Crowdfunding for Blockchain Startups: Unlocking Potential, Empowering Innovation

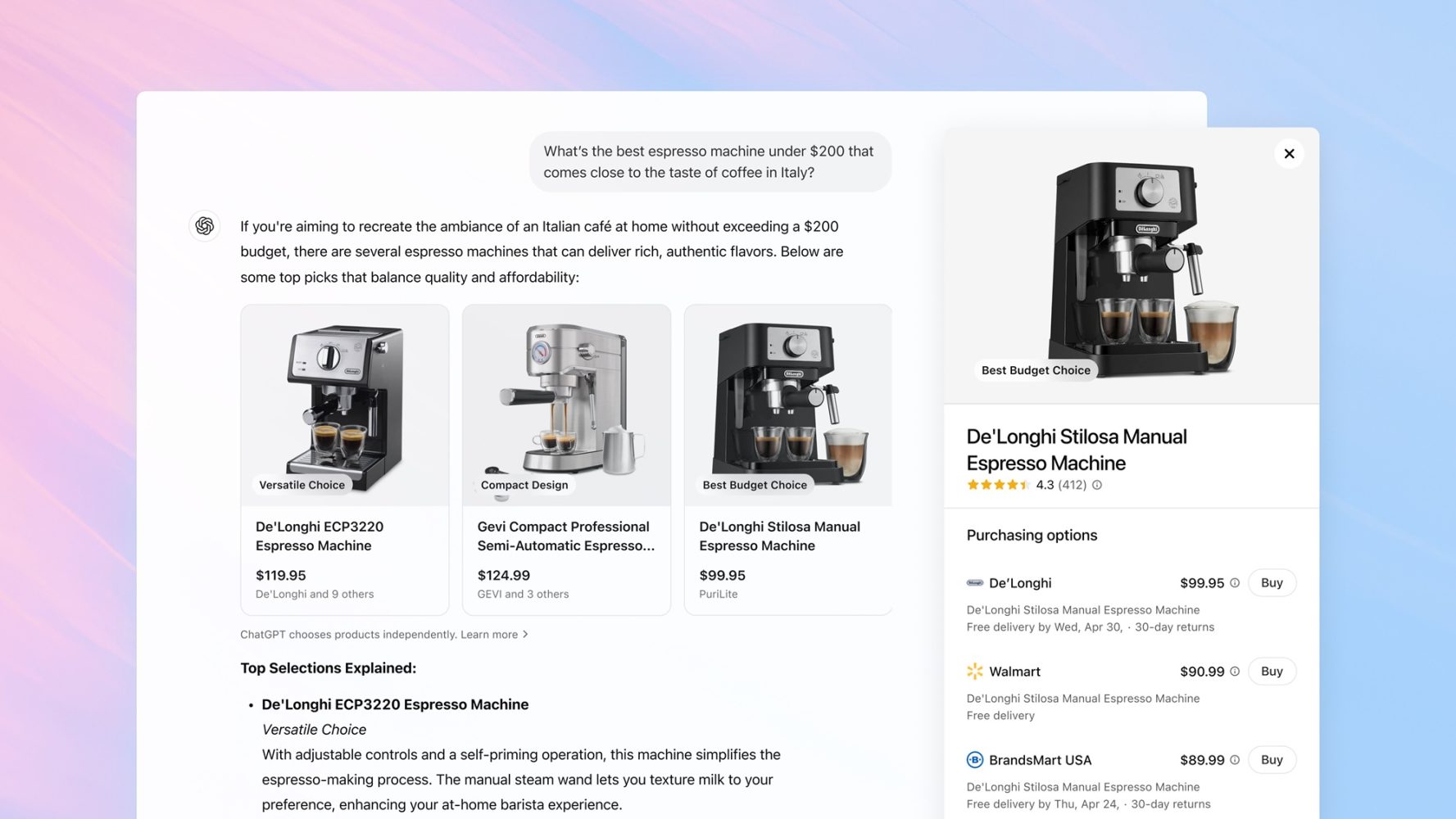

Abstract This post delves into how blockchain startups are reshaping the fundraising landscape using crowdfunding. We explore its history, key concepts such as tokenization, smart contracts and decentralized finance, and illustrate these ideas with practical examples like Ethereum’s ICO and Brave’s BAT project. We also analyze challenges such as regulatory uncertainty and security issues, and discuss promising innovations and future trends in scalability, AI integration, and hybrid funding. With clear tables, bullet lists, and actionable SEO-friendly content, this guide is designed for technical experts, startup founders, and blockchain enthusiasts alike. Introduction Blockchain technology has revolutionized the way startups raise capital. Gone are the days when traditional venture capital was the only option. Today, crowdfunding approaches such as Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and decentralized finance (DeFi) platforms are empowering startups to democratize investment. This post explores the convergence of crowdfunding with blockchain technology and explains why its transparency, tokenized ownership, and community-driven governance are key to unlocking innovation. In this guide, we will discuss: The historical background and ecosystem context of blockchain crowdfunding. Core concepts including tokenization, smart contracts, and futuristic DeFi models. Practical applications and case studies from the blockchain world. Current challenges and limitations facing these projects. Future outlook, innovations, and strategies to ensure long-term sustainability. By interweaving detailed analysis and actionable insights, this article aims to guide both new entrants and veteran developers in navigating the evolving crowdfunding ecosystem. Background and Context Blockchain technology started as the backbone of Bitcoin, a decentralized form of digital currency. Its underlying distributed ledger technology quickly found applications in finance, healthcare, supply chain, and beyond. The ecosystem is built on principles of immutability, transparency, and decentralization—an ideal match for crowdfunding initiatives. Traditional blockchain startups often struggled to secure funds from venture capital due to the novel nature of decentralized platforms. The ICO boom of 2017–2018 changed the funding landscape by allowing startups to issue digital tokens in exchange for capital. Subsequently, as regulations tightened, Security Token Offerings (STOs) emerged, connecting tokens with real-world assets and shares. This evolution is summarized in the table below: Funding Mechanism Key Features Advantages Challenges ICO Early token issuance, utility-driven