A Complete Guide to Recharge Software Development for Emerging Fintech Startups

As India accelerates toward a cashless and connected economy, digital payment solutions are becoming essential for businesses of all sizes. Among the most in-demand services in this space is mobile recharge software—a core product that enables retailers, agents, and fintech startups to offer prepaid mobile, DTH, and data recharge services. For new fintech businesses, understanding the scope and process of recharge software development is the key to entering this competitive yet rewarding market. This comprehensive guide covers everything emerging startups need to know about recharge software solutions, from core features and development requirements to choosing the right software provider like noblewebstudio, one of India’s most trusted names in digital payment software development. What is Recharge Software? Recharge software is a digital platform that allows users or agents to recharge prepaid mobile numbers, DTH connections, data cards, and more through a centralized dashboard or mobile app. It acts as a backend system to manage transactions, commissions, agent networks, and real-time operator integration. Fintech startups use multi-recharge software solutions to create value-added platforms that serve rural and urban consumers, generate revenue through commissions, and expand their digital service portfolios. Why Recharge Software Development Matters for Fintech Startups For emerging fintech companies in 2025, mobile recharge software development offers several advantages: Low entry barrier and high scalability Recurring commissions on recharges Add-on potential with AEPS, DMT, and BBPS Branding and white-label opportunities Increased customer retention through digital wallets and loyalty programs Fintech startups can build their own white-label recharge portals or apps, create agent networks, and offer services at the last mile—all with the help of customized recharge software. Key Features of a Robust Recharge Software Solution To be competitive, a recharge software platform must have a rich set of features that streamline operations, enhance user experience, and support scalability. These include: ✅ Multi-Operator Integration Seamless support for all major telecom, DTH, and utility service providers via real-time APIs. ✅ Agent and Distributor Panel Role-based dashboards to manage agent hierarchy, commissions, reports, and sales performance. ✅ Real-Time Recharge API Stable, high-uptime APIs that ensure fast recharge success with instant confirmation and notifications. ✅ White-Label Branding Custom logo, domain, and branding support for startups wanting to launch under their own business name. ✅ E-Wallet and Payment Gateway Integration Digital wallet support for wallet top-ups, refunds, and user payments via UPI, net banking, or cards. ✅ Reports and Analytics Smart dashboards with transaction logs, commission summaries, and reconciliation tools for admins and agents. ✅ Security and Data Protection SSL encryption, OTP verification, and secure login modules for user data safety and compliance. ✅ Add-On Services Integration with services like AEPS, BBPS, PAN card, and money transfer (DMT) can make your portal an all-in-one fintech solution. Recharge Software Development: The Technical Process Building high-performing recharge software for fintech startups involves several development stages. Here's a look at the typical process: 1. Requirement Analysis Define your business goals: Do you want to create a B2B multi-recharge portal? A retailer-only mobile app? Or a B2C recharge platform? 2. UI/UX Design Design intuitive and user-friendly interfaces for admin, agents, and customers. The design must be responsive and optimized for mobile. 3. Backend Development Set up a robust backend using scalable technologies (like PHP, Node.js, or .NET), integrated with recharge APIs and payment gateways. 4. API Integration Integrate multi-operator recharge APIs, wallet APIs, payment gateways, SMS gateways, and optional services like AEPS and DMT. 5. Testing and Quality Assurance Ensure functionality, API response time, security, and UI responsiveness through rigorous testing. 6. Deployment and Launch Deploy on secure cloud infrastructure or VPS, register domains, and begin onboarding agents. 7. Ongoing Maintenance Provide bug fixes, new feature rollouts, and API updates to stay ahead in the market. Choosing the Right Recharge Software Provider: Why noblewebstudio? For startups that want to avoid the technical hassle of in-house development, partnering with a reliable recharge software provider is a smart move. That’s where noblewebstudio shines. Why Choose noblewebstudio? ✅ Proven experience in mobile recharge API and fintech software development ✅ Customizable B2B and B2C platforms ✅ Fully white-labeled solutions with mobile app and web dashboard ✅ Real-time multi-operator API integration ✅ End-to-end agent management and commission control ✅ 24/7 support, training, and

As India accelerates toward a cashless and connected economy, digital payment solutions are becoming essential for businesses of all sizes. Among the most in-demand services in this space is mobile recharge software—a core product that enables retailers, agents, and fintech startups to offer prepaid mobile, DTH, and data recharge services. For new fintech businesses, understanding the scope and process of recharge software development is the key to entering this competitive yet rewarding market.

This comprehensive guide covers everything emerging startups need to know about recharge software solutions, from core features and development requirements to choosing the right software provider like noblewebstudio, one of India’s most trusted names in digital payment software development.

What is Recharge Software?

Recharge software is a digital platform that allows users or agents to recharge prepaid mobile numbers, DTH connections, data cards, and more through a centralized dashboard or mobile app. It acts as a backend system to manage transactions, commissions, agent networks, and real-time operator integration.

Fintech startups use multi-recharge software solutions to create value-added platforms that serve rural and urban consumers, generate revenue through commissions, and expand their digital service portfolios.

