Beyond Data Entry: How AP Automation Frees Finance Teams to Focus on Strategy

In today’s rapidly evolving business landscape, finance departments are expected to play a more strategic role than ever before. Yet, many organizations still rely on outdated, manual processes that hinder efficiency, limit visibility, and constrain the full potential of finance teams. Nowhere is this more apparent than in accounts payable (AP), where time-consuming tasks like data entry, invoice processing, and approvals continue to consume significant resources. Accounts Payable (AP) automation has emerged as a transformative solution, streamlining workflows and enabling finance professionals to focus on higher-value activities that support strategic decision-making. By digitizing and optimizing the invoice-to-payment lifecycle, AP automation eliminates inefficiencies, reduces risk, and elevates the role of finance within the organization. The Challenges of Manual AP Processes Traditional AP processes are labor-intensive, error-prone, and slow. Finance teams must manage invoices in various formats—paper, PDFs, email attachments—requiring manual entry, cross-referencing, approvals, and filing. This fragmentation often results in delayed payments, missed early payment discounts, duplicate processing, and strained vendor relationships. Moreover, manual systems offer limited visibility into liabilities and spending patterns, creating obstacles for accurate forecasting and strategic planning. As organizations grow, the complexity of managing increasing invoice volumes only compounds these challenges. What is AP Automation? AP automation refers to the use of technology to streamline the processing of invoices and payments. These solutions leverage artificial intelligence, machine learning, and intelligent data capture to digitize and automate tasks such as: Invoice ingestion and data extraction PO and non-PO invoice matching Automated routing for approvals Real-time payment scheduling and execution Integration with ERP and financial systems Comprehensive audit trails and compliance support By reducing human intervention, AP automation increases accuracy, accelerates processing times, and ensures consistency across the entire procure-to-pay cycle. Strategic Advantages of AP Automation The primary advantage of AP automation is operational efficiency—but its long-term value lies in how it transforms the role of finance from transactional to strategic. Here’s how: 1. Reallocation of Time to High-Value Activities Automated workflows drastically reduce the time spent on manual invoice processing. According to Ardent Partners, best-in-class AP departments can process an invoice in under five days and at a significantly lower cost compared to manual processes. The time saved can be redirected toward activities such as: Conducting financial and spend analysis Identifying and acting on cost-saving opportunities Supporting procurement in vendor negotiations Enhancing forecasting and liquidity planning Contributing to enterprise-wide strategic initiatives 2. Improved Accuracy and Compliance Manual data entry is susceptible to errors, which can lead to overpayments, missed discounts, or compliance violations. AP automation solutions help mitigate these risks by enforcing business rules, identifying discrepancies, and ensuring accurate data capture. Additionally, automated systems maintain comprehensive audit trails and provide easy access to historical data, simplifying internal audits and regulatory compliance. 3. Enhanced Financial Visibility One of the most significant limitations of manual AP processes is the lack of real-time visibility into outstanding invoices, liabilities, and cash outflows. AP automation platforms offer centralized dashboards and reporting tools that provide actionable insights into: Invoice aging and approval status Days payable outstanding (DPO) Vendor-specific spend trends Cash flow projections Exception rates and root cause analytics With better visibility, finance leaders can make more informed decisions, improve working capital management, and align AP performance with broader business goals. 4. Employee Satisfaction and Retention Skilled finance professionals are increasingly seeking roles that challenge them intellectually and contribute to strategic outcomes. When their time is dominated by routine data entry and approvals, it can lead to disengagement and turnover. By eliminating repetitive tasks, AP automation empowers finance professionals to focus on more meaningful work—such as analysis, business partnering, and strategic planning—resulting in greater job satisfaction and talent retention. Building a Strategic Finance Function Adopting AP automation is not merely a technology upgrade; it is a step toward transforming finance into a proactive and forward-thinking function. Finance teams equipped with modern tools are better positioned to drive business performance, support inn

In today’s rapidly evolving business landscape, finance departments are expected to play a more strategic role than ever before. Yet, many organizations still rely on outdated, manual processes that hinder efficiency, limit visibility, and constrain the full potential of finance teams. Nowhere is this more apparent than in accounts payable (AP), where time-consuming tasks like data entry, invoice processing, and approvals continue to consume significant resources.

