What It Takes to Build a Successful Startup: Lessons from the Crypto

In the high-speed, hype-driven world of crypto, it's easy to get lost in the noise. Between the promises of overnight moonshots and market reactions to every influential tweet, the fundamentals often get overlooked. But some voices cut through the chaos—and one of them is Bobie Cayao. Bobie is not only an experienced crypto trader but also a marketing specialist at LMF Ventures, Inc., and the Officer-in-Charge of R&D at Asbir Tech Inc. In this candid interview, Bobie shares his thoughts on what separates a sustainable crypto startup from a short-lived hype project, how to resist FOMO, and why trust, utility, and transparency will always outlast trends. The Foundation of a Successful Crypto Startup According to Bobie, the key to a successful crypto project isn’t flashy marketing or hype—it’s a combination of strong fundamentals, a real-world use case, and a solid team. “A great idea isn’t enough if you can’t execute,” he says. For any founder or investor, understanding the tokenomics, the team’s track record, and the engagement level of the community are all crucial. He stresses that while traditional equity investing often focuses on historical performance, crypto venture capital is all about future potential. That’s why utility, execution, and adaptability matter far more than whitepaper buzzwords. FOMO and Staying Grounded FOMO is a trap many new investors fall into. Bobie’s advice? “If you don’t understand the project—don’t invest.” He emphasizes discipline over emotion and long-term value over short-term pumps. “It’s okay to miss out on a trend,” he adds, “but it’s not okay to risk your capital blindly.” Building Real Trust in a Noisy Market In a saturated space, trust is everything. For Bobie, transparency, consistent updates, and community engagement are non-negotiable. “People don’t expect perfection, they expect honesty. That’s what builds long-term loyalty,” he notes. He warns against relying on fake engagement, paid influencers, or silencing community feedback. “That might get attention short-term, but it erodes credibility fast.” Infrastructure Matters: Exchanges That Get It Right When asked about exchanges like WhiteBIT and Binance, Bobie points out their full suite of institutional-grade services as a key factor in building investor trust. “Liquidity, security, and regulatory compliance show that an exchange is playing the long game. That’s what institutions care about—and that’s where trust begins.” Web3, Institutional Adoption, and the Road Ahead Bobie is optimistic about the future of crypto and Web3—but only for those willing to put in the work. “Web3 isn’t just about making money; it’s about decentralizing power, giving users control, and building real digital ownership.” He sees growing institutional interest as a sign of the ecosystem’s maturity, especially as companies like Binance and WhiteBIT continue to evolve and offer robust trading infrastructure. Learn First, Invest Later For newcomers entering the space, Bobie’s message is clear: “Crypto rewards curiosity and patience—not hype chasing.” Educate yourself, stay disciplined, and never invest in something you don’t fully understand.

In the high-speed, hype-driven world of crypto, it's easy to get lost in the noise. Between the promises of overnight moonshots and market reactions to every influential tweet, the fundamentals often get overlooked. But some voices cut through the chaos—and one of them is Bobie Cayao.

Bobie is not only an experienced crypto trader but also a marketing specialist at LMF Ventures, Inc., and the Officer-in-Charge of R&D at Asbir Tech Inc.

In this candid interview, Bobie shares his thoughts on what separates a sustainable crypto startup from a short-lived hype project, how to resist FOMO, and why trust, utility, and transparency will always outlast trends.

The Foundation of a Successful Crypto Startup

According to Bobie, the key to a successful crypto project isn’t flashy marketing or hype—it’s a combination of strong fundamentals, a real-world use case, and a solid team. “A great idea isn’t enough if you can’t execute,” he says. For any founder or investor, understanding the tokenomics, the team’s track record, and the engagement level of the community are all crucial.

He stresses that while traditional equity investing often focuses on historical performance, crypto venture capital is all about future potential. That’s why utility, execution, and adaptability matter far more than whitepaper buzzwords.

