Here’s why you’re still waiting for your tax refund

Getting your tax refund is the only fun part of filing your taxes every year—which can make it especially galling when Uncle Sam takes his sweet time sending your money. Waiting for a refund in 2025 has some added stress, considering the recent IRS layoffs, the department’s plans for a 25% reduction in force, and the heartburn-inducing game of acting director musical chairs that played out during this year’s tax season. With all of that turmoil in the IRS, any taxpayer still waiting on a refund may worry their tax return got lost in the shuffle. The good news is that the IRS is still processing tax returns and refunds at a steady clip, even with a reduced workforce. Additionally, this department offers taxpayers a number of resources to soothe your worries about the status of your refund. Here’s what you need to know about receiving your tax refund this year if it still hasn’t hit your bank account. Believe it or not, tax refunds are on track If you’ve waited more than the 21 calendar days the IRS claims it takes to process your refund, you can be excused for assuming the DOGE cuts are responsible for the delay. But the IRS filing season statistics tell a different story. Despite the reduced workforce, the IRS is processing returns and refunds at a similar rate to last year. As of April 11, 2025, the IRS has processed 74,858,000 refunds for the 2025 tax season—a 0.2% increase compared to the 74,685,000 refunds processed as of the same time frame in 2024. It’s also instructive to look at last year’s statistics from later in the tax season. The 2024 refunds processed by mid-April last year represented 71.2% of all refunds for the calendar year. That means it’s not unusual for more than a quarter of taxpayers to still be refund-less at this point in the tax season. Additionally, by May 10, 2024, nearly 90% of refunds had been processed for the year—which correlates pretty well to the nearly 92% of taxpayers who file on time. The remaining refunds paid out after mid-May 2024 were generally owed to late filers who got an extension. If you filed your taxes as of the April 15 deadline, you’ll probably receive your owed refund by mid-May at the latest. So is there a tax refund delay? While the beleaguered IRS is working full steam ahead under difficult circumstances, there are several global and individual reasons why you may not have received your refund: Filing volume: The volume of tax returns received by the IRS goes up steeply the closer it gets to April 15. The increased filing volume creates a bottleneck for IRS workers, which can delay your refund. Paper filing: Uncle Sam prefers e-filing, and taxpayers who file a paper return may have to wait four or more weeks to receive their refunds. Refund via check: If you requested a paper check instead of ACH deposit, that can also delay your refund. Tax credits: If you claimed the Earned Income Tax Credit or the Child Tax Credit, that can delay your refund. Errors: An error on your return can delay your refund. Amended return: Filing an amended return can also cause your refund to take longer to process. Where’s my refund? One of the best updates to modern taxation is the IRS Where’s My Refund? tool, which allows you to check the status of your refund. Typically, you can use this tool within 24 hours of e-filing your current-year tax return. To check your refund status, you will need your Social Security number (or individual taxpayer ID number, or ITIN), your filing status, and the exact amount of your refund. There are three potential refund statuses: Return Received: This status indicates the IRS has received your tax return and is currently processing it. Refund Approved: This status shows that your refund has been approved and will be submitted as of the date listed. Refund Sent: This status indicates that the IRS has sent the refund either via ACH or paper check through the mail. ACH could take up to five days to appear in your bank account, and a paper check could take several weeks to show up in your mailbox. When to pick up the phone Calling the IRS for help is about as appealing as a colonoscopy, especially if you expect the wait time for reaching a real live human being to rival the run time for Wicked—the director’s cut. However, you may need to reach out to the IRS by phone if there is no change to the refund status listed on the Where’s My Refund? tool after 21 calendar days or if the tool asks you to contact the IRS. Just remember that the IRS can’t answer questions about your delayed refund until you’ve hit the 21-day mark. If you’re ready to call the Taxpayer Assistance hotline, you can reach it at 800-829-1040 from 7 a.m. to 7 p.m. local time. The IRS is still working as designed—for now The 2025 tax season may seem more fraught than usual, but the IRS is still processing about the same number of returns and refunds as it has in past years. The delay on y