Why Recharge Software Development Matters for Fintech Startups

For emerging fintech companies in 2025, mobile recharge software development offers several advantages:

Low entry barrier and high scalability

Recurring commissions on recharges

Add-on potential with AEPS, DMT, and BBPS

Branding and white-label opportunities

Increased customer retention through digital wallets and loyalty programs

Fintech startups can build their own white-label recharge portals or apps, create agent networks, and offer services at the last mile—all with the help of customized recharge software.

Key Features of a Robust Recharge Software Solution

To be competitive, a recharge software platform must have a rich set of features that streamline operations, enhance user experience, and support scalability. These include:

✅ Multi-Operator Integration

Seamless support for all major telecom, DTH, and utility service providers via real-time APIs.

✅ Agent and Distributor Panel

Role-based dashboards to manage agent hierarchy, commissions, reports, and sales performance.

✅ Real-Time Recharge API

Stable, high-uptime APIs that ensure fast recharge success with instant confirmation and notifications.

✅ White-Label Branding

Custom logo, domain, and branding support for startups wanting to launch under their own business name.

✅ E-Wallet and Payment Gateway Integration

Digital wallet support for wallet top-ups, refunds, and user payments via UPI, net banking, or cards.

✅ Reports and Analytics

Smart dashboards with transaction logs, commission summaries, and reconciliation tools for admins and agents.

✅ Security and Data Protection

SSL encryption, OTP verification, and secure login modules for user data safety and compliance.

✅ Add-On Services

Integration with services like AEPS, BBPS, PAN card, and money transfer (DMT) can make your portal an all-in-one fintech solution.

Recharge Software Development: The Technical Process

Building high-performing recharge software for fintech startups involves several development stages. Here's a look at the typical process:

1. Requirement Analysis

Define your business goals: Do you want to create a B2B multi-recharge portal? A retailer-only mobile app? Or a B2C recharge platform?

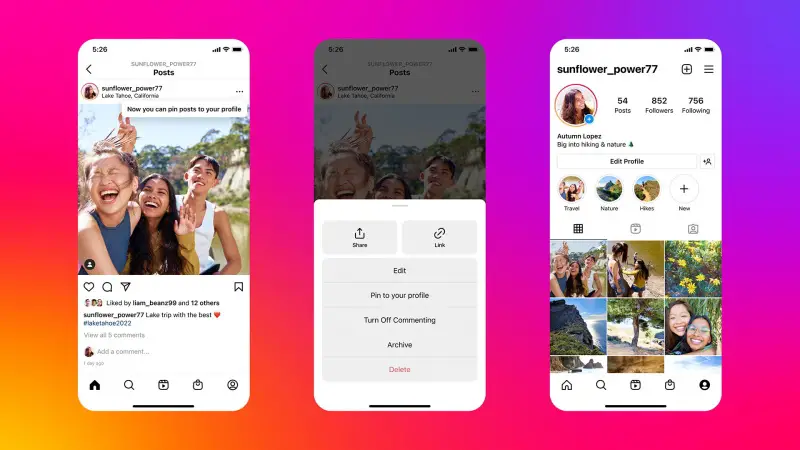

2. UI/UX Design

Design intuitive and user-friendly interfaces for admin, agents, and customers. The design must be responsive and optimized for mobile.

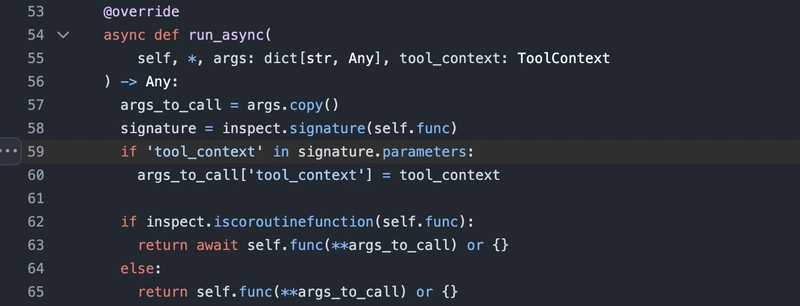

3. Backend Development

Set up a robust backend using scalable technologies (like PHP, Node.js, or .NET), integrated with recharge APIs and payment gateways.

4. API Integration

Integrate multi-operator recharge APIs, wallet APIs, payment gateways, SMS gateways, and optional services like AEPS and DMT.

5. Testing and Quality Assurance

Ensure functionality, API response time, security, and UI responsiveness through rigorous testing.

