Navigating the Complexities of Government Funding: A Technical & Holistic Perspective

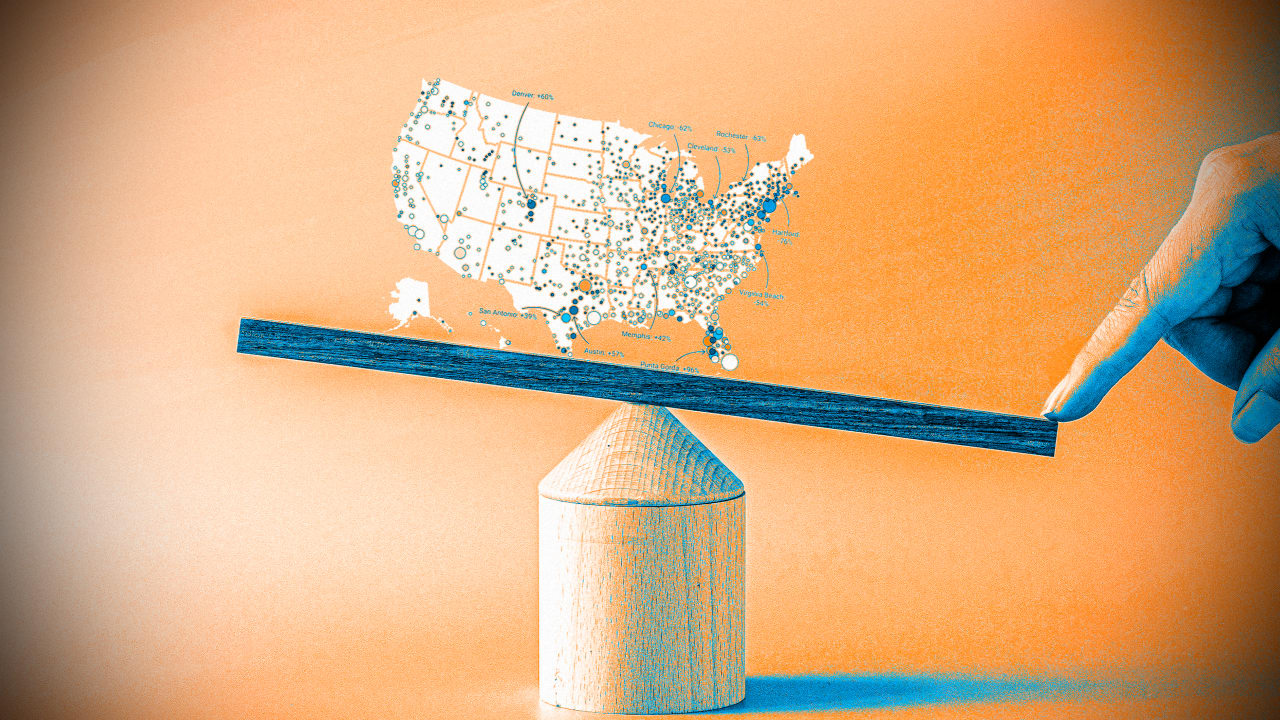

Abstract: Government funding is an ever‐challenging cornerstone for national development and public services. This blog post dives into the multifaceted world of public finance—from economic and political challenges to innovative solutions using technology and open-source methodologies. We analyze the obstacles, discuss historical background, and demonstrate use cases and future trends in government funding. With technical insights and actionable steps, we explore dynamic tax policies, public–private partnerships, and blockchain-based transparency to promote sustainable funding. The discussion is enriched with tables, bullet lists, and relevant hyperlinks including references to government funding issues, taxation, and other authoritative resources, as well as insights from trusted Dev.to posts. Introduction Government funding drives national development, ensuring that essential services like healthcare, education, and infrastructure are adequately supported. Yet, as economies fluctuate and political landscapes shift, maintaining a stable funding stream becomes increasingly complex. In this post, we delve into the intricacies of government funding and explore strategic solutions that can lead governments toward more transparent, efficient, and ethical financial management. By integrating modern approaches—such as blockchain for tracking public finance and innovative models for open-source funding—we can bridge the funding gaps that challenge many modern governments. Background and Context Historical Perspective and Definitions Government funding primarily comes from taxation, bond issuance, and loans. Historically, these financial mechanisms have enabled countries to pursue large-scale public projects and foster societal advancement. As noted in the original article, fluctuations in employment and consumer spending during economic downturns can dramatically affect these revenue streams. Taxation: A necessary tool for revenue generation. Detailed information is available on Tax. Bonds and Loans: These financial instruments can help governments quickly secure funds. Learn more at Bond (finance). Ecosystem of Funding The government funding ecosystem has multiple interconnected layers—from economic conditions to political influences and administrative structures. The framework serves as the backbone for maintaining public infrastructure and fostering innovation, including in the technology and open-source sectors. Notably, sustainable funding for open-source projects is critical to ensuring long-term advancements in software and technology (sustainable funding for open source). The Role of Politics and Bureaucracy Political dynamics can heavily influence funding allocation. Political parties may favor projects that align with their ideologies rather than focusing solely on public need. Additionally, bureaucratic inefficiencies and red tape can result in delayed fund dispersal, accountability issues, and waste. For those interested in more ethical approaches to funding, resources on ethical funding methods offer valuable insights. Core Concepts and Features Government funding involves a nuanced interplay of several factors that affect its workflow and outcomes. Here, we break down these core components: Economic Challenges Revenue Dependency: Government revenue relies