Lookout Zillow: A new real estate juggernaut is forming

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Speaking to ResiClub in December, Jay Bray, CEO of mortgage servicer Mr. Cooper, told me that real estate would see a lot of mergers and acquisitions in 2025—and that Mr. Cooper was out shopping—as the industry continues to “grind” through the prolonged housing activity slump that started back in summer 2022. “You’ve seen consolidation already. If you think about this industry going forward, you’re going to need a balanced business model. You’re going to need the capability to invest in technology, to use everybody’s favorite two initials: AI,” Bray said in December. “That requires scale, that requires capital, that requires a healthy balance sheet. So I think as long as we’re in this kind of grind it out origination market, I don’t see any reason you will not see more consolidation happen. The stronger players will continue to get stronger, to some degree, and continue to look for opportunities to consolidate.” Bray added that: “We are in the stronger category . . . We’ve probably done more acquisitions than anybody in the industry, by far, and so, yeah, we’re still in the market for that… We will be active and looking for opportunities.” Bray was right that a big deal loomed—only the hunter became the hunted. On March 31, mortgage lending giant Rocket Companies (owner of Rocket Mortgage, formerly known as Quicken Loans) announced it had reached an agreement to acquire Mr. Cooper for $9.4 billion. Rocket Companies claims that, combined, it will service more than $2.1 trillion in loan volume, including one in six mortgages in America. Rocket Companies CEO Varun Krishna [Photo: Rocket Companies] “Servicing is a critical pillar of homeownership alongside home search and mortgage origination,” said Varun Krishna, CEO of Rocket Companies, in the press release announcing the deal. “With the right data and AI infrastructure we will deliver the right products at the right time. That’s how we build lifelong relationships, by proactively unlocking benefits and meeting needs before they arise. We look forward to welcoming Mr. Cooper’s nearly 7 million clients.” This deal came just three weeks after Rocket Companies announced on March 10th that it struck an agreement to buy Redfin in a $1.75 billion deal. What’s going on? Rocket Companies is strategically positioning itself as a giant force in residential real estate, aiming to create a one-stop shop for homebuyers by merging Redfin’s customer funnel and Mr. Cooper’s mortgage servicing with its existing mortgage lending business. “It’s becoming increasingly clear that Zillow’s true competition isn’t CoStar—it’s Rocket,” Amanda Orson, CEO of real estate marketplace Galleon, tells ResiClub. “Everyone’s been watching CoStar’s $1 billion ad blitz with Homes.com, but their residential play is burning cash with no meaningful traction. Meanwhile, Rocket is executing something far more ambitious—and more dangerous: They’re buying the full residential real estate stack.” Redfin handles front-of-house customer acquisition, and Rocket does mortgage origination and lending, where it’s already the dominant direct-to-consumer player. Finally, Mr. Cooper has a $2.1 trillion mortgage servicing portfolio and 4.6 million customers. Says Orson: “This is vertical integration on an entirely new scale.” Orson adds that there are two major forces at play right now in the real estate industry: changes in the commission structure and a new administration that appears more friendly to mergers and acquisitions. “The real estate transaction itself is undergoing tectonic change,” says Orson. “[The National Association of Realtors] settlement is just the start. We’re watching the unbundling of a 112-year-old commission structure. A wave of agentless transactions is coming—and Rocket is positioning to serve them end-to-end.” Zillow’s current model relies heavily on agent commissions ($1.2 billion of its $1.9 billion in revenue), says Orson: “They’ve started to pivot into mortgage origination and full-stack products, but the scale Rocket already commands in direct-to-consumer lending puts them in a league of their own.” Plus, the new administration is a tailwind for M&A, she adds. “Rocket is taking advantage of this moment with bold moves, consolidating distribution, infrastructure, and recurring revenue,” says Orson. “Both Zillow and Rocket are chasing verticalization, but Rocket is further along—and playing to win. They now control the entire journey: from lead to loan to lifetime servicing. Zillow still has front-of-funnel traffic, for now—but Rocket has monetization.” Orson says that CoStar—the commercial real estate giant that owns Homes.com and was trying to compete with Zillow—is the biggest loser in all of this. “Their residential push isn’t sticky, isn’t scaled, and at $1 billion [per] year in ad spend is starting to look

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Speaking to ResiClub in December, Jay Bray, CEO of mortgage servicer Mr. Cooper, told me that real estate would see a lot of mergers and acquisitions in 2025—and that Mr. Cooper was out shopping—as the industry continues to “grind” through the prolonged housing activity slump that started back in summer 2022.

