Elon Musk made Tesla a household name. Now his presence is tanking the company

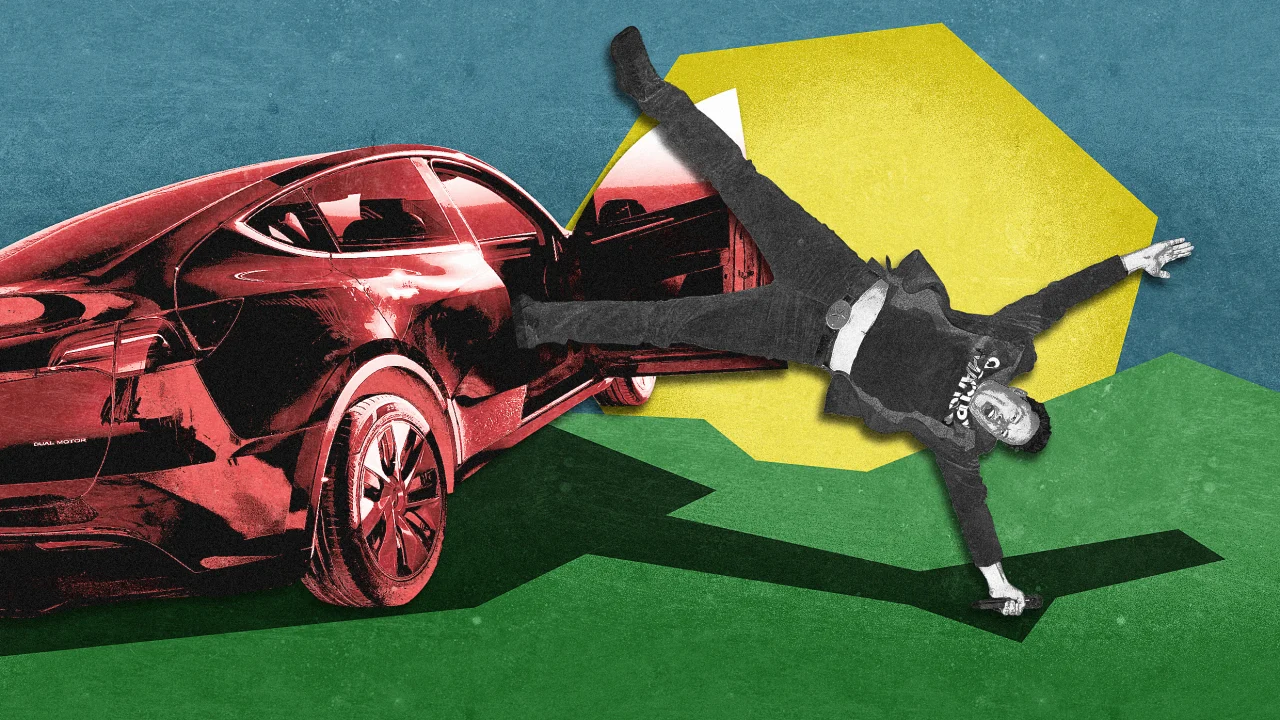

Tesla has reached a potentially lethal moment in its history, and it isn’t solely due to CEO Elon Musk’s political radicalization. Years of design and technology stagnation have led to a languishing model line and outdated technology. Back in 2023, I wrote that the beleaguered carmaker should aspire to survive and become yet another car manufacturer. Now that objective feels more pressing—and distant—than ever. The company just announced a new quarter of abysmal vehicle sales. Tesla’s first quarter of 2025 was a disaster—a 71% decline in net income compared to the same quarter last year—except for a better-than-expected gross margin thanks to its energy business. Its EV sales cratered, with a 13% sales drop in relation to the previous quarter. Worse yet: The company would have posted a loss if it weren’t for the government’s zero-emission credits. Predictably, Musk tried to distract from all of this with more of his usual empty promises about self-driving cabs and magical robots. During the Q1 financials conference call, he declared—with a faltering train of thought—that he remained optimistic about the future of the company. A future that is “based on a large number of autonomous cars and autonomous humanoid robots.” He said that he expects autonomy to start moving Tesla’s financial needle in mid-2026. Musk also claimed Tesla’s humanoid robot Optimus will be working at Tesla’s factories by year’s end. “I feel confident we will make a million units per year in less than five years, maybe four years,” he said. Tesla will be the most valuable company in the world by far “if we execute well,” he declared after a pause. Then he said it will be “maybe as valuable as the next five companies combined.” Delay tactics Is anyone falling for all this bluster? I’m not. You shouldn’t either. Musk’s promises have a tendency to end in the graveyard of delusions, some of them literally buried, most delayed for many years. During the Cybercab reveal in October 2024, he promised the two-seater with scissor doors and no steering wheel by 2026, a claim that was met with derision. Remember that he promised robotaxis for 2020. The company declared in its Q1 report that the Cybercab “is scheduled for volume production starting in 2026.” That’s very unlikely to happen, as fully autonomous Tesla cars have not been approved anywhere, and they are far from going through the certification process needed for “volume” to happen. Waymo is still progressing slowly in its approval process and it’s years ahead of Tesla. “Full Self-Driving manages just 489 miles between disengagements, dwarfed by Waymo’s 17,311,” notes industry expert Ashok Elluswamy. To achieve human-level safety, analysts say, Tesla needs a 1,400x improvement. Which is why Musk’s claim of launching unsupervised Full Self-Driving (FSD) in June 2025 sounds so absurd. Tesla’s FSD currently remains a beta experiment linked to federal probes and crashes. Meanwhile, Volvo and Mercedes currently deploy safer autonomous tech made by Waymo, a company that already has self-driving cabs on the road. Even if Musk could actually deliver on his Cybercab promise, Tesla’s internal analysis admitted Robotaxis would hemorrhage cash. According to a report by The Information, the company’s own executives warned Musk that the payback around FSD and Robotaxi would “be slow . . . very, very hard outside the U.S.” He ignored them. Instead, he canceled the Model 2—the alleged name for an affordable Tesla model—to chase the “geofenced 5mph Disneyland ride” of Robotaxis, as critic Dan O’Dowd mocked. The company is now implicitly recognizing it made a mistake in its first quarter financial report, saying that “more affordable options are as critical as ever.” No wonder its top