Donald Trump speech looms: can Bitcoin leverage exchange outflows, safe haven status for $100K?

Bitcoin climbed above $95,490 Monday ahead of Trump’s 100-day speech, eyeing policy clarity. Potential confirmation of a US Bitcoin strategic reserve could be a major catalyst towards $100K. Bitcoin shows resilience (YTD +5.6%) vs. US stocks (YTD -5%) amid tariff uncertainty, boosting safe-haven appeal. Bitcoin demonstrated renewed strength on Monday, climbing back above the significant […] The post Donald Trump speech looms: can Bitcoin leverage exchange outflows, safe haven status for $100K? appeared first on CoinJournal.

- Bitcoin climbed above $95,490 Monday ahead of Trump’s 100-day speech, eyeing policy clarity.

- Potential confirmation of a US Bitcoin strategic reserve could be a major catalyst towards $100K.

- Bitcoin shows resilience (YTD +5.6%) vs. US stocks (YTD -5%) amid tariff uncertainty, boosting safe-haven appeal.

Bitcoin demonstrated renewed strength on Monday, climbing back above the significant $95,000 mark as the broader financial markets turned their focus towards President Donald Trump’s upcoming 100-day policy review speech.

Amidst a complex macroeconomic backdrop shaped by Trump’s second term policies, on-chain data showing significant Bitcoin withdrawals from exchanges added fuel to bullish sentiment, prompting speculation about a potential push towards the $100,000 milestone.

Anticipation builds ahead of Trump’s 100-day review

After a period of consolidation, Bitcoin prices pushed higher, reaching levels above $95,490 according to CoinGecko data, marking an 0.8% gain over 24 hours and reflecting a robust 8.9% increase week-over-week.

This price action mirrored gains seen in US equity markets, particularly among top technology stocks, as investors awaited clarity from Trump’s address.

