Analysis of digital currency market trends

The digital currency market has experienced unprecedented growth and evolution in recent years, revolutionizing the way we perceive and transact value. This article provides a comprehensive analysis of the current trends shaping the digital currency landscape, offering insights into historical developments, key factors influencing market trends, market dynamics and volatility, adoption and regulation, emerging technologies driving innovation, and investment opportunities. By delving into these critical aspects, readers will gain a deeper understanding of the dynamic nature of the digital currency market and the potential opportunities and challenges it presents. Analysis of Digital Currency Market Trends 1. Introduction to Digital Currency Market Definition of Digital Currencies Digital currencies, also known as cryptocurrencies, are digital assets that use cryptography for security and operate independently of a central authority. They enable secure, peer-to-peer transactions and are stored in digital wallets. Growth and Evolution of the Digital Currency Market The digital currency market has experienced rapid growth and evolution since the launch of Bitcoin in 2009. With thousands of cryptocurrencies now available, the market has expanded to include a wide range of digital assets with varying use cases and technologies. 2. Historical Trends in Digital Currency Market Early Days of Digital Currencies In the early days, digital currencies were met with skepticism and viewed as niche technology. However, the launch of Bitcoin and subsequent cryptocurrencies paved the way for mainstream adoption and investment in digital assets. Major Milestones in Digital Currency Market Key milestones in the digital currency market include the introduction of altcoins, the rise of initial coin offerings (ICOs), and the development of blockchain technology for various applications beyond digital currencies. 3. Factors Influencing Digital Currency Market Trends Market Sentiment and Speculation Market sentiment and speculation play a significant role in shaping digital currency trends. Positive news, regulatory developments, and investor sentiment can drive prices up, while negative events can lead to market downturns. Regulatory Developments Regulatory developments, such as government policies and legal frameworks surrounding digital currencies, can impact market trends. Clarity and consistency in regulations are important for fostering investor confidence and market stability. 4. 市场动态 and Volatility in Digital Currency Price Fluctuations and Volatility Digital currencies are known for their price volatility, with prices capable of experiencing significant fluctuations in short periods. Factors such as market demand, supply dynamics, and external events can influence price movements. Market Liquidity and Trading Volumes Market liquidity, defined as the ease of buying or selling assets without impacting the price, is an important indicator of market health. Higher trading volumes and liquidity indicate a more active and liquid market for digital currencies.# Analysis of Digital Currency Market Trends 5. Adoption and Regulation of Digital Currencies Global Adoption Patterns of Digital Currencies Digital currencies are on the rise globally, with more people adopting digital payment methods and exploring new ways to transact. Countries like Japan and Switzerland are leading the way in embracing digital currencies, while others are starting to catch up. The convenience and efficiency of digital transactions are driving this adoption trend, making it easier for individuals and businesses to participate in the digital economy. Regulatory Landscape for Digital Currencies Regulation is a hot topic in the world of digital currencies, with governments and financial authorities trying to strike a balance between innovation and consumer protection. Some countries have embraced digital currencies with open arms, while others are taking a more cautious approach. Regulations around anti-money laundering (AML) and know your customer (KYC) procedures are becoming increasingly important to ensure the legitimacy of digital currency transactions. Keeping an eye on the regulatory landscape is crucial for investors and businesses operating in the digital currency space. 6. Emerging Technologies Shaping the Future of Digital Currency Blockchain Innovations in Digital Currency Blockchain technology is at the core of digital currencies, revolutionizing the way transactions are recorded and verified. New blockchain innovations are constantly being developed, improving security, scalability, and speed of digital currency transactions. Smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs) are just a few examples of

The digital currency market has experienced unprecedented growth and evolution in recent years, revolutionizing the way we perceive and transact value. This article provides a comprehensive analysis of the current trends shaping the digital currency landscape, offering insights into historical developments, key factors influencing market trends, market dynamics and volatility, adoption and regulation, emerging technologies driving innovation, and investment opportunities. By delving into these critical aspects, readers will gain a deeper understanding of the dynamic nature of the digital currency market and the potential opportunities and challenges it presents.

