Tesla Ticker NASDAQ Update: Price Trends, Predictions, and Analysis

The stock market moves fast. Some companies make big moves. Tesla is one of them. People watch Tesla closely. Its ticker on NASDAQ is TSLA. The Tesla ticker NASDAQ shows how the company is doing. Investors follow its price every day. Recent Price Trends Tesla’s stock price changes often. It can go up or down quickly. In the last few months, TSLA has been very active. Some days it rose sharply. Other days it dropped a lot. These moves create chances for traders. In January, TSLA dropped after earnings results. Investors were not happy with the profit margin. In February, it climbed again. People had hope for new Tesla products. March showed mixed signals. Some investors were careful. Others stayed bullish on long-term growth. Tesla’s price in April started low. Then, some good news boosted it. A new partnership helped the stock. It gained value over a few days. But then, news from China caused a drop. Sales were slower than expected. This pushed the price down again. What Drives Tesla’s Price Many things affect TSLA’s price. News is a big one. If Tesla launches a new car, prices can rise. If sales are weak, it may fall. Elon Musk’s tweets also affect the stock. One tweet can move the market. Earnings reports matter too. Each quarter, Tesla shares financial updates. Investors react quickly to the numbers. High revenue and profit cause joy. Weak numbers lead to worry. Government policies also affect Tesla. Tax credits for electric vehicles help the stock. Restrictions or bans can hurt it. Competition is growing. More companies now make electric vehicles. This makes Tesla fight for market share. If rivals do well, Tesla stock may drop. Investor Predictions for Tesla Some investors think Tesla will keep growing. They believe in the company’s future. They trust Elon Musk’s vision. These investors think the Tesla ticker NASDAQ will rise. Others are more cautious. They say Tesla is too expensive. They think growth will slow down. These people predict the stock may fall. Analysts give mixed opinions. Some see a $300 price target. Others think $180 is fair. It depends on who you ask. Short-term traders look at charts. They use tools to guess the next move. Long-term investors look at company goals. They think about five or ten years ahead. Technical Analysis of Tesla Stock Charts help traders see patterns. They look at past prices to guess the future. Moving averages are one tool. They show the average price over time. If the stock is above its average, it is strong. If below, it may be weak. Right now, Tesla trades near its 200-day average. That means it is in a key zone. Volume is another signal. High volume means strong interest. Low volume shows weak activity. Tesla has seen high volume lately. RSI is a popular indicator. It shows if a stock is overbought or oversold. A score above 70 is too high. Below 30 means too low. Tesla’s RSI now is near 50. That shows balance. What Experts Are Saying Many analysts cover Tesla. They share their views online. Some are from big banks. Others are from investment firms. Morgan Stanley still likes Tesla. They say it will lead in AI and robotics. They believe in long-term growth. Goldman Sachs is a bit cautious. They say demand in China may slow. But they still see good potential. JP Morgan is less positive. They say the stock is too pricey. They suggest waiting before buying. Most experts say Tesla is a unique stock. It does not follow usual rules. That makes it hard to predict. Tesla’s Role in the Market Tesla is part of the NASDAQ and S&P 500. Many index funds own it. When TSLA moves, those funds change too. If Tesla rises, it can lift other tech stocks. If it drops, the market may feel it. That’s why the Tesla ticker NASDAQ is so important. Retail investors love Tesla. Many people buy a few shares. They follow the news closely. Social media also boosts interest. Hedge funds also invest in Tesla. They buy big amounts. Their moves can change the price fast. Looking Ahead: What to Expect Tesla has big plans. It wants to launch new models. The Cybertruck is one of them. If this is a hit, the stock could rise. Tesla is also working on robotaxis. This could be a new income source. Investors like this idea. Energy products are growing too. Solar and batteries bring more revenue. This helps Tesla become less dependent on cars. Challenges remain. Rivals are strong. Supply chains are still weak. Inflation makes everything costly. Regulations can also change things. Government rules can help or hurt Tesla. Investors need to watch these closely. Tips for Investors If you invest in Tesla, be ready for ups and downs. The stock is very active. Use stop-loss orders to protect gains. Stay updated with news. Watch earnings reports. Follow global trends. Check what competitors are doing. Think about your goal. Are you a short-term trader or long-term investor? Plan your moves wisely. Conc

The stock market moves fast. Some companies make big moves. Tesla is one of them. People watch Tesla closely. Its ticker on NASDAQ is TSLA. The Tesla ticker NASDAQ shows how the company is doing. Investors follow its price every day.

Recent Price Trends

Tesla’s stock price changes often. It can go up or down quickly. In the last few months, TSLA has been very active. Some days it rose sharply. Other days it dropped a lot. These moves create chances for traders.

In January, TSLA dropped after earnings results. Investors were not happy with the profit margin. In February, it climbed again. People had hope for new Tesla products. March showed mixed signals. Some investors were careful. Others stayed bullish on long-term growth.

Tesla’s price in April started low. Then, some good news boosted it. A new partnership helped the stock. It gained value over a few days. But then, news from China caused a drop. Sales were slower than expected. This pushed the price down again.

What Drives Tesla’s Price

Many things affect TSLA’s price. News is a big one. If Tesla launches a new car, prices can rise. If sales are weak, it may fall. Elon Musk’s tweets also affect the stock. One tweet can move the market.

Earnings reports matter too. Each quarter, Tesla shares financial updates. Investors react quickly to the numbers. High revenue and profit cause joy. Weak numbers lead to worry.

