Understanding Arbitrum Transaction Fees: A Deep Dive into the Next-Gen Layer 2 Solution

Abstract: This post explores the intricacies of Arbitrum transaction fees and how this next-gen Layer 2 solution is reshaping Ethereum’s ecosystem. We cover the background of Ethereum’s scaling challenges, define key concepts like optimistic rollups and EVM compatibility, review core features and practical use cases (including DeFi and NFT platforms), assess challenges and limitations, and finally predict future innovations. With supporting tables, bullet lists, and curated resources such as Offchain Labs, Ethereum's Gas and Fees Explained, and more, this post provides a holistic outlook on the transformative role of Arbitrum in blockchain technology. Introduction Ethereum’s rapid growth and skyrocketing gas fees have spurred the adoption of Layer 2 solutions that enhance scalability, reduce costs, and provide a better user experience. One of the standout projects in this arena is Arbitrum. By leveraging optimistic rollups and maintaining native EVM compatibility, Arbitrum offers a secure, scalable solution with significantly lower transaction fees. In this post, we will explore the technical aspects behind Arbitrum transaction fees. We aim to provide a clear and detailed analysis targeted at developers, blockchain enthusiasts, and anyone keen on understanding how Arbitrum enhances Ethereum’s capabilities. This insights-rich discussion draws on both the foundational Original Article on Arbitrum Transaction Fees and complementary resources from the blockchain community. Background and Context Before diving into the details of Arbitrum’s fee structure, it is important to understand the broader context: Ethereum’s Growing Pains: Ethereum, the pioneer of smart contracts, has faced issues with scalability and high gas fees during periods of heavy network congestion. This has led to a proliferation of Layer 2 solutions designed to offload transactions from the main chain. Layer 2 Scaling Explained: Layer 2 solutions such as Arbitrum, Optimism, Polygon, and zk-Rollups focus on increasing transaction throughput without compromising security. For instance, Optimism's Approach to Layer 2 Scaling and Polygon's Network Overview are notable examples. Introduction to Arbitrum: Developed by Offchain Labs, Arbitrum leverages optimistic rollups to bundle transactions off-chain and then post minimal summary data on-chain. This not only reduces fees but also increases transaction speed and throughput. Ethereum’s Gas Fees: Gas fees reflect the computational effort required for transaction processing on Ethereum. Detailed insights into this mechanism are available in Ethereum's Gas and Fees Explained. The convergence of these factors has set the stage for Arbitrum to not only lower fees but also facilitate broader adoption of decentralized applications (dApps) and NFT marketplaces. Core Concepts and Features Arbitrum’s innovative design revolves around several core technical features. Below, we dive deep into these concepts: Key Technical Concepts Optimistic Rollups: Arbitrum employs optimistic rollups that assume transactions are valid and only trigger fraud proofs if a discrepancy is detected. This allows for efficient batching of transactions and reduces on-chain processing cost. EVM Compatibility: Developers can deploy smart contracts written in Solidity with minimal changes. This compatibility is crucial for ensuring a seamless shift from Ethereum’s Layer 1 to Arbitrum. Fee Structure and Transaction Fees: The mechanism for calculating fees on Arbitrum is dynamic. Fees are influenced by factors similar to Ethereum gas prices but are optimized thanks to aggregation and off-chain computation. Security and Decentralization: Despite operating off-chain, Arbitrum maintains strong security guarantees by leveraging Ethereum’s consensus layer. Validators and sequencers work in tandem to ensure fault tolerance. Interoperability: Arbitrum supports cross-chain transactions and integration with various DeFi protocols and NFT platforms, which enhances the user experience and ecosystem connectivity. Core Features at a Glance Below is a table summarizing Arbitrum’s core features: Feature Description Transaction Fees Reduced, dynamic fees calculated via off-chain batching and optimized gas mechanisms. Scalability High throughput via optimistic rollups, significantly lowering blockchain congestion. EVM Compatibility Native support for Ethereum smart contracts, ensuring developers face minimal friction during deployment. Security Leverages Ethereum’s security model along with fraud proofs to ensure transaction integrity in a decentralized manner. Interoperability Seamless integration with various DeFi dApps, NFT marketplaces, and cross-chain functionalities, creating broad ecosystem synergy. Bullet List: Benefits of Arbitrum Lower Transaction Costs: Smaller fees compared to Ethereum mainnet. Increased Throughput: Higher transactions

Abstract:

This post explores the intricacies of Arbitrum transaction fees and how this next-gen Layer 2 solution is reshaping Ethereum’s ecosystem. We cover the background of Ethereum’s scaling challenges, define key concepts like optimistic rollups and EVM compatibility, review core features and practical use cases (including DeFi and NFT platforms), assess challenges and limitations, and finally predict future innovations. With supporting tables, bullet lists, and curated resources such as Offchain Labs, Ethereum's Gas and Fees Explained, and more, this post provides a holistic outlook on the transformative role of Arbitrum in blockchain technology.

