2025 Global Millimeter-Wave Radar Market Analysis: Top 10 Brands & Competitive Advantages

Introduction The global millimeter-wave (mmWave) radar market is poised for transformative growth, driven by advancements in autonomous vehicles, industrial automation, and smart infrastructure. According to MarketsandMarkets™, the mmWave radar market is projected to reach $5.8 billion by 2025, growing at a CAGR of 22.3% from 2023 to 2025. Grand View Research further highlights that the automotive sector accounts for 65% of total demand, fueled by regulatory mandates for advanced driver-assistance systems (ADAS). Meanwhile, industrial applications (e.g., robotics, logistics) and smart city deployments are accelerating adoption, with 24 GHz and 77/79 GHz radars dominating frequency preferences. This report analyzes the competitive landscape, spotlighting ten key players shaping the market, including EBYTE, a rising challenger in cost-effective industrial radar solutions. Market Drivers ADAS Regulatory Push: Euro NCAP and NHTSA 5-star safety ratings now require automatic emergency braking (AEB) and blind-spot detection, boosting automotive radar demand. Industry 4.0: mmWave radars enable precise object detection in harsh environments (dust, fog) for autonomous forklifts and AGVs. Smart Infrastructure: Traffic monitoring, drone navigation, and perimeter security systems increasingly adopt mmWave for all-weather reliability. Top 10 Brands & Product Advantages Continental AG (Germany) Key Product: ARS540 (77 GHz) Advantages: Long-range detection (300+ meters) for highway autonomous driving. Dual-mode operation (SAR and Doppler) for enhanced pedestrian recognition. Applications: BMW, Mercedes-Benz ADAS suites. Bosch (Germany) Key Product: Fifth-Generation Radar (79 GHz) Advantages: Ultra-high resolution (1.5° azimuth accuracy) for urban AEB systems. AI-powered clutter filtering for reduced false positives. Applications: Volkswagen, Toyota ADAS. Denso (Japan) Key Product: DNN-RA1 (79 GHz) Advantages: Compact design (85×55 mm) for motorcycle and compact vehicle integration. Sub-100 ms latency for real-time collision avoidance. Applications: Honda, Suzuki motorcycles. ZF Friedrichshafen (Germany) Key Product: ZF ProAI Radar (77 GHz) Advantages: Scalable architecture for L2+ to L4 autonomy. Cybersecurity certified (ISO/SAE 21434). Applications: Commercial trucks, robotaxis. Infineon Technologies (Germany) Key Product: BGT60TR13C (60 GHz) Advantages: Single-chip radar for gesture control and occupancy detection. Low power (70 mW active) for battery-operated IoT devices. Applications: Smart home appliances, laptops. Texas Instruments (U.S.) Key Product: AWR2944 (77 GHz) Advantages: 4D imaging (range, velocity, azimuth, elevation) for 360° perception. Open-source SDK for rapid prototyping. Applications: Industrial robotics, drone navigation. Hella (Germany, part of Forvia) Key Product: 77 GHz Front Radar Advantages: Modular design for flexible OEM integration. -40°C to +85°C operational range. Applications: Audi, Volvo ADAS. Aptiv (Ireland) Key Product: ESR 2.5 (76-77 GHz) Advantages: Dual-radar fusion (short/mid-range) for urban driving. Over-the-air (OTA) update capability. Applications: GM Super Cruise, Ford BlueCruise. Veoneer (Sweden) Key Product: Gen 4 Collision Avoidance Radar (79 GHz) Advantages: 20% lower cost vs. competitors via silicon-germanium (SiGe) RF design. Pedestrian detection accuracy >98% at 50 meters. Applications: Hyundai, Kia entry-level ADAS. EBYTE (Chengdu Ebyte Electronic Technology Co., China) Key Product: ER24A (24 GHz) Advantages: Cost Leadership: Priced 30% below Western counterparts, ideal for SMEs. Industrial Focus: Optimized for liquid level sensing, conveyor belt monitoring. Ease of Integration: UART/RS485 interfaces and open API for legacy systems. Applications: Chinese smart factories, warehouse automation. 2025 Technology Trends Frequency Shift: 120 GHz radars emerge for micron-level precision in medical devices. AI Integration: On-chip neural networks for real-time object classification (e.g., Tesla’s "Photonet" radar). Sustainability: Gallium nitride (GaN)-based radars reduce power consumption by 40%. Challenges Regulatory Fragmentation: Differing frequency allocations in EU (79 GHz) vs. U.S./China (76-81 GHz). Supply Chain Risks: Silicon wafer shortages (2024-2025) may delay production.

