IPO-bound startups trim offers; Go Digit’s net profit more than doubles

Some late-stage companies are looking to raise funds at a flat valuation, while those with adequate cash flow prefer to wait and watch how things unfold.

Hello,

Fresh arrivals at the bourses!

EV maker Ather Energy’s IPO was subscribed 16% on day one, with the employee reserved category subscribed 1.78 times. The retail portion of the offering was subscribed by more than half, at 63%.

Also, the on-demand services platform Urban Company has filed its draft red herring prospectus with SEBI for a Rs 1,900-crore IPO that would see investors including Tiger Global, Accel India, Bessemer, and Vy Capital offload 14.7 billion shares.

Meesho isn’t very far behind either. The hyper-value ecommerce company changed the name of its legal entity from ‘Fashnear Technologies Private’ to ‘Meesho Private Limited’. This is viewed as a move to strengthen brand recognition among consumers and stakeholders ahead of an IPO.

Elsewhere in the startup ecosystem, mobility platforms like Rapido may have to rethink their bike taxi features.

The Karnataka Transport Minister has directed officials to implement the Karnataka High Court’s order suspending bike taxi operations across the state within six weeks. The High Court had observed the absence of specific state guidelines renders bike taxi operations illegal.

However, some commuters are finding innovative ways to get around Bengaluru. A man used ChatGPT to communicate and negotiate with an auto-rickshaw driver in Kannada, bringing his fare down from Rs 200 to Rs 150.

Now that’s a use case Sam Altman wouldn’t have thought of.

In today’s newsletter, we will talk about

- IPO-bound startups trim offers

- Go Digit’s net profit more than doubles

- Oldest Indian woman to summit Mt Kilimanjaro

Here’s your trivia for today: Which airline was named the most punctual globally in 2024 by aviation analytics platform Cirium?

Funding

IPO-bound startups trim offers

Amid uncertainty in the global economic environment, investors are exercising caution, prompting IPO-bound startups, including Ather Energy and Urban Company, to trim their offer sizes considerably. Some late-stage companies are looking to raise funds at a flat valuation, while those with adequate cash flow prefer to wait and watch how things unfold.

Meanwhile, the investing ecosystem—especially venture capitalists—seems to have found a silver lining in secondary funds to offload stakes.

Caution:

- The recent import tariffs levied by US President Donald Trump have triggered a global trade war of sorts, leading to uncertain macroeconomic conditions.

- In the first three months of 2025, 13 companies secured funding at the Series F stage and above, compared to six companies in the same period last year.

- While some mature companies are headed towards listing for their next phase of growth, late-stage companies with the cash flow to sustain themselves for a few more months may prefer to wait and watch for now.

Startup

Go Digit’s net profit more than doubles

Go Digit General Insurance reported a 119.5% surge in profit-after-tax (PAT) at Rs 115.61 crore for the quarter ended March 31, from Rs 52.66 crore a year earlier. Gross premiums written for the quarter rose 10.29% to Rs 2,576.38 crore, compared with Rs 2,335.91 crore in the same period last year.

Key takeaways:

- Founded in 2017, Go Digit offers motor, health, travel, property, marine, and liability insurance products.

- The company, with 6.7 crore customers, sold 1.2 crore policies during FY25. It issued over 48% of policies in FY25 through APIs, and the firm has settled 29.4 lakh claims digitally since inception.

- Its total income climbed 6.04% to Rs 2,855.18 crore from Rs 2,692.50 crore. Total expenses for the period increased 5.08% YoY to Rs 2,426.12 crore.

Inspiration

Oldest Indian woman to summit Mt Kilimanjaro

On March 13, Vidya Singh stood triumphantly at 5,895 metres above sea level, becoming the oldest woman in India to summit Mount Kilimanjaro. This 72-year-old woman from Chennai, whose passion for trekking began in 2013, has completed 19 high-altitude treks across India, Bhutan, and South America, including Mentok Kangri and Machu Picchu.

New heights:

- Born into the royal family of Vijayanagaram in northern Andhra Pradesh, Singh’s life has been anything but ordinary. “My father's elder brother was the last crowned Maharaja in 1945, just before independence,” she says.

- Singh admits that inheriting “good genes” and a consistent fitness routine have helped her immensely, despite her advancing age. “I don’t think there’s been a time in my life where I have not exercised. What I do has changed according to interests,” she explains.

- Singh lifts weights a couple of times a week, cycles every Sunday, swims twice a week and uses the ladder mill in the gym for a 30-minute climb each time. Before every trek, for five weeks, she climbs the hills on St Thomas Mount and Tirusulam in the city.

News & updates

- Power outage: Spain and Portugal were hit by a widespread power outage on Monday that paralysed public transport, caused large traffic jams, and delayed flights. Spanish electricity transmission operator Red Eléctrica said the outage, the cause of which was not immediately known, could last from 6-10 hours.