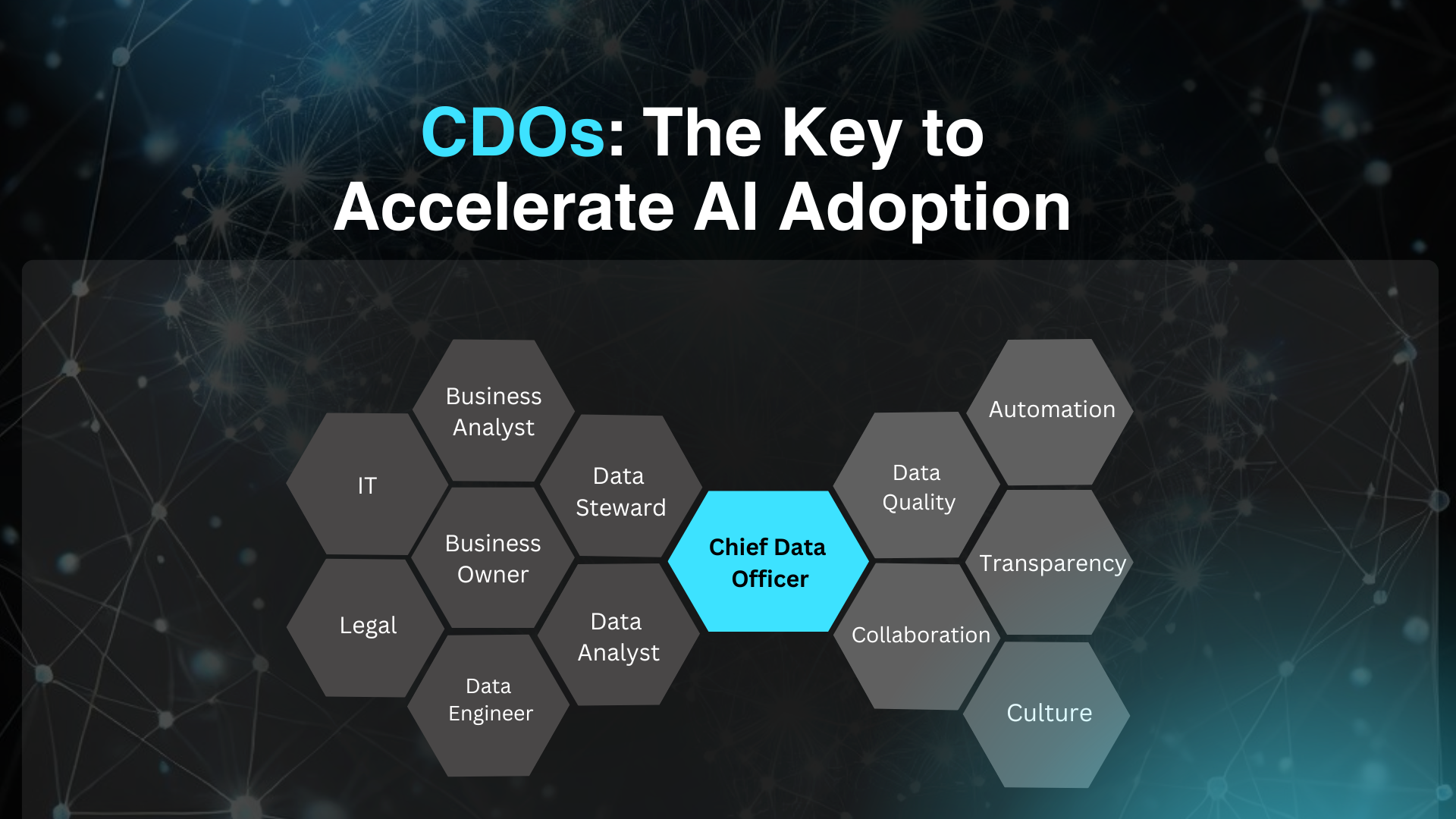

Crypto-related policies have been a notable feature of Trump’s second term thus far, and market participants are particularly keen for updates on proposals like the potential creation of a US Bitcoin strategic reserve.

A definitive announcement confirming the strategic reserve initiative could serve as a powerful catalyst, potentially triggering a rapid (“parabolic”) move towards and beyond $100,000.

Conversely, renewed emphasis on aggressive tariff strategies or drastic budget cuts in the speech could dampen overall market sentiment, potentially capping Bitcoin’s near-term upside despite its recent resilience.

Macro crosscurrents: tariffs, inflation, and Fed pressure

The first 100 days of Trump’s term have been marked by distinct policy trends influencing market dynamics.

While US inflation has continued its downward trend (falling from a 9.1% peak in 2022 to 2.4% in March 2025, per TradingEconomics), Trump’s continued advocacy for tariffs – measures widely warned by economists as potentially inflationary – creates tension.

The President has claimed victory over inflation while simultaneously pushing for policies that could reignite price pressures.

This backdrop informs Trump’s recently intensified calls for the Federal Reserve to cut interest rates, including public pressure and threats aimed at replacing Fed Chair Jerome Powell.

While these pronouncements have sparked market speculation, data from the CME FedWatch tool still indicates a dominant (90.1%) probability that the Fed will maintain current rates at its upcoming May 7 FOMC meeting.

However, the administration’s focus on tariffs (“impose across-the-board tariffs on most foreign-made goods”) continues to inject uncertainty into US stock markets.