Introduction

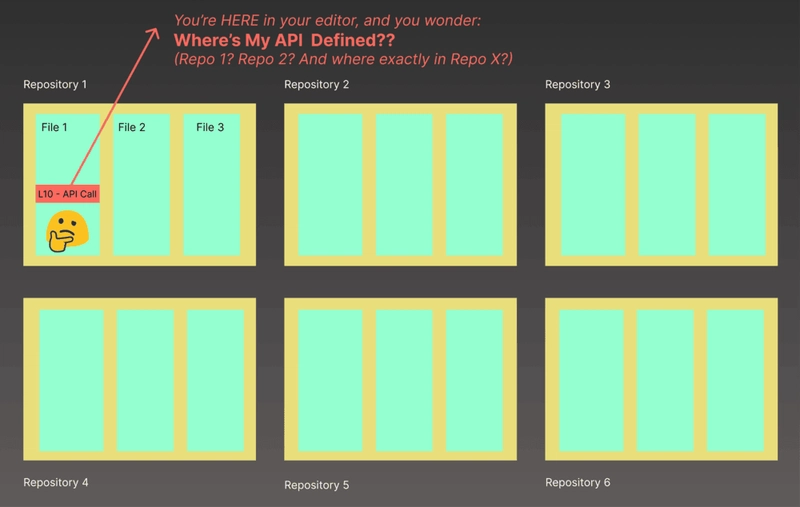

The global millimeter-wave (mmWave) radar market is poised for transformative growth, driven by advancements in autonomous vehicles, industrial automation, and smart infrastructure. According to MarketsandMarkets™, the mmWave radar market is projected to reach $5.8 billion by 2025, growing at a CAGR of 22.3% from 2023 to 2025. Grand View Research further highlights that the automotive sector accounts for 65% of total demand, fueled by regulatory mandates for advanced driver-assistance systems (ADAS). Meanwhile, industrial applications (e.g., robotics, logistics) and smart city deployments are accelerating adoption, with 24 GHz and 77/79 GHz radars dominating frequency preferences.

This report analyzes the competitive landscape, spotlighting ten key players shaping the market, including EBYTE, a rising challenger in cost-effective industrial radar solutions.

Market Drivers

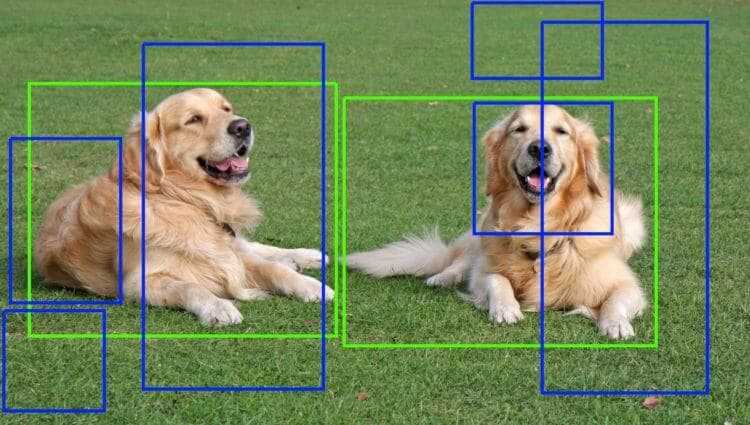

ADAS Regulatory Push: Euro NCAP and NHTSA 5-star safety ratings now require automatic emergency braking (AEB) and blind-spot detection, boosting automotive radar demand.

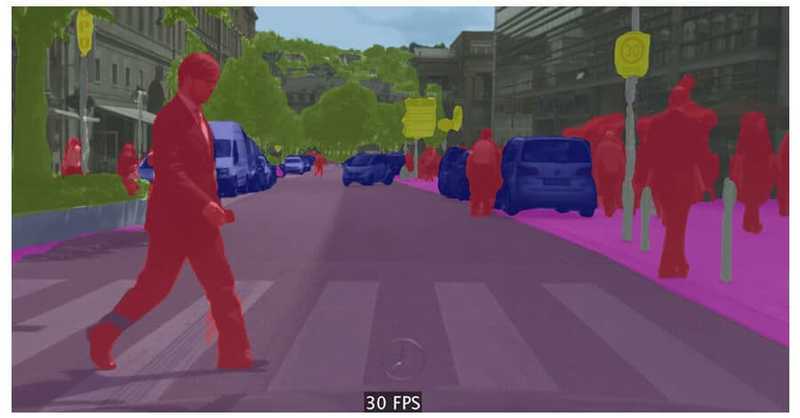

Industry 4.0: mmWave radars enable precise object detection in harsh environments (dust, fog) for autonomous forklifts and AGVs.

Smart Infrastructure: Traffic monitoring, drone navigation, and perimeter security systems increasingly adopt mmWave for all-weather reliability.

Top 10 Brands & Product Advantages

-

Continental AG (Germany)

Key Product: ARS540 (77 GHz)

Advantages:

Long-range detection (300+ meters) for highway autonomous driving.