Introduction

Ethereum’s rapid growth and skyrocketing gas fees have spurred the adoption of Layer 2 solutions that enhance scalability, reduce costs, and provide a better user experience. One of the standout projects in this arena is Arbitrum. By leveraging optimistic rollups and maintaining native EVM compatibility, Arbitrum offers a secure, scalable solution with significantly lower transaction fees.

In this post, we will explore the technical aspects behind Arbitrum transaction fees. We aim to provide a clear and detailed analysis targeted at developers, blockchain enthusiasts, and anyone keen on understanding how Arbitrum enhances Ethereum’s capabilities. This insights-rich discussion draws on both the foundational Original Article on Arbitrum Transaction Fees and complementary resources from the blockchain community.

Background and Context

Before diving into the details of Arbitrum’s fee structure, it is important to understand the broader context:

Ethereum’s Growing Pains:

Ethereum, the pioneer of smart contracts, has faced issues with scalability and high gas fees during periods of heavy network congestion. This has led to a proliferation of Layer 2 solutions designed to offload transactions from the main chain.Layer 2 Scaling Explained:

Layer 2 solutions such as Arbitrum, Optimism, Polygon, and zk-Rollups focus on increasing transaction throughput without compromising security. For instance, Optimism's Approach to Layer 2 Scaling and Polygon's Network Overview are notable examples.Introduction to Arbitrum:

Developed by Offchain Labs, Arbitrum leverages optimistic rollups to bundle transactions off-chain and then post minimal summary data on-chain. This not only reduces fees but also increases transaction speed and throughput.Ethereum’s Gas Fees:

Gas fees reflect the computational effort required for transaction processing on Ethereum. Detailed insights into this mechanism are available in Ethereum's Gas and Fees Explained.

The convergence of these factors has set the stage for Arbitrum to not only lower fees but also facilitate broader adoption of decentralized applications (dApps) and NFT marketplaces.

Core Concepts and Features

Arbitrum’s innovative design revolves around several core technical features. Below, we dive deep into these concepts:

Key Technical Concepts

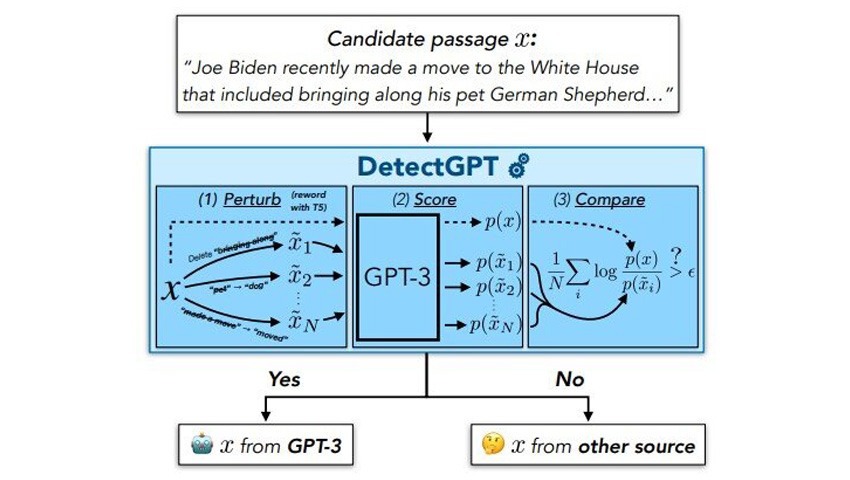

Optimistic Rollups:

Arbitrum employs optimistic rollups that assume transactions are valid and only trigger fraud proofs if a discrepancy is detected. This allows for efficient batching of transactions and reduces on-chain processing cost.EVM Compatibility:

Developers can deploy smart contracts written in Solidity with minimal changes. This compatibility is crucial for ensuring a seamless shift from Ethereum’s Layer 1 to Arbitrum.Fee Structure and Transaction Fees:

The mechanism for calculating fees on Arbitrum is dynamic. Fees are influenced by factors similar to Ethereum gas prices but are optimized thanks to aggregation and off-chain computation.Security and Decentralization:

Despite operating off-chain, Arbitrum maintains strong security guarantees by leveraging Ethereum’s consensus layer. Validators and sequencers work in tandem to ensure fault tolerance.Interoperability:

Arbitrum supports cross-chain transactions and integration with various DeFi protocols and NFT platforms, which enhances the user experience and ecosystem connectivity.