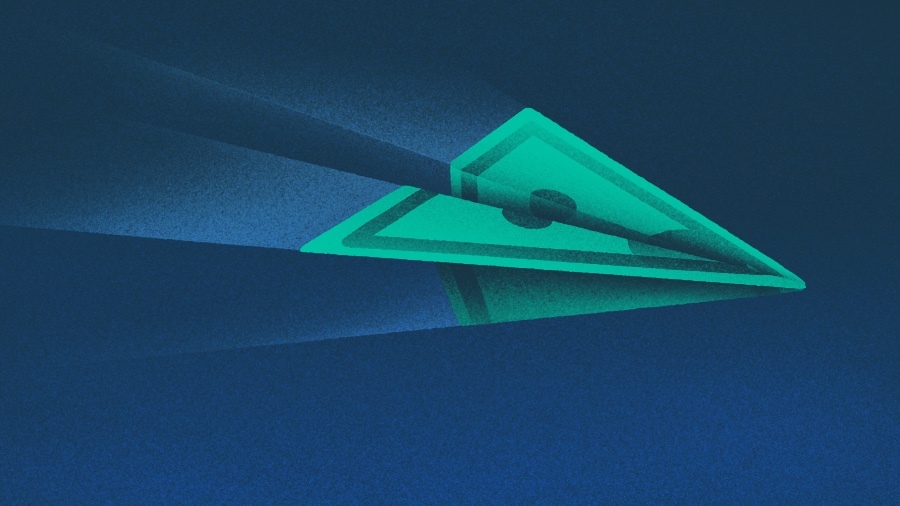

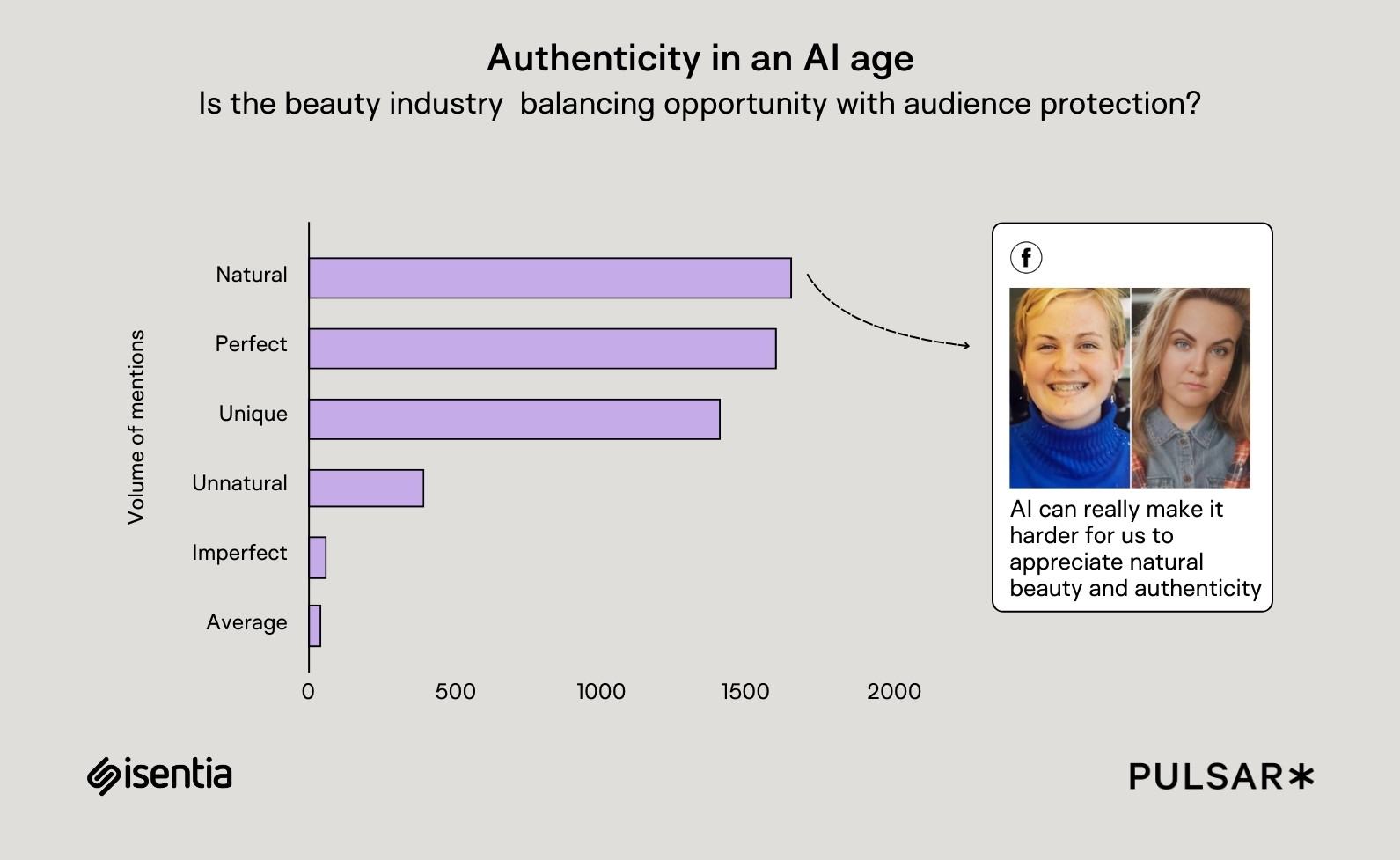

This uncertainty appears to be bolstering Bitcoin’s narrative as a potential safe-haven asset, relatively insulated from direct geopolitical trade spats and supply chain disruptions.

Notably, Bitcoin has posted year-to-date gains of 5.6%, contrasting with declines seen in the S&P 500 and Dow Jones indices (down 5% YTD) during the same period.

Should Trump’s policies continue to foster volatility in traditional financial (TradFi) markets, Bitcoin’s perceived resilience could attract further capital inflows.

