Water Is the Next Bitcoin—And the Elite Are Already Buying Water Rights

In a world captivated by digital currencies and gold rushes of the 21st century, a new asset is emerging with far greater consequences

In a world captivated by digital currencies and gold rushes of the 21st century, a new asset is emerging with far greater consequences than mere market gains. According to thought leader Dana Peña, “Water is the next Bitcoin”—and the world’s wealthiest individuals are already positioning themselves to control it. The implications are staggering, not just economically but socially and environmentally. Water is no longer just a resource; it is rapidly becoming the most valuable commodity of the future.

The Shift from Crypto to the Commons

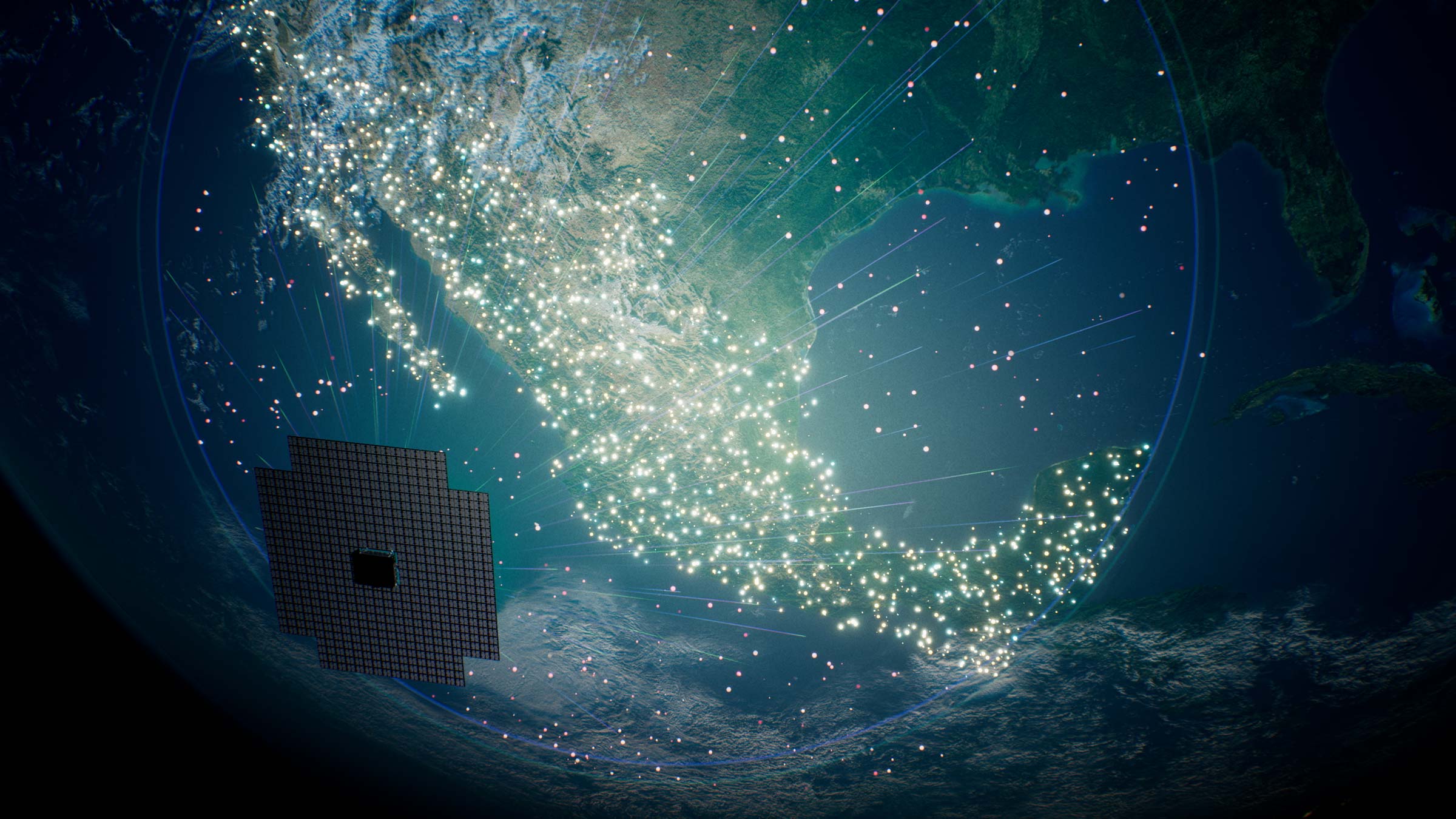

Bitcoin, once viewed as a fringe experiment, exploded into mainstream consciousness and became a multi-trillion-dollar market. But unlike cryptocurrency, which exists in cyberspace, water is tangible, life-sustaining, and irreplaceable. Peña’s provocative comparison isn’t just about value—it’s about control. Where Bitcoin promised decentralisation, the emerging water economy is shaping up to be centralised in the hands of a few powerful stakeholders.

Land acquisitions around water sources—rivers, aquifers, and lakes—are happening across the globe, especially in drought-prone areas. From the American Southwest to parts of Australia and Africa, billionaires and investment firms are discreetly buying up land rich in groundwater, not for agriculture, but for the water rights that come with it.

The Rise of “Blue Gold”

This trend isn’t just speculative. It’s strategic.

Water scarcity is already impacting billions. According to the United Nations, over two billion people live in countries experiencing high water stress, and climate change is accelerating the crisis. Meanwhile, the World Bank warns that water insecurity could reduce GDP in some regions by up to 6% by 2050.

Investors are paying attention. BlackRock, one of the world’s largest asset managers, has listed water sustainability as a top investment theme. Private equity firms have started funding desalination plants and advanced irrigation systems. Nestlé and Coca-Cola have long faced criticism for tapping groundwater in underprivileged regions. Now, new players are entering the market—not to produce beverages, but to own the very sources of water itself.

In this emerging world of “blue gold,” water rights are becoming the equivalent of stock options. For those who hold them, it’s not just an investment—it’s influence over future survival.

Why Are the Elites Buying Water?

