Emotions vs. Execution: What Developers Can Learn from Competitive Crypto Trading

The 2025 International Crypto Trading Cup (ICTC), organized by WhiteBIT, marked a new chapter in the evolution of digital finance. Held on May 9–10, this global, live-streamed trading competition featured eight high-performing traders from across Europe, Asia, and the Middle East, all navigating volatile markets with only $50,000 in stablecoins and no automated tools. But beneath the entertainment value and technical bravado, the event surfaced a more fundamental truth: successful trading is not only a matter of charts and strategies — it is about mastering emotional control under pressure. As developers, especially those building financial products or trading platforms, understanding the psychological environment in which users operate is essential. The ICTC offered a rare, transparent view into how trading behavior shifts when emotions take over. Key Constraints of the Competition No bots or automation tools Minimum of three trades per hour Use of 50x–100x leverage encouraged by tournament pacing Time-limited, high-pressure trading conditions The goal was to simulate a trading environment that emphasized human decision-making rather than algorithmic optimization. TradingView powered the live interface, while Tether backed the prize pool with a dedicated stablecoin (USDB) to ensure stability. In a controlled environment, traders rely on backtested strategies and probabilistic outcomes. In a live event with a ticking clock and millions on the line, those strategies become vulnerable to psychological stress. Common emotional pitfalls observed during the competition: Overtrading to meet minimum activity requirements Forced high-leverage positions due to time constraints Deviation from pre-defined strategies in response to leaderboard pressure Underperformance due to external technical issues (latency, slippage) Several traders, including Malik Roth Klindt Jensen and Luca Boiardi, noted that the compressed time frame disrupted their ability to execute skill-based strategies. Others commented that luck played a disproportionate role — not because skill was absent, but because emotion-driven behavior was amplified by the tournament format. For developers, these behavioral insights are instructive. Building robust trading systems is not just about technical speed or liquidity aggregation. It's about supporting traders when human behavior becomes the weakest link. Key considerations for trading platform development: UX under pressure: Interfaces must reduce cognitive load and help users avoid panic-based inputs. Real-time analytics: Deliver immediate feedback and performance metrics that reinforce disciplined behavior. Failsafes for risk: Implement features that detect emotional trading patterns (e.g., sudden leverage spikes) and provide contextual alerts or friction. Testing under stress: Include performance and usability tests simulating peak volatility and user anxiety. The winner of the ICTC, Ukrainian trader Max Hamaha, underscored the difference between strategic trading and competitive trading. “In a format like this, you’re forced to take positions you would never consider in a normal setting,” he said. His win wasn’t just about superior execution—it was about navigating an environment designed to destabilize decision-making. That’s a lesson with deep relevance for both traders and the developers who build for them.Trading competitions like the ICTC reveal a less-discussed dimension of crypto markets: the tension between logic and emotion. While technical strategy remains foundational, emotional regulation is the true differentiator in high-stakes environments. For developers in fintech, this is a call to look beyond the backend. Design systems that account for psychological realities—not just market data.