Accounts Payable (AP) automation has emerged as a transformative solution, streamlining workflows and enabling finance professionals to focus on higher-value activities that support strategic decision-making. By digitizing and optimizing the invoice-to-payment lifecycle, AP automation eliminates inefficiencies, reduces risk, and elevates the role of finance within the organization.

The Challenges of Manual AP Processes

Traditional AP processes are labor-intensive, error-prone, and slow. Finance teams must manage invoices in various formats—paper, PDFs, email attachments—requiring manual entry, cross-referencing, approvals, and filing. This fragmentation often results in delayed payments, missed early payment discounts, duplicate processing, and strained vendor relationships.

Moreover, manual systems offer limited visibility into liabilities and spending patterns, creating obstacles for accurate forecasting and strategic planning. As organizations grow, the complexity of managing increasing invoice volumes only compounds these challenges.

What is AP Automation?

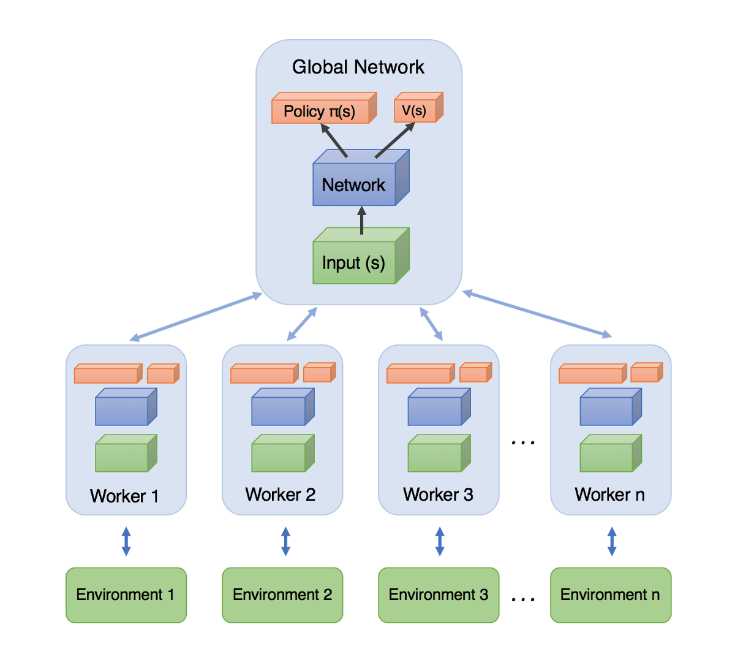

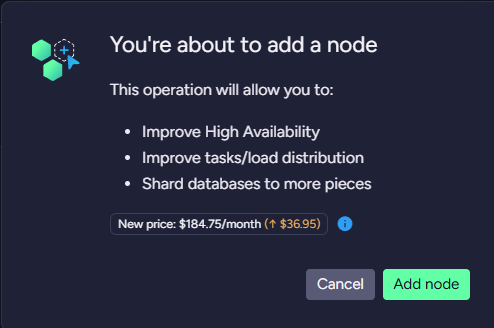

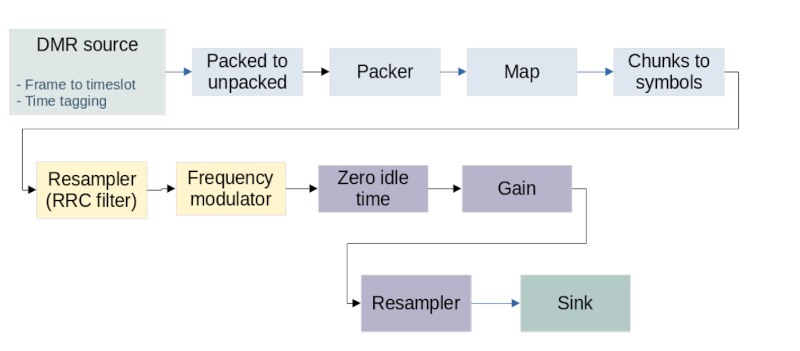

AP automation refers to the use of technology to streamline the processing of invoices and payments. These solutions leverage artificial intelligence, machine learning, and intelligent data capture to digitize and automate tasks such as:

- Invoice ingestion and data extraction

- PO and non-PO invoice matching

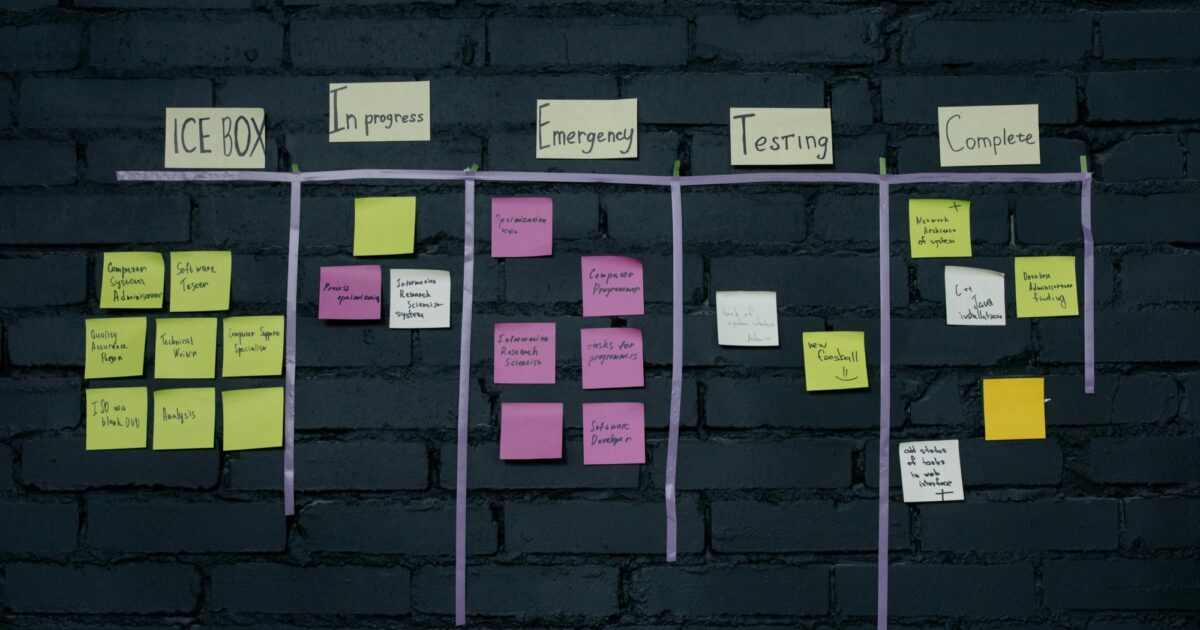

- Automated routing for approvals

- Real-time payment scheduling and execution

- Integration with ERP and financial systems

- Comprehensive audit trails and compliance support

By reducing human intervention, AP automation increases accuracy, accelerates processing times, and ensures consistency across the entire procure-to-pay cycle.

