Overview: The Challenge of Financial Reconciliation

Mastering Daily Financial Reconciliation: A Modern Approach In the fast-paced world of finance, ensuring the integrity of financial data is paramount. Every day, businesses record numerous transactions—sales, payments, refunds, and more. But how do you ensure these recorded transactions align with what your banking institution has processed? This brings us to the heart of financial reconciliation—a meticulous process that verifies that your internal records match those of your bank. Think about this: How often have you encountered discrepancies between your financial records and your bank statement? A missing entry, an incorrect charge, or a truly erroneous transaction can cost businesses time and money, not to mention potential regulatory scrutiny. A robust reconciliation engine is vital to ensure that every dollar accounted for finds its match. As we delve deeper into the topic, we'll explore the theoretical foundations of a reconciliation engine, drill down to practical implementation details, and ultimately reveal how modern programming paradigms like streams, virtual threads, and functional reactive programming can elevate this process to new heights. Understanding Financial Reconciliation In essence, reconciliation is a process to ensure that two sets of records (usually the balances of two accounts) are in agreement. In finance, this generally involves the daily alignment of your company's recorded transactions against the bank’s processed transactions. Key Benefits of Effective Reconciliation: Error Detection: Spotting discrepancies promptly prevents larger issues down the line. Financial Integrity: Ensures your books accurately reflect your business’s financial state. Regulatory Compliance: Many industries require reconciliation to meet legal standards. Operational Efficiency: Streamlining the reconciliation process saves time and resources. Breaking Down the Problem Data Ingestion: Throughout the day, transactions are added to your internal records. Data Source: At day’s end, you retrieve the bank statement. Comparison: We need to check if each transaction in your records matches any entries on the bank statement. Flagging Discrepancies: Any unmatched transactions need to be flagged for further investigation. High-Level Design of a Reconciliation Engine To implement an effective reconciliation engine, consider the following high-level components: Input Handling: Ability to accept daily transactions and bank statement data. Data Store: A structure to efficiently store and retrieve transaction data. Reconciliation Logic: Implement algorithms that accurately compare transactions and identify matches. Reporting: Generate reports on matched and unmatched transactions for review. Detailed Low-Level Design Data Structures Given the importance of efficiency in handling potentially large datasets, we can utilize a HashMap to store transaction amounts. This structure allows O(1) average time complexity for data access and insertion, making it ideal for our reconciliation operations. Example: `import java.util.HashMap; import java.util.Map; class TransactionManager { private final Map transactions = new HashMap(); public void addTransaction(double amount) { transactions.put(amount, transactions.getOrDefault(amount, 0) + 1); } public Map getTransactions() { return transactions; } }` Transaction Reconciliation Logic This component will utilize Java Streams for efficient data processing. By implementing a method that filters and collects transactions that exist in the bank statement, we can easily identify matches. `import java.util.List; import java.util.stream.Collectors; class ReconciliationService { public List reconcileTransactions(TransactionManager manager, List bankStatement) { return manager.getTransactions().keySet().stream() .filter(bankStatement::contains) .collect(Collectors.toList()); } }` Concurrency with Virtual Threads To speed things up, especially during peak hours when multiple transactions are being processed, virtual threads provide a lightweight way to run multiple reconciliation tasks concurrently without the usual overhead of traditional threads. This means reconciliation can happen without delays caused by I/O operations. Example Usage with Virtual Threads: `import java.util.concurrent.ExecutorService; import java.util.concurrent.Executors; public class ReconciliationApp { public static void main(String[] args) { TransactionManager manager = new TransactionManager(); ReconciliationService service = new ReconciliationService(); // Add transactions manager.addTransaction(100.00); manager.addTransaction(250.00); manager.addTransaction(100.00); // Duplicate to check for multiple matches // Assume we have received a bank statement List bankStatement = List.of(100.00, 200.00, 250.00); // Reconcile transactions using

Mastering Daily Financial Reconciliation: A Modern Approach

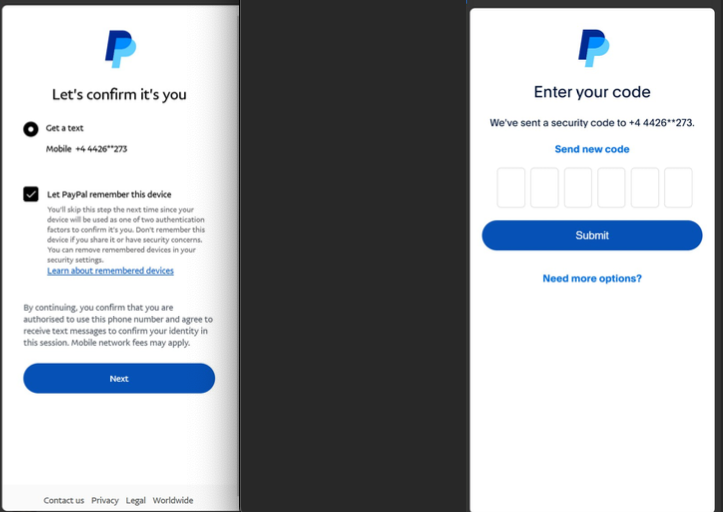

In the fast-paced world of finance, ensuring the integrity of financial data is paramount. Every day, businesses record numerous transactions—sales, payments, refunds, and more. But how do you ensure these recorded transactions align with what your banking institution has processed? This brings us to the heart of financial reconciliation—a meticulous process that verifies that your internal records match those of your bank.

