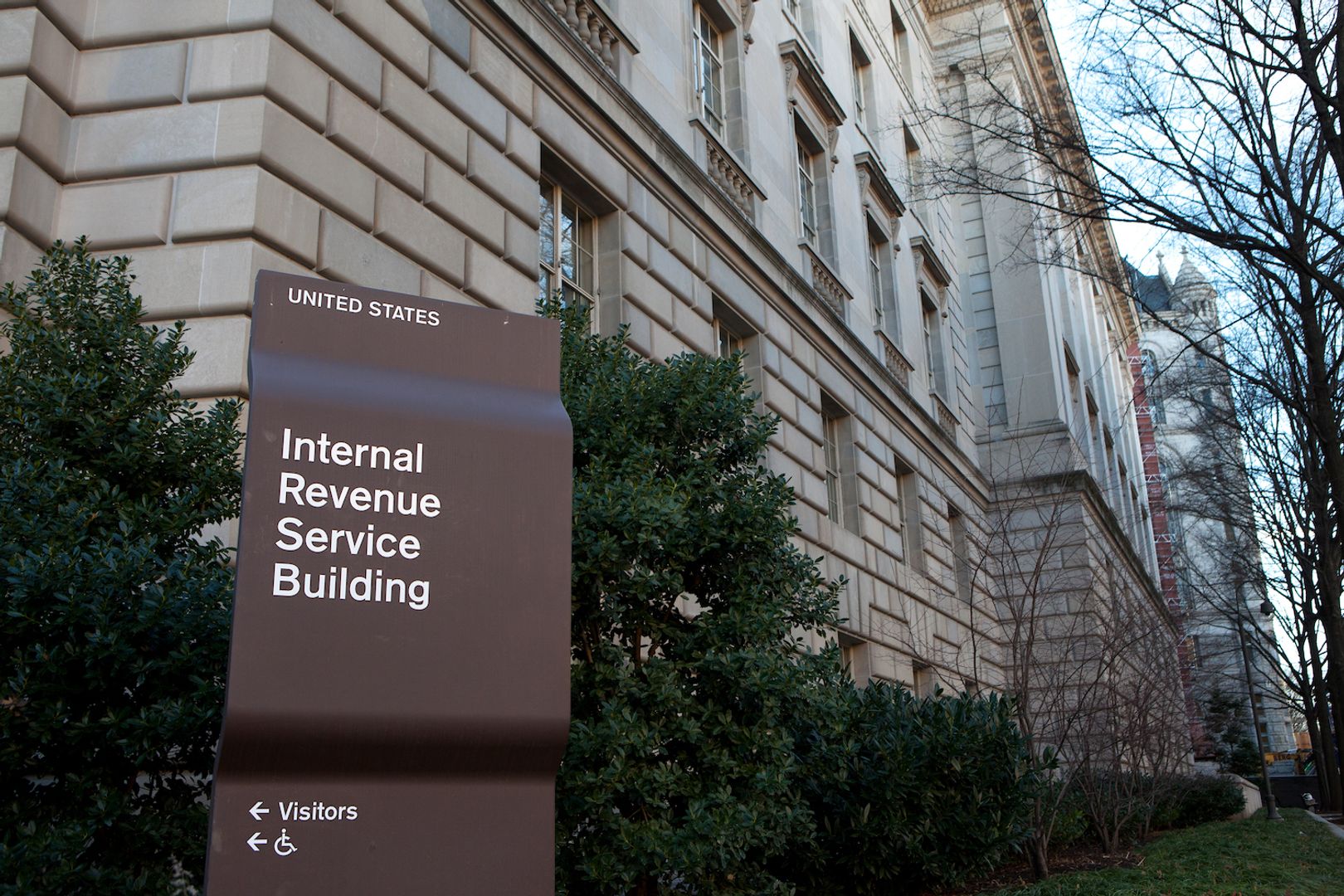

State of Crypto: IRS Departures

Seth Wilks and Raj Mukherjee, two IRS digital asset directors, are leaving the agency just over a year after joining it.