Strategic Advantages of AP Automation

The primary advantage of AP automation is operational efficiency—but its long-term value lies in how it transforms the role of finance from transactional to strategic. Here’s how:

1. Reallocation of Time to High-Value Activities

Automated workflows drastically reduce the time spent on manual invoice processing. According to Ardent Partners, best-in-class AP departments can process an invoice in under five days and at a significantly lower cost compared to manual processes. The time saved can be redirected toward activities such as:

- Conducting financial and spend analysis

- Identifying and acting on cost-saving opportunities

- Supporting procurement in vendor negotiations

- Enhancing forecasting and liquidity planning

- Contributing to enterprise-wide strategic initiatives

2. Improved Accuracy and Compliance

Manual data entry is susceptible to errors, which can lead to overpayments, missed discounts, or compliance violations. AP automation solutions help mitigate these risks by enforcing business rules, identifying discrepancies, and ensuring accurate data capture.

Additionally, automated systems maintain comprehensive audit trails and provide easy access to historical data, simplifying internal audits and regulatory compliance.

3. Enhanced Financial Visibility

One of the most significant limitations of manual AP processes is the lack of real-time visibility into outstanding invoices, liabilities, and cash outflows. AP automation platforms offer centralized dashboards and reporting tools that provide actionable insights into:

- Invoice aging and approval status

- Days payable outstanding (DPO)

- Vendor-specific spend trends

- Cash flow projections

- Exception rates and root cause analytics

With better visibility, finance leaders can make more informed decisions, improve working capital management, and align AP performance with broader business goals.

4. Employee Satisfaction and Retention

Skilled finance professionals are increasingly seeking roles that challenge them intellectually and contribute to strategic outcomes. When their time is dominated by routine data entry and approvals, it can lead to disengagement and turnover.

By eliminating repetitive tasks, AP automation empowers finance professionals to focus on more meaningful work—such as analysis, business partnering, and strategic planning—resulting in greater job satisfaction and talent retention.

Building a Strategic Finance Function

Adopting AP automation is not merely a technology upgrade; it is a step toward transforming finance into a proactive and forward-thinking function. Finance teams equipped with modern tools are better positioned to drive business performance, support innovation, and manage risk in real time.

Organizations don’t need to automate everything at once. Many begin by automating the invoice capture and approval process, then expand to include payment execution, vendor onboarding, and spend analysis. The key is to choose a solution that integrates with existing financial systems, supports scalability, and aligns with regulatory requirements.

Conclusion

As organizations navigate an increasingly complex economic environment, finance teams must evolve beyond traditional roles. AP automation provides the foundation for this evolution—delivering efficiency, accuracy, and strategic insight that empowers finance professionals to contribute meaningfully to business success.

By reducing reliance on manual processes, organizations not only improve operational outcomes but also unlock the full potential of their finance teams. It’s time to move beyond data entry—and toward a future where finance leads with insight, strategy, and innovation.

![[Webinar] AI Is Already Inside Your SaaS Stack — Learn How to Prevent the Next Silent Breach](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOWn65wd33dg2uO99NrtKbpYLfcepwOLidQDMls0HXKlA91k6HURluRA4WXgJRAZldEe1VReMQZyyYt1PgnoAn5JPpILsWlXIzmrBSs_TBoyPwO7hZrWouBg2-O3mdeoeSGY-l9_bsZB7vbpKjTSvG93zNytjxgTaMPqo9iq9Z5pGa05CJOs9uXpwHFT4/s1600/ai-cyber.jpg?#)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![[FREE EBOOKS] Machine Learning Hero, AI-Assisted Programming for Web and Machine Learning & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Rogue Company Elite tier list of best characters [April 2025]](https://media.pocketgamer.com/artwork/na-33136-1657102075/rogue-company-ios-android-tier-cover.jpg?#)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![What’s new in Android’s April 2025 Google System Updates [U: 4/18]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-3.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Watch Series 10 Back On Sale for $299! [Lowest Price Ever]](https://www.iclarified.com/images/news/96657/96657/96657-640.jpg)

![EU Postpones Apple App Store Fines Amid Tariff Negotiations [Report]](https://www.iclarified.com/images/news/97068/97068/97068-640.jpg)

![Apple Slips to Fifth in China's Smartphone Market with 9% Decline [Report]](https://www.iclarified.com/images/news/97065/97065/97065-640.jpg)