on economic activity. When the economy slows, decreased employment and consumer spending lead to reduced tax revenue. Budget Reallocation: Lower revenues force governments to cut spending, impacting critical services such as public health and infrastructure. Funding for Innovation: Projects like open-source software rely on consistent funding. Maintaining software sustainability is paramount in the digital age. Political Influences Funding Prioritization: Political agendas often determine which sectors receive funding. This can result in uneven distribution, where certain projects enjoy disproportionate attention over more pressing societal needs. Transparency and Accountability: Political and bureaucratic influences can reduce transparency. Adopting modern auditing tools and improving oversight mechanisms are essential to mitigate these challenges. External Pressures Crisis Response: During crises—such as the COVID-19 pandemic—governments must redirect funds to emergency response, often at the expense of other sectors. Risk Management: Implementing comprehensive risk management strategies is key to preparing for such unpredictable events and safeguarding essential services. Strategic Solutions Governments can utilize several strategies to improve funding efficiency: Dynamic Tax Policies: Adjusting tax rates in response to economic changes helps maintain a steady revenue stream. Public–Private Partnerships: These collaborations diversify funding sources and stimulate investment in public projects. B

Abstract:

Government funding is an ever‐challenging cornerstone for national development and public services. This blog post dives into the multifaceted world of public finance—from economic and political challenges to innovative solutions using technology and open-source methodologies. We analyze the obstacles, discuss historical background, and demonstrate use cases and future trends in government funding. With technical insights and actionable steps, we explore dynamic tax policies, public–private partnerships, and blockchain-based transparency to promote sustainable funding. The discussion is enriched with tables, bullet lists, and relevant hyperlinks including references to government funding issues, taxation, and other authoritative resources, as well as insights from trusted Dev.to posts.

Introduction

Government funding drives national development, ensuring that essential services like healthcare, education, and infrastructure are adequately supported. Yet, as economies fluctuate and political landscapes shift, maintaining a stable funding stream becomes increasingly complex. In this post, we delve into the intricacies of government funding and explore strategic solutions that can lead governments toward more transparent, efficient, and ethical financial management. By integrating modern approaches—such as blockchain for tracking public finance and innovative models for open-source funding—we can bridge the funding gaps that challenge many modern governments.

Background and Context

Historical Perspective and Definitions

Government funding primarily comes from taxation, bond issuance, and loans. Historically, these financial mechanisms have enabled countries to pursue large-scale public projects and foster societal advancement. As noted in the original article, fluctuations in employment and consumer spending during economic downturns can dramatically affect these revenue streams.