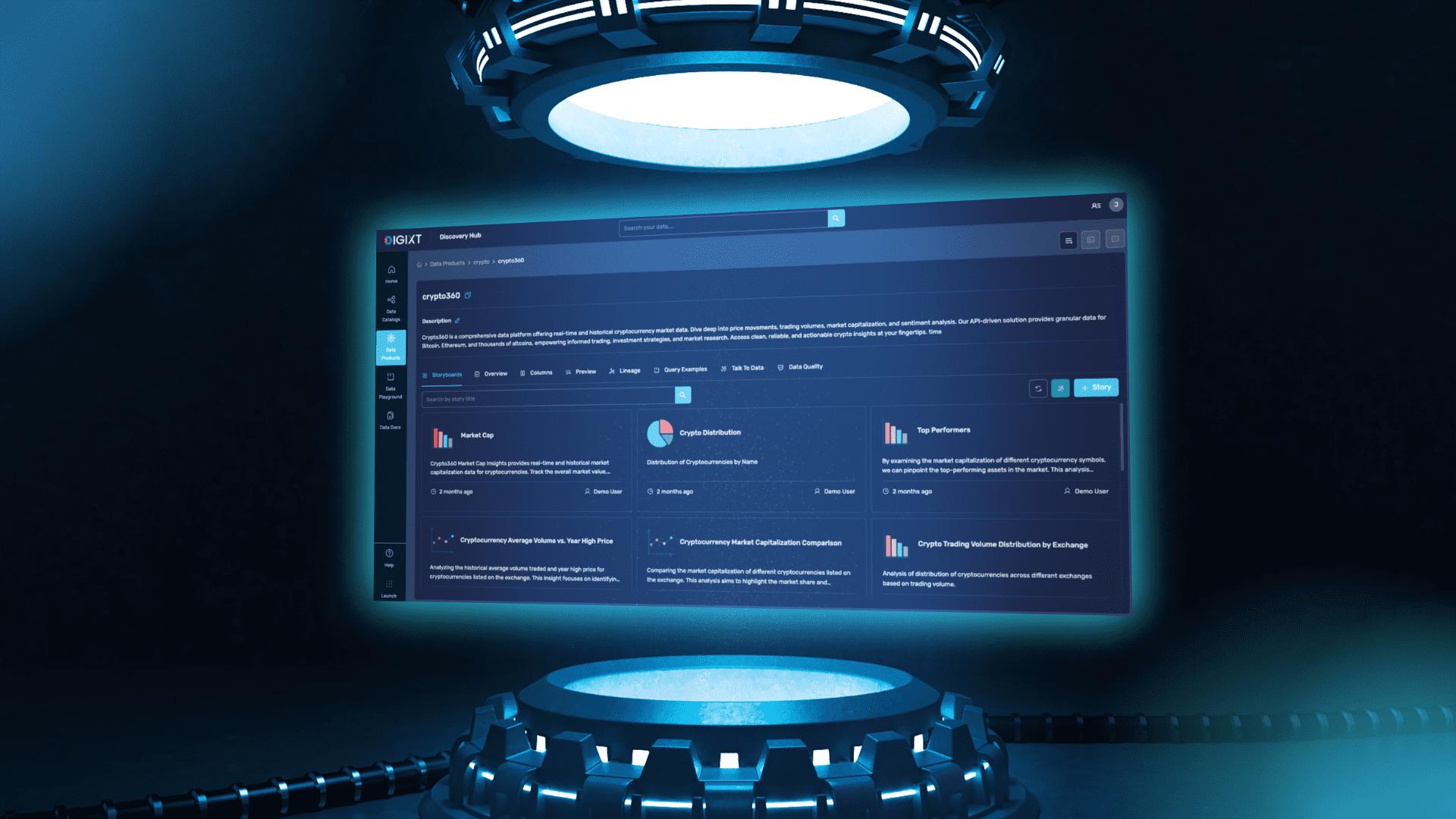

On-chain flows signal accumulation?

Adding weight to the bullish case is compelling on-chain data indicating significant Bitcoin movement off cryptocurrency exchanges.

Analysis from CryptoQuant reveals that investors have withdrawn over $4 billion worth of Bitcoin from tracked exchange wallets since Trump’s recent calls for rate cuts began around April 22.

Total exchange reserve balances reportedly fell from $237.8 billion to $233.8 billion during this period.

This trend of coins leaving exchanges is often interpreted bullishly, as it suggests investors are moving Bitcoin into private storage (“cold wallets”) for longer-term holding rather than keeping it readily available for sale on trading platforms.

This reduction in easily accessible supply, coupled with potentially steady or increasing demand triggers (like the safe-haven narrative or strategic reserve news), strengthens the argument for a potential price breakout.

Bitcoin tests $95K resistance, eyes $100K breakout

With demand factors seemingly active and exchange supply tightening, the technical picture comes into sharp focus. Bitcoin is currently testing the significant resistance zone around 95,000−95,500.

Successfully overcoming and holding above this level is seen as crucial for confirming the next leg higher.

