12 emotional habits that made Warren Buffett unstoppable

Explore the emotional habits that fueled Warren Buffett's legendary success—practical mindset traits anyone can adopt to build lasting wealth.

When people talk about Warren Buffett, they often mention his razor-sharp intellect, decades of experience, or ability to value companies in ways others can't. But there’s something deeper—something that has truly anchored his success through market crashes, booms, and life’s unpredictable tides.

It’s his emotional intelligence.

Warren Buffett once said, “The chains of habit are too light to be felt until they are too heavy to be broken.” While this might sound like a cautionary tale, in Buffett’s case, it reveals how he forged powerful emotional habits early on—and never let go.

He doesn't chase trends. He doesn’t panic when others sell. And despite being one of the richest men on Earth, he still lives in the same house he bought in 1958. His calm, long-term mindset, resilience under pressure, and deep self-awareness have been just as crucial to his fortune as his financial acumen.

12 emotional habits that quietly shaped Buffett’s rise

1. Patience as a superpower

Buffett isn't in a rush. He famously said, “The stock market is a device for transferring money from the impatient to the patient.” Patience allows him to wait for the perfect opportunity—even if it takes years. Emotionally, this requires resisting instant gratification, a trait rare in today’s fast-paced world.

2. Staying calm in chaos

While others panic during downturns, Buffett remains calm. In fact, he often buys more during crashes. His emotional control allows him to see fear as a buying opportunity, not a signal to run. This ability to regulate emotions during volatility is a core strength.

3. Detached from popular opinion

Buffett doesn’t care about the crowd. He’s often contrarian—buying when others sell and vice versa. Emotional independence allows him to trust his research and intuition, instead of being swayed by the market’s mood swings.

4. Optimism rooted in discipline

He believes in the long-term strength of the economy and humanity, but his optimism is not blind—it’s grounded in research, logic, and strategy. Emotionally, this habit of hopeful discipline keeps him steady through dark times.

5. Humble curiosity

Despite being a billionaire, Buffett is a lifelong learner. He reads up to 5–6 hours a day and never assumes he knows everything. This emotional habit of humility keeps his ego in check and his mind open to new information.

6. Comfortable with saying “No”

Buffett once said, “The difference between successful people and really successful people is that really successful people say no to almost everything.” His emotional clarity helps him protect his time, focus, and energy.

7. Delayed gratification

Buffett doesn’t fall for the next shiny object. He chooses long-term value over short-term thrills, a habit formed from deep emotional maturity. This is the core of his investing style—buy and hold for decades.

8. Gratitude over greed

Even with his immense wealth, Buffett remains grounded. He lives simply, gives generously, and values his relationships over possessions. This emotional habit fosters contentment, reducing the greed that ruins many investors.

9. Detached self-worth from net worth

Buffett never lets money define him. He measures success by doing what he loves, staying true to his values, and maintaining integrity. Emotionally, this allows him to live with purpose, not pressure.

10. Resilience after mistakes

He doesn’t deny his bad calls—he learns from them. Buffett once called buying Dexter Shoe Company one of his worst investments. Yet he turned the lesson into wisdom. His emotional resilience transforms losses into lifelong teachers.

11. Resisting envy

Buffett says envy is the worst of the seven deadly sins because it brings no joy. He focuses on his lane and never compares his wealth to others. Emotionally, this keeps his mind free of bitterness—a rare habit among the ultra-rich.

12. Long-term emotional vision

He isn't just thinking about the next quarter—he’s thinking 10, 20, or even 50 years ahead. This emotional habit of projecting long-term helps him make wise, enduring choices in both investing and life.

Final thoughts

Warren Buffett didn’t become one of the world’s richest men by chasing trends or reacting emotionally. He built his fortune—and his legacy—by mastering the quiet habits of the heart and mind. Emotional discipline, clarity, and long-term thinking have helped him thrive where others falter.

You don’t need billions to start using these habits. Whether you’re managing a career, a side hustle, or your first investment, these emotional traits are tools you can sharpen every day.

Because in the end, success isn't just about what you do—it's also about how you feel while doing it.