- Taxation: A necessary tool for revenue generation. Detailed information is available on Tax.

- Bonds and Loans: These financial instruments can help governments quickly secure funds. Learn more at Bond (finance).

Ecosystem of Funding

The government funding ecosystem has multiple interconnected layers—from economic conditions to political influences and administrative structures. The framework serves as the backbone for maintaining public infrastructure and fostering innovation, including in the technology and open-source sectors. Notably, sustainable funding for open-source projects is critical to ensuring long-term advancements in software and technology (sustainable funding for open source).

The Role of Politics and Bureaucracy

Political dynamics can heavily influence funding allocation. Political parties may favor projects that align with their ideologies rather than focusing solely on public need. Additionally, bureaucratic inefficiencies and red tape can result in delayed fund dispersal, accountability issues, and waste. For those interested in more ethical approaches to funding, resources on ethical funding methods offer valuable insights.

Core Concepts and Features

Government funding involves a nuanced interplay of several factors that affect its workflow and outcomes. Here, we break down these core components:

Economic Challenges

- Revenue Dependency: Government revenue relies on economic activity. When the economy slows, decreased employment and consumer spending lead to reduced tax revenue.

- Budget Reallocation: Lower revenues force governments to cut spending, impacting critical services such as public health and infrastructure.

- Funding for Innovation: Projects like open-source software rely on consistent funding. Maintaining software sustainability is paramount in the digital age.

Political Influences

- Funding Prioritization: Political agendas often determine which sectors receive funding. This can result in uneven distribution, where certain projects enjoy disproportionate attention over more pressing societal needs.

- Transparency and Accountability: Political and bureaucratic influences can reduce transparency. Adopting modern auditing tools and improving oversight mechanisms are essential to mitigate these challenges.

External Pressures

- Crisis Response: During crises—such as the COVID-19 pandemic—governments must redirect funds to emergency response, often at the expense of other sectors.

- Risk Management: Implementing comprehensive risk management strategies is key to preparing for such unpredictable events and safeguarding essential services.

Strategic Solutions

Governments can utilize several strategies to improve funding efficiency:

- Dynamic Tax Policies: Adjusting tax rates in response to economic changes helps maintain a steady revenue stream.

- Public–Private Partnerships: These collaborations diversify funding sources and stimulate investment in public projects.

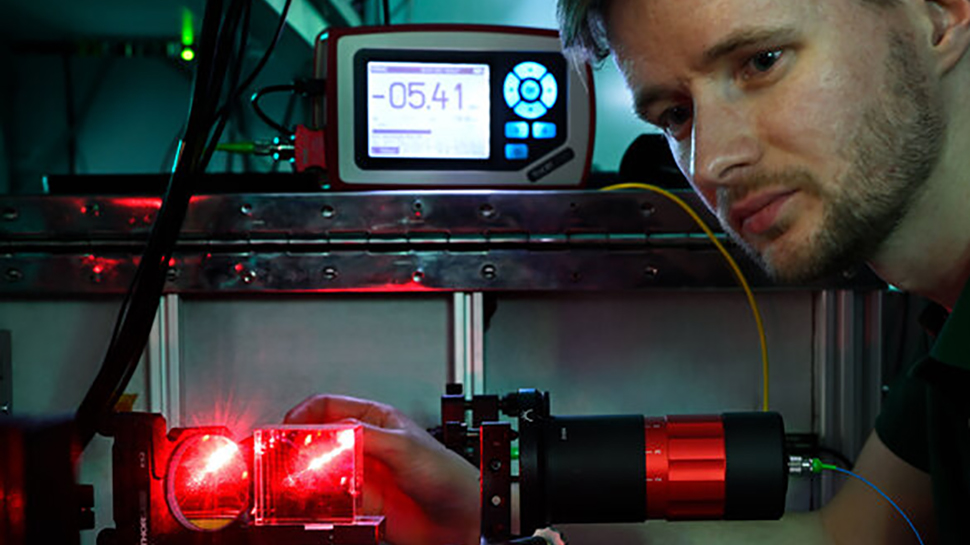

- Blockchain-Based Transparency: Modern auditing and fund tracking tools, particularly open-source financial tools (open source financial tools), can reduce inefficiencies and enhance accountability.