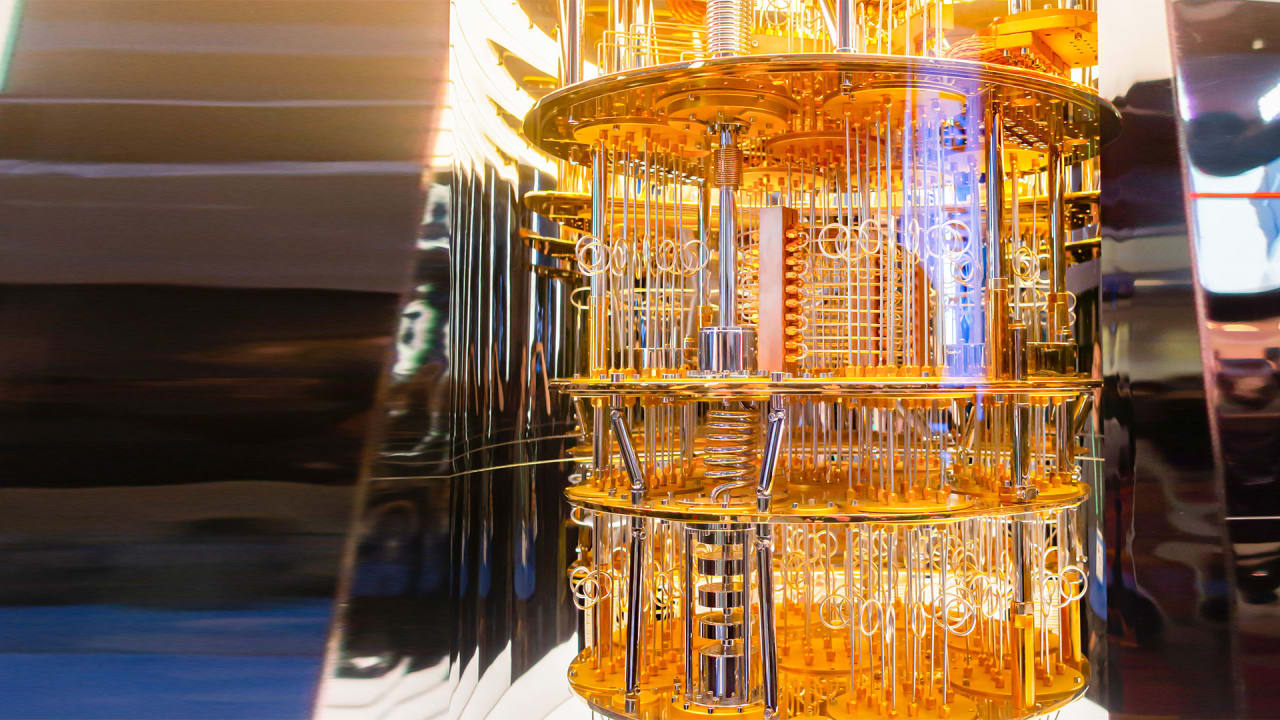

- Tech bets: IBM will invest $150 billion in the US, including on facilities for quantum computer production, over the next five years, the latest American technology company to back the Trump administration’s push for local manufacturing.

- Stablecoin: Abu Dhabi sovereign wealth fund ADQ, conglomerate IHC, and the United Arab Emirates's biggest lender by assets First Abu Dhabi Bank are planning to launch a new stablecoin backed by dirhams, they said on Monday.

Which airline was named the most punctual globally in 2024 by aviation analytics platform Cirium?

Answer: Aeromexico.

We would love to hear from you! To let us know what you liked and disliked about our newsletter, please mail nslfeedback@yourstory.com.

If you don’t already get this newsletter in your inbox, sign up here. For past editions of the YourStory Buzz, you can check our Daily Capsule page here.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

_Muhammad_R._Fakhrurrozi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![macOS 15.5 beta 4 now available for download [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/macOS-Sequoia-15.5-b4.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![AirPods Pro 2 With USB-C Back On Sale for Just $169! [Deal]](https://www.iclarified.com/images/news/96315/96315/96315-640.jpg)

![Apple Releases iOS 18.5 Beta 4 and iPadOS 18.5 Beta 4 [Download]](https://www.iclarified.com/images/news/97145/97145/97145-640.jpg)

![Apple Seeds watchOS 11.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97147/97147/97147-640.jpg)

![Apple Seeds visionOS 2.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97150/97150/97150-640.jpg)

![Apple Seeds Fourth Beta of iOS 18.5 to Developers [Update: Public Beta Available]](https://images.macrumors.com/t/uSxxRefnKz3z3MK1y_CnFxSg8Ak=/2500x/article-new/2025/04/iOS-18.5-Feature-Real-Mock.jpg)

![Apple Seeds Fourth Beta of macOS Sequoia 15.5 [Update: Public Beta Available]](https://images.macrumors.com/t/ne62qbjm_V5f4GG9UND3WyOAxE8=/2500x/article-new/2024/08/macOS-Sequoia-Night-Feature.jpg)