Dual-mode operation (SAR and Doppler) for enhanced pedestrian recognition.

Applications: BMW, Mercedes-Benz ADAS suites. -

Bosch (Germany)

Key Product: Fifth-Generation Radar (79 GHz)

Advantages:

Ultra-high resolution (1.5° azimuth accuracy) for urban AEB systems.

AI-powered clutter filtering for reduced false positives.

Applications: Volkswagen, Toyota ADAS. -

Denso (Japan)

Key Product: DNN-RA1 (79 GHz)

Advantages:

Compact design (85×55 mm) for motorcycle and compact vehicle integration.

Sub-100 ms latency for real-time collision avoidance.

Applications: Honda, Suzuki motorcycles. -

ZF Friedrichshafen (Germany)

Key Product: ZF ProAI Radar (77 GHz)

Advantages:

Scalable architecture for L2+ to L4 autonomy.

Cybersecurity certified (ISO/SAE 21434).

Applications: Commercial trucks, robotaxis. -

Infineon Technologies (Germany)

Key Product: BGT60TR13C (60 GHz)

Advantages:

Single-chip radar for gesture control and occupancy detection.

Low power (70 mW active) for battery-operated IoT devices.

Applications: Smart home appliances, laptops. -

Texas Instruments (U.S.)

Key Product: AWR2944 (77 GHz)

Advantages:

4D imaging (range, velocity, azimuth, elevation) for 360° perception.

Open-source SDK for rapid prototyping.

Applications: Industrial robotics, drone navigation. -

Hella (Germany, part of Forvia)

Key Product: 77 GHz Front Radar

Advantages:

Modular design for flexible OEM integration.

-40°C to +85°C operational range.

Applications: Audi, Volvo ADAS. -

Aptiv (Ireland)

Key Product: ESR 2.5 (76-77 GHz)

Advantages:

Dual-radar fusion (short/mid-range) for urban driving.

Over-the-air (OTA) update capability.

Applications: GM Super Cruise, Ford BlueCruise. -

Veoneer (Sweden)

Key Product: Gen 4 Collision Avoidance Radar (79 GHz)

Advantages:

20% lower cost vs. competitors via silicon-germanium (SiGe) RF design.

Pedestrian detection accuracy >98% at 50 meters.

Applications: Hyundai, Kia entry-level ADAS. -

EBYTE (Chengdu Ebyte Electronic Technology Co., China)

Key Product: ER24A (24 GHz)

Advantages:

Cost Leadership: Priced 30% below Western counterparts, ideal for SMEs.

Industrial Focus: Optimized for liquid level sensing, conveyor belt monitoring.

Ease of Integration: UART/RS485 interfaces and open API for legacy systems.

Applications: Chinese smart factories, warehouse automation.

2025 Technology Trends

Frequency Shift: 120 GHz radars emerge for micron-level precision in medical devices.

AI Integration: On-chip neural networks for real-time object classification (e.g., Tesla’s "Photonet" radar).

Sustainability: Gallium nitride (GaN)-based radars reduce power consumption by 40%.

Challenges

Regulatory Fragmentation: Differing frequency allocations in EU (79 GHz) vs. U.S./China (76-81 GHz).

Supply Chain Risks: Silicon wafer shortages (2024-2025) may delay production.

.jpg)

![[Webinar] AI Is Already Inside Your SaaS Stack — Learn How to Prevent the Next Silent Breach](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiOWn65wd33dg2uO99NrtKbpYLfcepwOLidQDMls0HXKlA91k6HURluRA4WXgJRAZldEe1VReMQZyyYt1PgnoAn5JPpILsWlXIzmrBSs_TBoyPwO7hZrWouBg2-O3mdeoeSGY-l9_bsZB7vbpKjTSvG93zNytjxgTaMPqo9iq9Z5pGa05CJOs9uXpwHFT4/s1600/ai-cyber.jpg?#)

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![[FREE EBOOKS] Machine Learning Hero, AI-Assisted Programming for Web and Machine Learning & Four More Best Selling Titles](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Rogue Company Elite tier list of best characters [April 2025]](https://media.pocketgamer.com/artwork/na-33136-1657102075/rogue-company-ios-android-tier-cover.jpg?#)

_Andreas_Prott_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

![What’s new in Android’s April 2025 Google System Updates [U: 4/18]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2025/01/google-play-services-3.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![Apple Watch Series 10 Back On Sale for $299! [Lowest Price Ever]](https://www.iclarified.com/images/news/96657/96657/96657-640.jpg)

![EU Postpones Apple App Store Fines Amid Tariff Negotiations [Report]](https://www.iclarified.com/images/news/97068/97068/97068-640.jpg)

![Apple Slips to Fifth in China's Smartphone Market with 9% Decline [Report]](https://www.iclarified.com/images/news/97065/97065/97065-640.jpg)