- Bipartisan Consensus: Building cross-party support for prioritizing critical funding areas can lead to more stable budgets and better public services.

Applications and Use Cases

Government funding issues have far-reaching implications across multiple sectors. Let’s explore two practical examples that illustrate the importance of innovative funding solutions.

Use Case 1: Enhancing Public Infrastructure

Scenario:

A nation faces aging infrastructure and extensive repair demands. With reduced tax revenues during an economic downturn, allocation becomes problematic.

Solution:

- Dynamic Taxation: Implement taxes that adjust based on economic performance, ensuring more stable revenue flows.

- Public–Private Partnerships (PPPs): Engage private investors to fund infrastructure projects and share the risk.

- Blockchain Transparency: Use open-source blockchain tools to monitor fund allocation in real time, reducing inefficiencies and boosting public trust.

Outcome:

By applying a combination of dynamic tax policies and blockchain tools, governments can maintain transparency and optimize infrastructure investments even during economic downturns.

Use Case 2: Supporting Open-Source Initiatives

Scenario:

Open-source projects are critical to technological innovation but require sustained funding. Political gridlock and economic challenges often lead to insufficient government support.

Solution:

- Investment Models: Create innovative funding models like crowdfunding or dedicated grants for open-source projects.

- Collaborative Governance: Engage open-source communities in decision-making to ensure funds are deployed effectively.

- Ethical Funding Methods: Adopt best practices from ethical funding methods to ensure transparency and fairness.

Outcome:

These approaches help maintain the vitality of open-source projects, which in turn enhance software sustainability and national innovation capabilities.

Challenges and Limitations

Despite strategic solutions, several challenges persist in addressing government funding complexities:

Technical Challenges

- Integration of Technology: Incorporating new technologies like blockchain requires significant changes in legacy systems.

- Data Privacy and Security: Implementing transparent systems while safeguarding sensitive information poses technical and regulatory challenges.

- Interoperability Issues: Ensuring that diverse systems (public finance software, blockchain tools) work together is complex.

Adoption Challenges

- Political Resistance: Changes in funding strategies often face resistance due to entrenched political interests and the inertia of bureaucratic systems.

- Stakeholder Buy-In: Gaining the trust of citizens, investors, and private partners is critical to implementing new funding models successfully.

- Economic Uncertainty: Global economic volatility makes it difficult to predict revenue streams, thus complicating long-term budgeting and planning.

Summary of Key Challenges and Solutions

Below is a table summarizing major challenges vs. strategic solutions:

| Challenge | Strategic Solution |

|---|---|

| Economic volatility | Dynamic tax policies; diversify revenue streams |

| Political gridlock | Bipartisan consensus; ethical funding methods |

| Bureaucratic inefficiencies | Blockchain transparency; public–private partnerships |

| External crises (e.g., pandemics) | Robust risk management strategies |

| Technology integration issues | Adoption of modern IT solutions and interoperability |

And here is a bullet list highlighting key terms and concepts:

- Government Funding: The allocation of public resources to maintain societal infrastructure and services.

- Dynamic Taxation: Flexible fiscal policies that adjust according to economic conditions.

- Blockchain Transparency: Use of distributed ledger technology to enhance accountability.

- Public–Private Partnerships (PPPs): Collaborative funding models that combine public oversight with private efficiency.

- Risk Management: Strategies to mitigate unforeseen global events affecting funding stability.

Future Outlook and Innovations

The landscape of government funding is likely to evolve in the coming years. Here are some trends and innovations that hold promise:

Embracing Technology

- Blockchain Integration: Governments are slowly incorporating blockchain into their financial governance structures. This promises enhanced transparency and accountability for public funds.

- Open-Source Financial Tools: The continued evolution of open-source software in managing government funds can lead to more secure and cost-effective solutions. Learn more about open source funding opportunities.

