Bridging AI Agents and Smart Contracts for an Automated Future

The intersection of Artificial Intelligence (AI) and blockchain technology, especially through AI agents and smart contracts, is revolutionizing industries by enabling unprecedented levels of automation, efficiency, and encryption security. Below, we explore some of the forefront use cases that highlight how this synergy is transforming various sectors. The Power of AI Agents and Smart Contracts AI Agents are sophisticated entities capable of performing tasks that require human intelligence, such as decision making, problem solving, and learning. When powered by AI, these agents can efficiently handle complex tasks and even predict future outcomes based on data patterns. Smart Contracts, on the other hand, are self-executing contracts with terms directly written into lines of code. These eliminate the need for intermediaries and ensure transparent, tamper-proof transaction execution based on predefined conditions. When AI agents are deployed in conjunction with smart contracts, the combined intelligence and self-enforcing nature of these technologies create a powerful tool that can drive the next wave of digital transformation. 1. Decentralized Finance (DeFi) Enhanced Trading Strategies AI agents can continuously analyze vast amounts of market data to identify profitable trading strategies. These agents can inform smart contracts to execute trades automatically, according to pre-established criteria, thus optimizing investment outcomes. Yield Farming and Risk Management In the DeFi ecosystem, AI-driven agents dynamically adjust yield farming strategies by interacting with smart contracts. This flexibility allows users to automatically rebalance their portfolios and mitigate risks, ensuring maximized returns. For instance, an AI agent may decide to reallocate funds across diverse DeFi protocols based on changing yield rates and potential risks. def rebalance_portfolio(current_allocation, market_data): optimal_allocation = AI_model.optimize_allocation(market_data) # Triggering smart contract to execute the newly optimized allocation smart_contract.rebalance(optimal_allocation) 2. Insurance Industry Automated Claims Processing In the insurance sector, AI agents assess insurance claims using algorithms to mimic human judgment. Smart contracts then automate the claims processing workflow, significantly reducing manual intervention and ensuring faster customer settlements. Risk Assessment and Personalized Pricing AI agents constantly data-mine information to assess risks and determine individualized insurance premiums. These dynamically calculated prices via smart contracts guarantee that policies are efficiently executed and transparently monitored. 3. Supply Chain Management Real-Time Monitoring and Automation AI agents are perfect for monitoring real-time supply chain data, such as temperature or inventory levels. By using this data, smart contracts can automate actions like reordering stock or pausing distribution lines, enhancing responsiveness. Predictive Maintenance AI analytics anticipate disruptions by using historical and real-time data to predict failures before they occur. Smart contracts subsequently facilitate logistics adjustments, proactively reducing downtime and costs. if AI_agent.predict_failure(inventory_data): smart_contract.adjust_logistics(mitigation_action) 4. Smart Contract Verification and Security Automated Auditing AI agents are becoming instrumental in auditing smart contracts to detect vulnerabilities or bugs. This proactive scrutiny enhances the security ecosystem and minimizes the risk of malicious exploitation. Adaptive Security Measures Unusual transactions or anomalies can be flagged by AI agents, prompting smart contracts to upgrade their security protocols or alert necessary parties, maintaining a dynamic defense system. 5. Dynamic Pricing and E-commerce Real-Time Price Adjustments E-commerce platforms can leverage AI to adjust pricing in real-time by monitoring competitive pricing schemes and market demands. Smart contracts enforce these changes to ensure maximum profitability and competitiveness. Personalized Offers AI agents can analyze customer preferences and spending behaviors to predict future purchases and tailor offers. Smart contracts then ensure these offers are executed seamlessly, aligning customer engagement with business strategies. def personalize_offer(customer_data): targeted_offers = AI_model.predict_offer(customer_data) smart_contract.execute_offer(targeted_offers) 6. Cross-Chain Operations Interoperability Enhancement AI agents simplify interactions across varying blockchain networks, enhancing the efficiency of cross-chain smart contract operations. They serve as intermediaries capable of interpreti

The intersection of Artificial Intelligence (AI) and blockchain technology, especially through AI agents and smart contracts, is revolutionizing industries by enabling unprecedented levels of automation, efficiency, and encryption security. Below, we explore some of the forefront use cases that highlight how this synergy is transforming various sectors.