The IRS, alongside many other regulators, has been pretty active in the crypto world over recent years. On Friday, two directors left.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

Deferred resignations

The narrative

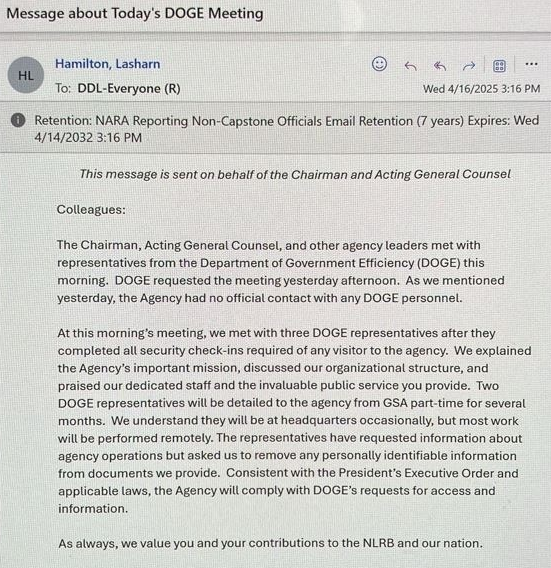

Over 20,000 IRS employees accepted deferred resignation offers made by the Donald Trump administration, including two directors tasked with overseeing digital assets rulemaking.

Why it matters

Raj Mukherjee and Seth Wilks went on paid administrative leave Saturday, though individuals familiar with the situation told CoinDesk that their departures should not indicate any change in the IRS' approach to crypto rules.

Breaking it down

Wilks, the IRS' executive director of digital asset strategy and development, and Mukherjee, the executive director of the digital assets office, accepted deferred resignation offers and left the IRS on Friday, two individuals told CoinDesk.

They joined thousands of other IRS employees who accepted the offer, which puts them on paid administrative leave until September.

Both of CoinDesk's sources said Wilks and Mukherjee left ahead of expected widespread layoffs at the IRS.

Stories you may have missed

- Inside Movement’s Token-Dump Scandal: Secret Contracts, Shadow Advisers and Hidden Middlemen: CoinDesk's Sam Kessler published a blockbuster investigation into Movement Labs, its recent agreements with a market maker and how its current internal investigation into whether it was misled into signing an agreement which gave that market maker control over a significant number of its tokens came to be.

- Fed Joins OCC, FDIC in Withdrawing Crypto Warnings for U.S. Banks: The Federal Reserve withdrew its crypto guidance advising banks to get pre-approvals before entering crypto activity (and other details).

- TRUMP Coin Jumps 70% on President's Dinner Event for Top Token Holders: The 220 individuals who hold the most TRUMP tokens will be able to attend a dinner with Donald Trump in May. The news sparked a surge in the token's price.

- Trump's Truth Social Mulls Launching Token for Subscriptions in Latest Crypto Push: Truth Social, the social media company owned by Donald Trump's Trump Media & Technology Group, said in a shareholder letter that it was exploring launching a utility token.

- Bitcoin-Friendly Poilievre Loses Seat as Carney's Liberals Win 2025 Election: Canada voted, and the Liberal Party is forming a minority government with Mark Carney staying on as the Prime Minister. Conservative Party leader Pierre Poilievre lost his seat.

- Unicoin CEO Rejects SEC’s Attempt to Settle Enforcement Probe: Unicoin rejected a settlement negotiation meeting with the U.S. Securities and Exchange Commission, CEO Alex Konanykhin told shareholders in a letter.

- Senator and Ex-Bridgewater CEO McCormick Invests More in Bitcoin as Bill in Works: Pennsylvania Republican Dave McCormick, who won his seat in last year's election and now sits on the Senate Banking Committee, disclosed investing up to $450,000 in Bitwise's Bitcoin exchange-traded fund (ETF).

- New SEC Chief Atkins Says Agency Doesn't Have to Wait to Impose Crypto Policy: Paul Atkins, who was sworn in as SEC chair last week, said the agency was considering special-purpose broker dealers and custody policies at the latest crypto roundtable hosted by the agency, and that it may not need to wait for new laws to act.

- FBI Says Americans Lost $9.3B to Crypto Scams in 2024: The FBI's latest Internet Crime Complaint Center report said Americans lost $9.3 billion to crypto crimes last year, a 66% year-over-year rise. Total losses added up to $16.6 billion, and the overall year-over-year increase was 33%.