Analysis of Digital Currency Market Trends

1. Introduction to Digital Currency Market

Definition of Digital Currencies

Digital currencies, also known as cryptocurrencies, are digital assets that use cryptography for security and operate independently of a central authority. They enable secure, peer-to-peer transactions and are stored in digital wallets.

Growth and Evolution of the Digital Currency Market

The digital currency market has experienced rapid growth and evolution since the launch of Bitcoin in 2009. With thousands of cryptocurrencies now available, the market has expanded to include a wide range of digital assets with varying use cases and technologies.

2. Historical Trends in Digital Currency Market

Early Days of Digital Currencies

In the early days, digital currencies were met with skepticism and viewed as niche technology. However, the launch of Bitcoin and subsequent cryptocurrencies paved the way for mainstream adoption and investment in digital assets.

Major Milestones in Digital Currency Market

Key milestones in the digital currency market include the introduction of altcoins, the rise of initial coin offerings (ICOs), and the development of blockchain technology for various applications beyond digital currencies.

3. Factors Influencing Digital Currency Market Trends

Market Sentiment and Speculation

Market sentiment and speculation play a significant role in shaping digital currency trends. Positive news, regulatory developments, and investor sentiment can drive prices up, while negative events can lead to market downturns.

Regulatory Developments

Regulatory developments, such as government policies and legal frameworks surrounding digital currencies, can impact market trends. Clarity and consistency in regulations are important for fostering investor confidence and market stability.

4. 市场动态 and Volatility in Digital Currency

Price Fluctuations and Volatility

Digital currencies are known for their price volatility, with prices capable of experiencing significant fluctuations in short periods. Factors such as market demand, supply dynamics, and external events can influence price movements.

Market Liquidity and Trading Volumes

Market liquidity, defined as the ease of buying or selling assets without impacting the price, is an important indicator of market health. Higher trading volumes and liquidity indicate a more active and liquid market for digital currencies.# Analysis of Digital Currency Market Trends

5. Adoption and Regulation of Digital Currencies

Global Adoption Patterns of Digital Currencies

Digital currencies are on the rise globally, with more people adopting digital payment methods and exploring new ways to transact. Countries like Japan and Switzerland are leading the way in embracing digital currencies, while others are starting to catch up. The convenience and efficiency of digital transactions are driving this adoption trend, making it easier for individuals and businesses to participate in the digital economy.

Regulatory Landscape for Digital Currencies

Regulation is a hot topic in the world of digital currencies, with governments and financial authorities trying to strike a balance between innovation and consumer protection. Some countries have embraced digital currencies with open arms, while others are taking a more cautious approach. Regulations around anti-money laundering (AML) and know your customer (KYC) procedures are becoming increasingly important to ensure the legitimacy of digital currency transactions. Keeping an eye on the regulatory landscape is crucial for investors and businesses operating in the digital currency space.

