AMD price jumps on $6 billion stock buyback plan: What that means and why it matters

Shares of semiconductor manufacturer Advanced Micro Devices (NASDAQ: AMD) rose 6% Wednesday on news the company is issuing a $6 billion stock buyback, which represents about 3.3% of the company’s current market value, according to data from Bloomberg. The $6 billion stock buyback authorization comes in addition to a $4 billion existing buyback, for a total of $10 billion in share repurchases, CNBC reported. What is a stock buyback? A stock buyback is when a company buys shares of its own stock, reducing the total number of outstanding shares, according to Bankrate. It is also known as a share repurchase. All things equal, buybacks can create value for investors by reducing share count, thus increasing earnings per share. It’s a popular way for a company to use cash; other ways including paying off debt, investing back in the company, or paying out a dividend to investors. In 2022 alone, U.S. corporations spent over $1 trillion on buybacks. However, some critics have have said buy backs encourage corporations to meet short-term financial goals, instead of making long-term investments in capital assets, research, and development. A big week for AMD The stock buyback news comes after AMD announced a multi-year $10 billion AI partnership with Saudi Arabia’s Humain, a subsidiary of Saudi Arabia’s Public Investment Fund, the country’s sovereign wealth fund, focused on developing advanced AI infrastructure and technology, in order to diversify the nation’s economy beyond just oil. Nvidia announced a similar, but separate, multi-year deal. “At AMD, we have a bold vision to enable the future of AI everywhere – bringing open, high-performance computing to every developer, AI start-up and enterprise around the world,” AMD’s CEO Lisa Su told Fast Company in a statement. “Our investment with HUMAIN is a significant milestone in advancing global AI infrastructure. Together, we are building a globally significant AI platform that delivers performance, openness and reach at unp recedented levels.” The announcement comes in conjunction with President Trump’s visit this week to Saudi Arabia as part of his tour of the Gulf region. “This is not just another infrastructure play – it’s an open invitation to the world’s innovators,” Tareq Amin, CEO of Humain, said in a statement. “We are democratizing AI at the compute level, ensuring that access to advanced AI is limited only by imagination, not by infrastructure.” Analysts at Bank of America noted it marks the first time AMD is on a “similar” footing as rival Nvidia in terms of “engagement in large projects” and reiterated buy rating for both companies, as reported by Investing.com.

Shares of semiconductor manufacturer Advanced Micro Devices (NASDAQ: AMD) rose 6% Wednesday on news the company is issuing a $6 billion stock buyback, which represents about 3.3% of the company’s current market value, according to data from Bloomberg.

The $6 billion stock buyback authorization comes in addition to a $4 billion existing buyback, for a total of $10 billion in share repurchases, CNBC reported.

What is a stock buyback?

A stock buyback is when a company buys shares of its own stock, reducing the total number of outstanding shares, according to Bankrate. It is also known as a share repurchase. All things equal, buybacks can create value for investors by reducing share count, thus increasing earnings per share.

It’s a popular way for a company to use cash; other ways including paying off debt, investing back in the company, or paying out a dividend to investors.

In 2022 alone, U.S. corporations spent over $1 trillion on buybacks. However, some critics have have said buy backs encourage corporations to meet short-term financial goals, instead of making long-term investments in capital assets, research, and development.

