Tariffs actually helped the PC industry grow…for now

A nervous PC industry shipped more inventory than normal during the first quarter, anticipating the effects of tariffs, an analyst firm said Monday. But that doesn’t bode well for the remainder of the year, they added. Gartner said that the PC industry shipped 59 million units during the first quarter of 2025, a 4.8 percent increase from a year ago. Last week, rival IDC said that 63.2 million PCs shipped, a 4.9 percent increase. What seems to be clear is that the PC industry “front-loaded” shipments, trying to get them inside the United States before tariffs could take effect. “The growth in the PC market in the first quarter of 2025 was driven by the surge in shipments in two key markets, the U.S. and Japan, but for different underlying reasons,” said Rishi Padhi, research principal at Gartner, in a statement. “In the U.S., the PC market experienced a surge in shipments as vendors increased inventory in anticipation of tariff announcements, resulting in 12.6 percent year-over-year growth. Despite this increase and the subsequent strong topline growth, underlying end-user demand remained cautious, even with the added boost from enterprises upgrading PCs for Windows 11.” “The market is clearly showing some level of pull-in in the first quarter this year as both vendors and end-users brace for the impact of US tariffs,” said Jean Philippe Bouchard, a research vice president with IDC, last week. “In a first quarter still relatively untouched by tariffs, the entire ecosystem attempted to accelerate the pace of deliveries to avoid the first round of U.S. tariffs and expected volatility for the remainder of the year.” Tariffs imposed by the Trump administration currently sit at 20 percent, after a few days where administration statements went back and forth. In a “clarification of exceptions” announced Friday, Trump seemed to imply that the PC, component, and smartphone industry would not be subject to tariffs. But Sunday night, Trump declared on Truth Social that there was no exception, and that tariffs would still remain at 20 percent. Other Chinese imports are tariffed at 125 percent, at press time. Lenovo, HP remain on top Worldwide, Lenovo remains the top PC vendor, with a 9.6 percent year-over-year increase in shipments that took it to 15.2 million units in the first quarter of 2025. Lenovo was followed by HP, Dell, Apple, Acer, and Asus, Gartner said. Within the U.S., HP remains on top, Gartner said, with a 13.1 percent shipment increase that took it to 4.1 million shipments. Dell, Lenovo, and Apple followed it, essentially divvying up the entire U.S. market somewhat equally. IDC said last week that it believes that the downdraft of tariff pressures will offset the potential for growth by the Windows 10 replacement cycle, which will force consumers and businesses to replace Windows 10 PCs by October or risk them falling out of support. “While many are still unpacking the details from the April 2 tariff announcement, it’s safe to say most are reevaluating what the following months will look like,” said Ryan Reith, group vice president with IDC’s Worldwide Device Trackers, in a statement. “So far, our supply chain checks haven’t shown any drastic shifts, but this isn’t surprising as it’s almost too volatile to make drastic business decisions. Companies are undoubtedly evaluating everything from inventory on hand, capacity to manufacture by location, possible reroute opportunities to lower import tariffs, and for some, their deal discussions with the U.S. administration. When it comes to hardware like PCs and similar devices, we still maintain the view that most (if not all) price increases will get passed directly to the consumer.”

A nervous PC industry shipped more inventory than normal during the first quarter, anticipating the effects of tariffs, an analyst firm said Monday. But that doesn’t bode well for the remainder of the year, they added.

Gartner said that the PC industry shipped 59 million units during the first quarter of 2025, a 4.8 percent increase from a year ago. Last week, rival IDC said that 63.2 million PCs shipped, a 4.9 percent increase.

What seems to be clear is that the PC industry “front-loaded” shipments, trying to get them inside the United States before tariffs could take effect.

