Bad news for Tesla: Trump might kill the climate credits that have been a key part of its business model

One crucial factor helped keep Tesla profitable last quarter, and it wasn’t direct car sales. In its latest earnings report, the company said that it earned $595 million from selling regulatory credits to other automakers. The credits are issued by governments, including California, that require car companies to hit certain emissions goals by selling cleaner vehicles. If they don’t, they have to make up the gap by buying credits from companies like Tesla that make zero-emissions cars. Tesla’s sales tanked in the first quarter as Elon Musk’s dive into politics pushed away customers, both in the U.S. and internationally. The company reported that it earned $409 million in the first quarter of 2025, down 71% from the same quarter a year ago. Without the revenue from selling credits, Tesla would have posted a $186 million loss. Now, President Trump is actively trying to dismantle the system that makes the credits possible. Republicans in Congress are helping that effort. The House is set to vote this week on a bill that aims to take away California’s right to have strict air quality standards—and the market for zero-emissions vehicle credits that exists in the state. A long history of relying on credits The credits have been important since Tesla’s beginning. In the early years, “it’s really what kept them out of bankruptcy,” says David Sperling, founding director of the Institute for Transportation Studies at UC Davis. Sperling previously helped set up the zero-emissions vehicle credit system in California. Multiple other states that follow California’s air quality standards, from Colorado to Virginia, also issue the credits. While Tesla also earns money from a credit system in Europe and a small amount through a federal program, most of the credits it sells are in California and other states. At points in the company’s history when it particularly struggled, credits kept it going. “The company was structurally unprofitable for a long, long time,” says Ed Niedermeyer, author of Ludicrous: The Unvarnished Story of Tesla Motors. If the cushion of the credits hadn’t existed, the company might look very different now. Musk once considered a sale to Google at one of Tesla’s low points, for example. In theory, the company might not have even survived. The credits still matter Eventually, Tesla was selling enough cars that it became profitable without the credits (at least until now). But the credits continued playing an important role. “Especially given the economic uncertainty right now, it remains an important driver for a type of profit in pre-cash flows,” says Seth Goldstein, an equity analyst at Morningstar. Credits also helped it accrue around $37 billion in cash. “If we do have a long-term economic slowdown, Tesla should be able to withstand the slowdown because it does have such a strong balance sheet,” Goldstein says. “So I’ll attribute that to the credit allowing Tesla to put itself in a very strong position.” The credits weren’t designed to last forever, and Goldstein argues that Tesla is positioning itself not to need them. As more automakers make EVs, they’ll have to buy fewer credits from electric-first companies like Tesla. Eventually, if California can keep its plan in place, all new car sales in the state will be zero-emissions by 2035. But as the state ramps up its emissions requirements on the way to that goal, some brands may not be able to keep up the pace and credits will become more valuable. “The value of the credits is pretty low right now because the market is outpacing the regulatory requirements,” says Sperling. “But that’s going to change probably within a year or two. If the authority stays in place and the regulations stay in place, those credits are going to become more and more valuable.” As Tesla’s sales falter, the credits play a more important role. The drop in sales isn’t solely because of the damage that Musk has caused the brand. Other car companies now offer a suite of options for EVs that customers may find more appealing, especially as Tesla has been slow to roll out new models. Musk has touted Tesla’s work on robotics and automation, but neither are ready to immediately come to market. (Both may be the latest examples of Musk’s hype machine.) The company has promised a new, more affordable car, but it likely won’t be out until next year. The sales of its current lineup of cars are still critical, which means that credits are, too. No one knows what’s next The state credits are at risk in two ways. Right now they’re possible because of California’s long-standing right to regulate air pollution. When the Clean Air Act passed in 1970, California already had air quality laws, so it was given a waiver to continue setting its own strict emissions standards for cars. Other states also have the option to follow California. Trump tried to eliminate that waiver in his first term, and California and other states sued. (Four automakers t