“You’ve seen consolidation already. If you think about this industry going forward, you’re going to need a balanced business model. You’re going to need the capability to invest in technology, to use everybody’s favorite two initials: AI,” Bray said in December. “That requires scale, that requires capital, that requires a healthy balance sheet. So I think as long as we’re in this kind of grind it out origination market, I don’t see any reason you will not see more consolidation happen. The stronger players will continue to get stronger, to some degree, and continue to look for opportunities to consolidate.”

Bray added that: “We are in the stronger category . . . We’ve probably done more acquisitions than anybody in the industry, by far, and so, yeah, we’re still in the market for that… We will be active and looking for opportunities.”

Bray was right that a big deal loomed—only the hunter became the hunted.

On March 31, mortgage lending giant Rocket Companies (owner of Rocket Mortgage, formerly known as Quicken Loans) announced it had reached an agreement to acquire Mr. Cooper for $9.4 billion.

Rocket Companies claims that, combined, it will service more than $2.1 trillion in loan volume, including one in six mortgages in America.

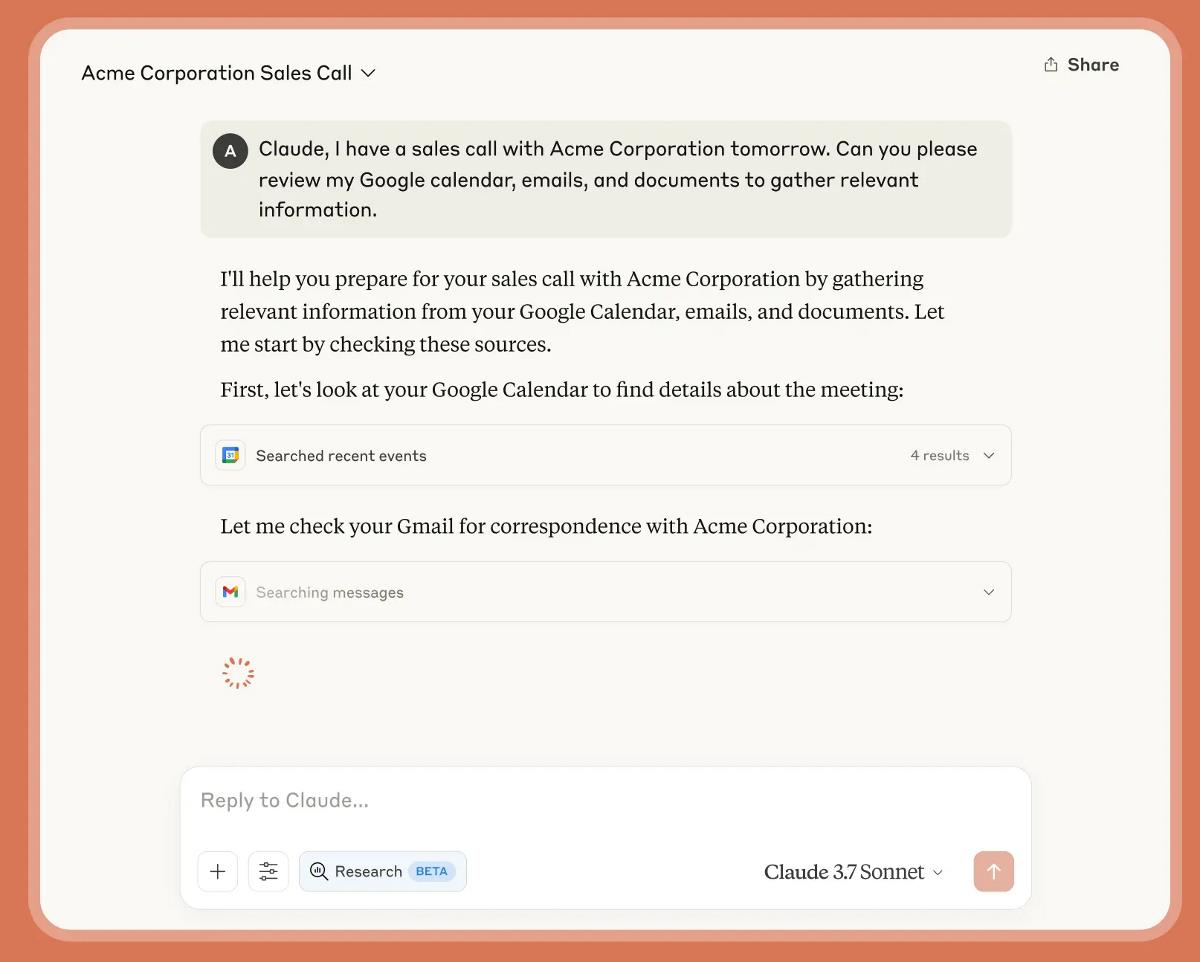

“Servicing is a critical pillar of homeownership alongside home search and mortgage origination,” said Varun Krishna, CEO of Rocket Companies, in the press release announcing the deal. “With the right data and AI infrastructure we will deliver the right products at the right time. That’s how we build lifelong relationships, by proactively unlocking benefits and meeting needs before they arise. We look forward to welcoming Mr. Cooper’s nearly 7 million clients.”

This deal came just three weeks after Rocket Companies announced on March 10th that it struck an agreement to buy Redfin in a $1.75 billion deal.

What’s going on?

Rocket Companies is strategically positioning itself as a giant force in residential real estate, aiming to create a one-stop shop for homebuyers by merging Redfin’s customer funnel and Mr. Cooper’s mortgage servicing with its existing mortgage lending business.

“It’s becoming increasingly clear that Zillow’s true competition isn’t CoStar—it’s Rocket,” Amanda Orson, CEO of real estate marketplace Galleon, tells ResiClub. “Everyone’s been watching CoStar’s $1 billion ad blitz with Homes.com, but their residential play is burning cash with no meaningful traction. Meanwhile, Rocket is executing something far more ambitious—and more dangerous: They’re buying the full residential real estate stack.”