A big week for AMD

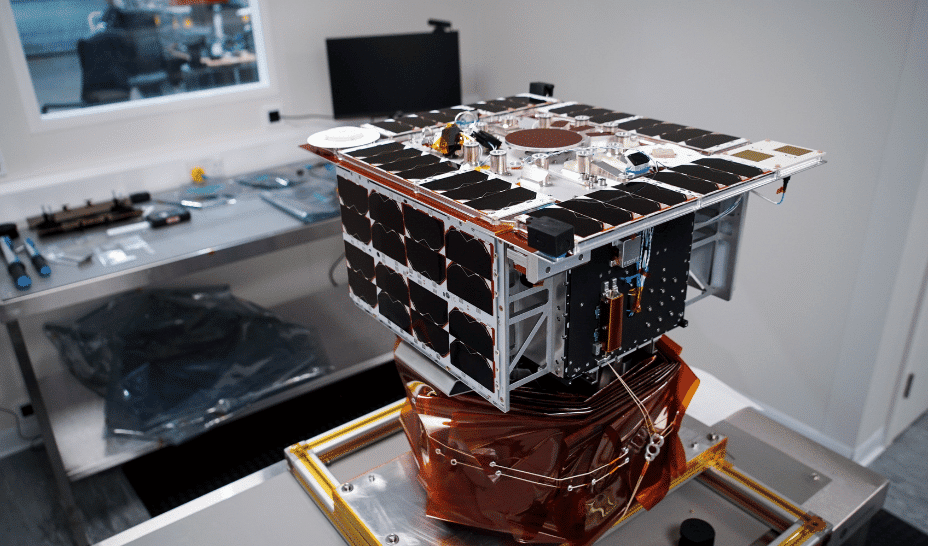

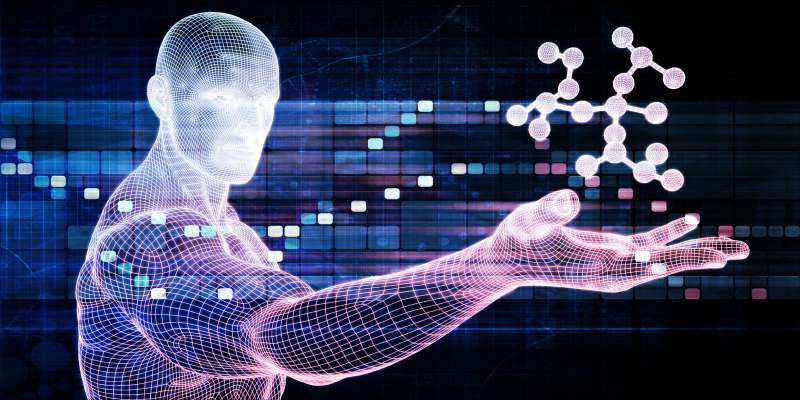

The stock buyback news comes after AMD announced a multi-year $10 billion AI partnership with Saudi Arabia’s Humain, a subsidiary of Saudi Arabia’s Public Investment Fund, the country’s sovereign wealth fund, focused on developing advanced AI infrastructure and technology, in order to diversify the nation’s economy beyond just oil. Nvidia announced a similar, but separate, multi-year deal.

“At AMD, we have a bold vision to enable the future of AI everywhere – bringing open, high-performance computing to every developer, AI start-up and enterprise around the world,” AMD’s CEO Lisa Su told Fast Company in a statement. “Our investment with HUMAIN is a significant milestone in advancing global AI infrastructure. Together, we are building a globally significant AI platform that delivers performance, openness and reach at unp recedented levels.”

The announcement comes in conjunction with President Trump’s visit this week to Saudi Arabia as part of his tour of the Gulf region.

“This is not just another infrastructure play – it’s an open invitation to the world’s innovators,” Tareq Amin, CEO of Humain, said in a statement. “We are democratizing AI at the compute level, ensuring that access to advanced AI is limited only by imagination, not by infrastructure.”

Analysts at Bank of America noted it marks the first time AMD is on a “similar” footing as rival Nvidia in terms of “engagement in large projects” and reiterated buy rating for both companies, as reported by Investing.com.

![[The AI Show Episode 147]: OpenAI Abandons For-Profit Plan, AI College Cheating Epidemic, Apple Says AI Will Replace Search Engines & HubSpot’s AI-First Scorecard](https://www.marketingaiinstitute.com/hubfs/ep%20147%20cover.png)

![Legends Reborn tier list of best heroes for each class [May 2025]](https://media.pocketgamer.com/artwork/na-33360-1656320479/pg-magnum-quest-fi-1.jpeg?#)

_KristofferTripplaar_Alamy_.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

.webp?#)

-xl.jpg)

![Vision Pro May Soon Let You Scroll With Your Eyes [Report]](https://www.iclarified.com/images/news/97324/97324/97324-640.jpg)

![Apple's 20th Anniversary iPhone May Feature Bezel-Free Display, AI Memory, Silicon Anode Battery [Report]](https://www.iclarified.com/images/news/97323/97323/97323-640.jpg)