From Features to Finances: A Simple Guide to Fintech App Development in Australia

Introduction Fintech apps help Australians manage their money in simple ways. From paying bills to sending money or investing, everything is just a few taps away. If you’re thinking about building a fintech app in Australia, this guide will walk you through the key features, tools, timeline, and how to choose the best team. Key Features Every Fintech App Should Have To create a helpful and safe fintech app, here are some important features: Easy Sign-Up & Login – Let users log in using their phone, email, or social media. Two-Step Security – Extra protection to keep accounts safe. Simple Dashboard – A clean screen where users can see their money activity. Payment Options – Support for cards, bank transfers, and digital wallets. Chat Support – Quick help through a chatbot or real person. Alerts – Notify users about transactions and updates. Data Safety – Use encryption to protect information. Spending & Saving Tools – Help users manage budgets or track their money. Legal Compliance – Follow rules from Australian regulators like ASIC or AUSTRAC . Tools Used to Build Fintech Apps Developers use different tools to make fintech apps secure and easy to use. Some popular ones include: Firebase – For sending push messages and real-time updates. Stripe or PayPal – To manage payments. Twilio – For SMS or voice-based user verification. AWS or Google Cloud – To safely store app data online. Kotlin (Android) & Swift (iOS) – Used to build mobile apps. Modern Technologies Used in Fintech Apps Here are some smart technologies that make fintech apps better: Blockchain – Adds strong security for payments and data. AI (Artificial Intelligence) – Helps with fraud detection and customer support. Machine Learning – Learns from user actions to improve the app. Big Data – Helps manage and understand large amounts of user data. Cloud Services – Keeps the app fast and reliable. Flutter or React Native – Makes apps work on both Android and iOS devices. Who Builds a Fintech App? A small expert team usually works together to create a fintech app: Business Analyst – Understands the idea and plans the features. UI/UX Designer – Creates a clean and simple look. Developers – Build and code the app. Testers – Find and fix bugs before launch. Project Manager – Organises the team and makes sure everything is on time. How Much Time Does It Take to Create a Fintech App? The time it takes depends on how simple or advanced the app is: Basic App – Might take 3 to 6 months Medium App – Around 6 to 9 months Complex App – May take 9 to 12 months or more If you add extra features like advanced security or more tools, it may take longer. What Should You Consider Financially When Building a Fintech App? While exact figures can vary, the total investment depends on things like design complexity, the number of features, and the tech stack used. It’s also important to plan for ongoing needs like updates, security, and cloud hosting as part of the overall journey. How to Choose the Right Fintech App Partner in Australia? Working with the right team is important. Here are a few tips: Check Their Experience – See if they’ve built fintech apps before. Look at Past Work – Review their apps and client feedback. Ask About Security – Make sure they understand data protection. Know Their Knowledge of Laws – They should follow Australian finance rules. Discuss Timeline – Ensure they can deliver the app when you need it. Final Thoughts Fintech apps are growing fast in Australia. They help users do more with their money in less time. With the right features, tools, and a trusted development team, you can create a fintech app that people will love. Keep it simple, safe, and useful. FAQs 1. What’s the biggest challenge in building a fintech app? Making sure it’s secure and follows Australian financial rules. 2. Can I create a fintech app without knowing how to code? Yes. You can hire a professional team or use simple no-code platforms. 3. How do I keep my fintech app safe? Use encryption, secure login, and follow finance regulations. 4. Should I build the app for Android or iOS? Both are great. You can also use tools like Flutter to build for both. 5. Do I need approval to launch my fintech app in Australia? Yes. Depending on your app's features, you may need licenses or follow certain laws. This guide is a good starting point for building a fintech app in Australia. Find a reliable team and create something helpful for your users!

Introduction

Fintech apps help Australians manage their money in simple ways. From paying bills to sending money or investing, everything is just a few taps away.

If you’re thinking about building a fintech app in Australia, this guide will walk you through the key features, tools, timeline, and how to choose the best team.

Key Features Every Fintech App Should Have

To create a helpful and safe fintech app, here are some important features:

- Easy Sign-Up & Login – Let users log in using their phone, email, or social media.

- Two-Step Security – Extra protection to keep accounts safe.

- Simple Dashboard – A clean screen where users can see their money activity.

- Payment Options – Support for cards, bank transfers, and digital wallets.

- Chat Support – Quick help through a chatbot or real person.

- Alerts – Notify users about transactions and updates.

- Data Safety – Use encryption to protect information.

- Spending & Saving Tools – Help users manage budgets or track their money.

- Legal Compliance – Follow rules from Australian regulators like ASIC or AUSTRAC .

Tools Used to Build Fintech Apps

Developers use different tools to make fintech apps secure and easy to use. Some popular ones include:

- Firebase – For sending push messages and real-time updates.

- Stripe or PayPal – To manage payments.

- Twilio – For SMS or voice-based user verification.