Redfin handles front-of-house customer acquisition, and Rocket does mortgage origination and lending, where it’s already the dominant direct-to-consumer player. Finally, Mr. Cooper has a $2.1 trillion mortgage servicing portfolio and 4.6 million customers. Says Orson: “This is vertical integration on an entirely new scale.”

Orson adds that there are two major forces at play right now in the real estate industry: changes in the commission structure and a new administration that appears more friendly to mergers and acquisitions. “The real estate transaction itself is undergoing tectonic change,” says Orson. “[The National Association of Realtors] settlement is just the start. We’re watching the unbundling of a 112-year-old commission structure. A wave of agentless transactions is coming—and Rocket is positioning to serve them end-to-end.”

Zillow’s current model relies heavily on agent commissions ($1.2 billion of its $1.9 billion in revenue), says Orson: “They’ve started to pivot into mortgage origination and full-stack products, but the scale Rocket already commands in direct-to-consumer lending puts them in a league of their own.”

Plus, the new administration is a tailwind for M&A, she adds. “Rocket is taking advantage of this moment with bold moves, consolidating distribution, infrastructure, and recurring revenue,” says Orson. “Both Zillow and Rocket are chasing verticalization, but Rocket is further along—and playing to win. They now control the entire journey: from lead to loan to lifetime servicing. Zillow still has front-of-funnel traffic, for now—but Rocket has monetization.”

Orson says that CoStar—the commercial real estate giant that owns Homes.com and was trying to compete with Zillow—is the biggest loser in all of this. “Their residential push isn’t sticky, isn’t scaled, and at $1 billion [per] year in ad spend is starting to look like a costly distraction.”

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.webp?#)

![[Update: Optional] Google rolling out auto-restart security feature to Android](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-2.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Security Database Used by Apple Goes Independent After Funding Cut [Updated]](https://images.macrumors.com/t/FWFeAmxnHKf7vkk_MCBh9TcNMVg=/1600x/article-new/2023/05/bug-security-vulnerability-issue-fix-larry.jpg)