designers and engineers are leaving the company. Rotting design and cybertruck carnage During the call, Musk said he will focus more on Tesla and less on the government, blaming “people benefiting from fraudulent government money” for the protests against him. In his mind, these fraudsters are responsible for the company’s ongoing disaster, not him. But that shouldn’t distract from the real reasons for the “Teslapocalypse.” This didn’t happen because of Musk’s support for Donald Trump, though it did accelerate it. Even without Musk’s recent behavior, Tesla would still suffer from its preexisting condition and the bare facts of its business model: stale design, no forward vision, no technological innovation. This is a trifecta for failure. Tesla lacks what it needs to save itself from the current realities of the automobile market. China—mainly BYD and brands like Xiaomi and Xpeng—has established itself as the clear design and technological car manufacturing leader in the world, resulting in its top spot in global sales, despite U.S. tariffs. And in Europe, Japan, and South Korea, the old brands have finally risen to the challenge, with BMW’s EV sales in Europe overtaking Tesla for th

Tesla has reached a potentially lethal moment in its history, and it isn’t solely due to CEO Elon Musk’s political radicalization. Years of design and technology stagnation have led to a languishing model line and outdated technology. Back in 2023, I wrote that the beleaguered carmaker should aspire to survive and become yet another car manufacturer. Now that objective feels more pressing—and distant—than ever.

The company just announced a new quarter of abysmal vehicle sales. Tesla’s first quarter of 2025 was a disaster—a 71% decline in net income compared to the same quarter last year—except for a better-than-expected gross margin thanks to its energy business. Its EV sales cratered, with a 13% sales drop in relation to the previous quarter. Worse yet: The company would have posted a loss if it weren’t for the government’s zero-emission credits.

Predictably, Musk tried to distract from all of this with more of his usual empty promises about self-driving cabs and magical robots. During the Q1 financials conference call, he declared—with a faltering train of thought—that he remained optimistic about the future of the company. A future that is “based on a large number of autonomous cars and autonomous humanoid robots.” He said that he expects autonomy to start moving Tesla’s financial needle in mid-2026.

Musk also claimed Tesla’s humanoid robot Optimus will be working at Tesla’s factories by year’s end. “I feel confident we will make a million units per year in less than five years, maybe four years,” he said. Tesla will be the most valuable company in the world by far “if we execute well,” he declared after a pause. Then he said it will be “maybe as valuable as the next five companies combined.”

Delay tactics

Is anyone falling for all this bluster? I’m not. You shouldn’t either. Musk’s promises have a tendency to end in the graveyard of delusions, some of them literally buried, most delayed for many years.

During the Cybercab reveal in October 2024, he promised the two-seater with scissor doors and no steering wheel by 2026, a claim that was met with derision. Remember that he promised robotaxis for 2020. The company declared in its Q1 report that the Cybercab “is scheduled for volume production starting in 2026.”

That’s very unlikely to happen, as fully autonomous Tesla cars have not been approved anywhere, and they are far from going through the certification process needed for “volume” to happen. Waymo is still progressing slowly in its approval process and it’s years ahead of Tesla. “Full Self-Driving manages just 489 miles between disengagements, dwarfed by Waymo’s 17,311,” notes industry expert Ashok Elluswamy.