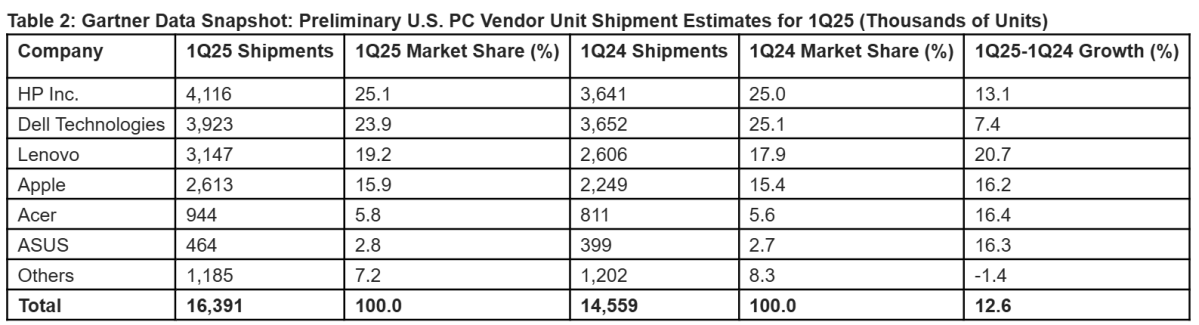

“The growth in the PC market in the first quarter of 2025 was driven by the surge in shipments in two key markets, the U.S. and Japan, but for different underlying reasons,” said Rishi Padhi, research principal at Gartner, in a statement. “In the U.S., the PC market experienced a surge in shipments as vendors increased inventory in anticipation of tariff announcements, resulting in 12.6 percent year-over-year growth. Despite this increase and the subsequent strong topline growth, underlying end-user demand remained cautious, even with the added boost from enterprises upgrading PCs for Windows 11.”

“The market is clearly showing some level of pull-in in the first quarter this year as both vendors and end-users brace for the impact of US tariffs,” said Jean Philippe Bouchard, a research vice president with IDC, last week. “In a first quarter still relatively untouched by tariffs, the entire ecosystem attempted to accelerate the pace of deliveries to avoid the first round of U.S. tariffs and expected volatility for the remainder of the year.”

Tariffs imposed by the Trump administration currently sit at 20 percent, after a few days where administration statements went back and forth. In a “clarification of exceptions” announced Friday, Trump seemed to imply that the PC, component, and smartphone industry would not be subject to tariffs. But Sunday night, Trump declared on Truth Social that there was no exception, and that tariffs would still remain at 20 percent. Other Chinese imports are tariffed at 125 percent, at press time.

Lenovo, HP remain on top

Worldwide, Lenovo remains the top PC vendor, with a 9.6 percent year-over-year increase in shipments that took it to 15.2 million units in the first quarter of 2025. Lenovo was followed by HP, Dell, Apple, Acer, and Asus, Gartner said.

Within the U.S., HP remains on top, Gartner said, with a 13.1 percent shipment increase that took it to 4.1 million shipments. Dell, Lenovo, and Apple followed it, essentially divvying up the entire U.S. market somewhat equally.

IDC said last week that it believes that the downdraft of tariff pressures will offset the potential for growth by the Windows 10 replacement cycle, which will force consumers and businesses to replace Windows 10 PCs by October or risk them falling out of support.

“While many are still unpacking the details from the April 2 tariff announcement, it’s safe to say most are reevaluating what the following months will look like,” said Ryan Reith, group vice president with IDC’s Worldwide Device Trackers, in a statement. “So far, our supply chain checks haven’t shown any drastic shifts, but this isn’t surprising as it’s almost too volatile to make drastic business decisions. Companies are undoubtedly evaluating everything from inventory on hand, capacity to manufacture by location, possible reroute opportunities to lower import tariffs, and for some, their deal discussions with the U.S. administration. When it comes to hardware like PCs and similar devices, we still maintain the view that most (if not all) price increases will get passed directly to the consumer.”

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

-Baldur’s-Gate-3-The-Final-Patch---An-Animated-Short-00-03-43.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![Nanoleaf Announces New Pegboard Desk Dock With Dual-Sided Lighting [Video]](https://www.iclarified.com/images/news/97030/97030/97030-640.jpg)

![Apple's Foldable iPhone May Cost Between $2100 and $2300 [Rumor]](https://www.iclarified.com/images/news/97028/97028/97028-640.jpg)

![Apple Releases Public Betas of iOS 18.5, iPadOS 18.5, macOS Sequoia 15.5 [Download]](https://www.iclarified.com/images/news/97024/97024/97024-640.jpg)