NPCI to decide on UPI merchant transaction limits, says RBI Governor

However, RBI Governor Sanjay Malhotra said, limits on person-to-person (P2P) UPI payments, which is Rs 1 lakh as of now, will remain unchanged.

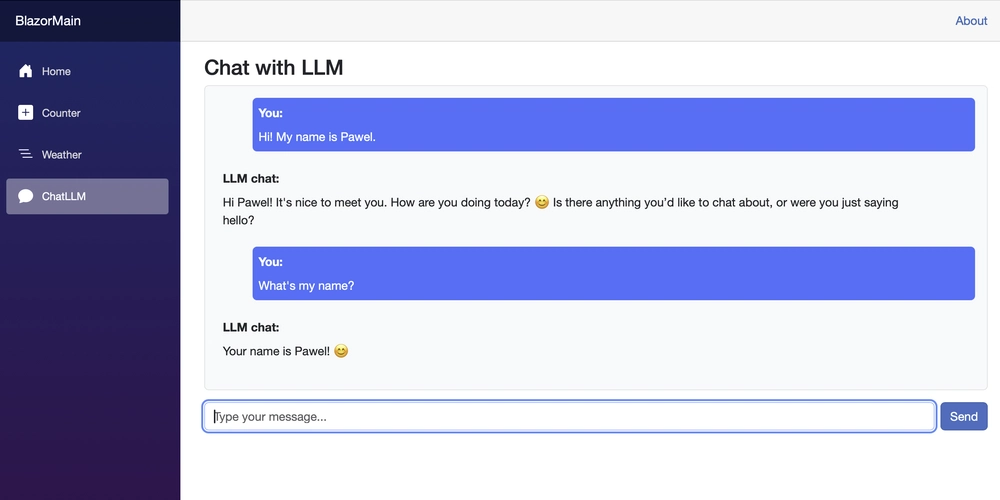

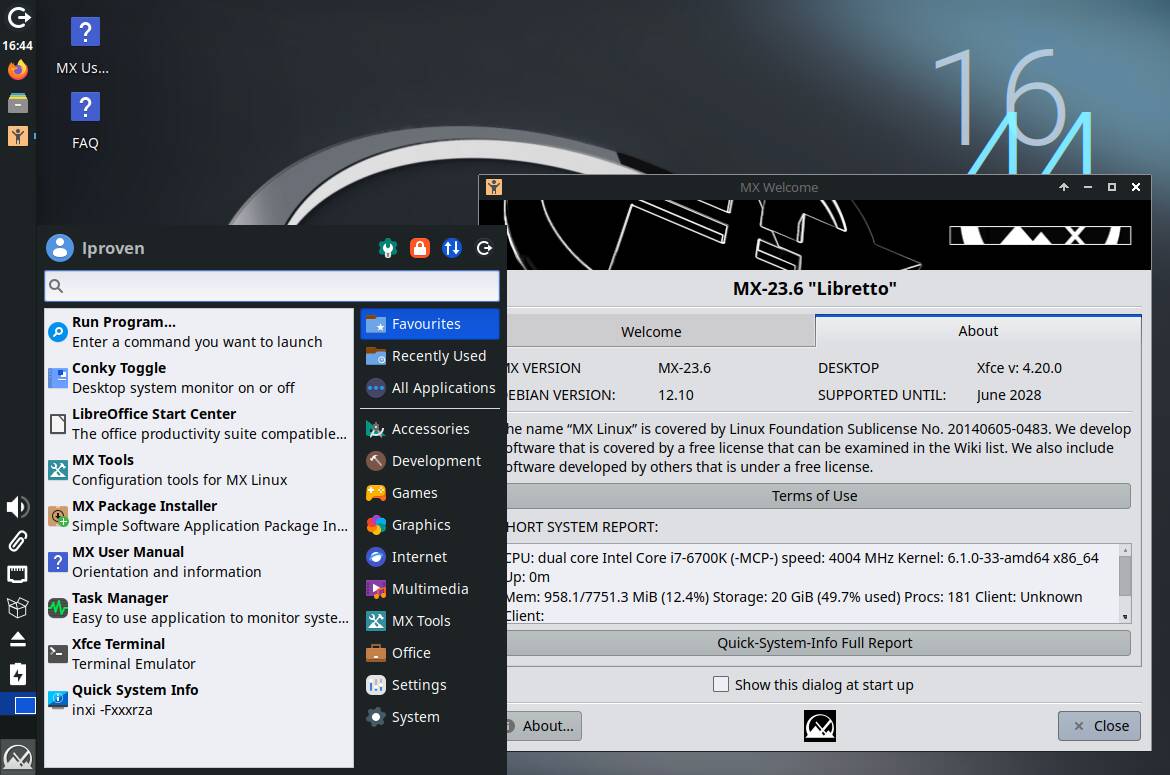

India’s central bank, the Reserve Bank of India, on Wednesday said that it will allow the National Payments Corporation of India (NPCI) to revise the transaction limits for Unified Payments Interface (UPI) payments made to merchants. The move is aimed at making the digital payments system more responsive to the economy’s needs.

Speaking at a press briefing, RBI Governor Sanjay Malhotra said, “RBI is enabling NPCI to decide, in consultation with the banks and other stakeholders, the transaction limits in UPI for person to merchant transactions.” Currently, the limit for such transactions stands at Rs 2 lakh.

The new policy framework gives NPCI—the umbrella body for retail digital payments—greater flexibility in calibrating limits for person-to-merchant (P2M) payments. “We will give the freedom to NPCI, in consultation with other stakeholders, to revise it as per the needs of the economy,” Malhotra added.

However, limits on person-to-person (P2P) UPI payments will remain unchanged. “I may also clarify over here that the P to P transaction limit, which is one lakh rupees as of now, will remain the same, and there is no change with regard to the regulations,” Malhotra said.

Edited by Megha Reddy

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![GrandChase tier list of the best characters available [April 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)