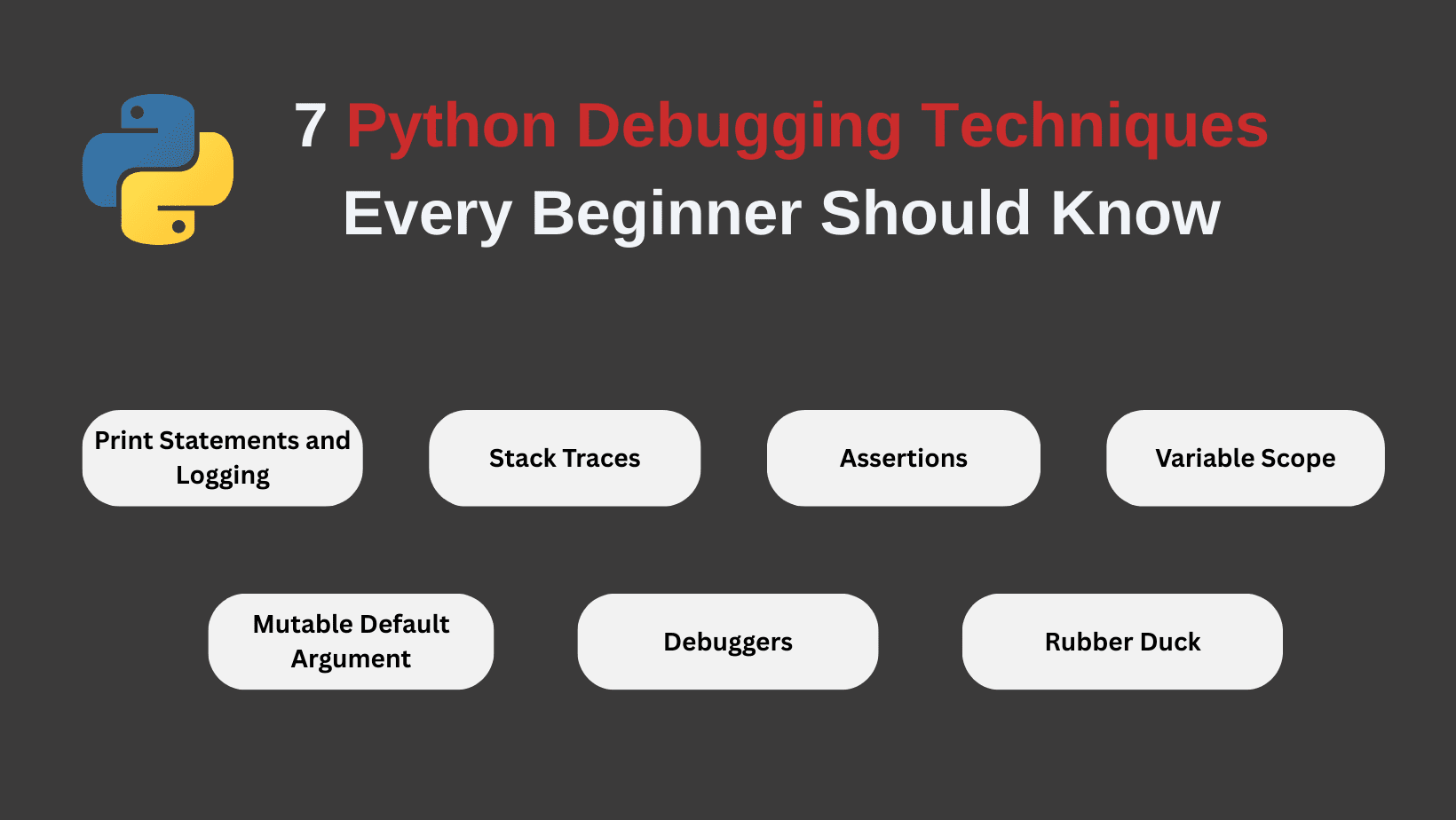

6. Emerging Technologies Shaping the Future of Digital Currency

Blockchain Innovations in Digital Currency

Blockchain technology is at the core of digital currencies, revolutionizing the way transactions are recorded and verified. New blockchain innovations are constantly being developed, improving security, scalability, and speed of digital currency transactions. Smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs) are just a few examples of how blockchain is shaping the future of digital currencies.