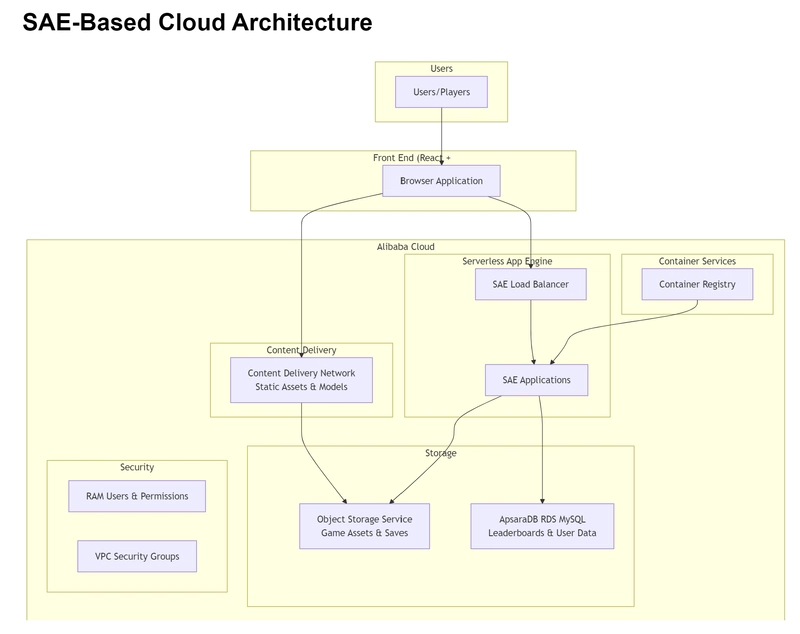

6. Deployment and Launch

Deploy on secure cloud infrastructure or VPS, register domains, and begin onboarding agents.

7. Ongoing Maintenance

Provide bug fixes, new feature rollouts, and API updates to stay ahead in the market.

Choosing the Right Recharge Software Provider: Why noblewebstudio?

For startups that want to avoid the technical hassle of in-house development, partnering with a reliable recharge software provider is a smart move. That’s where noblewebstudio shines.

Why Choose noblewebstudio?

✅ Proven experience in mobile recharge API and fintech software development

✅ Customizable B2B and B2C platforms

✅ Fully white-labeled solutions with mobile app and web dashboard

✅ Real-time multi-operator API integration

✅ End-to-end agent management and commission control

✅ 24/7 support, training, and technical guidance

✅ Additional modules like AEPS, DMT, BBPS, and PAN card services

Whether you’re launching in Tier-1 cities or targeting rural markets, noblewebstudio empowers fintech startups to grow fast and deliver reliable digital services.

Business Models Supported by Recharge Software

Your recharge software can follow one or more of these models:

B2B – Set up a distributor/retailer network and earn commissions from their transactions.

B2C – Allow end users to directly recharge via your branded app or website.

Aggregator – Integrate recharge with other services like travel bookings, PAN cards, and AEPS for a full-service platform.

Franchise Model – Onboard local business owners as franchise partners offering recharges and utility services.

Monetization and Revenue Opportunities

Recharge software offers multiple revenue streams:

Commissions on each mobile, DTH, or data recharge

Wallet top-up charges

Add-on service fees (AEPS, BBPS, PAN, DMT)

Franchise and white-label package sales

How to Get Started as a Fintech Startup

If you're new to the space, follow these steps to launch your recharge business in India:

Define your niche – B2B, B2C, or aggregator.

Partner with noblewebstudio for reliable software and support.

Apply for mobile recharge API access from providers or aggregators.

Launch your white-label platform with branding and agent panels.

Market to retailers, shop owners, and rural entrepreneurs.

Conclusion

In 2025, recharge services continue to be a foundational element of digital financial ecosystems in India. For emerging fintech startups, developing or adopting robust recharge software is not just a business move—it’s a gateway to innovation, customer loyalty, and sustained revenue.

Whether you aim to serve the next billion users in Bharat or compete in urban digital markets, the right technology will define your success. With noblewebstudio as your technology partner, you gain access to customizable, secure, and scalable recharge solutions that grow with your business.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![From fast food worker to cybersecurity engineer with Tae'lur Alexis [Podcast #169]](https://cdn.hashnode.com/res/hashnode/image/upload/v1745242807605/8a6cf71c-144f-4c91-9532-62d7c92c0f65.png?#)

![BPMN-procesmodellering [closed]](https://i.sstatic.net/l7l8q49F.png)

_Tanapong_Sungkaew_via_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![Apple highlights Apple Intelligence ‘Clean Up’ feature in new ad [Video]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2025/04/apple-intelligence-clean-up.jpeg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![CMF Phone 2 Pro has a dual-tone design and improved camera in latest teasers [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/04/cmf-phone-2-pro-camera-tease.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Lenovo shows off its next 8.8-inch Legion Tab with vague AI promises [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/04/lenovo-legion-tab-y700-2025-1.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Samsung Targets Late 2026 Launch for Advanced Texas Chip Fab Following Delays [Report]](https://www.iclarified.com/images/news/97073/97073/97073-640.jpg)

![Apple Shares Official Trailer for 'Long Way Home' Starring Ewan McGregor and Charley Boorman [Video]](https://www.iclarified.com/images/news/97069/97069/97069-640.jpg)

![Apple Watch Series 10 Back On Sale for $299! [Lowest Price Ever]](https://www.iclarified.com/images/news/96657/96657/96657-640.jpg)

![Mobile Legends: Bang Bang [MLBB] Free Redeem Codes April 2025](https://www.talkandroid.com/wp-content/uploads/2024/07/Screenshot_20240704-093036_Mobile-Legends-Bang-Bang.jpg)