Core Features at a Glance

Below is a table summarizing Arbitrum’s core features:

| Feature | Description |

|---|---|

| Transaction Fees | Reduced, dynamic fees calculated via off-chain batching and optimized gas mechanisms. |

| Scalability | High throughput via optimistic rollups, significantly lowering blockchain congestion. |

| EVM Compatibility | Native support for Ethereum smart contracts, ensuring developers face minimal friction during deployment. |

| Security | Leverages Ethereum’s security model along with fraud proofs to ensure transaction integrity in a decentralized manner. |

| Interoperability | Seamless integration with various DeFi dApps, NFT marketplaces, and cross-chain functionalities, creating broad ecosystem synergy. |

Bullet List: Benefits of Arbitrum

- Lower Transaction Costs: Smaller fees compared to Ethereum mainnet.

- Increased Throughput: Higher transactions per second reduce network congestion.

- Developer-friendly: EVM compatibility allows for easy migration and integration with existing dApps.

- Robust Security: Utilizes Ethereum’s security through periodic on-chain commitment.

- Enhanced Interoperability: Facilitates cross-chain and multi-protocol connectivity.

In addition to these features, Arbitrum’s design lays the groundwork for a new era of decentralized applications. For further insights, check out Arbitrum and Ethereum Gas Price discussions and overviews of the Arbitrum Ecosystem.

Applications and Use Cases

Arbitrum’s scalability and fee efficiency drive practical applications across several domains:

1. Decentralized Finance (DeFi)

Arbitrum’s lowered fees have significant implications for DeFi protocols:

- Lending/Borrowing Platforms: Lower fees enable micro-transactions and open avenues for innovative lending models.

- Yield Farming and Staking: Reduced cost facilitates more efficient yield generation.

- Example: Users can interact with DeFi platforms with minimal overhead costs. Explore Arbitrum and DeFi Yield for in-depth case studies.

2. NFT Marketplaces and Gaming

The NFT space has benefited immensely from Layer 2 solutions like Arbitrum:

- Lower Minting Costs: Reduced fees make it more attractive for artists and developers to mint NFTs.

- Enhanced User Experience: Quicker confirmation times improve trading and in-game asset management.

- Example: Projects such as NFTs on Arbitrum with Open Source Solutions emphasize this trend. Additionally, platforms supporting NFT gaming see improved scalability and cost efficiency.

3. Decentralized Applications (dApps)

dApps across various sectors (finance, social media, and more) have integrated Arbitrum to lower operational costs:

- Seamless User Interactions: With faster transaction finality, end-users enjoy reduced waiting times.

- Developer Flexibility: Developers benefit from a stable fee structure and enhanced cross-chain functionality.

- Example: Several dApps are already exploring integration into the Arbitrum ecosystem. For more on dApp innovations, see Arbitrum dApps.

These use cases illustrate how Arbitrum serves as a catalyst for blockchain innovation, enabling applications that were once hindered by high fees and slow transaction times.

Challenges and Limitations

While Arbitrum represents a significant leap forward, there are still challenges that the platform must confront:

Centralization Concerns:

Some critics argue that the early reliance on centralized sequencers could pose risks. Although robust fraud proof mechanisms exist, the transition toward a more decentralized model remains a work in progress.Delayed Finality:

Although transaction processing is faster overall, finality depends on periodic data commitments to Ethereum. This delay can occasionally impact time-sensitive applications.Complex Fee Dynamics:

The dynamic nature of fee calculations means that users may see fluctuations during periods of network congestion. Understanding the fee structure may be challenging for non-technical users.Interoperability Hurdles:

While Arbitrum is EVM compatible, integrating with a rapidly evolving multi-chain ecosystem could present challenges in terms of standardized protocols and user experience.User Education:

For mass adoption, users must have clarity about how fees are computed and how Layer 2 solutions differ from the Ethereum mainnet.

For more detailed insights into these challenges, consider reading Arbitrum Scalability Issues and Arbitrum and Community Governance for a balanced analysis.

