Trimmer IPOs and secondaries: How late-stage startups and investors are braving the choppy markets

In an increasingly volatile market, investors are exercising caution, prompting IPO-bound startups to slash their offer sizes considerably. Some late-stage companies are looking to raise funds at a flat valuation, while those with adequate cash flow may wait and watch how things unfold.

The first three months of 2025 saw a significant surge in late-stage funding compared to the same period last year. However, the next few months may not be as buoyant for late-stage startups, given the various developments on the global economic front, according to industry experts.

The money tap may not dry out completely but it is likely to slow down, and smaller cheques could be the order of the day.

Amidst the choppy waters, investors are exercising caution, prompting IPO-bound startups, including Ather Energy and Urban Company, to trim their offer sizes considerably. Some late-stage companies are looking to raise funds at a flat valuation, while those with adequate cash flow prefer to wait and watch how things unfold.

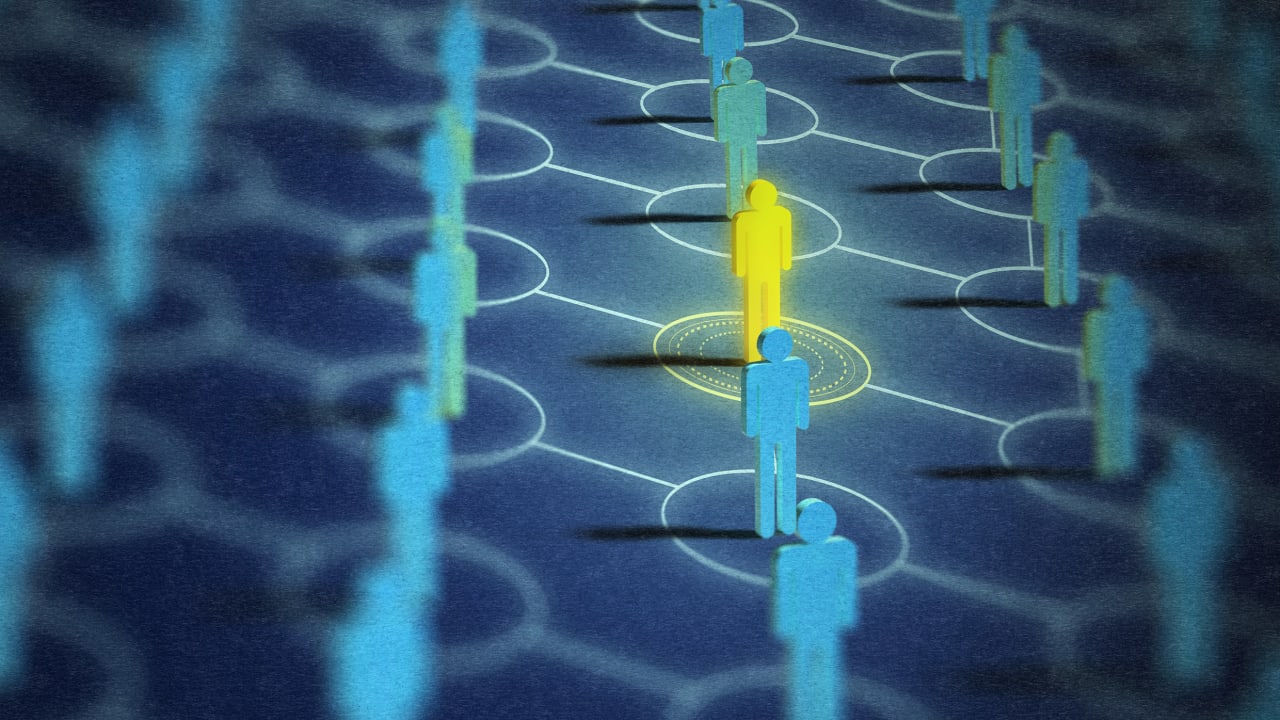

Meanwhile, the investing ecosystem—especially venture capitalists—seems to have found a silver lining in secondary funds to offload stakes.

Ripples in the startup ecosystem

The recent import tariffs levied by US President Donald Trump have triggered a global trade war of sorts, leading to uncertain macroeconomic conditions. They have also affected investor sentiments in the Indian markets, sparking fears of a trade slowdown.

The ripples can be felt in the startup ecosystem too. According to market watchers and industry experts, investors are planning to slow down funding to late-stage companies, barring highly scalable and profitable startups.

The market conditions may be volatile now, but the year began on a strong note for late-stage startups—driven by a slew of VC-backed startups that went public in 2024 and the rising number of matured startups ready for the public markets.

In the first three months of 2025, 13 companies secured funding at the Series F stage and above, compared to 6 companies in the same period last year. According to data from Venture Intelligence, the total amount raised in the Series F round and above was $918 million for the three months ended March 25—a significant rise from $179 million routed to late-stage companies in the first quarter of 2024.

However, late-stage funding is heading towards tricky times in the coming months.

“It’s a tricky market at this point of time. There are many macro factors at play and it wouldn't be right to call it a bear market either. Investors are okay with a slow market and maybe even some negative sentiment but they don’t like uncertainty. Especially in the VC market, off late, investors are okay to wait and watch and spend a lot of time building conviction,” says Aakash Agrawal, Head of Digital and New Age Business, Anand Rathi Investment Banking. In the first three months of this year, 13 companies secured funding at the Series F and above stages.

