Standard Chartered predicts 1,326% AVAX price jump by 2029

AVAX currently trades at $18, 88% below its 2021 peak. One-quarter of layer-1 chains are now compatible with Etna. AVAX expected to reach $55 in 2025, $200 by 2028. Avalanche’s AVAX token could be set for a sharp price rally, with Standard Chartered projecting a rise to $250 by the end of 2029—an increase of […] The post Standard Chartered predicts 1,326% AVAX price jump by 2029 appeared first on CoinJournal.

- AVAX currently trades at $18, 88% below its 2021 peak.

- One-quarter of layer-1 chains are now compatible with Etna.

- AVAX expected to reach $55 in 2025, $200 by 2028.

Avalanche’s AVAX token could be set for a sharp price rally, with Standard Chartered projecting a rise to $250 by the end of 2029—an increase of 1,326% from current levels.

The bank’s forecast hinges on the blockchain’s unique scaling architecture and the impact of its Etna Upgrade, which aims to cut costs and draw more developers.

While most digital assets are consolidating or recovering from previous peaks, AVAX is attracting attention for its ability to host application-specific blockchains, known as subnets, that differentiate it from major rivals.

Subnet technology seen as key AVAX growth driver

Standard Chartered’s latest digital assets outlook identifies AVAX as one of the most promising tokens due to its use of dedicated layer-1 application networks.

These networks, formerly called subnets, allow developers to build custom blockchains that run independently but still settle on Avalanche’s main network.

This approach enables scalability without compromising on decentralisation or security.

AVAX is currently trading around $18, having once peaked at nearly $145 in 2021.

That places it about 88% below its all-time high.

According to the bank, Avalanche’s relatively small market capitalisation means it can benefit disproportionately from incremental improvements—especially in a market where Ethereum and Bitcoin dominate most of the attention.

The bank anticipates AVAX will trade at $55 by the end of 2025, before climbing steadily to $100 in 2026, $150 in 2027, $200 in 2028, and eventually $250 in 2029.

Etna upgrade boosts subnet adoption

A core factor behind Standard Chartered’s bullish outlook is the Etna Upgrade, which rolled out to improve network performance and reduce development costs.

The upgrade enhances subnet compatibility, making it easier for teams to launch scalable applications that benefit from Avalanche’s high-speed consensus and flexible infrastructure.

This upgrade is already showing impact: one-quarter of active layer-1 blockchains are now compatible with the Etna framework, highlighting growing interest from developers.

With lower onboarding costs and technical flexibility, Avalanche is expected to attract a wider developer base, particularly in decentralised finance (DeFi), gaming, and enterprise solutions.

The wider blockchain sector is in a race to optimise transaction speeds, reduce gas fees, and improve developer experience.

Avalanche’s early move in this direction gives it a potential edge, especially as other chains grapple with congestion and scalability challenges.

Bitcoin forecast to increase 500%

Alongside AVAX, Standard Chartered also forecasts a substantial long-term rally for Bitcoin.

The bank expects BTC to rise to approximately $500,000 by the end of 2029—a nearly 500% increase from its current value of about $82,650.

While Bitcoin’s growth is attributed to broader institutional adoption and its role as a digital store of value, Avalanche’s gains are expected to come from technical innovation and growing use-case diversity.

The bank’s head of digital assets research, Geoff Kendrick, has emphasised that Avalanche’s structural advantages in building tailored networks could set it apart in the long term, even as larger coins like Bitcoin and Ethereum continue to dominate investor portfolios.

DeFi competition fuels AVAX growth

The DeFi ecosystem remains highly competitive, with multiple networks aiming to become the preferred base layer for decentralised applications.

Ethereum continues to lead in terms of total value locked (TVL), but high gas fees and slower transaction speeds have pushed developers to seek alternatives.

Other networks such as Solana, Binance Smart Chain, and Polkadot are also expanding, but Avalanche’s subnet model presents a distinctive path.

