The Smart Way to Handle Invoices: Why AI Automation Is a Game-Changer for AP Teams

In today's fast-paced business environment, efficiency and accuracy in financial operations are more critical than ever. Accounts Payable (AP) teams are under constant pressure to streamline workflows, reduce manual errors, ensure compliance, and support overall business agility. Traditional invoice processing methods, often bogged down by paper trails, data entry, and approval bottlenecks, are no longer sustainable. Enter AI automation—a transformative technology that is rapidly reshaping the landscape of AP operations. The Challenge with Traditional AP Processes Manual invoice processing is not just time-consuming—it’s expensive and prone to error. According to industry research, the average cost to manually process a single invoice can range from $12 to $30, depending on complexity and the size of the organization. Moreover, manual workflows can lead to delayed approvals, missed payments, duplicate entries, and even fraud, all of which can significantly impact an organization’s bottom line and supplier relationships. For growing businesses, scaling AP operations without digital tools means increasing headcount, which further drives up operational costs. Clearly, a smarter, scalable solution is needed. What Is AI Automation in AP? AI automation in AP refers to the use of artificial intelligence and machine learning technologies to automate routine tasks such as data capture, invoice matching, approval routing, and fraud detection. These solutions integrate with ERP systems to create a seamless, touchless invoice workflow—from receipt to payment. AI can intelligently extract data from invoices (even unstructured formats), classify documents, detect anomalies, and adapt to new formats over time without extensive human intervention. The result is faster, more accurate invoice processing and improved visibility into cash flow and liabilities. Key Benefits of AI-Driven Invoice Automation 1. Increased Efficiency and Speed AI eliminates the need for manual data entry by automatically capturing and validating invoice data. This significantly reduces processing times, allowing AP teams to handle higher volumes without additional resources. Invoices that once took days to approve can now be processed in hours—or even minutes. 2. Reduced Errors and Improved Accuracy Manual processes are highly susceptible to human error. AI systems are trained to detect inconsistencies, flag duplicates, and validate entries against purchase orders and contracts. This greatly minimizes the risk of overpayments and ensures data integrity across financial systems. 3. Enhanced Fraud Prevention With advanced pattern recognition and anomaly detection, AI can identify suspicious activities and prevent fraudulent transactions before they occur. Whether it's a duplicate invoice or a vendor payment irregularity, AI brings an added layer of security to your AP processes. 4. Cost Savings By reducing the need for manual labor and improving processing accuracy, companies can significantly lower the cost per invoice. Furthermore, faster invoice approvals enable businesses to take advantage of early payment discounts offered by suppliers. 5. Scalability AI-driven AP automation platforms are designed to scale effortlessly with growing business needs. Whether processing hundreds or thousands of invoices per month, the system adapts without the need to expand staff or infrastructure. 6. Improved Vendor Relationships Faster and more accurate payments lead to stronger supplier partnerships. With real-time visibility into payment statuses, vendors are kept in the loop, reducing inquiries and enhancing trust. 7. Better Compliance and Audit Readiness Automated invoice trails make it easier to meet regulatory requirements and prepare for audits. AI systems can log every step of the invoice lifecycle, ensuring transparency and accountability across all transactions. How to Implement AI Automation in Your AP Department Transitioning to AI-powered invoice automation doesn’t happen overnight, but a structured approach can help ensure a smooth implementation: Assess Your Current Workflow Identify bottlenecks, repetitive tasks, and areas where human error frequently occurs. This will help you determine which processes can benefit most from automation. Choose the Right Solution Look for a platform that integrates with your existing ERP system, supports multiple invoice formats, and offers machine learning capabilities. Cloud-based solutions offer additional flexibility and lower upfront costs. Engage Stakeholders Early Collaboration between finance, IT, procurement, and compliance teams is key. Ensure everyone understands the benefits and objectives of automation to foster adoption. Start with a Pilot Program Roll out the automation system in phases. Begin with a small group of vendors

