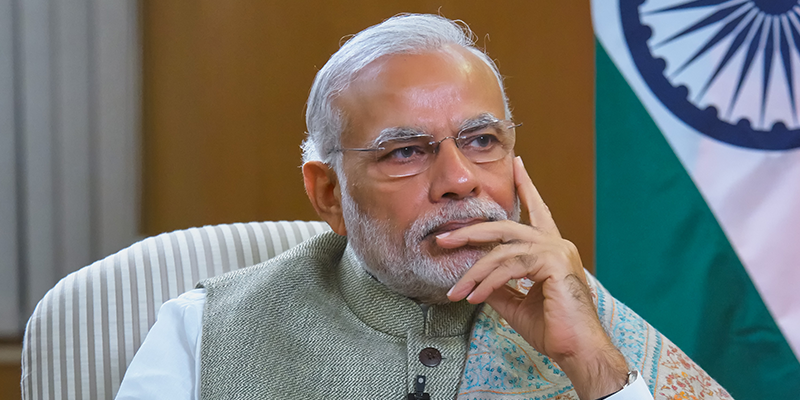

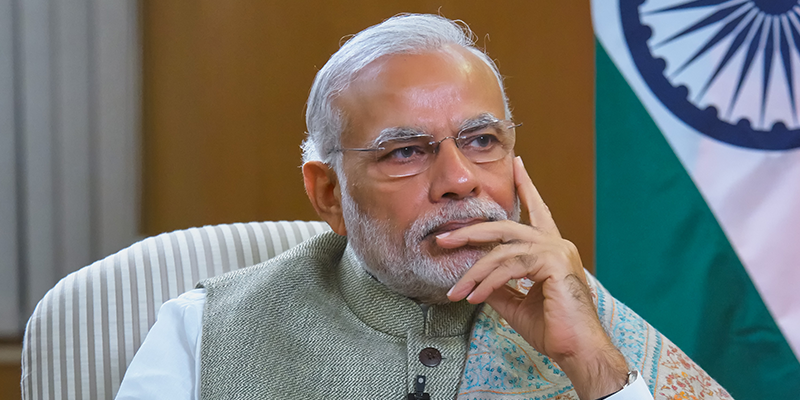

Mudra loan empowering countless individuals to showcase their entrepreneurial skills: PM

The PM Mudra Yojana, launched in 2015 with the objective of funding the unfunded, provides collateral-free institutional credit through member lending institutions.

Prime Minister Narendra Modi on Tuesday said more than Rs 33 lakh crore of collateral-free loans have been sanctioned under Mudra Yojana, empowering countless individuals to showcase their entrepreneurial skills.

Interacting with the select beneficiaries of the PM Mudra Yojana (PMMY) at his residence on the 10th anniversary of the scheme, he said the scheme has helped promote the spirit of entrepreneurship among the youth of the country and given them confidence to become job providers rather than job seekers.

With the objective of funding the unfunded, Prime Minister Modi on April 8 launched PMMY to provide collateral-free institutional credit through member lending institutions (MLIs).

"It is particularly heartening that half of the Mudra beneficiaries belong to SC, ST and OBC communities, and over 70% of the beneficiaries are women.

"Every Mudra loan carries with it dignity, self-respect, and opportunity. In addition to financial inclusion, this scheme has also ensured social inclusion and economic freedom," he said.

In the Mudra scheme, he said, the highest number of women have come forward. Women have applied for the most loans, received the most loans, and are also the fastest to repay them.

The prime minister also assured the beneficiaries that the government would review the scheme and take steps to further improve it.

In the times to come, he said, the government will continue focusing on ensuring a robust ecosystem where every aspiring entrepreneur has access to credit thus giving him or her the confidence and a chance to grow.

Under the PMMY, collateral-free loans of up to Rs 20 lakh are extended by MLIs viz scheduled commercial banks, regional rural banks, small finance banks, non-banking financial companies (NBFCs), and microfinance institutions, among others.

The loans are given for income-generating activities in the manufacturing, trading and services sectors and activities allied to agriculture.

The scheme was launched to encourage small businesses, and banks were asked to provide collateral-free loans up to Rs 20 lakh under three categories: Shishu (up to Rs 50,000), Kishore (between Rs 50,000 and Rs 5 lakh) and Tarun (Rs 20 lakh).

Edited by Swetha Kannan

.jpg)

![[Webinar] AI Is Already Inside Your SaaS Stack — Learn How to Prevent the Next Silent Breach](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOWn65wd33dg2uO99NrtKbpYLfcepwOLidQDMls0HXKlA91k6HURluRA4WXgJRAZldEe1VReMQZyyYt1PgnoAn5JPpILsWlXIzmrBSs_TBoyPwO7hZrWouBg2-O3mdeoeSGY-l9_bsZB7vbpKjTSvG93zNytjxgTaMPqo9iq9Z5pGa05CJOs9uXpwHFT4/s1600/ai-cyber.jpg?#)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![Rogue Company Elite tier list of best characters [April 2025]](https://media.pocketgamer.com/artwork/na-33136-1657102075/rogue-company-ios-android-tier-cover.jpg?#)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![What’s new in Android’s April 2025 Google System Updates [U: 4/18]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-3.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Watch Series 10 Back On Sale for $299! [Lowest Price Ever]](https://www.iclarified.com/images/news/96657/96657/96657-640.jpg)

![EU Postpones Apple App Store Fines Amid Tariff Negotiations [Report]](https://www.iclarified.com/images/news/97068/97068/97068-640.jpg)

![Apple Slips to Fifth in China's Smartphone Market with 9% Decline [Report]](https://www.iclarified.com/images/news/97065/97065/97065-640.jpg)