To achieve human-level safety, analysts say, Tesla needs a 1,400x improvement. Which is why Musk’s claim of launching unsupervised Full Self-Driving (FSD) in June 2025 sounds so absurd. Tesla’s FSD currently remains a beta experiment linked to federal probes and crashes. Meanwhile, Volvo and Mercedes currently deploy safer autonomous tech made by Waymo, a company that already has self-driving cabs on the road.

Even if Musk could actually deliver on his Cybercab promise, Tesla’s internal analysis admitted Robotaxis would hemorrhage cash. According to a report by The Information, the company’s own executives warned Musk that the payback around FSD and Robotaxi would “be slow . . . very, very hard outside the U.S.” He ignored them. Instead, he canceled the Model 2—the alleged name for an affordable Tesla model—to chase the “geofenced 5mph Disneyland ride” of Robotaxis, as critic Dan O’Dowd mocked. The company is now implicitly recognizing it made a mistake in its first quarter financial report, saying that “more affordable options are as critical as ever.” No wonder its top designers and engineers are leaving the company.

Rotting design and cybertruck carnage

During the call, Musk said he will focus more on Tesla and less on the government, blaming “people benefiting from fraudulent government money” for the protests against him. In his mind, these fraudsters are responsible for the company’s ongoing disaster, not him. But that shouldn’t distract from the real reasons for the “Teslapocalypse.” This didn’t happen because of Musk’s support for Donald Trump, though it did accelerate it.

Even without Musk’s recent behavior, Tesla would still suffer from its preexisting condition and the bare facts of its business model: stale design, no forward vision, no technological innovation. This is a trifecta for failure. Tesla lacks what it needs to save itself from the current realities of the automobile market. China—mainly BYD and brands like Xiaomi and Xpeng—has established itself as the clear design and technological car manufacturing leader in the world, resulting in its top spot in global sales, despite U.S. tariffs. And in Europe, Japan, and South Korea, the old brands have finally risen to the challenge, with BMW’s EV sales in Europe overtaking Tesla for the first time in February of this year.

Tesla’s collapse began with its rotting design DNA. “The Model S is 10 years old now,” Adrian Clarke, a veteran car designer, told me in 2023. “Its other cars—Models 3, X, and Y—look like spitting-image cousins.” It’s 2025, and except for a lackluster refresh of Model Y so unappealing that the company has just announced a zero-interest five-year buying plan, nothing has changed. Tesla’s lineup remains a museum of stagnation in an industry where everyone refreshes models yearly. “Most manufacturers would replace a model after about seven or eight years,” Clarke told me. But Tesla clings to a decade-old template, a strategy former Jaguar designer Jeremy Newman calls “strategically irresponsible.”

How can anyone expect the market to keep buying Teslas when every other manufacturer is releasing new models, like BYD’s Yangwang U7 and its magical suspension system that eliminates all bumps. Then there’s the Xiaomi SU7 Ultra and its supercar features that come at regular sports car prices. Or the BMW iX—the best 2024 EV according to Consumer Reports. With this in mind, can anyone truly be surprised to see Tesla’s U.S. market share plummeting from 79.4% in 2020 to 65.4% in 2022 to 48.7% in 2024? Only the most deluded fanboys and Tesla bulls could ignore this. Everyone else is seeing the writing on the wall.

The Cybertruck epitomizes Musk’s delusional leadership. When it launched, industry experts criticized and warned about its design. “Cold, sterile, and almost repulsive,” legendary designer Frank Stephenson spat. “Everyone I know thought there’s no way they’re gonna get that into production,” Clarke said at the time. They were partially right. The truck’s “dead straight panels” defied manufacturing logic, leading to countless recalls for razor-sharp frunks that slice fingers, accelerators that stick mid-drive, and “bulletproof” windows that can shatter from hail. By June 2024, more than 11,000 units faced recalls for failing wipers and loose trim. Sales cratered: After peaking at 16,692 units in Q3 2024, sales dropped to 12,991 in Q4—a 22% decrease—and fell further to 6,406 in Q1 2025, marking a 50% decline from the previous quarter.

Can it be saved?

Now you can add cratering financials to this technological and design mayhem. Tesla’s Q4 2024 deliveries hit a record 495,570 vehicles, but the cost was catastrophic. Price cuts and 0% financing slashed profit margins, with average sales prices plunging to $41,000—the lowest in four years. Annual deliveries fell 1.1% to 1.79 million, Tesla’s first decline since 2011. Meanwhile, BYD sold 595,413 battery electric vehicles in the same quarter. Analysts called Tesla’s performance an “unmitigated disaster” masked by temporary incentives.

Today confirmed what we knew. Tesla’s first-quarter 2025 revenue came short of the estimated $21.1 billion at only $19.3 billion. Auto revenue fell 20%. It’s the worst quarter in almost three years, and the company’s first-ever year-to-year drop in sales.

