ousted CEO makes his case; Why LPs are making fund managers shrink

In an exclusive interview with YourStory, Vivek Tiwari opens up about the audit, whistleblower allegations, and the subsequent internal power struggles. Many limited partners (LPs) now favour disciplined fund sizes focusing on long-term performance rather than asset accumulation.

Apr 25, 2025

Hello,

AI and data analytics firm Databricks has big plans for India.

The San Francisco-based firm said it will invest over $250 million in the country over the next three years.

The capital will primarily support training and enablement, R&D, and go-to-market resources, according to a statement. Databricks also plans to increase its headcount by more than 50% to over 750 employees in the country at the end of this fiscal year.

Speaking of AI, what is most famous for?

Well, it turns out that, like the movie Her, AI chatbots are popular as a source of companionship. Here’s an infographic charting how AI usage has changed over the last year.

ICYMI: In an era when touchscreens are ubiquitous, Japanese carmaker Subaru has decided to go old school by bringing back physical buttons and knobs for its 2026 Outback midsize SUV.

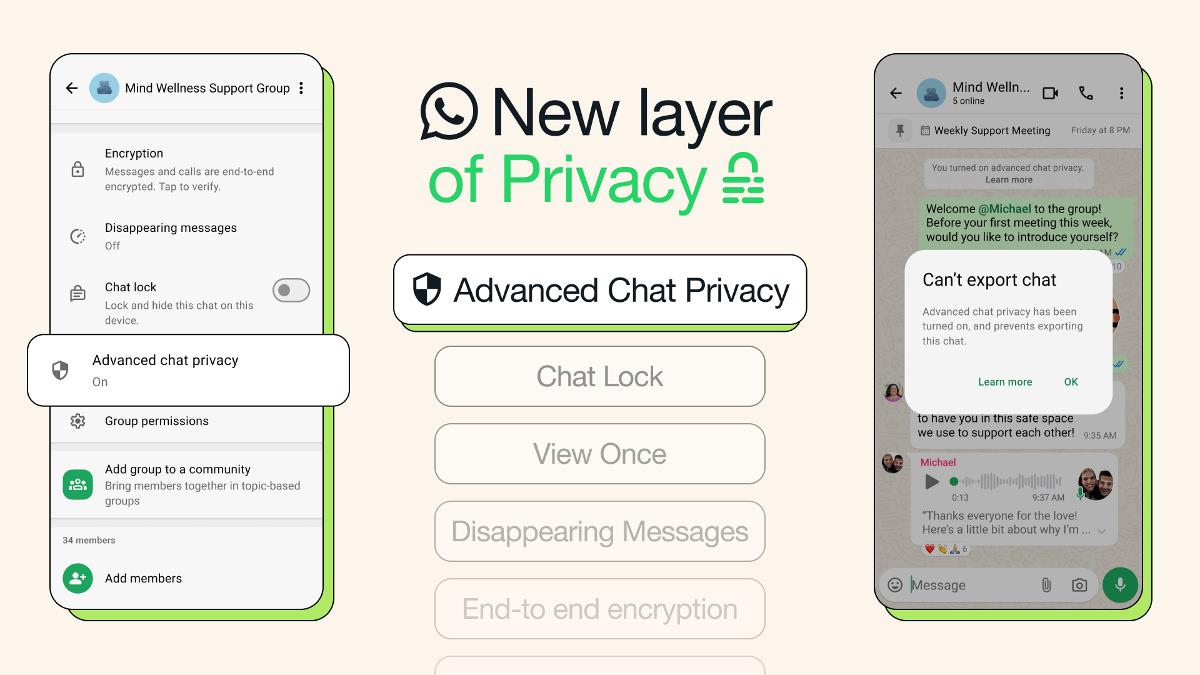

Meanwhile, WhatsApp said it is launching a new feature allowing users to add an extra layer of privacy to chats. The new “Advanced Chat Privacy” setting prevents users from exporting chats and auto-downloading media to their phones.

In today’s newsletter, we will talk about

- Medikabazaar’s Vivek Tiwari makes his case

- Why LPs are making fund managers shrink

- Atlys simplifying visa applications

Here’s your trivia for today: Which country boasts the longest coastline in Europe?