![[The AI Show Episode 146]: Rise of “AI-First” Companies, AI Job Disruption, GPT-4o Update Gets Rolled Back, How Big Consulting Firms Use AI, and Meta AI App](https://www.marketingaiinstitute.com/hubfs/ep%20146%20cover.png)

![|ー ▶︎ [ Wouldn't it be easier if you could trace your data structure with lines? ] ー,ー,ー;](https://media2.dev.to/dynamic/image/width%3D1000,height%3D500,fit%3Dcover,gravity%3Dauto,format%3Dauto/https:%2F%2Fdev-to-uploads.s3.amazonaws.com%2Fuploads%2Farticles%2F2k02ska8tyhhnijercgq.png)

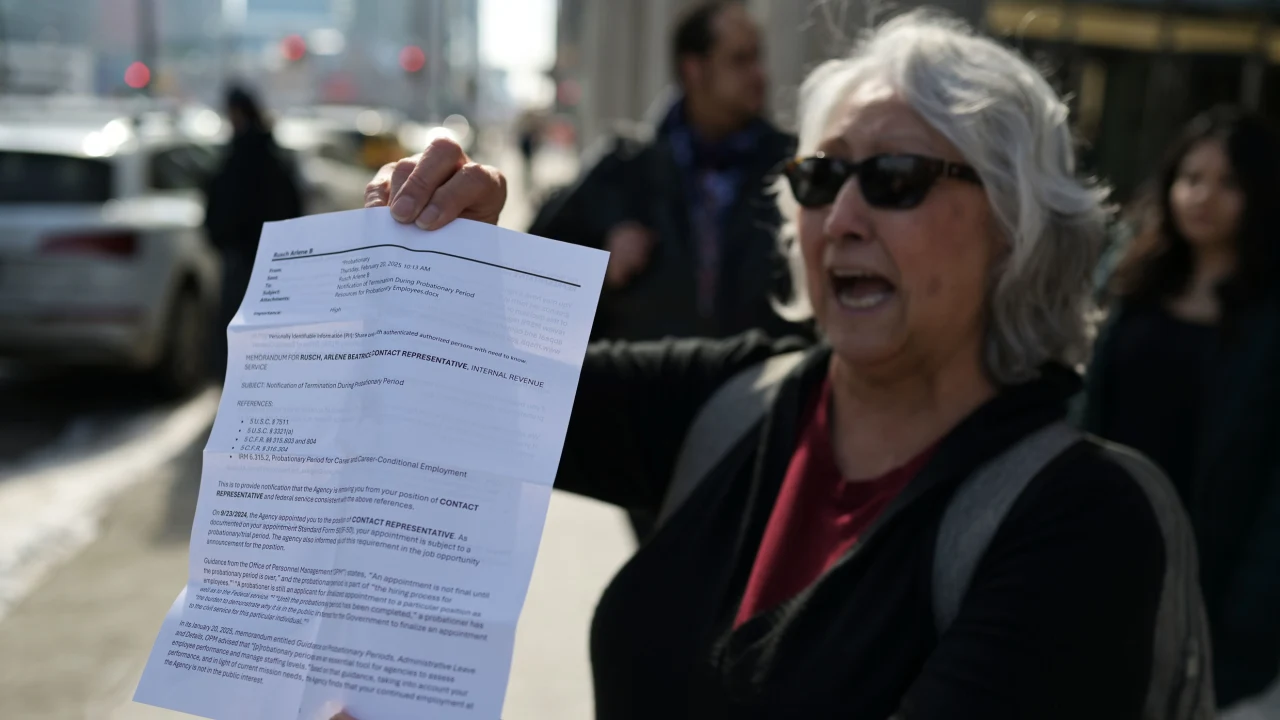

_Brian_Jackson_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

Stolen 884,000 Credit Card Details on 13 Million Clicks from Users Worldwide.webp?#)

![Apple Shares Official Teaser for 'Highest 2 Lowest' Starring Denzel Washington [Video]](https://www.iclarified.com/images/news/97221/97221/97221-640.jpg)

![Under-Display Face ID Coming to iPhone 18 Pro and Pro Max [Rumor]](https://www.iclarified.com/images/news/97215/97215/97215-640.jpg)