DeFi Isn’t Dead — But Most Tokens Are

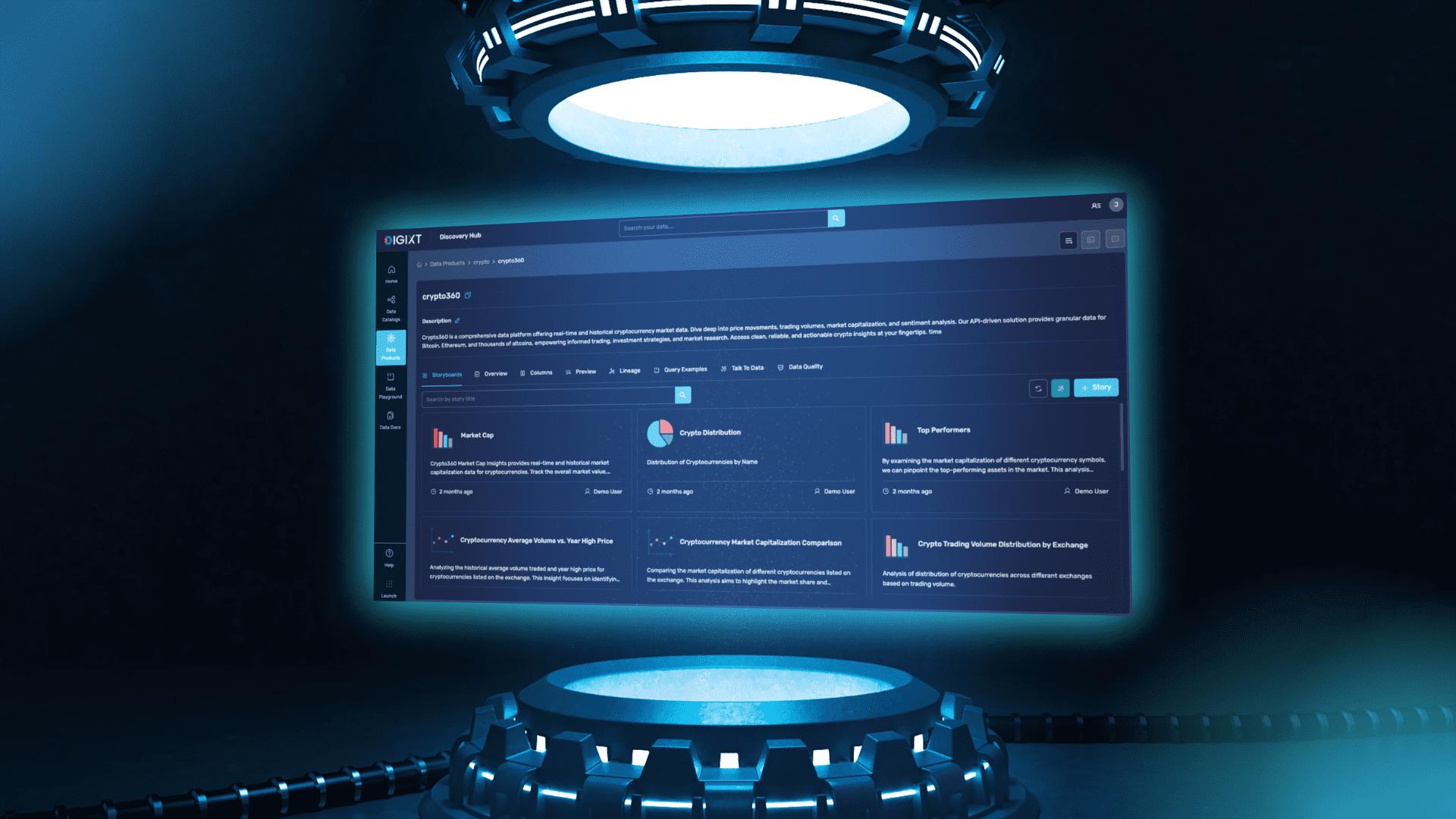

In crypto, the spotlight moves fast. A token that dominated headlines in 2020 might be forgotten in 2025. But does disappearance from the top 10 mean irrelevance? Or can a protocol-native asset quietly evolve, weather the cycles, and reclaim its place? The sheer number of token failures over the past five years shows just how brutal this industry can be — and how rare survivorship actually is. Here’s how many projects have disappeared from the market each year: ☠️ 2021 - 2,584 ☠️ 2022 - 213,075 ☠️ 2023 - 245,049 ☠️ 2024 - 1,382,010 ☠️ 2025 - 1,821,549 The rise and retreat of many DeFi tokens has created a sort of digital graveyard. Yet, not every token buried under a price chart is truly dead. Some simply mature in silence. One of the clearest examples? $CRV Launched in 2020 by Curve Finance, $CRV was born with a purpose far beyond speculative trading. As part of an AMM protocol designed to optimize stablecoin liquidity, CRV served functional roles: incentivizing liquidity provision, governance participation, boosting rewards, and redistributing platform fees. This wasn’t just another meme asset — CRV was (and is) a utility token tightly embedded in the protocol’s mechanics. With a capped supply of 3.03B and a 355-year emission curve, the tokenomics were designed for endurance. Still, the market isn’t always rational. After reaching an ATH of over $60 in 2020, CRV tumbled — trading at ~$0.66 today. Many assumed it had joined the pile of forgotten DeFi coins. In a sea of flashy launches and rug pulls, longevity depends on more than branding or early hype. It depends on sustained use, meaningful integrations, and the ability to evolve. For CRV, that’s exactly what’s been happening — quietly:

In crypto, the spotlight moves fast. A token that dominated headlines in 2020 might be forgotten in 2025. But does disappearance from the top 10 mean irrelevance? Or can a protocol-native asset quietly evolve, weather the cycles, and reclaim its place?