Sure, the protests at stores and vandalism of Tesla lots fueled by Musk’s polarizing politics didn’t help this situation. But at the end of the day, if you give consumers the choice of buying a new EV design with superior technology at a lower price or a tired Tesla model, they will choose the former. Having a better product at the best price possible is the most important part for the long-term survival of any company. Talking to CNBC, Patrick George, editor-in-chief of InsideEVs, said the biggest operational challenge in the latest quarter was “the nuts-and-bolts job of being a car company.” For a car company that runs on, you know, car sales, things like robocabs and humanoid robots are a distraction. It’s no wonder that Tesla’s stock plummeted since December.

Meanwhile, the rest of the market keeps innovating at record speeds. BYD’s flash-charging tech—refueling EVs in five minutes—and its Blade battery, hailed as “the world’s safest,” have left Tesla in the dust. The Xiaomi SU7, a luxury sports sedan priced like a Toyota, sold 88,898 units in 24 hours, proving Chinese brands can out-innovate and undercut. In Europe, BMW and Mercedes leveraged 60% customer loyalty to reclaim the luxury segment. “People want cars that fit into their lives,” Clarke told me two years ago. It was an industry lesson that Musk ignored.

Legendary investor and economist Bruce Greenwald warned about all of this in 2021, way before Musk descended into the political mud: “Twenty years from now—you really think that [Tesla is] going to dominate the auto market? Not a chance.” He was wrong by almost two decades.

After today’s results, there are only two questions in my mind. First: How much more value will Musk obliterate before shareholders eject him? And the other, more pressing question: Will the next CEO be able to save the company? Tesla needs to do something radical right now. And that should start with Musk leaving the company.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

-All-will-be-revealed-00-35-05.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![What iPhone 17 model are you most excited to see? [Poll]](https://9to5mac.com/wp-content/uploads/sites/6/2025/04/iphone-17-pro-sky-blue.jpg?quality=82&strip=all&w=290&h=145&crop=1)

![Hands-On With 'iPhone 17 Air' Dummy Reveals 'Scary Thin' Design [Video]](https://www.iclarified.com/images/news/97100/97100/97100-640.jpg)

![Mike Rockwell is Overhauling Siri's Leadership Team [Report]](https://www.iclarified.com/images/news/97096/97096/97096-640.jpg)

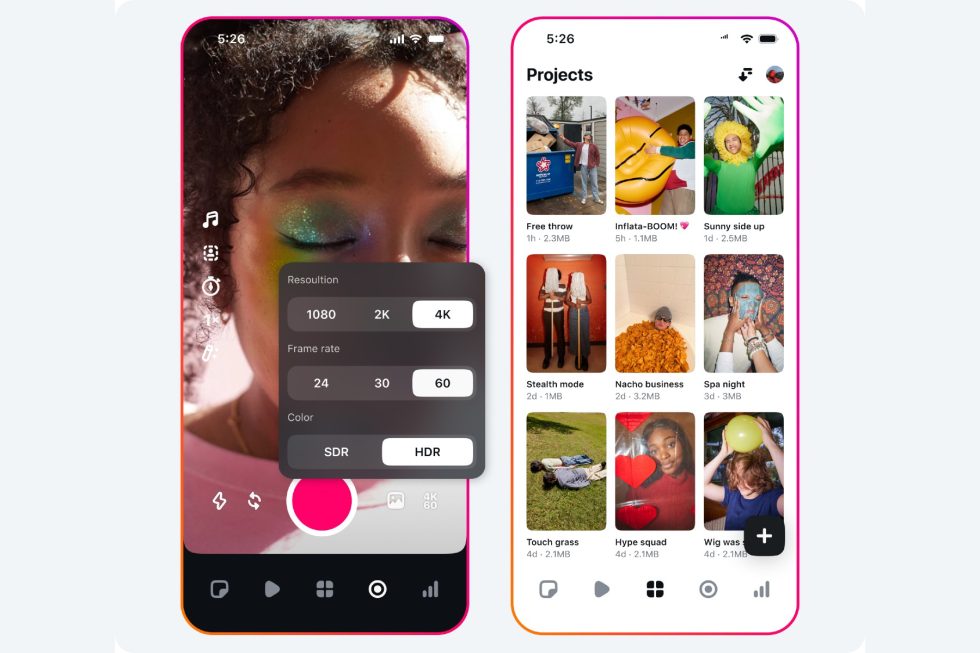

![Instagram Releases 'Edits' Video Creation App [Download]](https://www.iclarified.com/images/news/97097/97097/97097-640.jpg)

![Inside Netflix's Rebuild of the Amsterdam Apple Store for 'iHostage' [Video]](https://www.iclarified.com/images/news/97095/97095/97095-640.jpg)