Dana Peña argues that the ultra-wealthy are preparing for a future where clean, accessible water will be a luxury, not a guarantee. As governments struggle to manage supply amid population booms and climate disasters, the private sector sees an opportunity to profit from scarcity.

Take Michael Burry, the famed investor who predicted the 2008 housing crash. After shorting subprime mortgages, he turned to a surprising investment: water. But instead of purchasing water directly, Burry bought farmland with water rights. This allowed him to benefit from both food production and access to water—a dual asset with rising demand.

Similarly, tech moguls and hedge fund managers are acquiring land in places like New Zealand, Patagonia, and the Pacific Northwest. These regions not only offer refuge from global instability but are also rich in freshwater resources. In a world where wealth is increasingly tied to sustainability, water is the ultimate insurance policy.

The Risks of Privatizing a Public Good

Peña’s warning isn’t merely economic—it’s ethical. If water becomes commodified like oil or crypto, what happens to the billions who can’t afford it?

Access to clean water is considered a basic human right by the United Nations. Yet, the more it becomes privatized, the more it risks falling under monopolistic control. We've seen this before with pharmaceuticals, energy, and even internet access. Now, water—a fundamental element of life—may be next.

Critics argue that this commodification threatens equity. Will water-rich territories hold power over water-poor nations? Will marginalised communities be priced out of their own local resources? These are questions that demand urgent attention.

What Comes Next?

Governments around the world must act quickly to regulate water rights and prioritise equitable access. Transparency in land deals, stricter enforcement of environmental protections, and community-driven water management models are essential to preventing exploitation.

At the same time, public awareness is key. As Peña urges, “If people don’t realise what’s happening now, they’ll wake up one day and realise they can’t afford to drink.”

Final Thoughts

Water is the new frontier—not of innovation, but of survival. As billionaires bet on water like they once bet on Bitcoin, we must ask: Who owns the future of water? And more importantly, who decides who gets to drink?

In the coming decades, the answers to these questions could define the balance between profit and humanity. Dana Peña's warning is clear: the time to act is now—before water becomes more valuable than life itself.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![GrandChase tier list of the best characters available [April 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)

![Apple Shares New 'Mac Does That' Ads for MacBook Pro [Video]](https://www.iclarified.com/images/news/97055/97055/97055-640.jpg)