AVAX’s ability to support customisable and interoperable layer-1 chains gives it a structural advantage in hosting a variety of decentralised apps.

The Etna Upgrade, in particular, positions Avalanche to attract more teams looking to deploy at scale without being constrained by shared network throughput.

While investor sentiment across altcoins remains cautious following the 2022 market downturn, Standard Chartered’s projection suggests confidence in AVAX’s long-term fundamentals.

If the forecasted growth materialises, AVAX could emerge as a significant player in the next phase of blockchain evolution.

The post Standard Chartered predicts 1,326% AVAX price jump by 2029 appeared first on CoinJournal.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Blue Archive tier list [April 2025]](https://media.pocketgamer.com/artwork/na-33404-1636469504/blue-archive-screenshot-2.jpg?#)

.png?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

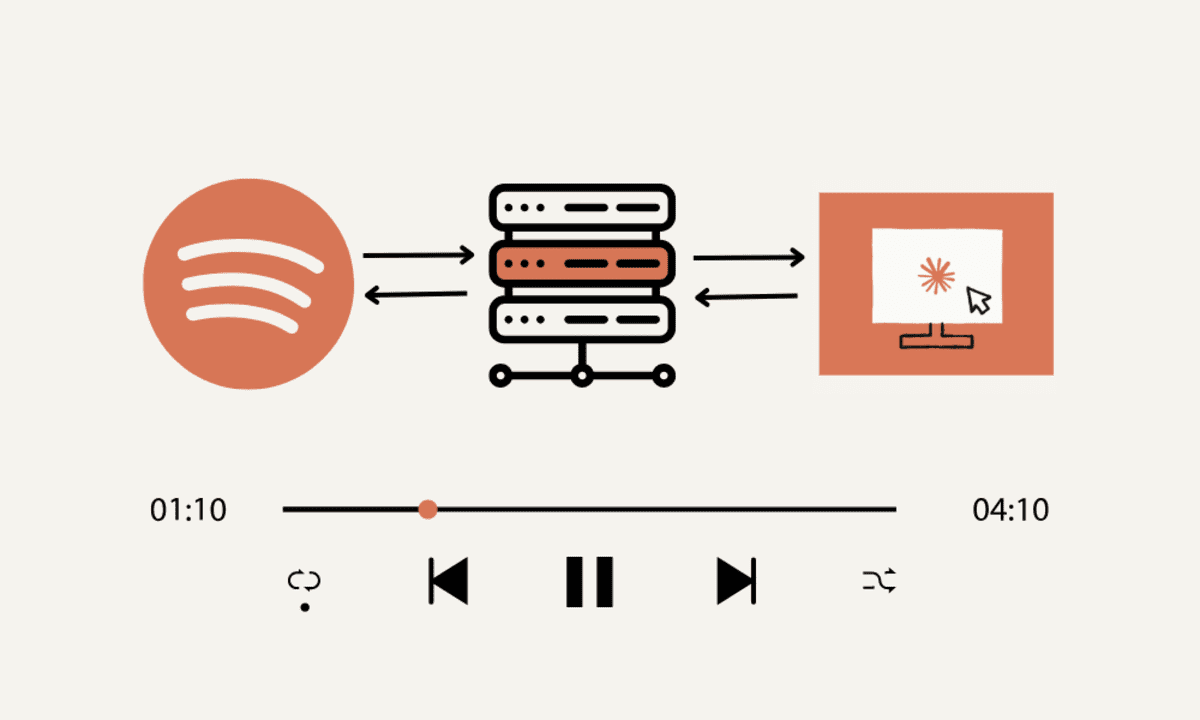

![PSA: It’s not just you, Spotify is down [U: Fixed]](https://i0.wp.com/9to5mac.com/wp-content/uploads/sites/6/2023/06/spotify-logo-2.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![[Update: Optional] Google rolling out auto-restart security feature to Android](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-2.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Releases iOS 18.4.1 and iPadOS 18.4.1 [Download]](https://www.iclarified.com/images/news/97043/97043/97043-640.jpg)