FOMO and Staying Grounded

FOMO is a trap many new investors fall into. Bobie’s advice? “If you don’t understand the project—don’t invest.” He emphasizes discipline over emotion and long-term value over short-term pumps. “It’s okay to miss out on a trend,” he adds, “but it’s not okay to risk your capital blindly.”

Building Real Trust in a Noisy Market

In a saturated space, trust is everything. For Bobie, transparency, consistent updates, and community engagement are non-negotiable. “People don’t expect perfection, they expect honesty. That’s what builds long-term loyalty,” he notes.

He warns against relying on fake engagement, paid influencers, or silencing community feedback. “That might get attention short-term, but it erodes credibility fast.”

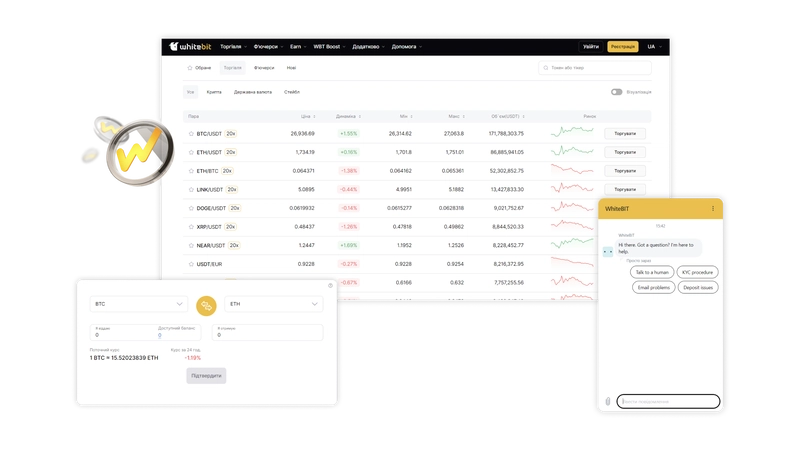

Infrastructure Matters: Exchanges That Get It Right

When asked about exchanges like WhiteBIT and Binance, Bobie points out their full suite of institutional-grade services as a key factor in building investor trust. “Liquidity, security, and regulatory compliance show that an exchange is playing the long game. That’s what institutions care about—and that’s where trust begins.”

Web3, Institutional Adoption, and the Road Ahead

Bobie is optimistic about the future of crypto and Web3—but only for those willing to put in the work. “Web3 isn’t just about making money; it’s about decentralizing power, giving users control, and building real digital ownership.”

He sees growing institutional interest as a sign of the ecosystem’s maturity, especially as companies like Binance and WhiteBIT continue to evolve and offer robust trading infrastructure.

Learn First, Invest Later

For newcomers entering the space, Bobie’s message is clear: “Crypto rewards curiosity and patience—not hype chasing.” Educate yourself, stay disciplined, and never invest in something you don’t fully understand.

![[The AI Show Episode 143]: ChatGPT Revenue Surge, New AGI Timelines, Amazon’s AI Agent, Claude for Education, Model Context Protocol & LLMs Pass the Turing Test](https://www.marketingaiinstitute.com/hubfs/ep%20143%20cover.png)

![[DEALS] Koofr Cloud Storage: Lifetime Subscription (1TB) (80% off) & Other Deals Up To 98% Off – Offers End Soon!](https://www.javacodegeeks.com/wp-content/uploads/2012/12/jcg-logo.jpg)

![Is this too much for a modular monolith system? [closed]](https://i.sstatic.net/pYL1nsfg.png)

_roibu_Alamy.jpg?width=1280&auto=webp&quality=80&disable=upscale#)

CISO’s Core Focus.webp?#)

![M4 MacBook Air Drops to Just $849 - Act Fast! [Lowest Price Ever]](https://www.iclarified.com/images/news/97140/97140/97140-640.jpg)

![Apple Smart Glasses Not Close to Being Ready as Meta Targets 2025 [Gurman]](https://www.iclarified.com/images/news/97139/97139/97139-640.jpg)

![iPadOS 19 May Introduce Menu Bar, iOS 19 to Support External Displays [Rumor]](https://www.iclarified.com/images/news/97137/97137/97137-640.jpg)