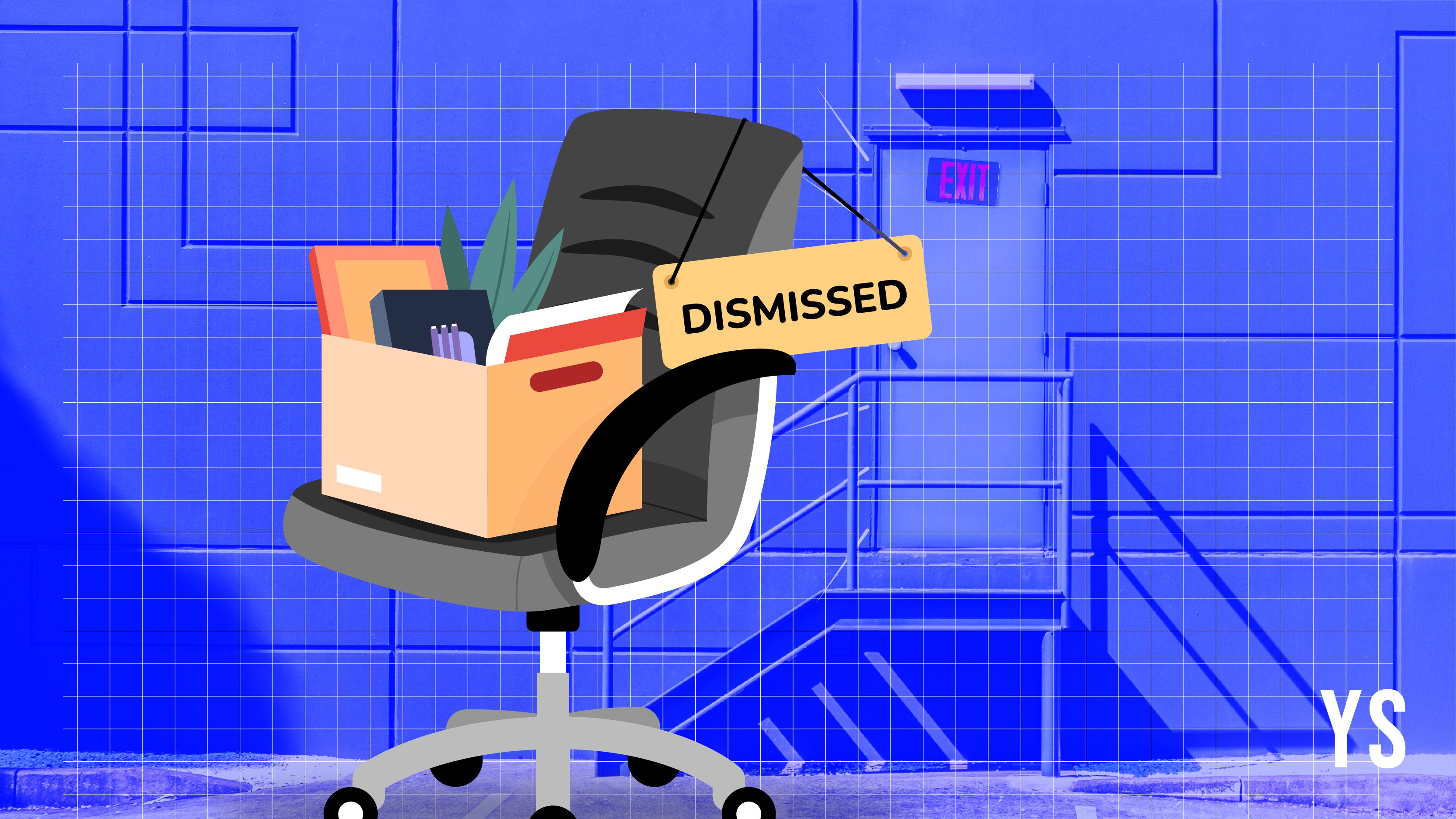

Getting your tax refund is the only fun part of filing your taxes every year—which can make it especially galling when Uncle Sam takes his sweet time sending your money. Waiting for a refund in 2025 has some added stress, considering the recent IRS layoffs, the department’s plans for a 25% reduction in force, and the heartburn-inducing game of acting director musical chairs that played out during this year’s tax season.

With all of that turmoil in the IRS, any taxpayer still waiting on a refund may worry their tax return got lost in the shuffle.

The good news is that the IRS is still processing tax returns and refunds at a steady clip, even with a reduced workforce. Additionally, this department offers taxpayers a number of resources to soothe your worries about the status of your refund.

Here’s what you need to know about receiving your tax refund this year if it still hasn’t hit your bank account.