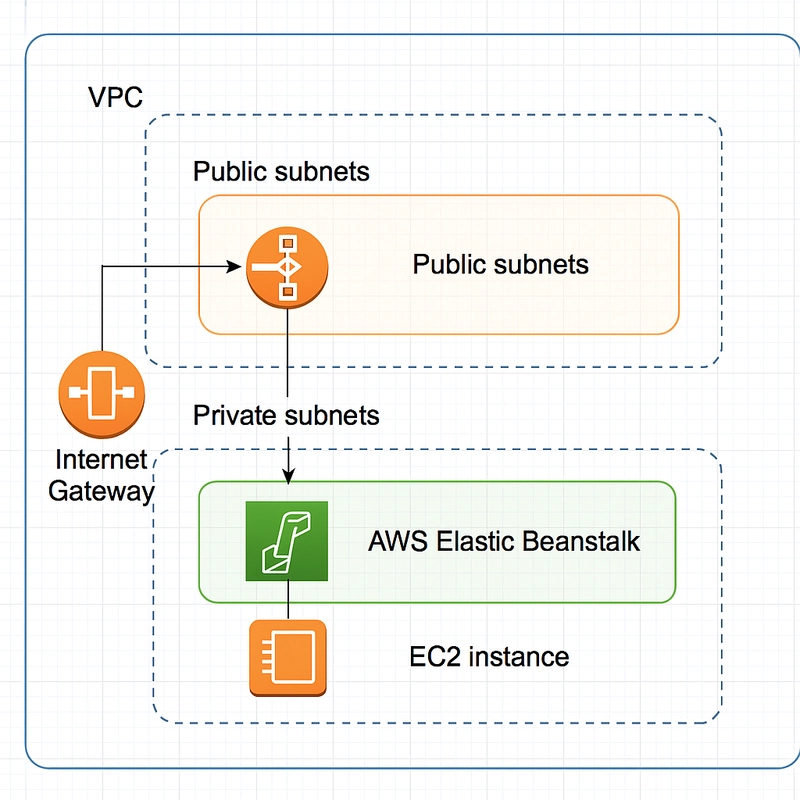

- AWS or Google Cloud – To safely store app data online.

- Kotlin (Android) & Swift (iOS) – Used to build mobile apps.

Modern Technologies Used in Fintech Apps

Here are some smart technologies that make fintech apps better:

- Blockchain – Adds strong security for payments and data.

- AI (Artificial Intelligence) – Helps with fraud detection and customer support.

- Machine Learning – Learns from user actions to improve the app.

- Big Data – Helps manage and understand large amounts of user data.

- Cloud Services – Keeps the app fast and reliable.

- Flutter or React Native – Makes apps work on both Android and iOS devices.

Who Builds a Fintech App?

A small expert team usually works together to create a fintech app:

- Business Analyst – Understands the idea and plans the features.

- UI/UX Designer – Creates a clean and simple look.

- Developers – Build and code the app.

- Testers – Find and fix bugs before launch.

- Project Manager – Organises the team and makes sure everything is on time.

How Much Time Does It Take to Create a Fintech App?

The time it takes depends on how simple or advanced the app is:

- Basic App – Might take 3 to 6 months

- Medium App – Around 6 to 9 months

- Complex App – May take 9 to 12 months or more If you add extra features like advanced security or more tools, it may take longer.

What Should You Consider Financially When Building a Fintech App?

While exact figures can vary, the total investment depends on things like design complexity, the number of features, and the tech stack used. It’s also important to plan for ongoing needs like updates, security, and cloud hosting as part of the overall journey.

How to Choose the Right Fintech App Partner in Australia?

Working with the right team is important. Here are a few tips:

- Check Their Experience – See if they’ve built fintech apps before.

- Look at Past Work – Review their apps and client feedback.

- Ask About Security – Make sure they understand data protection.

- Know Their Knowledge of Laws – They should follow Australian finance rules.

- Discuss Timeline – Ensure they can deliver the app when you need it.

Final Thoughts

Fintech apps are growing fast in Australia. They help users do more with their money in less time. With the right features, tools, and a trusted development team, you can create a fintech app that people will love. Keep it simple, safe, and useful.

FAQs

1. What’s the biggest challenge in building a fintech app?

Making sure it’s secure and follows Australian financial rules.

2. Can I create a fintech app without knowing how to code?

Yes. You can hire a professional team or use simple no-code platforms.

3. How do I keep my fintech app safe?

Use encryption, secure login, and follow finance regulations.

4. Should I build the app for Android or iOS?

Both are great. You can also use tools like Flutter to build for both.

5. Do I need approval to launch my fintech app in Australia?

Yes. Depending on your app's features, you may need licenses or follow certain laws.

This guide is a good starting point for building a fintech app in Australia. Find a reliable team and create something helpful for your users!

![[The AI Show Episode 142]: ChatGPT’s New Image Generator, Studio Ghibli Craze and Backlash, Gemini 2.5, OpenAI Academy, 4o Updates, Vibe Marketing & xAI Acquires X](https://www.marketingaiinstitute.com/hubfs/ep%20142%20cover.png)

![[DEALS] The Premium Learn to Code Certification Bundle (97% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![From drop-out to software architect with Jason Lengstorf [Podcast #167]](https://cdn.hashnode.com/res/hashnode/image/upload/v1743796461357/f3d19cd7-e6f5-4d7c-8bfc-eb974bc8da68.png?#)

.png?#)

_Christophe_Coat_Alamy.jpg?#)

(1).webp?#)

![Apple Considers Delaying Smart Home Hub Until 2026 [Gurman]](https://www.iclarified.com/images/news/96946/96946/96946-640.jpg)

![iPhone 17 Pro Won't Feature Two-Toned Back [Gurman]](https://www.iclarified.com/images/news/96944/96944/96944-640.jpg)

![Tariffs Threaten Apple's $999 iPhone Price Point in the U.S. [Gurman]](https://www.iclarified.com/images/news/96943/96943/96943-640.jpg)