Combating pressure

Challenging market conditions and investor concerns are forcing many startups to raise late-stage funding at a flat valuation.

For instance, B2B ecommerce firm Udaan raised $75 million in a fresh funding round from existing investors in February this year at a flat valuation. The company, which is reportedly preparing for an IPO, was valued at $1.8 billion as on January 16, according to data from Tracxn.

Used car marketplace, Spinny, also reportedly raised $131 million at a flat valuation, according to an Inc42 report.

Companies that are IPO-bound are caught in a conundrum: should they wait for the markets to improve or reduce their issue size? Some are choosing the latter.

Professional services platform Urban Company has slashed its IPO size to Rs 528 crore from a reportedly previous target of Rs 3,000 crore, in the face of turbulent markets and rising investor pressure.

EV maker Ather Energy plans to raise Rs 2,626 crore, as opposed to its earlier plan of raising Rs 3,100 crore outlined in its DRHP filed in September last year.

Trimming the issue size can help the startup achieve optimum pricing on the bourses and attract investors, and prevent anchor investors and mutual funds from squeezing the startup on pricing, says Norbert Fernandes, Partner at Kenro Capital.

While some mature companies are headed towards listing for their next phase of growth, late-stage companies with the cash flow to sustain themselves for a few more months may prefer to wait and watch for now.

“Company promoters and management will want to take a pause and see where things are headed. They will want to wait to see how the market conditions fundamentally impact their business,” says Shobhit Mathur, Co-founder of wealth management company Ionic Wealth.

Meanwhile, the investing ecosystem is turning to secondary funds to navigate the current period. Secondary funds are investment vehicles that purchase existing stakes or assets from private equity fund investors.

For VCs struggling for exits amidst the market uncertainty, secondaries are becoming an attractive option to liquidate their holdings.

“The more nervousness there is around the IPO market, the more potential sellers who are coming forward and having pragmatic conversations around secondaries," notes Fernandes.

While big-ticket transactions continue to happen in the overall startup ecosystem, the constituents of this capital are seeing a shift. There is a smaller percentage of primary capital and a larger share of secondary capital, according to Fernandes.

What this means is that the amount of new money coming into a company, typically in exchange for newly issued shares, has gone down, indicating that companies being built today need lower amounts of capital to fund their growth.

VCs will continue to cut smaller cheques

It is no secret that VC firms have scaled back on writing large cheques to companies across all funding stages—a marked shift from 2022, which saw ballooning valuations and lofty cheques.

As mentioned earlier, the total amount raised in Series F stage and above was $918 million in the first three months of 2025. In 2022, this was $2.61 billion.

As a result of the funding boom of 2022, a large number of startups are in their late stages now. While VCs have a bigger pool of startups to choose from, as they seek to diversify their investment bets, cheque sizes will continue to be smaller, and price rationalisation will be key going forward.

“Late stage VC investors who would earlier deploy anywhere from $100 million to $300 million in maturing startups are more comfortable taking $50 million to $100 million bets and instead look for companies that are more capital efficient,” says Agrawal of Anand Rathi Investment Banking.

Focus on quality and profitability

Late-stage startups are often benchmarked against public companies as they line up to list on public bourses. This comes with greater investor scrutiny over performance, deeper due diligence, and focus on burn rate and quality.

Investors are increasingly backing late-stage startups that have built a strong business model, rising above all the noise and clutter, and have neared profitability or have clear profitability targets for the near-term.

“It’s going to be very tough for companies that are significantly EBITDA loss-making or with low clarity on how they will move into the green. If you are that kind of company, the chances of going public are quite low right now, and likely so for the next 6-12 months," says Fernandes of Kenro Capital.

Edited by Swetha Kannan

.jpg)

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[Research] Starting Web App in 2025: Vibe-coding, AI Agents….](https://media2.dev.to/dynamic/image/width%3D1000,height%3D500,fit%3Dcover,gravity%3Dauto,format%3Dauto/https:%2F%2Fdev-to-uploads.s3.amazonaws.com%2Fuploads%2Farticles%2Fby8z0auultdpyfrx5tx8.png)

![[DEALS] Koofr Cloud Storage: Lifetime Subscription (1TB) (80% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

-RTAガチ勢がSwitch2体験会でゼルダのラスボスを撃破して世界初のEDを流してしまう...【ゼルダの伝説ブレスオブザワイルドSwitch2-Edition】-00-06-05.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_roibu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

.webp?#)

![M4 MacBook Air Drops to Just $849 - Act Fast! [Lowest Price Ever]](https://www.iclarified.com/images/news/97140/97140/97140-640.jpg)

![Apple Smart Glasses Not Close to Being Ready as Meta Targets 2025 [Gurman]](https://www.iclarified.com/images/news/97139/97139/97139-640.jpg)

![iPadOS 19 May Introduce Menu Bar, iOS 19 to Support External Displays [Rumor]](https://www.iclarified.com/images/news/97137/97137/97137-640.jpg)