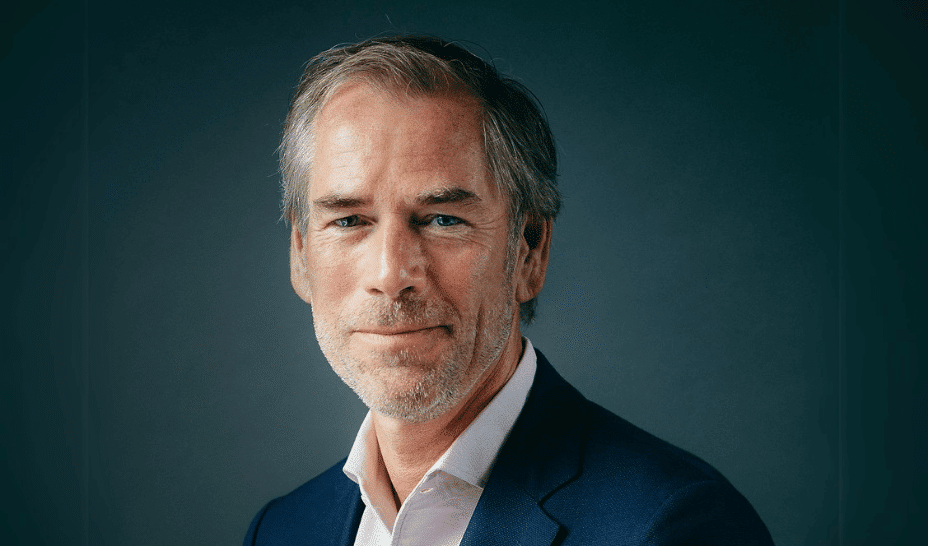

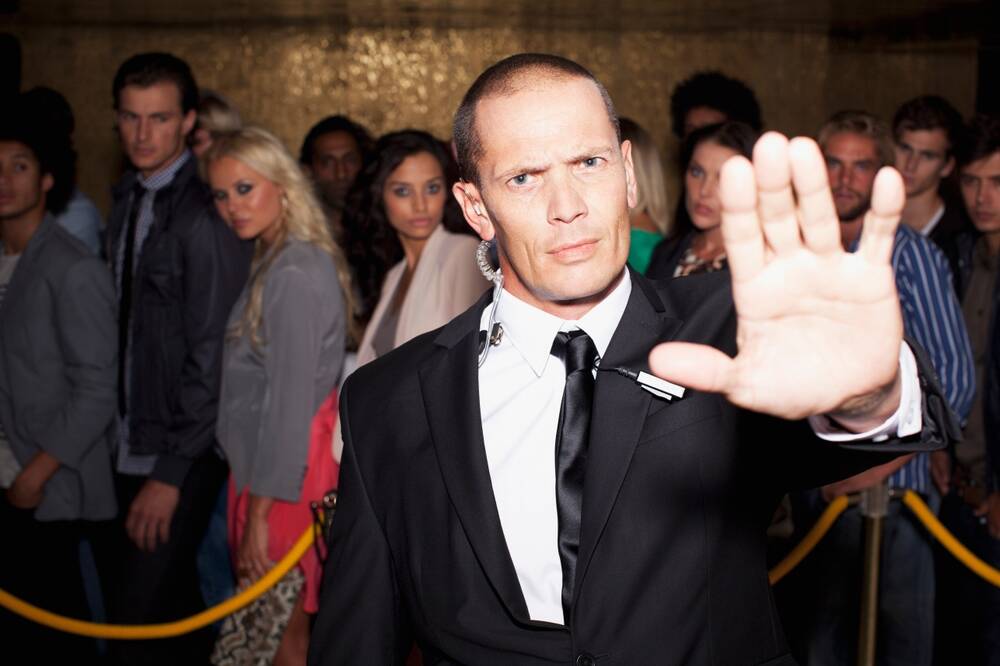

The 2025 International Crypto Trading Cup (ICTC), organized by WhiteBIT, marked a new chapter in the evolution of digital finance. Held on May 9–10, this global, live-streamed trading competition featured eight high-performing traders from across Europe, Asia, and the Middle East, all navigating volatile markets with only $50,000 in stablecoins and no automated tools.

But beneath the entertainment value and technical bravado, the event surfaced a more fundamental truth: successful trading is not only a matter of charts and strategies — it is about mastering emotional control under pressure.

As developers, especially those building financial products or trading platforms, understanding the psychological environment in which users operate is essential. The ICTC offered a rare, transparent view into how trading behavior shifts when emotions take over.

Key Constraints of the Competition

- No bots or automation tools

- Minimum of three trades per hour

- Use of 50x–100x leverage encouraged by tournament pacing

- Time-limited, high-pressure trading conditions

The goal was to simulate a trading environment that emphasized human decision-making rather than algorithmic optimization. TradingView powered the live interface, while Tether backed the prize pool with a dedicated stablecoin (USDB) to ensure stability.

In a controlled environment, traders rely on backtested strategies and probabilistic outcomes. In a live event with a ticking clock and millions on the line, those strategies become vulnerable to psychological stress.