Rapid capital accumulation, global reach Regulatory uncertainty, scam risk STO Securities-compliant tokens linked to assets Enhanced investor security and trust Complexity and higher compliance fees DeFi Crowdfunding Decentralized liquidity, yield farming, smart contracts Reduced intermediaries, real-time governance Interface complexities, security issues Crowdfunding in blockchain leverages open-source principles, promoting community contributions and innovation. Regulatory improvements, coupled with advancements in smart contracts and decentralization, have removed barriers that once hindered new projects. Additional insights can be gained from News AI News Q1 2025 and KI Trends Deutschland 2025 Q1. Core Concepts and Features Blockchain crowdfunding is built on several core pillars that ensure transparency, decentralization, and efficiency: 1. Tokenization Tokenization converts physical or digital assets into blockchain-based tokens. These tokens grant holders ownership, voting rights, or access to a platform’s services. Key benefits include: Increased Liquidity: Tokens can be easily traded across numerous platforms. Fractional Ownership: Even small investors can own a fraction of an asset. Transparency: Every transaction is recorded on the blockchain, creating verifiable audit trails. For more details on tokenization, see What is Tokenization of Assets. 2. Smart Contracts Smart contracts are self-executing contracts encoded on the blockchain. They help automate fundraising by: Releasing funds upon achieving milestones. Ensuring investor funds are used appropriately. Implementing community governance through voting mechanisms. To explore smart contracts further, refer to Smart Contracts on Blockchain. 3. Decentralized Finance (DeFi) DeFi platforms bypass traditional intermediaries by using smart contracts for financial operations. In the crowdfunding sphere, DeFi offers: Automated Liquidity Solutions: Allowing startups to tap into a global pool of funds. Yield Farming and Staking: Providing investors with rewards for supporting projects. Transparent Governance: Often implemented via Decentralized Autonomous Organizatio

Abstract

This post delves into how blockchain startups are reshaping the fundraising landscape using crowdfunding. We explore its history, key concepts such as tokenization, smart contracts and decentralized finance, and illustrate these ideas with practical examples like Ethereum’s ICO and Brave’s BAT project. We also analyze challenges such as regulatory uncertainty and security issues, and discuss promising innovations and future trends in scalability, AI integration, and hybrid funding. With clear tables, bullet lists, and actionable SEO-friendly content, this guide is designed for technical experts, startup founders, and blockchain enthusiasts alike.