The Power of AI Agents and Smart Contracts

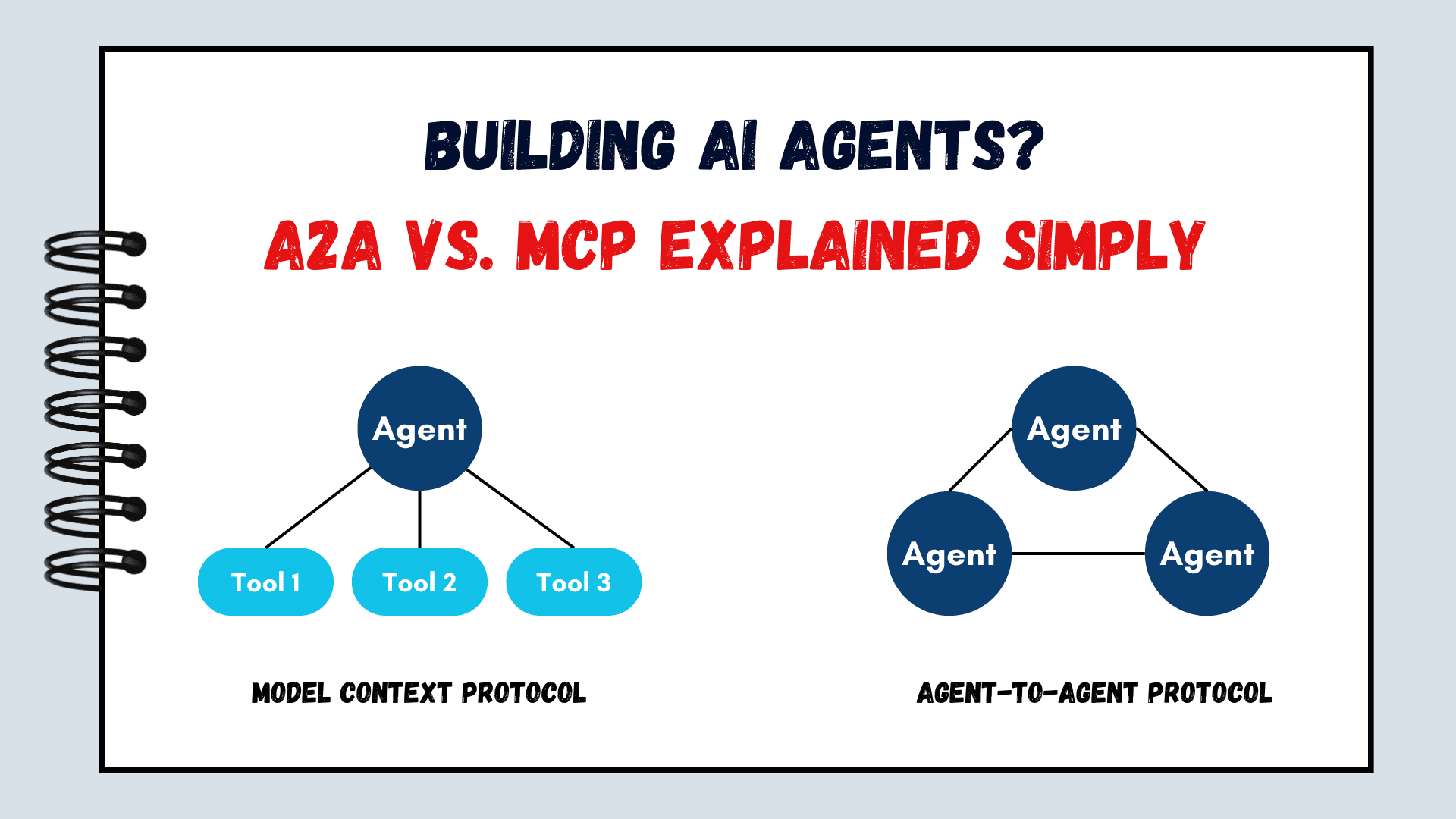

AI Agents are sophisticated entities capable of performing tasks that require human intelligence, such as decision making, problem solving, and learning. When powered by AI, these agents can efficiently handle complex tasks and even predict future outcomes based on data patterns.

Smart Contracts, on the other hand, are self-executing contracts with terms directly written into lines of code. These eliminate the need for intermediaries and ensure transparent, tamper-proof transaction execution based on predefined conditions.

When AI agents are deployed in conjunction with smart contracts, the combined intelligence and self-enforcing nature of these technologies create a powerful tool that can drive the next wave of digital transformation.

1. Decentralized Finance (DeFi)

Enhanced Trading Strategies

AI agents can continuously analyze vast amounts of market data to identify profitable trading strategies. These agents can inform smart contracts to execute trades automatically, according to pre-established criteria, thus optimizing investment outcomes.

Yield Farming and Risk Management

In the DeFi ecosystem, AI-driven agents dynamically adjust yield farming strategies by interacting with smart contracts. This flexibility allows users to automatically rebalance their portfolios and mitigate risks, ensuring maximized returns. For instance, an AI agent may decide to reallocate funds across diverse DeFi protocols based on changing yield rates and potential risks.

def rebalance_portfolio(current_allocation, market_data):

optimal_allocation = AI_model.optimize_allocation(market_data)

# Triggering smart contract to execute the newly optimized allocation

smart_contract.rebalance(optimal_allocation)

2. Insurance Industry

Automated Claims Processing

In the insurance sector, AI agents assess insurance claims using algorithms to mimic human judgment. Smart contracts then automate the claims processing workflow, significantly reducing manual intervention and ensuring faster customer settlements.