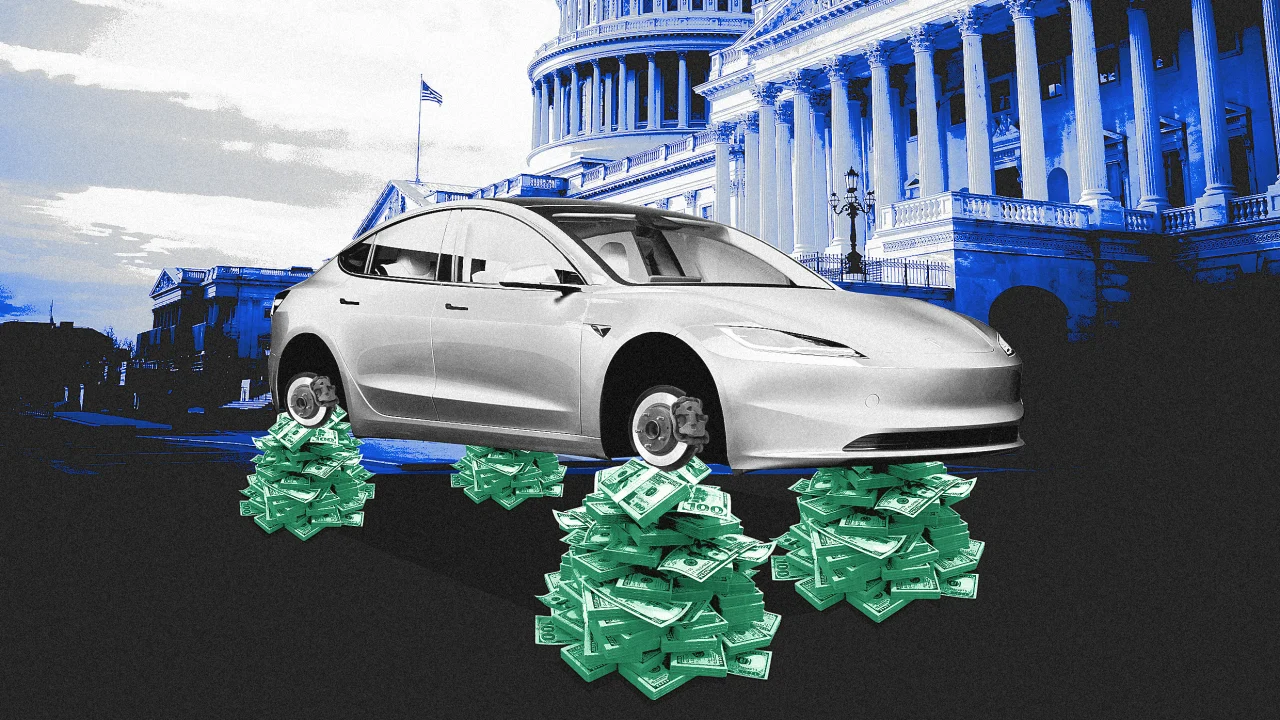

One crucial factor helped keep Tesla profitable last quarter, and it wasn’t direct car sales.

In its latest earnings report, the company said that it earned $595 million from selling regulatory credits to other automakers. The credits are issued by governments, including California, that require car companies to hit certain emissions goals by selling cleaner vehicles. If they don’t, they have to make up the gap by buying credits from companies like Tesla that make zero-emissions cars.

Tesla’s sales tanked in the first quarter as Elon Musk’s dive into politics pushed away customers, both in the U.S. and internationally. The company reported that it earned $409 million in the first quarter of 2025, down 71% from the same quarter a year ago. Without the revenue from selling credits, Tesla would have posted a $186 million loss.

Now, President Trump is actively trying to dismantle the system that makes the credits possible. Republicans in Congress are helping that effort. The House is set to vote this week on a bill that aims to take away California’s right to have strict air quality standards—and the market for zero-emissions vehicle credits that exists in the state.

A long history of relying on credits

The credits have been important since Tesla’s beginning. In the early years, “it’s really what kept them out of bankruptcy,” says David Sperling, founding director of the Institute for Transportation Studies at UC Davis. Sperling previously helped set up the zero-emissions vehicle credit system in California.

Multiple other states that follow California’s air quality standards, from Colorado to Virginia, also issue the credits. While Tesla also earns money from a credit system in Europe and a small amount through a federal program, most of the credits it sells are in California and other states.

At points in the company’s history when it particularly struggled, credits kept it going. “The company was structurally unprofitable for a long, long time,” says Ed Niedermeyer, author of Ludicrous: The Unvarnished Story of Tesla Motors. If the cushion of the credits hadn’t existed, the company might look very different now. Musk once considered a sale to Google at one of Tesla’s low points, for example. In theory, the company might not have even survived.

The credits still matter

Eventually, Tesla was selling enough cars that it became profitable without the credits (at least until now). But the credits continued playing an important role. “Especially given the economic uncertainty right now, it remains an important driver for a type of profit in pre-cash flows,” says Seth Goldstein, an equity analyst at Morningstar.

Credits also helped it accrue around $37 billion in cash. “If we do have a long-term economic slowdown, Tesla should be able to withstand the slowdown because it does have such a strong balance sheet,” Goldstein says. “So I’ll attribute that to the credit allowing Tesla to put itself in a very strong position.”

The credits weren’t designed to last forever, and Goldstein argues that Tesla is positioning itself not to need them. As more automakers make EVs, they’ll have to buy fewer credits from electric-first companies like Tesla. Eventually, if California can keep its plan in place, all new car sales in the state will be zero-emissions by 2035. But as the state ramps up its emissions requirements on the way to that goal, some brands may not be able to keep up the pace and credits will become more valuable.

“The value of the credits is pretty low right now because the market is outpacing the regulatory requirements,” says Sperling. “But that’s going to change probably within a year or two. If the authority stays in place and the regulations stay in place, those credits are going to become more and more valuable.”

