What is Point of Sale Security?

As digital payments become the norm, the security of point-of-sale (POS) systems plays a pivotal role in protecting customer transactions and maintaining brand integrity. From local retailers to global chains, any organization that processes card payments must prioritize the security of its POS infrastructure. What Is POS Security and Why It Matters POS security encompasses a set of practices, tools, and compliance standards aimed at defending point-of-sale terminals and systems against cyber threats. These systems are high-value targets for attackers due to their access to credit card data, personal information, and transaction records. A breach in POS security could result in massive data loss, financial penalties, and irreparable damage to customer trust. Therefore, safeguarding these systems is not just a technical necessity—it's a business imperative. How POS Attacks Occur Cybercriminals often exploit outdated software, weak configurations, or physical access points to install memory-scraping malware on POS devices. Once inside, the malware captures payment card data as it passes through the system’s memory, exfiltrating it to external servers for fraudulent use. Lessons from Major POS Breaches Several high-profile breaches have emphasized the risks tied to POS systems: Target (2013): Malware compromised 70 million customer records, resulting in over $50 million in settlements and legal fees. Home Depot (2014): POS attacks affected 56 million customers, leading to significant financial and reputational damage. Wendy’s (2020): Over 1,000 stores were hit by malware, resulting in lawsuits and a public trust crisis. These cases underline the urgent need for proactive security protocols. POS Security Best Practices To minimize exposure to threats, organizations should consider the following: Utilize Secure Devices: iPads and single-application terminals minimize malware exposure. Implement End-to-End Encryption: Encrypt cardholder data during transmission to prevent interception. Install Anti-Malware Tools: Regular updates and scans help detect emerging threats. Limit Network Access: POS systems should be isolated from external or public networks. Lock Down Physical Access: Secure terminals after hours and restrict usage to authorized personnel. Maintain PCI DSS Compliance: Adhering to industry standards ensures a baseline level of protection. Final Thoughts POS environments are attractive targets for cybercriminals, but with the right mix of technical safeguards and operational vigilance, businesses can significantly reduce their risk. Strengthening POS security isn’t just about compliance—it’s about preserving trust, protecting assets, and ensuring continuity in an increasingly digital retail world.

As digital payments become the norm, the security of point-of-sale (POS) systems plays a pivotal role in protecting customer transactions and maintaining brand integrity. From local retailers to global chains, any organization that processes card payments must prioritize the security of its POS infrastructure.

What Is POS Security and Why It Matters

POS security encompasses a set of practices, tools, and compliance standards aimed at defending point-of-sale terminals and systems against cyber threats. These systems are high-value targets for attackers due to their access to credit card data, personal information, and transaction records.

A breach in POS security could result in massive data loss, financial penalties, and irreparable damage to customer trust. Therefore, safeguarding these systems is not just a technical necessity—it's a business imperative.