Interview

Medikabazaar’s Vivek Tiwari makes his case

“This feels like a corporate coup.”

That’s how Vivek Tiwari describes his dramatic fall from the top at Medikabazaar, the healthtech startup he co-founded and steered through the chaotic highs of the COVID-19 boom. Tiwari was abruptly terminated “for cause” in August 2023—an ouster he claims was politically motivated, opaque, and deeply unfair.

In an exclusive interview with YourStory, he opens up about the audit, whistleblower allegations, and the subsequent internal power struggles.

Straight talk:

- Tiwari insists he always aimed to build systems with transparency. But the company’s breakneck growth during the COVID-19 pandemic, internal delays in hiring key CXOs, and the complex dynamics of boardroom control left him exposed.

- “The finance and internal audit teams had the authority to raise concerns. But the phantom inventory, fictitious transactions—none of it was ever reported to me directly. I only learned of these through the later phases of the audit or investigation,” Tiwari asserts.

- “I was terminated after a 50-minute board meeting, just a day after I revoked certain consents I gave under duress to help the company during the investigation. I wasn’t weak—I just wanted to help. But I was pushed out unfairly,” he adds.

Funding Alert

Startup: PB Fintech

Amount: Rs 539 Cr

Round: CCPS

Startup: GreenGrahi

Amount: Rs 32 Cr

Round: Seed

Startup: Visa2Fly

Amount: $2M

Round: Seed

In-depth

Why LPs are making fund managers shrink

Venture capital and private credit managers are increasingly moving away from raising large funds and leaning into leaner, sub-$100 million vehicles. That shift isn’t just being driven by tighter capital conditions—it’s being reinforced by a structural realignment of incentives across limited partners and general partners.

Many limited partners (LPs) now favour disciplined fund sizes focusing on long-term performance rather than asset accumulation.

Numbers game:

- “With recent market corrections, more capital is expected to flow back into VC. But the lack of capital has already forced fund managers to stay small and agile,” said an LP who wished to remain anonymous.

- Ashwin Poorswani, a limited partner in several funds, notes a shift in how emerging managers raise capital. “In India, we are seeing many first-time managers launch venture funds under the AIF umbrella.”

- Rahul Chowdhury, Founder of private credit fund RevX Capital, argues that smaller fund sizes help maintain investment discipline. He has deliberately kept his fund size between Rs 500-750 crore to align with both his investment philosophy and LP expectations.

Startup

No more visa woes

Atlys is a centralised visa-processing platform for travellers across the world. Every step of the visa journey—from eligibility checks, form filling and document upload to payment, status tracking, and customer support— happens inside a single, secure platform, explains founder Mohak Nahta.

Fly away:

- Atlys collects all essential information from the user and uses intelligent systems to automate the filling of visa forms accurately and quickly. Its platform compiles all the documentation based on the specific requirements of each country and visa type.

- For US visas, Atlys offers a mock interview tool trained on real-world data to help applicants prepare for consular interviews. For Schengen visas, the platform has a guided interface that helps reduce the time typically spent navigating forms.

- Recently, Atlys acquired the UK branch of Artionis, a travel document management company, to deepen its presence in international markets, especially those with large immigrant populations holding ‘weaker’ passports.

News & updates

- Diversifying: Cryptocurrency campaigners have stepped up calls for the Swiss National Bank to buy bitcoin, saying the global economic turmoil triggered by US President Donald Trump's tariffs made it more important for the central bank to diversify its reserves.

- DeepSeek data: South Korea’s data protection authority has concluded that Chinese artificial intelligence startup DeepSeek collected personal information from local users and transferred it overseas without their permission.

Which country boasts the longest coastline in Europe?

Answer: Norway.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

.jpg?#)

![Apple to Shift Robotics Unit From AI Division to Hardware Engineering [Report]](https://www.iclarified.com/images/news/97128/97128/97128-640.jpg)

![Apple Shares New Ad for iPhone 16: 'Trust Issues' [Video]](https://www.iclarified.com/images/news/97125/97125/97125-640.jpg)