TapFin rolls out NBFC arm to boost green financing

The wholly-owned subsidiary, GoGreen Capital, aims to provide financing for clean mobility, solar, and battery circulatory sectors.

Sustainable financing platform TapFin on Tuesday rolled out its non-banking financial company (NBFC), GoGreen Capital, to help provide green financing as it looks to help businesses transition to renewable energy.

The NBFC, which will initially focus on clean mobility, solar, and battery circulatory sectors, will help startups, middle, small, and medium enterprises (MSMEs), and fleet operators, among others to secure capital for sustainability driven initiatives.

According to Pramod Mara, Co-founder and CBO at TapFin, the idea to set up an NBFC came from observing and closely working in the financial services sector.

“Lenders are still not too excited about that space, while the regulators are nudging financial institutions to start focusing on sustainability. And we realised there's a great opportunity out there where you're not just there as a platform matchmaking different ecosystem participants, but also playing an extremely active role as one of the ecosystem participants. And this is where we thought we'd start with our own NBFC,” Mara told YourStory.

The new unit will provide commercial asset loans, business loans, and leasing solutions tailored to the initial focus sectors. GoGreen will tap into TapFin’s platform for data driven underwriting and contextual credit assessments that is based on non-traditional insights like vehicle usage patterns, battery analytics, and fleet operations. This will help the company tailor solutions suitable for each player in the ecosystem.

GoGreen Capital will also partner with financial institutions and fintech platforms to expand green financing, including co-lending oppurtunities, and will take steps to ensure businesses across Tier II and III cities have access to financing solutions.

Edited by Megha Reddy

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

![PSA: It’s not just you, Spotify is down [U: Fixed]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2023/06/spotify-logo-2.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![[Update: Optional] Google rolling out auto-restart security feature to Android](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-2.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

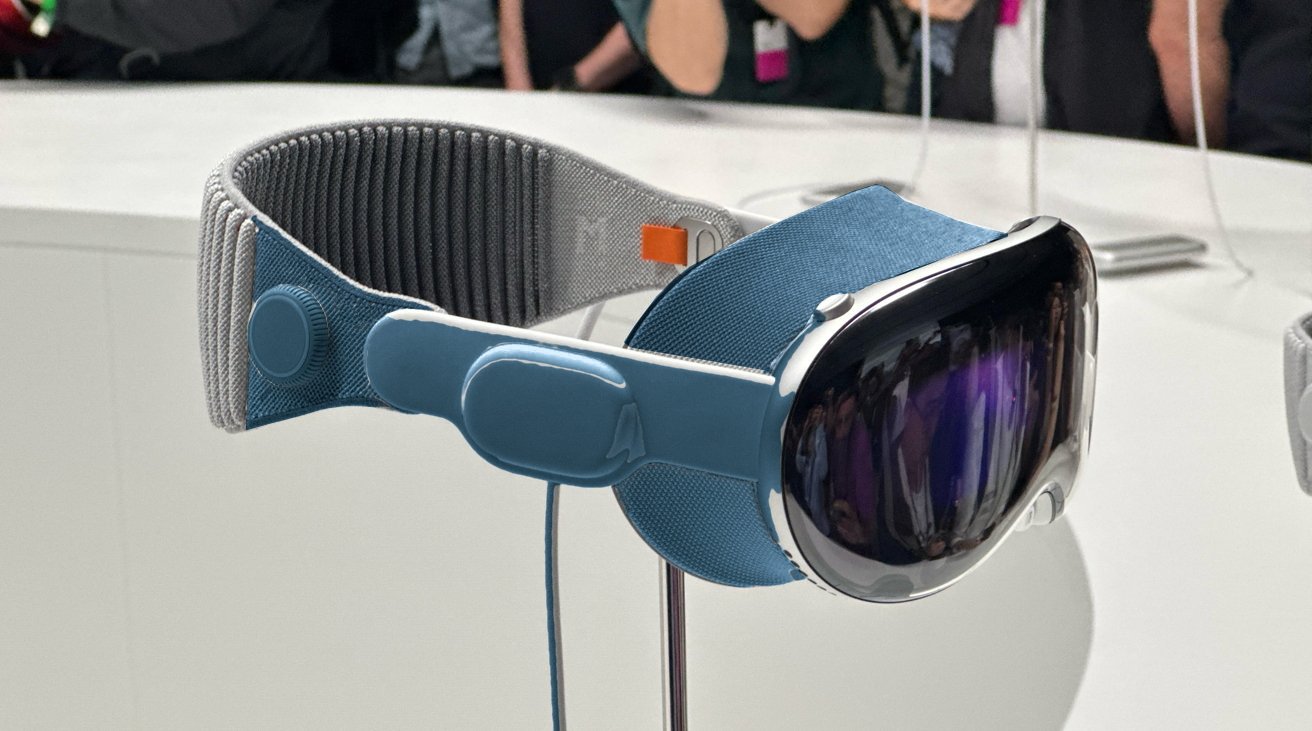

![Apple Vision 'Air' Headset May Feature Titanium and iPhone 5-Era Black Finish [Rumor]](https://www.iclarified.com/images/news/97040/97040/97040-640.jpg)

![Apple to Split Enterprise and Western Europe Roles as VP Exits [Report]](https://www.iclarified.com/images/news/97032/97032/97032-640.jpg)