Think about this: How often have you encountered discrepancies between your financial records and your bank statement? A missing entry, an incorrect charge, or a truly erroneous transaction can cost businesses time and money, not to mention potential regulatory scrutiny. A robust reconciliation engine is vital to ensure that every dollar accounted for finds its match.

As we delve deeper into the topic, we'll explore the theoretical foundations of a reconciliation engine, drill down to practical implementation details, and ultimately reveal how modern programming paradigms like streams, virtual threads, and functional reactive programming can elevate this process to new heights.

Understanding Financial Reconciliation

In essence, reconciliation is a process to ensure that two sets of records (usually the balances of two accounts) are in agreement. In finance, this generally involves the daily alignment of your company's recorded transactions against the bank’s processed transactions.

Key Benefits of Effective Reconciliation:

- Error Detection: Spotting discrepancies promptly prevents larger issues down the line.

- Financial Integrity: Ensures your books accurately reflect your business’s financial state.

- Regulatory Compliance: Many industries require reconciliation to meet legal standards.

- Operational Efficiency: Streamlining the reconciliation process saves time and resources.

Breaking Down the Problem

- Data Ingestion: Throughout the day, transactions are added to your internal records.

- Data Source: At day’s end, you retrieve the bank statement.

- Comparison: We need to check if each transaction in your records matches any entries on the bank statement.

- Flagging Discrepancies: Any unmatched transactions need to be flagged for further investigation.

High-Level Design of a Reconciliation Engine

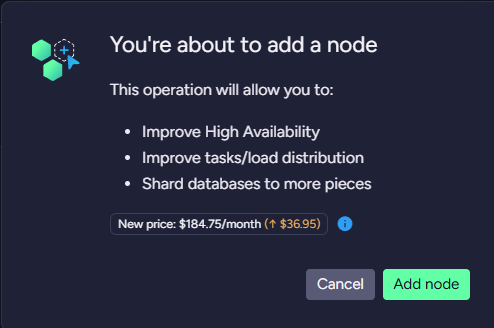

To implement an effective reconciliation engine, consider the following high-level components:

- Input Handling: Ability to accept daily transactions and bank statement data.

- Data Store: A structure to efficiently store and retrieve transaction data.

- Reconciliation Logic: Implement algorithms that accurately compare transactions and identify matches.

- Reporting: Generate reports on matched and unmatched transactions for review.

Detailed Low-Level Design

- Data Structures

Given the importance of efficiency in handling potentially large datasets, we can utilize a HashMap to store transaction amounts. This structure allows O(1) average time complexity for data access and insertion, making it ideal for our reconciliation operations.

Example:

`import java.util.HashMap;

import java.util.Map;

class TransactionManager {

private final Map transactions = new HashMap<>();

public void addTransaction(double amount) {

transactions.put(amount, transactions.getOrDefault(amount, 0) + 1);

}

public Map getTransactions() {

return transactions;

}

}`

- Transaction Reconciliation Logic

This component will utilize Java Streams for efficient data processing. By implementing a method that filters and collects transactions that exist in the bank statement, we can easily identify matches.

`import java.util.List;

import java.util.stream.Collectors;

class ReconciliationService {

public List reconcileTransactions(TransactionManager manager, List bankStatement) {

return manager.getTransactions().keySet().stream()

.filter(bankStatement::contains)

.collect(Collectors.toList());