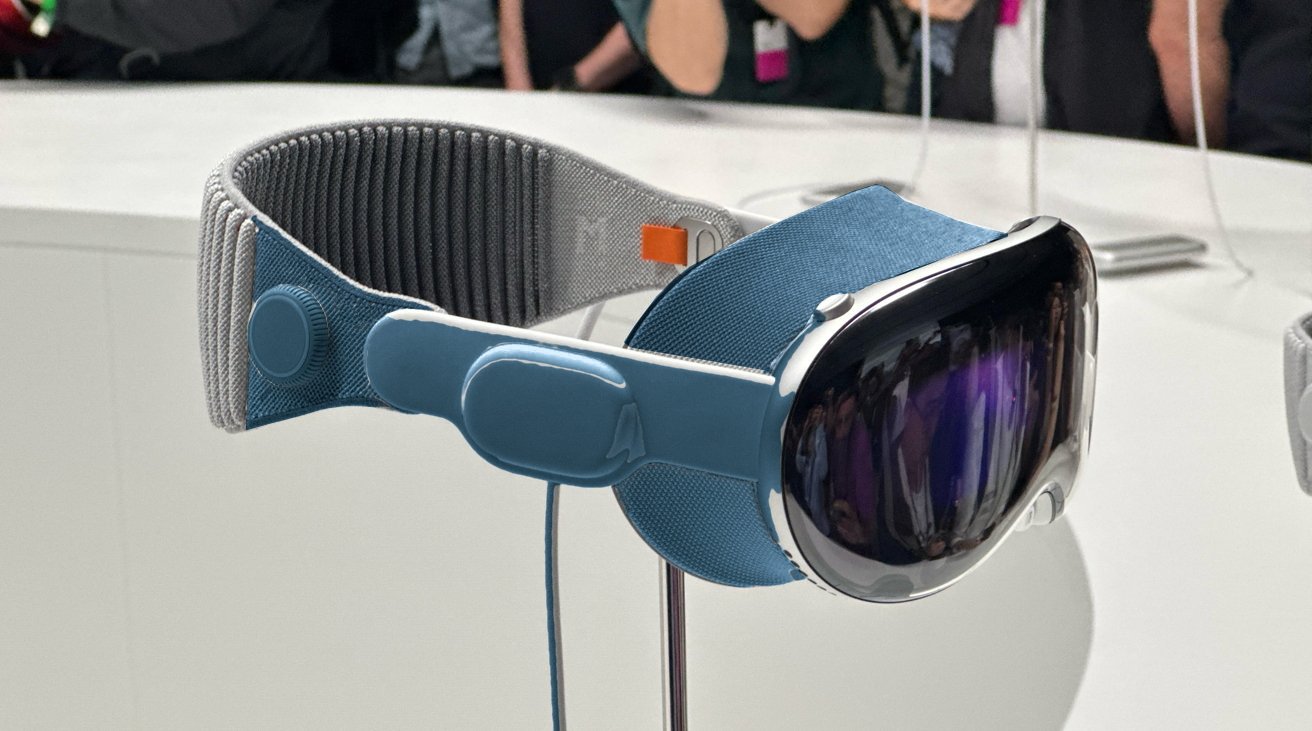

![Apple Releases visionOS 2.4.1 for Vision Pro [Download]](https://www.iclarified.com/images/news/97046/97046/97046-640.jpg)

![Apple Vision 'Air' Headset May Feature Titanium and iPhone 5-Era Black Finish [Rumor]](https://www.iclarified.com/images/news/97040/97040/97040-640.jpg)

![[Update: Trump Backtracks]The U.S. Just Defunded a Key Security Database, And Your Android Phone Could Pay the Price](https://www.androidheadlines.com/wp-content/uploads/2025/03/Android-logo-AM-AH.jpg)