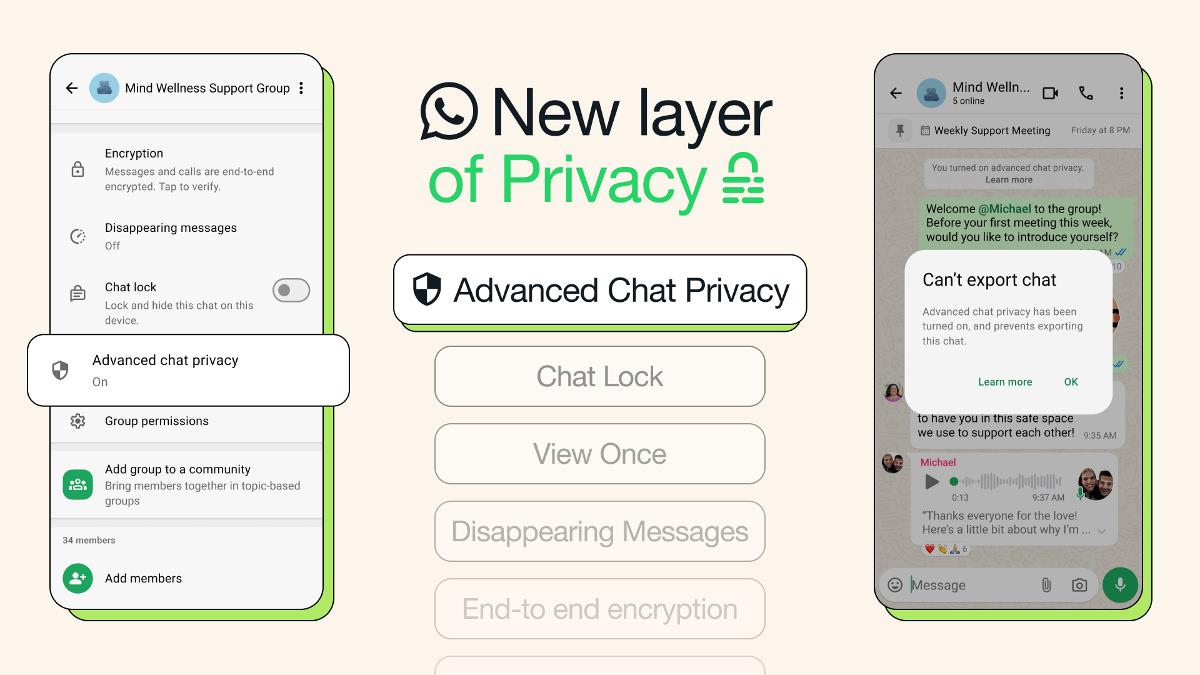

In today's fast-paced business environment, efficiency and accuracy in financial operations are more critical than ever. Accounts Payable (AP) teams are under constant pressure to streamline workflows, reduce manual errors, ensure compliance, and support overall business agility. Traditional invoice processing methods, often bogged down by paper trails, data entry, and approval bottlenecks, are no longer sustainable. Enter AI automation—a transformative technology that is rapidly reshaping the landscape of AP operations.

The Challenge with Traditional AP Processes

Manual invoice processing is not just time-consuming—it’s expensive and prone to error. According to industry research, the average cost to manually process a single invoice can range from $12 to $30, depending on complexity and the size of the organization. Moreover, manual workflows can lead to delayed approvals, missed payments, duplicate entries, and even fraud, all of which can significantly impact an organization’s bottom line and supplier relationships.

For growing businesses, scaling AP operations without digital tools means increasing headcount, which further drives up operational costs. Clearly, a smarter, scalable solution is needed.

What Is AI Automation in AP?

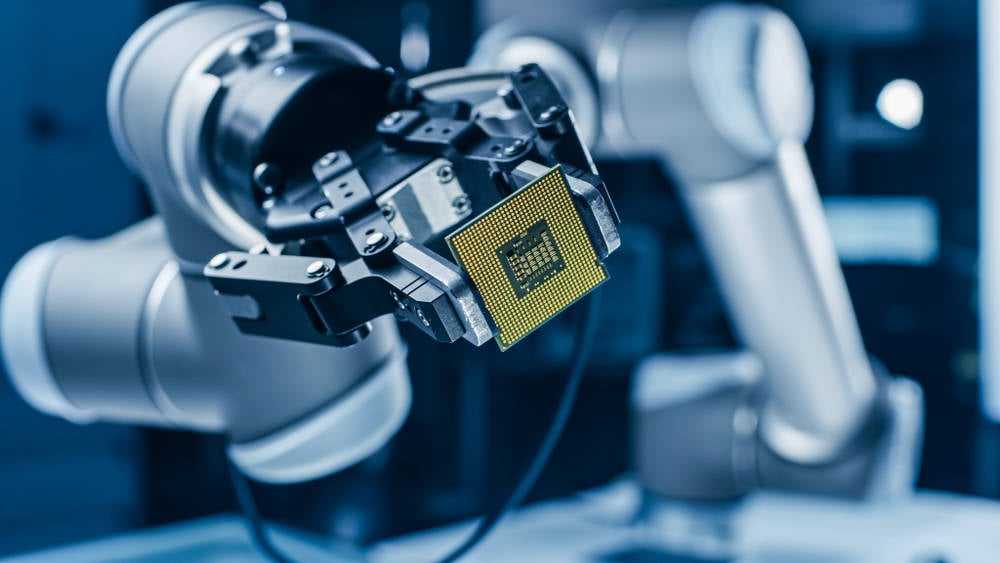

AI automation in AP refers to the use of artificial intelligence and machine learning technologies to automate routine tasks such as data capture, invoice matching, approval routing, and fraud detection. These solutions integrate with ERP systems to create a seamless, touchless invoice workflow—from receipt to payment.