}

}`

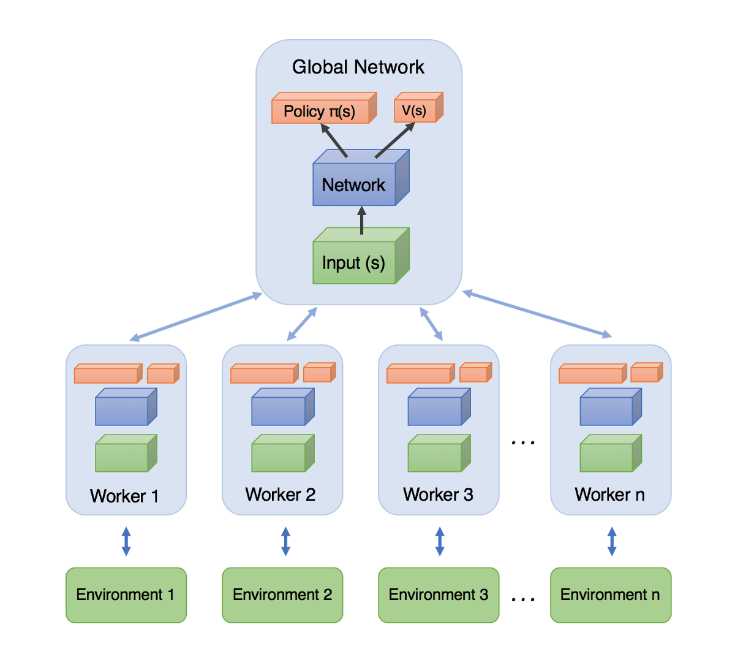

- Concurrency with Virtual Threads

To speed things up, especially during peak hours when multiple transactions are being processed, virtual threads provide a lightweight way to run multiple reconciliation tasks concurrently without the usual overhead of traditional threads. This means reconciliation can happen without delays caused by I/O operations.

Example Usage with Virtual Threads:

`import java.util.concurrent.ExecutorService;

import java.util.concurrent.Executors;

public class ReconciliationApp {

public static void main(String[] args) {

TransactionManager manager = new TransactionManager();

ReconciliationService service = new ReconciliationService();

// Add transactions

manager.addTransaction(100.00);

manager.addTransaction(250.00);

manager.addTransaction(100.00); // Duplicate to check for multiple matches

// Assume we have received a bank statement

List bankStatement = List.of(100.00, 200.00, 250.00);

// Reconcile transactions using virtual threads

ExecutorService executor = Executors.newVirtualThreadPerTaskExecutor();

executor.submit(() -> {

List matchedTransactions = service.reconcileTransactions(manager, bankStatement);

System.out.println("Matched Transactions: " + matchedTransactions);

});

executor.shutdown();

}

}`

4.Incorporating Functional Reactive Programming

To enhance responsiveness, consider integrating **Functional Reactive Programming (FRP). This paradigm enables your application to react in real time to changes in data—like the addition of new transactions.

Here’s how you could structure a reactive transaction manager using RxJava:

`import io.reactivex.rxjava3.core.Observable;

public class ReactiveTransactionManager extends TransactionManager {

private final Observable transactionObservable;

public ReactiveTransactionManager() {

transactionObservable = Observable.create(emitter -> {

// Logic to add transactions reactively

});

transactionObservable.subscribe(amount -> {

System.out.println("New transaction added: " + amount);

// Trigger reconciliation if new data requires it

});

}

@Override

public void addTransaction(double amount) {

super.addTransaction(amount);

transactionObservable.onNext(amount); // Emit the new transaction

}

}`

Conclusion

As we've explored throughout this article, the daily reconciliation engine is a critical component for maintaining financial integrity within any organization. By using modern programming paradigms such as streams, virtual threads, and functional reactive programming, we can significantly enhance the efficiency, responsiveness, and accuracy of the reconciliation process.

The future of financial reconciliation lies in leveraging these advanced programming techniques to simplify what was once a tedious task, allowing professionals to focus more on strategic decision-making rather than manual checks and balances. By adopting these practices, businesses not only safeguard their financial data but also prepare themselves for a more agile and data-driven future.

This comprehensive approach to designing a reconciliation engine equips you with the tools necessary to tackle complexity with confidence, ensuring your financial operations are not just maintained but optimized for success.

![[Webinar] AI Is Already Inside Your SaaS Stack — Learn How to Prevent the Next Silent Breach](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOWn65wd33dg2uO99NrtKbpYLfcepwOLidQDMls0HXKlA91k6HURluRA4WXgJRAZldEe1VReMQZyyYt1PgnoAn5JPpILsWlXIzmrBSs_TBoyPwO7hZrWouBg2-O3mdeoeSGY-l9_bsZB7vbpKjTSvG93zNytjxgTaMPqo9iq9Z5pGa05CJOs9uXpwHFT4/s1600/ai-cyber.jpg?#)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Rogue Company Elite tier list of best characters [April 2025]](https://media.pocketgamer.com/artwork/na-33136-1657102075/rogue-company-ios-android-tier-cover.jpg?#)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![What’s new in Android’s April 2025 Google System Updates [U: 4/18]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-3.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Watch Series 10 Back On Sale for $299! [Lowest Price Ever]](https://www.iclarified.com/images/news/96657/96657/96657-640.jpg)

![EU Postpones Apple App Store Fines Amid Tariff Negotiations [Report]](https://www.iclarified.com/images/news/97068/97068/97068-640.jpg)

![Apple Slips to Fifth in China's Smartphone Market with 9% Decline [Report]](https://www.iclarified.com/images/news/97065/97065/97065-640.jpg)