DOJ's mixers

Prosecutors and defense attorneys in the Department of Justice's case against the developers of Samourai Wallet filed a joint memo asking the federal judge overseeing the case to pause it for a few weeks while the DOJ considers a request from the defense to drop it entirely.

An attorney for Roman Storm, asked if the Tornado Cash developer's team had made a similar request, declined to comment.

This same week, a federal judge ruled that the U.S. Treasury Department cannot sanction Tornado Cash again, saying the Office of Foreign Asset Control did "not suggest they will not sanction Tornado Cash again, and they may seek to 'reenact precisely the same [designation] in the future.'"

Last month, Leah Moushey, an attorney with Miller & Chevalier, told CoinDesk that the judge may decide to reject OFAC's argument that the case was moot because of previous cases where agencies tried to keep the ability to redesignate someone after a court case was resolved.

The judge indeed appeared to buy into that view in his ruling.

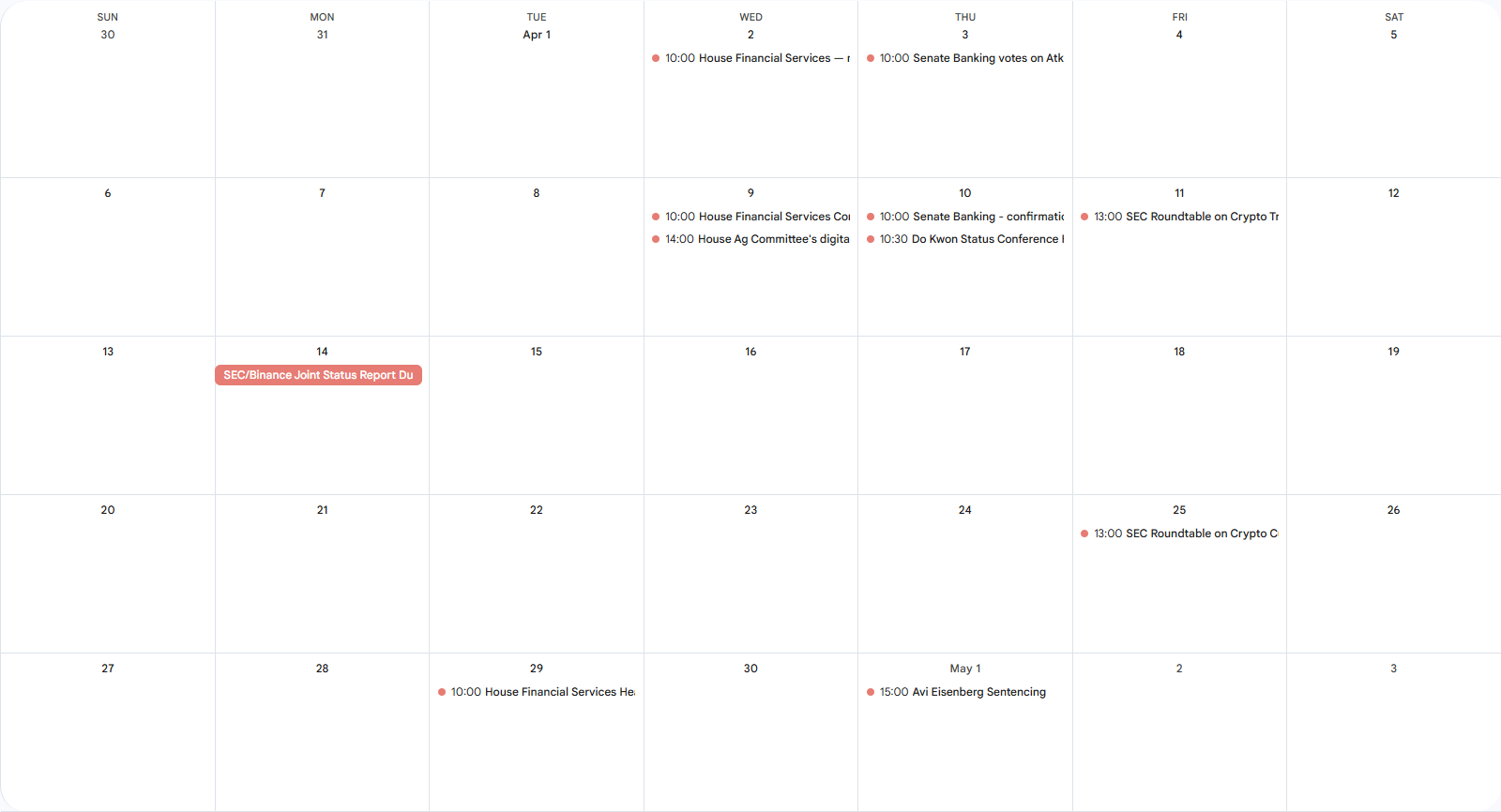

This week

Tuesday

- 14:00 UTC (10:00 a.m. ET) The House Financial Services Committee held a subcommittee hearing titled "Hearing Entitled: Regulatory Overreach: The Price Tag on American Prosperity."

Thursday

- 19:00 UTC (3:00 p.m. ET) Avraham Eisenberg, who was arrested and tried for his $110 million exploit of Mango Markets, was sentenced to just over four years in prison after pleading guilty to possession of child sexual abuse material. During the sentencing hearing, the federal judge overseeing the case said he was open to a retrial on the Mango Markets-related charges.

Elsewhere:

- (The New York Times) The Times dug into Donald Trump's entry and deepening connections into the crypto industry.

- (The Washington Post) The Post published a list of the top donors to Trump's inauguration fund. Included in this list: Ripple Labs ($4.9 million donated), Robinhood Markets ($2 million), Fred Ehrsam, Circle, Coinbase, Crypto.com, Galaxy Digital, Ondo Finance, Kraken and Solana Labs ($1 million each). Several of these companies have since filed to go public, seen the SEC drop lawsuits and investigations against them or announced partnerships with Trump-affiliated businesses.

- (Politico) The Senate is likely to vote on stablecoin legislation before the end of May, Majority Leader John Thune said at a Republican conference lunch.

- (The New York Times) The Times also published a deep dive into Tether and its own deepening ties to Washington, D.C.