AI can intelligently extract data from invoices (even unstructured formats), classify documents, detect anomalies, and adapt to new formats over time without extensive human intervention. The result is faster, more accurate invoice processing and improved visibility into cash flow and liabilities.

Key Benefits of AI-Driven Invoice Automation

1. Increased Efficiency and Speed

AI eliminates the need for manual data entry by automatically capturing and validating invoice data. This significantly reduces processing times, allowing AP teams to handle higher volumes without additional resources. Invoices that once took days to approve can now be processed in hours—or even minutes.

2. Reduced Errors and Improved Accuracy

Manual processes are highly susceptible to human error. AI systems are trained to detect inconsistencies, flag duplicates, and validate entries against purchase orders and contracts. This greatly minimizes the risk of overpayments and ensures data integrity across financial systems.

3. Enhanced Fraud Prevention

With advanced pattern recognition and anomaly detection, AI can identify suspicious activities and prevent fraudulent transactions before they occur. Whether it's a duplicate invoice or a vendor payment irregularity, AI brings an added layer of security to your AP processes.

4. Cost Savings

By reducing the need for manual labor and improving processing accuracy, companies can significantly lower the cost per invoice. Furthermore, faster invoice approvals enable businesses to take advantage of early payment discounts offered by suppliers.

5. Scalability

AI-driven AP automation platforms are designed to scale effortlessly with growing business needs. Whether processing hundreds or thousands of invoices per month, the system adapts without the need to expand staff or infrastructure.

6. Improved Vendor Relationships

Faster and more accurate payments lead to stronger supplier partnerships. With real-time visibility into payment statuses, vendors are kept in the loop, reducing inquiries and enhancing trust.

7. Better Compliance and Audit Readiness

Automated invoice trails make it easier to meet regulatory requirements and prepare for audits. AI systems can log every step of the invoice lifecycle, ensuring transparency and accountability across all transactions.

How to Implement AI Automation in Your AP Department

Transitioning to AI-powered invoice automation doesn’t happen overnight, but a structured approach can help ensure a smooth implementation:

Assess Your Current Workflow

Identify bottlenecks, repetitive tasks, and areas where human error frequently occurs. This will help you determine which processes can benefit most from automation.

Choose the Right Solution

Look for a platform that integrates with your existing ERP system, supports multiple invoice formats, and offers machine learning capabilities. Cloud-based solutions offer additional flexibility and lower upfront costs.

Engage Stakeholders Early

Collaboration between finance, IT, procurement, and compliance teams is key. Ensure everyone understands the benefits and objectives of automation to foster adoption.

Start with a Pilot Program

Roll out the automation system in phases. Begin with a small group of vendors or a specific department, gather feedback, and fine-tune the process before expanding organization-wide.

Monitor and Optimize

Post-implementation, track key performance metrics such as invoice cycle time, error rates, and cost per invoice. Use these insights to continuously improve the system’s performance.

Looking Ahead: The Future of AP Automation

AI automation is just the beginning. As technology evolves, AP departments will increasingly leverage predictive analytics, robotic process automation (RPA), and blockchain for even more secure and intelligent financial operations. The goal is not just automation—but optimization of the entire procure-to-pay lifecycle.

Organizations that embrace AI in AP today are positioning themselves for a more agile, cost-efficient future. By freeing staff from tedious, manual work, they can focus on strategic activities that drive business value.

Final Thoughts

In a digital-first world, businesses can no longer afford the inefficiencies of manual invoice handling. AI Invoice Processing Automation offers a smarter, faster, and more cost-effective solution that modern AP teams need to stay ahead. By leveraging AI, companies not only streamline operations but also enhance accuracy, reduce risks, and build stronger supplier relationships.

This isn’t just about automation—it’s about transforming finance into a strategic function. As more organizations recognize the value of intelligent systems, AI Invoice Processing Automation is set to become a standard in achieving operational excellence and long-term scalability.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![[DEALS] Sterling Stock Picker: Lifetime Subscription (85% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

_Olekcii_Mach_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Dummy Models Showcase 'Unbelievably' Thin iPhone 17 Air Design [Images]](https://www.iclarified.com/images/news/97114/97114/97114-640.jpg)

![M4 MacBook Air Drops to New All-Time Low of $912 [Deal]](https://www.iclarified.com/images/news/97108/97108/97108-640.jpg)