The sheer number of token failures over the past five years shows just how brutal this industry can be — and how rare survivorship actually is.

Here’s how many projects have disappeared from the market each year:

☠️ 2021 - 2,584

☠️ 2022 - 213,075

☠️ 2023 - 245,049

☠️ 2024 - 1,382,010

☠️ 2025 - 1,821,549

The rise and retreat of many DeFi tokens has created a sort of digital graveyard. Yet, not every token buried under a price chart is truly dead. Some simply mature in silence. One of the clearest examples? $CRV

Launched in 2020 by Curve Finance, $CRV was born with a purpose far beyond speculative trading. As part of an AMM protocol designed to optimize stablecoin liquidity, CRV served functional roles:

- incentivizing liquidity provision,

- governance participation,

- boosting rewards,

- and redistributing platform fees.

This wasn’t just another meme asset — CRV was (and is) a utility token tightly embedded in the protocol’s mechanics. With a capped supply of 3.03B and a 355-year emission curve, the tokenomics were designed for endurance.

Still, the market isn’t always rational. After reaching an ATH of over $60 in 2020, CRV tumbled — trading at ~$0.66 today. Many assumed it had joined the pile of forgotten DeFi coins.

In a sea of flashy launches and rug pulls, longevity depends on more than branding or early hype. It depends on sustained use, meaningful integrations, and the ability to evolve.

For CRV, that’s exactly what’s been happening — quietly:

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

_Andy_Dean_Photography_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Developing AI 'Vibe-Coding' Assistant for Xcode With Anthropic [Report]](https://www.iclarified.com/images/news/97200/97200/97200-640.jpg)

![Apple's New Ads Spotlight Apple Watch for Kids [Video]](https://www.iclarified.com/images/news/97197/97197/97197-640.jpg)

![[Weekly funding roundup April 26-May 2] VC inflow continues to remain downcast](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/WeeklyFundingRoundupNewLogo1-1739546168054.jpg)