Evolving Funding Models

- Public–Private Collaborations: Governments will increasingly partner with private sectors and innovative startups to create hybrid funding models that bolster public services.

- Crowdfunding and DAO Models: Decentralized finance (DeFi) and crowdfunding platforms are emerging as viable alternatives, offering direct ways for citizens to contribute to essential projects.

Regulatory and Policy Developments

- Reforming Tax Policies: Anticipate further reforms in tax regulations that adapt to the evolving economic landscape, ensuring that revenue collection methods remain resilient.

- Enhanced Oversight Mechanisms: With growing demand for accountability, governments may adopt more stringent regulatory frameworks focused on transparency and ethical management of funds.

Expert Opinions from the Dev.to Community

Insightful discussions on funding innovations can be found on Dev.to. For example:

- Unlocking the Future: The Dynamics of Blockchain Project ICOs highlights how emerging blockchain technologies are redefining funding paradigms.

- Unlocking Liquidity: Understanding the Drip Network offers insight into managing liquidity and funding challenges using technology-driven approaches.

- Open Source: A Goldmine for Indie Hackers demonstrates how open-source projects are evolving to attract sustainable funding.

Summary

Navigating the complexities of government funding requires a multifaceted approach that integrates economic insight, political pragmatism, and technological innovation. As explored in this post, the key challenges—from economic volatility and political gridlock to bureaucratic inefficiencies and external pressures—demand dynamic tax policies, public–private partnerships, and advanced technology integration.

By incorporating modern auditing tools, blockchain-based transparency, and ethical funding models, governments can restructure their revenue streams while ensuring that essential services remain uninterrupted even during crises. Embracing a collaborative approach with all stakeholders, including open-source communities, not only fosters innovation but also creates a sustainable environment for long-term growth.

To recapitulate, here are the main takeaways:

- Understanding the Ecosystem: Government funding is a complex interplay of economic, political, and technological factors.

- Core Challenges: Economic volatility, political influences, and external crises are significant obstacles.

- Strategic Solutions: Dynamic tax policies, blockchain transparency, and public–private partnerships offer promising paths forward.

- Future Trends: Integration of innovative technologies and evolving regulatory frameworks will shape the future of public finance.

For further reading on government funding challenges and solutions, be sure to explore the original article on government funding issues and the wide array of resources available on open-source project funding.

Through continuous innovation and ethical approaches, government funding can become more resilient and responsive to the demands of the modern era—paving the way for sustained societal advancement and enhanced public trust.

By addressing both the historical context and the cutting-edge innovations in funding methodologies, this post provides a comprehensive guide for policymakers, technologists, and the public on forging a more sustainable future in public finance. With ongoing improvements in transparency, risk management, and collaborative governance, the path to better government funding is clear and navigable for all.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Microsoft 365: 1-Year Subscription (Family/Up to 6 Users) (23% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From Art School Drop-out to Microsoft Engineer with Shashi Lo [Podcast #170]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746203291209/439bf16b-c820-4fe8-b69e-94d80533b2df.png?#)

(1).jpg?#)

_Inge_Johnsson-Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple to Split iPhone Launches Across Fall and Spring in Major Shakeup [Report]](https://www.iclarified.com/images/news/97211/97211/97211-640.jpg)

![Apple to Move Camera to Top Left, Hide Face ID Under Display in iPhone 18 Pro Redesign [Report]](https://www.iclarified.com/images/news/97212/97212/97212-640.jpg)

![Apple Developing Battery Case for iPhone 17 Air Amid Battery Life Concerns [Report]](https://www.iclarified.com/images/news/97208/97208/97208-640.jpg)

![AirPods 4 On Sale for $99 [Lowest Price Ever]](https://www.iclarified.com/images/news/97206/97206/97206-640.jpg)

![[Updated] Samsung’s 65-inch 4K Smart TV Just Crashed to $299 — That’s Cheaper Than an iPad](https://www.androidheadlines.com/wp-content/uploads/2025/05/samsung-du7200.jpg)