Common emotional pitfalls observed during the competition:

- Overtrading to meet minimum activity requirements

- Forced high-leverage positions due to time constraints

- Deviation from pre-defined strategies in response to leaderboard pressure

- Underperformance due to external technical issues (latency, slippage)

Several traders, including Malik Roth Klindt Jensen and Luca Boiardi, noted that the compressed time frame disrupted their ability to execute skill-based strategies. Others commented that luck played a disproportionate role — not because skill was absent, but because emotion-driven behavior was amplified by the tournament format.

For developers, these behavioral insights are instructive. Building robust trading systems is not just about technical speed or liquidity aggregation. It's about supporting traders when human behavior becomes the weakest link.

Key considerations for trading platform development:

- UX under pressure: Interfaces must reduce cognitive load and help users avoid panic-based inputs.

- Real-time analytics: Deliver immediate feedback and performance metrics that reinforce disciplined behavior.

- Failsafes for risk: Implement features that detect emotional trading patterns (e.g., sudden leverage spikes) and provide contextual alerts or friction.

- Testing under stress: Include performance and usability tests simulating peak volatility and user anxiety.

The winner of the ICTC, Ukrainian trader Max Hamaha, underscored the difference between strategic trading and competitive trading. “In a format like this, you’re forced to take positions you would never consider in a normal setting,” he said.

His win wasn’t just about superior execution—it was about navigating an environment designed to destabilize decision-making. That’s a lesson with deep relevance for both traders and the developers who build for them.Trading competitions like the ICTC reveal a less-discussed dimension of crypto markets: the tension between logic and emotion. While technical strategy remains foundational, emotional regulation is the true differentiator in high-stakes environments.

For developers in fintech, this is a call to look beyond the backend. Design systems that account for psychological realities—not just market data.

![[The AI Show Episode 145]: OpenAI Releases o3 and o4-mini, AI Is Causing “Quiet Layoffs,” Executive Order on Youth AI Education & GPT-4o’s Controversial Update](https://www.marketingaiinstitute.com/hubfs/ep%20145%20cover.png)

![[DEALS] Internxt Cloud Storage Lifetime Subscription: 10TB Plan (88% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Ditching a Microsoft Job to Enter Startup Purgatory with Lonewolf Engineer Sam Crombie [Podcast #171]](https://cdn.hashnode.com/res/hashnode/image/upload/v1746753508177/0cd57f66-fdb0-4972-b285-1443a7db39fc.png?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Gurman: First Foldable iPhone 'Should Be on the Market by 2027' [Updated]](https://images.macrumors.com/t/7O_4ilWjMpNSXf1pIBM37P_dKgU=/2500x/article-new/2025/03/Foldable-iPhone-2023-Feature-Homescreen.jpg)

![Federal ‘click to cancel subscriptions’ rule delayed, may be weakened [U]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2024/10/Federal-click-to-cancel-subscriptions-rule-is-ratified.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![What Google Messages features are rolling out [May 2025]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2023/12/google-messages-name-cover.png?resize=1200%2C628&quality=82&strip=all&ssl=1)

![[Fixed] Gemini 2.5 Flash missing file upload for free app users](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/03/google-gemini-workspace-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![So your [expletive] test failed. So [obscene participle] what?](https://regmedia.co.uk/2016/08/18/shutterstock_mobile_surprise.jpg)

![Apple Shares 'Last Scene' Short Film Shot on iPhone 16 Pro [Video]](https://www.iclarified.com/images/news/97289/97289/97289-640.jpg)

![Apple M4 MacBook Air Hits New All-Time Low of $824 [Deal]](https://www.iclarified.com/images/news/97288/97288/97288-640.jpg)

![An Apple Product Renaissance Is on the Way [Gurman]](https://www.iclarified.com/images/news/97286/97286/97286-640.jpg)

![Apple to Sync Captive Wi-Fi Logins Across iPhone, iPad, and Mac [Report]](https://www.iclarified.com/images/news/97284/97284/97284-640.jpg)