Government policies also affect Tesla. Tax credits for electric vehicles help the stock. Restrictions or bans can hurt it. Competition is growing. More companies now make electric vehicles. This makes Tesla fight for market share. If rivals do well, Tesla stock may drop.

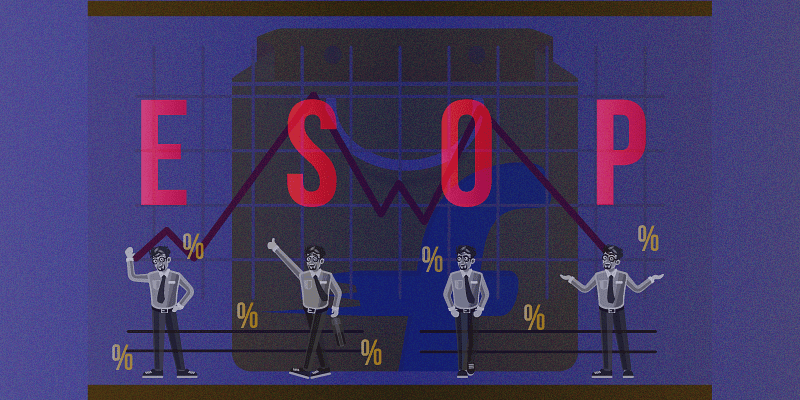

Investor Predictions for Tesla

Some investors think Tesla will keep growing. They believe in the company’s future. They trust Elon Musk’s vision. These investors think the Tesla ticker NASDAQ will rise. Others are more cautious. They say Tesla is too expensive. They think growth will slow down. These people predict the stock may fall.

Analysts give mixed opinions. Some see a $300 price target. Others think $180 is fair. It depends on who you ask.

Short-term traders look at charts. They use tools to guess the next move. Long-term investors look at company goals. They think about five or ten years ahead.

Technical Analysis of Tesla Stock

Charts help traders see patterns. They look at past prices to guess the future. Moving averages are one tool. They show the average price over time.

If the stock is above its average, it is strong. If below, it may be weak. Right now, Tesla trades near its 200-day average. That means it is in a key zone. Volume is another signal. High volume means strong interest. Low volume shows weak activity. Tesla has seen high volume lately.

RSI is a popular indicator. It shows if a stock is overbought or oversold. A score above 70 is too high. Below 30 means too low. Tesla’s RSI now is near 50. That shows balance.

What Experts Are Saying

Many analysts cover Tesla. They share their views online. Some are from big banks. Others are from investment firms. Morgan Stanley still likes Tesla. They say it will lead in AI and robotics. They believe in long-term growth. Goldman Sachs is a bit cautious. They say demand in China may slow. But they still see good potential.

JP Morgan is less positive. They say the stock is too pricey. They suggest waiting before buying.

Most experts say Tesla is a unique stock. It does not follow usual rules. That makes it hard to predict.

Tesla’s Role in the Market

Tesla is part of the NASDAQ and S&P 500. Many index funds own it. When TSLA moves, those funds change too.

If Tesla rises, it can lift other tech stocks. If it drops, the market may feel it. That’s why the Tesla ticker NASDAQ is so important.

Retail investors love Tesla. Many people buy a few shares. They follow the news closely. Social media also boosts interest.

Hedge funds also invest in Tesla. They buy big amounts. Their moves can change the price fast.

Looking Ahead: What to Expect

Tesla has big plans. It wants to launch new models. The Cybertruck is one of them. If this is a hit, the stock could rise.

Tesla is also working on robotaxis. This could be a new income source. Investors like this idea. Energy products are growing too. Solar and batteries bring more revenue. This helps Tesla become less dependent on cars.

Challenges remain. Rivals are strong. Supply chains are still weak. Inflation makes everything costly.

Regulations can also change things. Government rules can help or hurt Tesla. Investors need to watch these closely.

Tips for Investors

If you invest in Tesla, be ready for ups and downs. The stock is very active. Use stop-loss orders to protect gains.

Stay updated with news. Watch earnings reports. Follow global trends. Check what competitors are doing.

Think about your goal. Are you a short-term trader or long-term investor? Plan your moves wisely.

Conclusion

Tesla is not a normal stock. It is fast, exciting, and powerful. The Tesla ticker NASDAQ shows this every day. Price trends show sharp changes. Predictions are mixed. Some see growth, others see risk.

Analysis tools help, but nothing is certain. Many things can affect the price. News, reports, and tweets all matter.

Whether you buy or sell, watch closely. Learn more each day. That’s the best way to deal with Tesla stock. The Tesla ticker NASDAQ will remain in focus. It will guide tech and EV investors. Keep an eye on it always.

tags:

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![From fast food worker to cybersecurity engineer with Tae'lur Alexis [Podcast #169]](https://cdn.hashnode.com/res/hashnode/image/upload/v1745242807605/8a6cf71c-144f-4c91-9532-62d7c92c0f65.png?#)

![BPMN-procesmodellering [closed]](https://i.sstatic.net/l7l8q49F.png)

.webp?#)

![Next Generation iPhone 17e Nears Trial Production [Rumor]](https://www.iclarified.com/images/news/97083/97083/97083-640.jpg)

![Apple Releases iOS 18.5 Beta 3 and iPadOS 18.5 Beta 3 [Download]](https://www.iclarified.com/images/news/97076/97076/97076-640.jpg)

![Apple Seeds visionOS 2.5 Beta 3 to Developers [Download]](https://www.iclarified.com/images/news/97077/97077/97077-640.jpg)

![Apple Seeds tvOS 18.5 Beta 3 to Developers [Download]](https://www.iclarified.com/images/news/97078/97078/97078-640.jpg)