How POS Attacks Occur

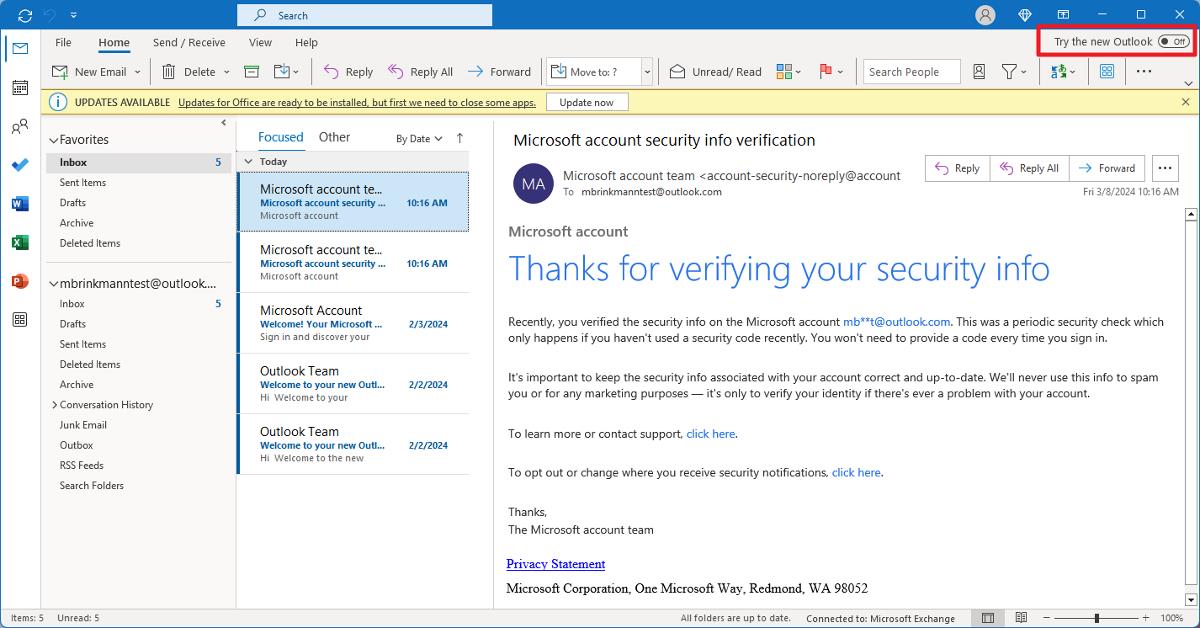

Cybercriminals often exploit outdated software, weak configurations, or physical access points to install memory-scraping malware on POS devices. Once inside, the malware captures payment card data as it passes through the system’s memory, exfiltrating it to external servers for fraudulent use.

Lessons from Major POS Breaches

Several high-profile breaches have emphasized the risks tied to POS systems:

- Target (2013): Malware compromised 70 million customer records, resulting in over $50 million in settlements and legal fees.

- Home Depot (2014): POS attacks affected 56 million customers, leading to significant financial and reputational damage.

- Wendy’s (2020): Over 1,000 stores were hit by malware, resulting in lawsuits and a public trust crisis.

These cases underline the urgent need for proactive security protocols.

POS Security Best Practices

To minimize exposure to threats, organizations should consider the following:

- Utilize Secure Devices: iPads and single-application terminals minimize malware exposure.

- Implement End-to-End Encryption: Encrypt cardholder data during transmission to prevent interception.

- Install Anti-Malware Tools: Regular updates and scans help detect emerging threats.

- Limit Network Access: POS systems should be isolated from external or public networks.

- Lock Down Physical Access: Secure terminals after hours and restrict usage to authorized personnel.

- Maintain PCI DSS Compliance: Adhering to industry standards ensures a baseline level of protection.

Final Thoughts

POS environments are attractive targets for cybercriminals, but with the right mix of technical safeguards and operational vigilance, businesses can significantly reduce their risk. Strengthening POS security isn’t just about compliance—it’s about preserving trust, protecting assets, and ensuring continuity in an increasingly digital retail world.

![[The AI Show Episode 144]: ChatGPT’s New Memory, Shopify CEO’s Leaked “AI First” Memo, Google Cloud Next Releases, o3 and o4-mini Coming Soon & Llama 4’s Rocky Launch](https://www.marketingaiinstitute.com/hubfs/ep%20144%20cover.png)

![GrandChase tier list of the best characters available [April 2025]](https://media.pocketgamer.com/artwork/na-33057-1637756796/grandchase-ios-android-3rd-anniversary.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.webp?#)

![Here’s everything new in Android 16 Beta 4 [Gallery]](https://i0.wp.com/9to5google.com/wp-content/uploads/sites/4/2024/11/Android-16-logo-top-down.jpg?resize=1200%2C628&quality=82&strip=all&ssl=1)

![New Beats USB-C Charging Cables Now Available on Amazon [Video]](https://www.iclarified.com/images/news/97060/97060/97060-640.jpg)

![Apple M4 13-inch iPad Pro On Sale for $200 Off [Deal]](https://www.iclarified.com/images/news/97056/97056/97056-640.jpg)