As Tesla’s sales falter, the credits play a more important role. The drop in sales isn’t solely because of the damage that Musk has caused the brand. Other car companies now offer a suite of options for EVs that customers may find more appealing, especially as Tesla has been slow to roll out new models. Musk has touted Tesla’s work on robotics and automation, but neither are ready to immediately come to market. (Both may be the latest examples of Musk’s hype machine.) The company has promised a new, more affordable car, but it likely won’t be out until next year. The sales of its current lineup of cars are still critical, which means that credits are, too.

No one knows what’s next

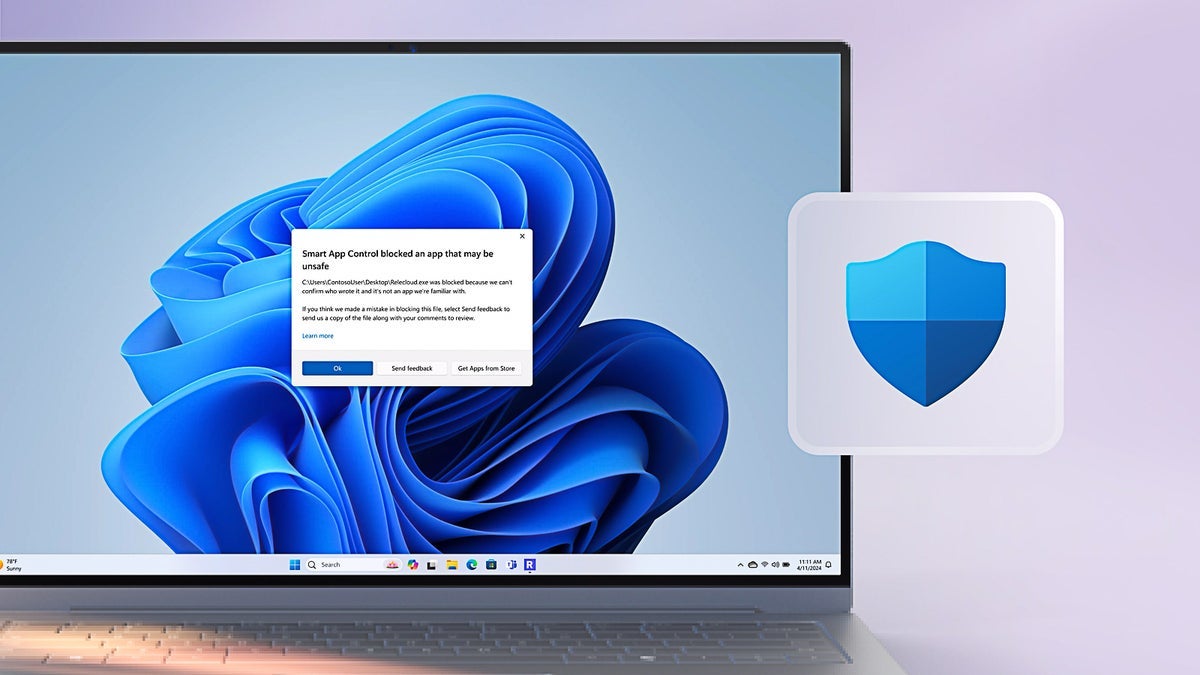

The state credits are at risk in two ways. Right now they’re possible because of California’s long-standing right to regulate air pollution. When the Clean Air Act passed in 1970, California already had air quality laws, so it was given a waiver to continue setting its own strict emissions standards for cars. Other states also have the option to follow California.

Trump tried to eliminate that waiver in his first term, and California and other states sued. (Four automakers then agreed to voluntarily meet California’s standards.) When Biden took office, with the lawsuit still underway, he restored the waiver. But fuel producers and industry groups sued—saying the Environmental Protection Agency shouldn’t have put the waiver back in place—and the Supreme Court is now considering whether that lawsuit can proceed.

Separately, Congressional Republicans are trying to reverse the EPA’s waivers for California’s plans to phase out new gas cars and trucks. The House will vote this week. In the Senate, the parliamentarian has said that Congress doesn’t have the authority to repeal the waivers. But Senate Republicans may try anyway.

Whatever happens, more lawsuits will follow. That means that the regulatory credits won’t immediately disappear. And Tesla, for now, will be able to keep using them—even as Elon Musk continues to rant about government handouts.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Koofr Cloud Storage: Lifetime Subscription (1TB) (80% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

-RTAガチ勢がSwitch2体験会でゼルダのラスボスを撃破して世界初のEDを流してしまう...【ゼルダの伝説ブレスオブザワイルドSwitch2-Edition】-00-06-05.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

_roibu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![M4 MacBook Air Drops to Just $849 - Act Fast! [Lowest Price Ever]](https://www.iclarified.com/images/news/97140/97140/97140-640.jpg)

![Apple Smart Glasses Not Close to Being Ready as Meta Targets 2025 [Gurman]](https://www.iclarified.com/images/news/97139/97139/97139-640.jpg)

![iPadOS 19 May Introduce Menu Bar, iOS 19 to Support External Displays [Rumor]](https://www.iclarified.com/images/news/97137/97137/97137-640.jpg)