Risk Assessment and Personalized Pricing

AI agents constantly data-mine information to assess risks and determine individualized insurance premiums. These dynamically calculated prices via smart contracts guarantee that policies are efficiently executed and transparently monitored.

3. Supply Chain Management

Real-Time Monitoring and Automation

AI agents are perfect for monitoring real-time supply chain data, such as temperature or inventory levels. By using this data, smart contracts can automate actions like reordering stock or pausing distribution lines, enhancing responsiveness.

Predictive Maintenance

AI analytics anticipate disruptions by using historical and real-time data to predict failures before they occur. Smart contracts subsequently facilitate logistics adjustments, proactively reducing downtime and costs.

if AI_agent.predict_failure(inventory_data):

smart_contract.adjust_logistics(mitigation_action)

4. Smart Contract Verification and Security

Automated Auditing

AI agents are becoming instrumental in auditing smart contracts to detect vulnerabilities or bugs. This proactive scrutiny enhances the security ecosystem and minimizes the risk of malicious exploitation.

Adaptive Security Measures

Unusual transactions or anomalies can be flagged by AI agents, prompting smart contracts to upgrade their security protocols or alert necessary parties, maintaining a dynamic defense system.

5. Dynamic Pricing and E-commerce

Real-Time Price Adjustments

E-commerce platforms can leverage AI to adjust pricing in real-time by monitoring competitive pricing schemes and market demands. Smart contracts enforce these changes to ensure maximum profitability and competitiveness.

Personalized Offers

AI agents can analyze customer preferences and spending behaviors to predict future purchases and tailor offers. Smart contracts then ensure these offers are executed seamlessly, aligning customer engagement with business strategies.

def personalize_offer(customer_data):

targeted_offers = AI_model.predict_offer(customer_data)

smart_contract.execute_offer(targeted_offers)

6. Cross-Chain Operations

Interoperability Enhancement

AI agents simplify interactions across varying blockchain networks, enhancing the efficiency of cross-chain smart contract operations. They serve as intermediaries capable of interpreting and reconciling differing blockchain protocols to allow seamless asset transfers and communication.

7. Autonomous Decision-Making

Autonomous Systems

AI agents embedded within smart contracts can autonomously make and execute decisions based on real-world data, reducing reliance on human intervention. This capability is key for organizations aiming to streamline processes and maintain fluid operations even in complex environments.

def autonomous_decision(system_state):

if AI_agent.evaluate(system_state) == 'action_required':

smart_contract.initiate_procedure(decision_data)

Conclusion

The integration of AI agents with smart contracts is steering the digital future towards enhanced automation and efficiency. By providing sophisticated analytics and decision-making capabilities alongside the self-enforcing nature of blockchain contracts, this combination empowers businesses across sectors to innovate and compete at unprecedented levels. As these technologies evolve, we can anticipate even more groundbreaking applications emerging at the intersection of AI and blockchain.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![[FREE EBOOKS] Modern Generative AI with ChatGPT and OpenAI Models, Offensive Security Using Python & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![How to make Developer Friends When You Don't Live in Silicon Valley, with Iraqi Engineer Code;Life [Podcast #172]](https://cdn.hashnode.com/res/hashnode/image/upload/v1747360508340/f07040cd-3eeb-443c-b4fb-370f6a4a14da.png?#)

![[Virtual Event] Strategic Security for the Modern Enterprise](https://eu-images.contentstack.com/v3/assets/blt6d90778a997de1cd/blt55e4e7e277520090/653a745a0e92cc040a3e9d7e/Dark_Reading_Logo_VirtualEvent_4C.png?width=1280&auto=webp&quality=80&disable=upscale#)

-xl-(1)-xl-xl.jpg)

![How to upgrade the M4 Mac mini SSD and save hundreds [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/05/M4-Mac-mini-SSD-Upgrade-Tutorial-2TB.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![iPhone 17 Air Could Get a Boost From TDK's New Silicon Battery Tech [Report]](https://www.iclarified.com/images/news/97344/97344/97344-640.jpg)

![Vision Pro Owners Say They Regret $3,500 Purchase [WSJ]](https://www.iclarified.com/images/news/97347/97347/97347-640.jpg)

![Apple Showcases 'Magnifier on Mac' and 'Music Haptics' Accessibility Features [Video]](https://www.iclarified.com/images/news/97343/97343/97343-640.jpg)

![Sony WH-1000XM6 Unveiled With Smarter Noise Canceling and Studio-Tuned Sound [Video]](https://www.iclarified.com/images/news/97341/97341/97341-640.jpg)