- (Reuters) North Korean employees set up corporate entities in the U.S. to target crypto firms.

- (The New York Times) This is a very bonkers story of some folks who stole some crypto. Just read it.

- (Politico) This is a fascinating read by Politico's Victoria Guida about Canadian Prime Minister Mark Carney's experience and views.

- (404 Media) Researchers claiming to be part of the University of Zurich set up a "large-scale experiment in which they secretly deployed AI-powered bots into a popular debate subreddit" to see whether AI would change people's minds. These bots used fake backstories and made over 1,700 comments. Reddit said it was issuing "formal legal demands" to the researchers in response.

- (The New York Times) Roger Ver, i.e. "Bitcoin Jesus," hired Roger Stone to try and lobby for legal changes that might help Ver, who is accused of tax charges.

- (Semafor) A number of prominent venture capitalists and tech executives, including crypto company executives, have private group chats that Semafor reports show a growing political divide.

- (Wired) Spain and Portugal suffered a massive blackout earlier this week. Wired dug into some of the technical issues at play.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at nik@coindesk.com or find me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See ya’ll next week!

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[FREE EBOOKS] Learn Computer Forensics — 2nd edition, AI and Business Rule Engines for Excel Power Users & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Art School Drop-out to Microsoft Engineer with Shashi Lo [Podcast #170]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746203291209/439bf16b-c820-4fe8-b69e-94d80533b2df.png?#)

(1).jpg?#)

_Inge_Johnsson-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple to Split iPhone Launches Across Fall and Spring in Major Shakeup [Report]](https://www.iclarified.com/images/news/97211/97211/97211-640.jpg)

![Apple to Move Camera to Top Left, Hide Face ID Under Display in iPhone 18 Pro Redesign [Report]](https://www.iclarified.com/images/news/97212/97212/97212-640.jpg)

![Apple Developing Battery Case for iPhone 17 Air Amid Battery Life Concerns [Report]](https://www.iclarified.com/images/news/97208/97208/97208-640.jpg)

![AirPods 4 On Sale for $99 [Lowest Price Ever]](https://www.iclarified.com/images/news/97206/97206/97206-640.jpg)

![[Updated] Samsung’s 65-inch 4K Smart TV Just Crashed to $299 — That’s Cheaper Than an iPad](https://www.androidheadlines.com/wp-content/uploads/2025/05/samsung-du7200.jpg)