Future Outlook and Innovations

The innovation trajectory of Arbitrum is promising and could drive lasting change in the blockchain ecosystem:

Enhanced Decentralization:

Future upgrades may further decentralize sequencer responsibilities and improve trust models. This will address centralization concerns and promote community governance.Multi-Chain Support:

Interoperability with other blockchains is on the horizon. Multi-chain support could facilitate transactions across diverse ecosystems, allowing for greater liquidity and user reach.Innovative Fee Models:

As the technology matures, we may see more refined fee structures that adjust automatically based on transaction volume and network conditions, ensuring a stable user experience.Integration with NFTs and DeFi Evolution:

Improved transaction speeds and reduced fees are expected to drive higher adoption in NFT marketplaces, gaming platforms, and broader DeFi applications. For instance, Beeple Genesis on Arbitrum sheds light on how Arbitrum is influencing NFT trends.Community-Driven Innovations:

With support mechanisms like GitHub Sponsors for Developers and collaborative funding models, open-source projects on Arbitrum might receive enhanced backing, leading to accelerated development.Emerging Ecosystem Partnerships:

Increased collaboration with established blockchain projects and financial institutions could further legitimize Arbitrum’s role as the backbone for Layer 2 scaling, thereby driving institutional participation.

The convergence of these factors points to an exciting future where reduced transaction fees and enhanced scalability empower a new wave of decentralized innovation.

Summary

In this deep dive on Arbitrum transaction fees, we’ve examined the following key points:

Introduction and Context:

Arbitrum addresses Ethereum’s high gas fees by using Layer 2 scaling solutions via optimistic rollups while staying EVM-compatible.Background and Core Concepts:

We explained Ethereum’s bottlenecks, the principle of optimistic rollups, and how Arbitrum achieves reduced fees through off-chain computation and efficient batch processing.Practical Applications:

Use cases include decentralized finance protocols, NFT marketplaces, and various dApps, which benefit immensely from faster and cheaper transactions.Challenges and Limitations:

Despite its strong potential, Arbitrum faces challenges such as centralization concerns, fee volatility during congestion, and the need for user education on its fee dynamics.Future Innovations:

We highlighted the promise of enhanced decentralization, multi-chain support, innovative fee models, and deeper community integration to drive the future of blockchain.

Additional Resources

For further exploration and to gain deeper insights, the following links are highly recommended:

- Original Article on Arbitrum Transaction Fees

- Offchain Labs - Official Arbitrum

- Ethereum's Gas and Fees Explained

- Optimism's Approach to Layer 2 Scaling

- Polygon (Matic) Network Overview

- zk-Rollups vs Optimistic Rollups

- Arbitrum and Ethereum Gas Price

- Arbitrum dApps

- Arbitrum Ecosystem

- Arbitrum Scalability Issues

Additionally, from the developer community on dev.to, insightful articles include:

- Arbitrum Sequencer Transforming Ethereum’s Capabilities

- Beeple Genesis on Arbitrum: A New Chapter in the NFT Revolution

- License Token: A New Dawn in Open Source Funding

Conclusion

Arbitrum is a groundbreaking Layer 2 solution dedicated to solving Ethereum’s scalability challenges while drastically reducing transaction fees. By harnessing advanced concepts such as optimistic rollups, EVM compatibility, and efficient fee models, Arbitrum is democratizing blockchain usage for developers and end-users alike. While challenges remain—especially around centralization and user education—the future looks bright with promising upgrades and expanding partnerships.

Whether you are a developer eager to optimize your dApp’s performance or a blockchain enthusiast interested in the next chapter of DeFi and NFT innovation, understanding Arbitrum’s transaction fees is key. As this technology evolves, its impact on the broader ecosystem will undoubtedly grow, paving the way for a more scalable, efficient, and decentralized future.

Embracing innovations like Arbitrum not only lowers transaction costs but also inspires a reimagined digital landscape—where blockchain usability meets industry-scale adoption.

By staying informed and engaging with resources across the blockchain spectrum, we can collectively power the next generation of decentralized solutions. Happy exploring!

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Koofr Cloud Storage: Lifetime Subscription (1TB) (80% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Is this too much for a modular monolith system? [closed]](https://i.sstatic.net/pYL1nsfg.png)

_roibu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![M4 MacBook Air Drops to Just $849 - Act Fast! [Lowest Price Ever]](https://www.iclarified.com/images/news/97140/97140/97140-640.jpg)

![Apple Smart Glasses Not Close to Being Ready as Meta Targets 2025 [Gurman]](https://www.iclarified.com/images/news/97139/97139/97139-640.jpg)

![iPadOS 19 May Introduce Menu Bar, iOS 19 to Support External Displays [Rumor]](https://www.iclarified.com/images/news/97137/97137/97137-640.jpg)