Introduction

Blockchain technology has revolutionized the way startups raise capital. Gone are the days when traditional venture capital was the only option. Today, crowdfunding approaches such as Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and decentralized finance (DeFi) platforms are empowering startups to democratize investment. This post explores the convergence of crowdfunding with blockchain technology and explains why its transparency, tokenized ownership, and community-driven governance are key to unlocking innovation.

In this guide, we will discuss:

- The historical background and ecosystem context of blockchain crowdfunding.

- Core concepts including tokenization, smart contracts, and futuristic DeFi models.

- Practical applications and case studies from the blockchain world.

- Current challenges and limitations facing these projects.

- Future outlook, innovations, and strategies to ensure long-term sustainability.

By interweaving detailed analysis and actionable insights, this article aims to guide both new entrants and veteran developers in navigating the evolving crowdfunding ecosystem.

Background and Context

Blockchain technology started as the backbone of Bitcoin, a decentralized form of digital currency. Its underlying distributed ledger technology quickly found applications in finance, healthcare, supply chain, and beyond. The ecosystem is built on principles of immutability, transparency, and decentralization—an ideal match for crowdfunding initiatives.

Traditional blockchain startups often struggled to secure funds from venture capital due to the novel nature of decentralized platforms. The ICO boom of 2017–2018 changed the funding landscape by allowing startups to issue digital tokens in exchange for capital. Subsequently, as regulations tightened, Security Token Offerings (STOs) emerged, connecting tokens with real-world assets and shares.

This evolution is summarized in the table below:

| Funding Mechanism | Key Features | Advantages | Challenges |

|---|---|---|---|

| ICO | Early token issuance, utility-driven | Rapid capital accumulation, global reach | Regulatory uncertainty, scam risk |

| STO | Securities-compliant tokens linked to assets | Enhanced investor security and trust | Complexity and higher compliance fees |

| DeFi Crowdfunding | Decentralized liquidity, yield farming, smart contracts | Reduced intermediaries, real-time governance | Interface complexities, security issues |

Crowdfunding in blockchain leverages open-source principles, promoting community contributions and innovation. Regulatory improvements, coupled with advancements in smart contracts and decentralization, have removed barriers that once hindered new projects.

Additional insights can be gained from News AI News Q1 2025 and KI Trends Deutschland 2025 Q1.

Core Concepts and Features

Blockchain crowdfunding is built on several core pillars that ensure transparency, decentralization, and efficiency:

1. Tokenization

Tokenization converts physical or digital assets into blockchain-based tokens. These tokens grant holders ownership, voting rights, or access to a platform’s services. Key benefits include:

- Increased Liquidity: Tokens can be easily traded across numerous platforms.

- Fractional Ownership: Even small investors can own a fraction of an asset.

- Transparency: Every transaction is recorded on the blockchain, creating verifiable audit trails.

For more details on tokenization, see What is Tokenization of Assets.

2. Smart Contracts

Smart contracts are self-executing contracts encoded on the blockchain. They help automate fundraising by:

- Releasing funds upon achieving milestones.

- Ensuring investor funds are used appropriately.

- Implementing community governance through voting mechanisms.

To explore smart contracts further, refer to Smart Contracts on Blockchain.

3. Decentralized Finance (DeFi)

DeFi platforms bypass traditional intermediaries by using smart contracts for financial operations. In the crowdfunding sphere, DeFi offers:

- Automated Liquidity Solutions: Allowing startups to tap into a global pool of funds.

- Yield Farming and Staking: Providing investors with rewards for supporting projects.

- Transparent Governance: Often implemented via Decentralized Autonomous Organizations (DAOs).

This innovation fosters an environment where community backing and technical robustness go hand in hand.

4. Equity Crowdfunding

Traditional capital-raising also finds a new home in blockchain-based equity crowdfunding. Here, digital tokens represent real shares in a company, thereby providing:

- Direct Ownership: Investors receive a tangible claim on profits.

- Regulatory Alignment: Higher compliance standards ensure investor protection.

- Scalability: Blockchain reduces administrative overhead, facilitating rapid growth.

5. Network Transparency and Security

The decentralized nature of blockchain ensures that every transaction is public and immutable. Platforms such as KickICO and Waves utilize these features to maintain high standards of security, incorporating multi-signature authorizations and regular audits.