Believe it or not, tax refunds are on track

If you’ve waited more than the 21 calendar days the IRS claims it takes to process your refund, you can be excused for assuming the DOGE cuts are responsible for the delay. But the IRS filing season statistics tell a different story.

Despite the reduced workforce, the IRS is processing returns and refunds at a similar rate to last year. As of April 11, 2025, the IRS has processed 74,858,000 refunds for the 2025 tax season—a 0.2% increase compared to the 74,685,000 refunds processed as of the same time frame in 2024.

It’s also instructive to look at last year’s statistics from later in the tax season. The 2024 refunds processed by mid-April last year represented 71.2% of all refunds for the calendar year. That means it’s not unusual for more than a quarter of taxpayers to still be refund-less at this point in the tax season.

Additionally, by May 10, 2024, nearly 90% of refunds had been processed for the year—which correlates pretty well to the nearly 92% of taxpayers who file on time. The remaining refunds paid out after mid-May 2024 were generally owed to late filers who got an extension.

If you filed your taxes as of the April 15 deadline, you’ll probably receive your owed refund by mid-May at the latest.

So is there a tax refund delay?

While the beleaguered IRS is working full steam ahead under difficult circumstances, there are several global and individual reasons why you may not have received your refund:

- Filing volume: The volume of tax returns received by the IRS goes up steeply the closer it gets to April 15. The increased filing volume creates a bottleneck for IRS workers, which can delay your refund.

- Paper filing: Uncle Sam prefers e-filing, and taxpayers who file a paper return may have to wait four or more weeks to receive their refunds.

- Refund via check: If you requested a paper check instead of ACH deposit, that can also delay your refund.

- Tax credits: If you claimed the Earned Income Tax Credit or the Child Tax Credit, that can delay your refund.

- Errors: An error on your return can delay your refund.

- Amended return: Filing an amended return can also cause your refund to take longer to process.

Where’s my refund?

One of the best updates to modern taxation is the IRS Where’s My Refund? tool, which allows you to check the status of your refund. Typically, you can use this tool within 24 hours of e-filing your current-year tax return.

To check your refund status, you will need your Social Security number (or individual taxpayer ID number, or ITIN), your filing status, and the exact amount of your refund.

There are three potential refund statuses:

- Return Received: This status indicates the IRS has received your tax return and is currently processing it.

- Refund Approved: This status shows that your refund has been approved and will be submitted as of the date listed.

- Refund Sent: This status indicates that the IRS has sent the refund either via ACH or paper check through the mail. ACH could take up to five days to appear in your bank account, and a paper check could take several weeks to show up in your mailbox.

When to pick up the phone

Calling the IRS for help is about as appealing as a colonoscopy, especially if you expect the wait time for reaching a real live human being to rival the run time for Wicked—the director’s cut.

However, you may need to reach out to the IRS by phone if there is no change to the refund status listed on the Where’s My Refund? tool after 21 calendar days or if the tool asks you to contact the IRS. Just remember that the IRS can’t answer questions about your delayed refund until you’ve hit the 21-day mark.

If you’re ready to call the Taxpayer Assistance hotline, you can reach it at 800-829-1040 from 7 a.m. to 7 p.m. local time.

The IRS is still working as designed—for now

The 2025 tax season may seem more fraught than usual, but the IRS is still processing about the same number of returns and refunds as it has in past years. The delay on your refund may be related to when or how you filed your taxes, whether you took any tax credits, or if there is an error on your return.

You can check the status of your refund using the online Where’s My Refund? tool, and give the IRS a ring if the status hasn’t changed after 21 days.

Just remember that if you do need to call, the IRS worker who answers the phone is almost definitely having a worse tax season than you are.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[FREE EBOOKS] AI and Business Rule Engines for Excel Power Users, Machine Learning Hero & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Hostinger Horizons lets you effortlessly turn ideas into web apps without coding [10% off]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/IMG_1551.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![This new Google TV streaming dongle looks just like a Chromecast [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/04/thomson-cast-150-google-tv-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Drops New Immersive Adventure Episode for Vision Pro: 'Hill Climb' [Video]](https://www.iclarified.com/images/news/97133/97133/97133-640.jpg)

![Most iPhones Sold in the U.S. Will Be Made in India by 2026 [Report]](https://www.iclarified.com/images/news/97130/97130/97130-640.jpg)

![Apple to Shift Robotics Unit From AI Division to Hardware Engineering [Report]](https://www.iclarified.com/images/news/97128/97128/97128-640.jpg)