Ather Energy IPO: Tiger Global and other investors to walk away with handsome gains

The Bengaluru-based EV maker has priced its IPO between Rs 304 and Rs 321. Tiger Global is set to see gains of 734% in its investment in the company after selling its shares in the public issue.

Hero MotoCorp-backed EV maker Ather Energy has priced its initial public offering (IPO) between Rs 304 and Rs 321.

Tiger Global, a key investor in Ather Energy, is set to walk away with gains of 734% on its investments in the company after selling shares in the public issue.

Ather is the second EV (electric vehicle) manufacturer to go public after Bhavish Aggarwal-led Ola Electric, which listed on the public bourses last year. Its IPO is scheduled to open for bidding on April 28 and close on April 30; bidding for anchor investors will take place on April 25.

Bengaluru-based Ather, which began operations in 2013, raised its first major round of funding in 2015 from Tiger Global. It had raised $12 million in Series A funding at the time.

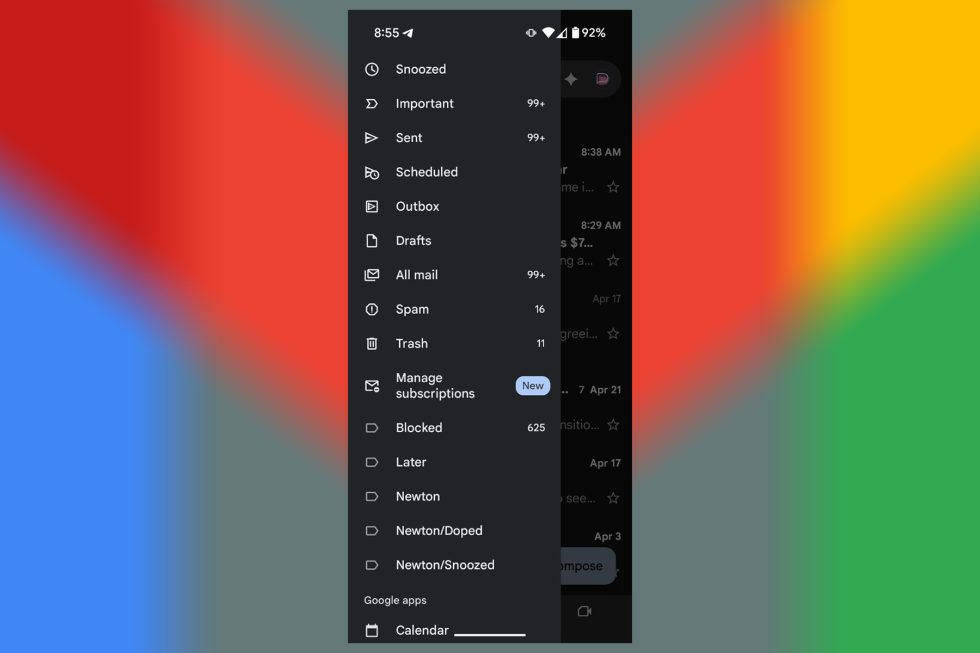

Internet Fund III, which is managed by Tiger Global, will tender up to 400,000 equity shares in the offer for sale (OFS), and will see about 8X returns, given that it will be selling its shares at the upper end of the price band. The cost of acquisition per share for the firm was Rs 38.58 apiece. Internet Fund III is likely to receive Rs 12.84 crore through this sale.

National Investment and Infrastructure Fund (NIIF), which came onto the company’s cap table in 2022 by participating in its Series E fundraise, will see a 74.7% increase in returns from the company, at the upper end. NIIF is likely to get Rs 84.57 crore by selling 26,34,514 shares. The cost of acquisition per share was Rs 183.71 per share.

Caladium Investment, an affiliate of the Singapore-based sovereign wealth fund GIC, will see a gain of 57.17% and walk away with about Rs 192.71 crore by selling 60,03,460 equity shares in the OFS. The cost of acquisition was Rs 204.24 apiece.

Additionally, co-founders and promoters Tarun Mehta and Swapnil Jain will claim more than 15X returns and are likely to snag Rs 31.46 crore each. Both founders are tendering 9,80,000 equity shares in the offer.

Other corporate shareholders selling shares include IITM Incubation Cell and IITMS Rural Technology and Business Incubator, while Amit Bhatia is the individual shareholder selling shares.

The company’s biggest shareholder HeroMoto Corp, which holds about 40% stake, will not be selling its shares in the IPO.

The OFS in Ather’s IPO will see 11.05 million shares being tendered. Ather plans to raise Rs 2,626 crore through the fresh issue of shares, majority of which will be used to set up an electric two-wheeler manufacturing facility in Maharashtra.

Edited by Swetha Kannan

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![SwiftUI Complex Animations - Lume GPT Weather UI - Matched Geometry Effect [Video]](https://media2.dev.to/dynamic/image/width%3D1000,height%3D500,fit%3Dcover,gravity%3Dauto,format%3Dauto/https:%2F%2Fdev-to-uploads.s3.amazonaws.com%2Fuploads%2Farticles%2F1j2ptyj6dxsebl6iidnx.png)

-Nintendo-Switch-2-–-First-look-trailer-00-01-35.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

-The-Elder-Scrolls-IV-Oblivion-Remastered---Official-Reveal-00-18-14.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![What iPhone 17 model are you most excited to see? [Poll]](https://9to5mac.com/wp-content/uploads/sites/6/2025/04/iphone-17-pro-sky-blue.jpg?quality=82&strip=all&w=290&h=145&crop=1)

![Hands-On With 'iPhone 17 Air' Dummy Reveals 'Scary Thin' Design [Video]](https://www.iclarified.com/images/news/97100/97100/97100-640.jpg)

![Mike Rockwell is Overhauling Siri's Leadership Team [Report]](https://www.iclarified.com/images/news/97096/97096/97096-640.jpg)

![Instagram Releases 'Edits' Video Creation App [Download]](https://www.iclarified.com/images/news/97097/97097/97097-640.jpg)

![Inside Netflix's Rebuild of the Amsterdam Apple Store for 'iHostage' [Video]](https://www.iclarified.com/images/news/97095/97095/97095-640.jpg)

![[Weekly funding roundup Feb 22-28] VC investments plummets further](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/Weekly-funding-1740751767102.jpg)