6. Community-Driven Governance

By integrating DAOs, projects empower community members to make funding and strategic decisions. This helps align the interests of founders and backers, fostering real-time feedback and agile project management.

Bullet List of Core Benefits:

- Transparency: Each transaction is verifiable on the public ledger.

- Security: Robust protocols mitigate hack risks and fraud.

- Efficiency: Reduced dependency on intermediaries speeds up funding cycles.

- Global Reach: Crowdfunding platforms remove geographical restrictions.

- Community Engagement: Active participation in governance builds strong project foundations.

Applications and Use Cases

Blockchain crowdfunding is not just a concept—it is already powering major industry players. Here we explore three use cases:

Example 1: Ethereum’s ICO

Ethereum is a prime example of blockchain crowdfunding success. Its ICO in 2014 raised over $18 million by issuing tokens to early adopters who later became vital participants in the network’s evolution. Highlights include:

- Rapid Fundraising: Demonstrated the potential to accumulate capital quickly.

- Community Formation: The network’s founding members contributed to early governance.

- Innovation in Smart Contracts: Laid the groundwork for a vast ecosystem of decentralized applications (dApps).

Example 2: Brave Browser and BAT

Brave Browser introduced the Basic Attention Token (BAT) to transform digital advertising. The platform’s token sale enabled them to create a system where users are rewarded for their attention while advertisers access a transparent financing model. Key points include:

- Integration of Token Utility: BAT serves as a bridge between advertising value and user engagement.

- Smart Contract Safety: Funds are automatically released based on performance metrics.

- Community Governance: Users help shape advertising policies via decentralized decision-making.

Example 3: Polkadot and Cross-Chain Interoperability

Polkadot’s crowdfunding model, led by Ethereum co-founder Dr. Gavin Wood, demonstrates the power of blockchain interoperability. Its token sale not only secured vast funds but also championed cross-chain connections, allowing multiple blockchains to interact. Notable features:

- Cross-Chain Connectivity: Facilitates liquidity sharing across diverse ecosystems.

- Regulatory Compliance: Uses evolved STO methods to gain investor confidence.

- Robust Security: Employs state-of-the-art smart contracts to secure funds.

For additional examples and insights, consider reading Berita NFT Indonesia 2025 Q1.

Challenges and Limitations

Even with its many advantages, the blockchain crowdfunding model faces notable challenges:

Regulatory Uncertainty

Given the rapid evolution of blockchain technology, governmental regulations are still catching up. This means that:

- Global Compliance Issues: Jurisdiction-specific rules create a patchwork of guidelines.

- Potential Legal Delays: Startups may face setbacks due to evolving security and compliance standards.

Security Risks

While blockchain is inherently secure, vulnerabilities remain:

- Smart Contract Bugs: Faults in code can lead to major financial losses.

- Cyberattacks: Continuous threats necessitate rigorous audits and constant updates.

- Phishing Scams: Investors must be wary of fraudulent schemes.

Market Saturation

As more startups adopt blockchain crowdfunding, the market becomes saturated, making it harder to:

- Stand Out: Projects must differentiate themselves to attract attention.

- Gain Investor Trust: Increased sophistication in investor requirements demands solid roadmaps and transparency.

Scalability and Integration Issues

With growing adoption, scalability becomes a prime concern:

- Throughput Concerns: Increased transaction volumes can cause bottlenecks.

- Integration Complexity: Merging advanced solutions like Layer 2 scaling and DeFi protocols requires technical expertise.

Adoption Hurdles

Finally, cultural and educational barriers remain:

- Investor Skepticism: Many potential backers remain unfamiliar with blockchain concepts.

- Need for Education: Robust educational efforts are required to bridge the gap between traditional finance and blockchain innovation.

Future Outlook and Innovations

The future of blockchain crowdfunding is bright, with several trends promising to further transform the space:

Enhanced Regulatory Clarity

As international standards evolve, startups can expect:

- Harmonized Regulations: Global standards that reduce compliance complexity.

- Increased Investor Protection: More robust frameworks to minimize fraudulent activities.

Integration of Artificial Intelligence (AI)

AI is set to enhance every aspect of blockchain crowdfunding:

- Predictive Analytics: AI can forecast project success and optimize token allocation.

- Automated Audits: Improved smart contract security through continuous AI-driven checks.

- Tailored Investor Dashboards: Enhance communication and decision-making processes.