The $100,000 psychological milestone remains the key upside target in the near term, with the confluence of macro uncertainty, potential policy catalysts from Trump’s speech, and supportive on-chain data suggesting the stage could be set for such a move.

The post Donald Trump speech looms: can Bitcoin leverage exchange outflows, safe haven status for $100K? appeared first on CoinJournal.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

_Muhammad_R._Fakhrurrozi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![macOS 15.5 beta 4 now available for download [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/macOS-Sequoia-15.5-b4.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![AirPods Pro 2 With USB-C Back On Sale for Just $169! [Deal]](https://www.iclarified.com/images/news/96315/96315/96315-640.jpg)

![Apple Releases iOS 18.5 Beta 4 and iPadOS 18.5 Beta 4 [Download]](https://www.iclarified.com/images/news/97145/97145/97145-640.jpg)

![Apple Seeds watchOS 11.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97147/97147/97147-640.jpg)

![Apple Seeds visionOS 2.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97150/97150/97150-640.jpg)

![Apple Seeds Fourth Beta of iOS 18.5 to Developers [Update: Public Beta Available]](https://images.macrumors.com/t/uSxxRefnKz3z3MK1y_CnFxSg8Ak=/2500x/article-new/2025/04/iOS-18.5-Feature-Real-Mock.jpg)

![Apple Seeds Fourth Beta of macOS Sequoia 15.5 [Update: Public Beta Available]](https://images.macrumors.com/t/ne62qbjm_V5f4GG9UND3WyOAxE8=/2500x/article-new/2024/08/macOS-Sequoia-Night-Feature.jpg)