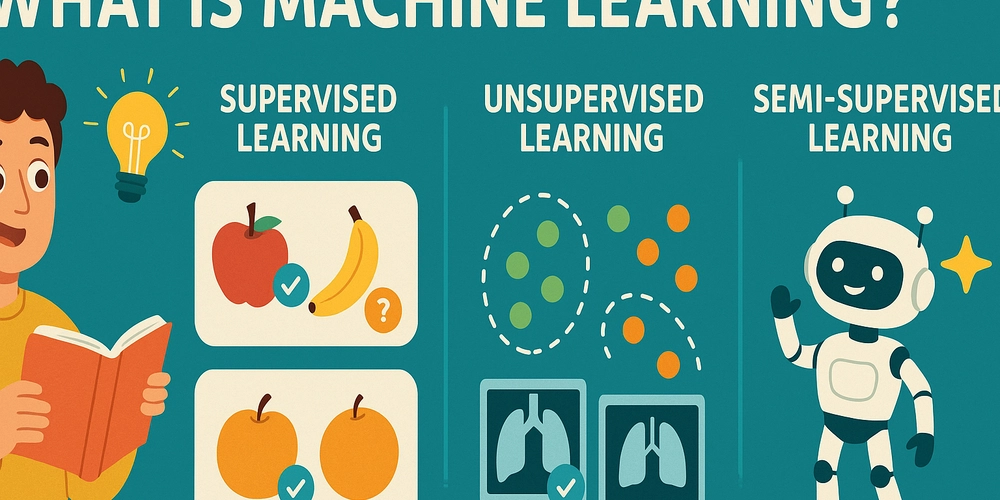

Integration of AI and IoT in Digital Currency Market

Artificial intelligence (AI) and the Internet of Things (IoT) are also playing a significant role in the digital currency market. AI algorithms are being used to analyze market trends, detect fraud, and optimize trading strategies. IoT devices are enabling seamless and secure transactions, creating new opportunities for digital currency use cases. 投资风险 of these technologies is paving the way for a more efficient and interconnected digital currency ecosystem.

7. Investment Strategies and Opportunities in the Digital Currency Market

Diversification Strategies for Digital Currency Portfolios

Diversification is key when it comes to investing in digital currencies. Building a well-balanced portfolio with a mix of established cryptocurrencies like Bitcoin and Ethereum, as well as up-and-coming altcoins, can help mitigate risk and maximize potential returns. Staying informed about market trends and adjusting your portfolio accordingly is essential for long-term investment success in the digital currency market.

Identifying Promising Investment Opportunities

With the rapid evolution of the digital currency market, identifying promising investment opportunities requires thorough research and a keen eye for innovation. Keeping an eye on emerging projects, partnerships, and technological advancements can help investors spot potential winners early on. It's important to consider factors like team expertise, market demand, and scalability potential when evaluating investment opportunities in the dynamic world of digital currencies.

Investing in digital currencies can be exciting and rewarding, but it's crucial to approach it with caution and a long-term perspective. By staying informed, diversifying your portfolio, and seizing promising opportunities, you can navigate the ever-changing landscape of the digital currency market with confidence.In conclusion, the analysis of digital currency market trends underscores the transformative potential and inherent complexities of this rapidly evolving financial ecosystem. As market participants navigate the challenges and opportunities presented by digital currencies, staying informed and adapting to changing trends will be essential for success in this dynamic and burgeoning sector. By fostering a deeper understanding of the forces at play, stakeholders can position themselves strategically to capitalize on the promising future of digital currencies.

FAQs

What are the primary factors influencing trends in the digital currency market?

How do regulatory developments impact the adoption and growth of digital currencies?

What are some emerging technologies that are reshaping the future of the digital currency market?

What are some key strategies for investors looking to capitalize on opportunities in the digital currency market?市场动态

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![Ditching a Microsoft Job to Enter Startup Purgatory with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

.png?#)

.jpeg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_designer491_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple Shares New 'Mac to School' Ads: Pointed, Mirrored, Dropped In [Video]](https://www.iclarified.com/images/news/97295/97295/97295-640.jpg)

![Apple Drops New Trailer for 'F1' Starring Brad Pitt [Video]](https://www.iclarified.com/images/news/97296/97296/97296-640.jpg)

![Apple iPhone Exports From India Surge 116% [Report]](https://www.iclarified.com/images/news/97292/97292/97292-640.jpg)

![Apple Shares 'Last Scene' Short Film Shot on iPhone 16 Pro [Video]](https://www.iclarified.com/images/news/97289/97289/97289-640.jpg)