Improved Scalability Solutions

Innovations such as Layer 2 scaling solutions and cross-chain interoperability will:

- Boost Transaction Throughput: Ensuring smooth and cost-effective fundraising campaigns.

- Lower Costs: Reducing fees and increasing accessibility for smaller investors.

Greater Community-Driven Ecosystems

The evolution of DAOs points to:

- Granular Governance: Real-time voting and community-led funding decisions.

- Sustainable Engagement: Stronger bonds between investors and startups foster long-term project success.

Hybrid Funding Models

The convergence of traditional equity crowdfunding with blockchain tokenization could yield:

- Dual Benefits: Regulatory compliance paired with blockchain’s liquidity and transparency.

- Wider Investor Pool: Attracting institutional and retail investors alike.

For more forward-thinking insights, visit Copyleft Licenses: The Ultimate Guide.

Trends in Open-Source and Environmental Impact

Blockchain crowdfunding may also see breakthroughs such as:

- Tokenized Open-Source Funding: Leveraging crowdfunding to support innovation and sustainability.

- Eco-Friendly Protocols: Projects focusing on renewable energy and lower energy consumption can attract socially conscious investors.

- Privacy-First Frameworks: Emphasizing data control and user privacy as seen in initiatives like Firefox Data Sharing & Privacy.

Summary

Blockchain crowdfunding is changing the rules of fundraising. By harnessing the power of tokenization, smart contracts, and decentralized governance, startups are now able to secure capital in ways that were once unimaginable. While challenges such as regulatory uncertainty, security risks, and market saturation remain, ongoing innovations in scalability, AI integration, and hybrid funding models indicate a promising future.

To recap:

- We examined the evolution of crowdfunding from ICOs to STOs and DeFi platforms.

- We discussed core technical features like tokenization, smart contracts, and transparency-enhancing protocols.

- We presented real-world use cases including Ethereum’s ICO, Brave’s BAT, and Polkadot’s innovative model.

- We evaluated challenges and limitations—ranging from regulatory issues to scalability—and discussed robust future trends such as enhanced AI integration and hybrid funding models.

By democratizing investment and fostering a vibrant community of backers and developers, blockchain crowdfunding is truly unlocking potential and empowering innovation.

Additional Resources

For further insights and case studies, consider these authoritative sources and industry examples:

- News AI News Q1 2025

- KI Trends Deutschland 2025 Q1

- Berita NFT Indonesia 2025 Q1

- KickICO and Waves for crowdfunding platform case studies

- Dev.to articles such as Navigating Open Source Funding for Startups: Opportunities and Challenges and Gitcoin Funding Rounds: Empowering the Open Source Ecosystem

Whether you are an entrepreneur or a technical expert, embracing blockchain crowdfunding could be the key to propelling your next groundbreaking project.

Embrace the future of decentralized fundraising and join the conversation as blockchain continues to revolutionize how we innovate and invest.

Happy innovating!

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

_Muhammad_R._Fakhrurrozi_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_NicoElNino_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![macOS 15.5 beta 4 now available for download [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/macOS-Sequoia-15.5-b4.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![AirPods Pro 2 With USB-C Back On Sale for Just $169! [Deal]](https://www.iclarified.com/images/news/96315/96315/96315-640.jpg)

![Apple Releases iOS 18.5 Beta 4 and iPadOS 18.5 Beta 4 [Download]](https://www.iclarified.com/images/news/97145/97145/97145-640.jpg)

![Apple Seeds watchOS 11.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97147/97147/97147-640.jpg)

![Apple Seeds visionOS 2.5 Beta 4 to Developers [Download]](https://www.iclarified.com/images/news/97150/97150/97150-640.jpg)

![Apple Seeds Fourth Beta of iOS 18.5 to Developers [Update: Public Beta Available]](https://images.macrumors.com/t/uSxxRefnKz3z3MK1y_CnFxSg8Ak=/2500x/article-new/2025/04/iOS-18.5-Feature-Real-Mock.jpg)

![Apple Seeds Fourth Beta of macOS Sequoia 15.5 [Update: Public Beta Available]](https://images.macrumors.com/t/ne62qbjm_V5f4GG9UND3WyOAxE8=/2500x/article-new/2024/08/macOS-Sequoia-Night-Feature.jpg)